In the digital age, the Indian government has implemented various measures to streamline processes and enhance security, including linking Aadhaar cards to different services. If you have a Life Insurance Corporation (LIC) policy, it is important to link your Aadhaar card to ensure authenticity and transparency.

LIC stands for Life Insurance Corporation. It is a state-owned insurance company in India that offers a wide range of life insurance products and services to individuals and organizations. LIC is known for its extensive network, reliable insurance coverage, and customer-centric approach, making it one of the leading insurance providers in the country.

This blog serves as a comprehensive guide, providing you with a step-by-step approach to seamlessly link your Aadhaar card to your LIC policy. By following these simple instructions, you can navigate the linking process with ease, ensuring compliance with government regulations while enjoying the benefits of a secure and streamlined insurance experience.

Prerequisites Before Linking Aadhaar Card to LIC Policy

- Aadhaar card: It is crucial to have your original Aadhaar card as it will be required for the linking process.

- LIC Policy Documents: Keep the original policy documents along with a photocopy for reference.

Online Process to Link Aadhaar With LIC Policy

- Visit the official LIC website (www.licindia.in) and navigate to the ‘Link Aadhaar and PAN to Policy’ section. You can find this under the ‘Online Services’ or ‘Customer Services’ tab.

- Click on the ‘Link Aadhaar and PAN to Policy’ option.

- On the new screen that opens, you will be asked to enter the required details, including policy number, Aadhaar number, and PAN card number. Fill in the details accurately.

- After entering the details, cross-verify them to ensure accuracy of information. Then, click on the ‘Submit’ button.

- Once you submit the form, a confirmation message will be displayed on the screen indicating successful submission.

- The linking process usually takes a few working days to be completed. You will receive an email or SMS confirmation once the linking is successful.

Offline Process to Link Aadhaar With LIC Policy

- Visit your nearest LIC branch office.

- Collect the LIC Aadhaar Linking Form, also known as the UID Mandate Form.

- Fill in the form accurately with the necessary details, including policy number, Aadhaar number, and PAN card number. Make sure to attach a photocopy of your Aadhaar card with the form.

- Submit the filled form and photocopies of required documents to the LIC representative.

- The LIC representative will verify your documents and provide you with an acknowledgement receipt for future reference.

- After processing the request, LIC will update your policy with the linked Aadhaar card.

Note: Remember to carry the original documents for verification at the LIC branch office.

Why It is Important to Link Aadhaar Card With LIC Policy?

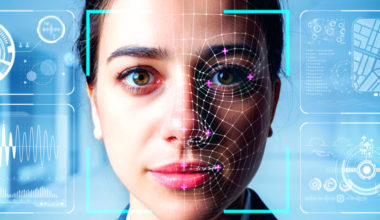

- Authenticity and Transparency: Linking LIC policies with Aadhaar enhances the authenticity and transparency of policyholder information. It helps establish a verifiable connection between the policyholder’s identity and their insurance policies, reducing the possibility of fraud or impersonation.

- Simplified KYC Process: By linking Aadhaar with LIC policies, the Know Your Customer (KYC) process becomes simpler and more streamlined. The Aadhaar card serves as a valid proof of identity and address, eliminating the need for multiple documents during policy application or renewal.

- Convenient Premium Payment: Aadhaar-linked LIC policies enable policyholders to make premium payments easily. The Aadhaar-based e-KYC service allows for seamless digital authentication, facilitating hassle-free online premium payments without the need for additional documentation.

- Quicker Claims Settlement: Linking Aadhaar with LIC policies expedites the claims settlement process. It helps in verifying the policyholder’s identity and other relevant details, enabling faster processing and settlement of claims, thereby reducing unnecessary delays.

- Direct Benefit Transfers: Linking Aadhaar with LIC policies enables policyholders to receive government subsidies, benefits, and direct transfers. Various welfare schemes, subsidies, or financial assistance provided by the government can be directly credited to the policyholder’s bank account linked to their Aadhaar, making access to such benefits more efficient.

- Security and Fraud Prevention: Linking Aadhaar with LIC policies enhances security and helps prevent identity fraud. It ensures that policy benefits are availed only by legitimate policyholders, reducing the risk of fraudulent claims and enhancing the overall integrity of the insurance system.

- Digitization and Convenience: Linking LIC policies with Aadhaar aligns with the government’s digitization initiatives. It promotes a paperless and online approach, allowing policyholders to access and manage their policies conveniently through online portals or mobile apps.

Link Aadhaar Card

Conclusion

Linking your Aadhaar card to your LIC policy is a simple and essential process that helps in maintaining accurate records and ensuring the integrity of policyholder’s information. Whether you choose to do it online or offline, following the step-by-step guide outlined in this blog will help you complete the process smoothly. By linking your Aadhaar card to your LIC policy, you comply with government regulations and contribute to a more efficient and transparent insurance system in India.