Key Takeaways:

- You can link Aadhaar with PAN card online through the Income Tax e-filing portal or by SMS.

- If you miss link Aadhaar with PAN online deadline, you must pay a ₹1,000 penalty.

- Name mismatches between PAN and Aadhaar need to be corrected before linking.

- You can check the Aadhaar-PAN linking status on the Income Tax e-filing portal.

Linking your Aadhaar Card with your PAN Card is an important step in ensuring your financial records are up-to-date and compliant with government regulations. It not only simplifies your tax filings but also helps reduce the risk of discrepancies in your personal details. If you haven’t linked these two key documents yet, don’t worry!

This guide will walk you through the steps to link Aadhaar with PAN card, so you can get it done online or offline.

How to Link Aadhaar with PAN Card?

You can link your PAN to your Aadhaar using one of two simple methods, depending on what’s most convenient for you.

Here are the two ways you can find out how to link Aadhaar with PAN card:

Method 1: Without Logging in to Your Account

Link PAN to Aadhaar Card Through the E-filing Website:

Step 1: Visit the official Income Tax Department e-filing website.

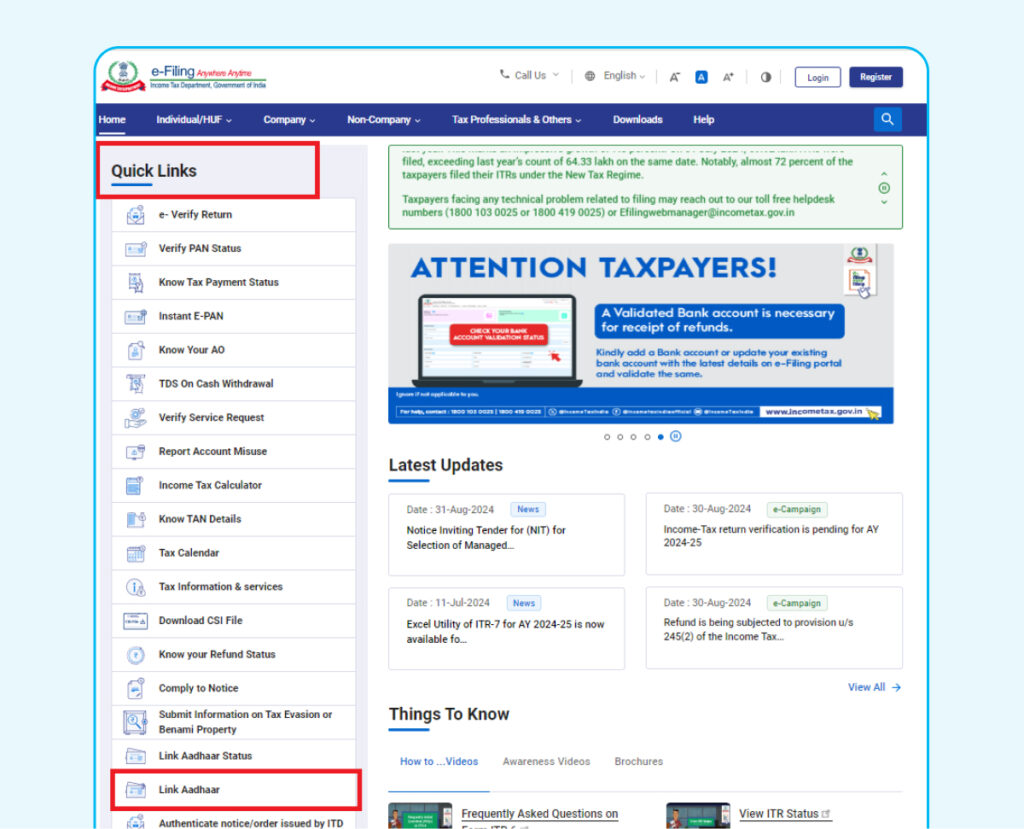

Step 2: Click on the “Link Aadhaar” option located under the “Quick Links” section.

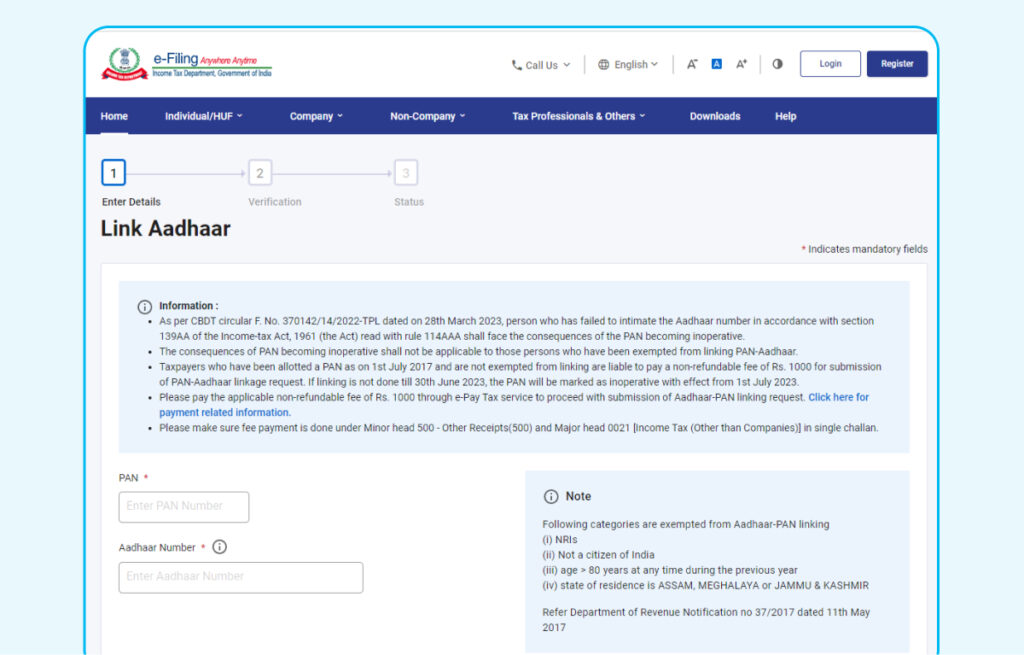

Step 3: Enter your PAN and Aadhaar numbers in their respective fields.

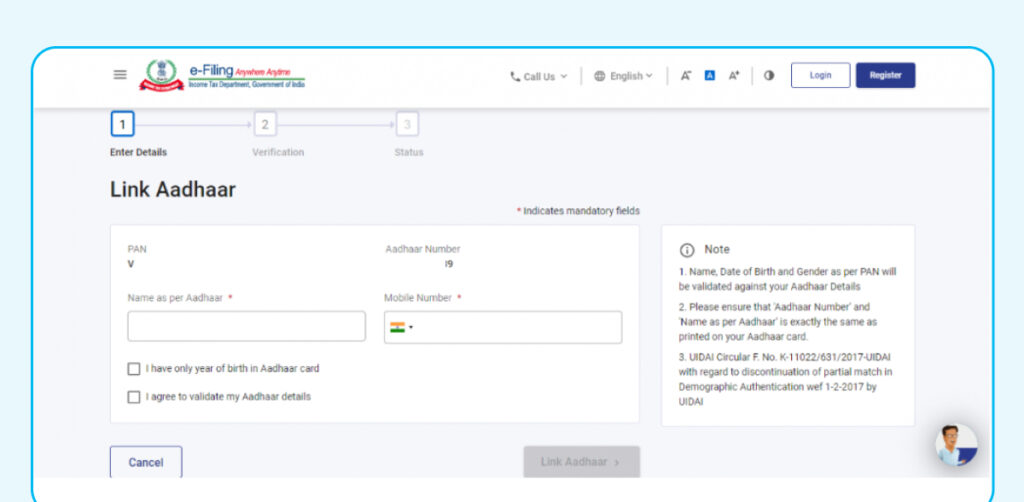

Step 4: Enter your name as it appears on your Aadhaar card and click on ‘Link’ option.

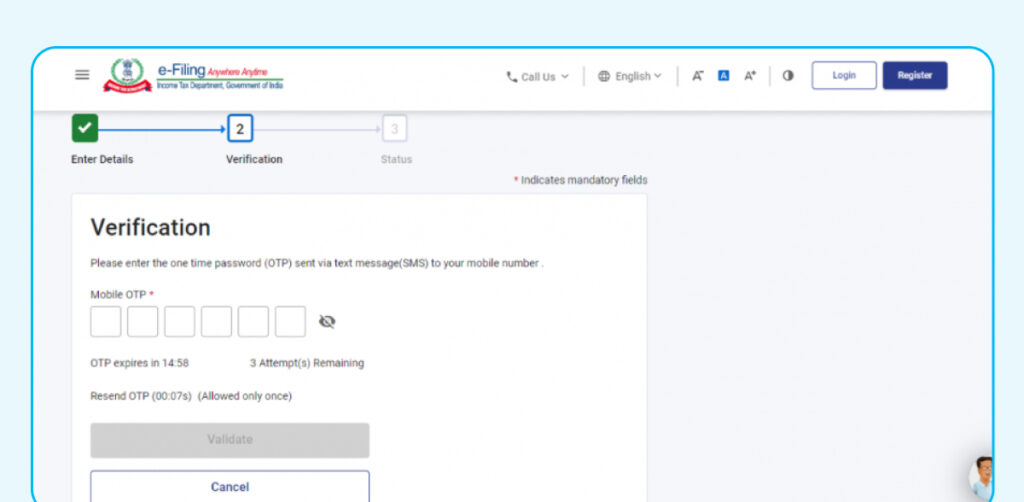

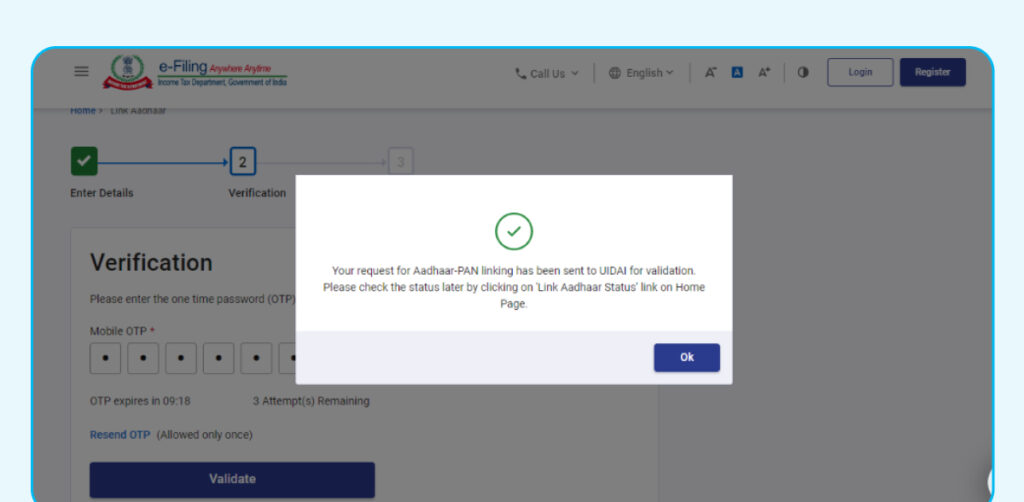

Step 5: Enter the OTP sent to your registered mobile number and click the ‘Validate’ button.

Step 6: Your request for PAN-Aadhaar linking will be sent to UIDAI for validation. If there is any discrepancy, an error message will appear, and you’ll need to correct the information.

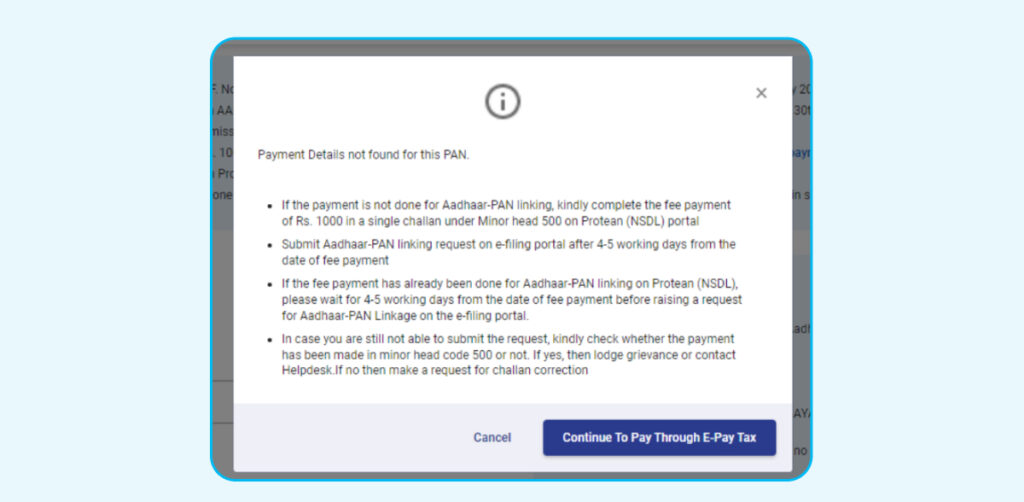

Note: If payment details aren’t verified on the e-filing portal: After validating PAN and Aadhaar, you may see “Payment details not found.” Click ‘Pay Through e-Pay Tax’ to proceed. Although it says processing may take 4-5 days, payments usually reflect within 30 minutes to 1 hour, allowing quicker linking of PAN and Aadhaar.

Method 2: By Logging in to Your Account

Step 1: Register on the Income Tax e-filing portal and log in using your user ID and password.

Step 2: Verify the secure access message, enter your password, and click ‘Continue.’

Step 3: Once logged in, select ‘Link Aadhaar’ or find it under the ‘Personal Details’ section in ‘My Profile.’

Step 4: Enter your Aadhaar number and click ‘Validate.’

Step 5: A confirmation pop-up will appear, indicating that your Aadhaar has been successfully linked to your PAN.

Once submitted, your PAN will be reactivated within 7 to 30 days if it was inactive due to non-linking.

Method 3: Link PAN to Aadhaar Card by Sending an SMS:

- Type UIDPAN<SPACE><12-digit Aadhaar><SPACE><10-digit PAN> on your mobile phone. Example: If your Aadhaar is 123456789012 and your PAN is ABCDE1234F, type: UIDPAN 123456789012 ABCDE1234F

- Send this message to either 567678 or 56161 from your registered mobile number.

- You will receive a message confirming the successful linkage of your PAN and Aadhaar card.

Make sure to link your PAN to your Aadhaar card before the deadline to avoid any inconvenience.

How to Link Aadhaar with PAN Card Online After Missing the Deadline?

If you missed the June 30, 2023, deadline to link your PAN with Aadhaar, you can still complete the process by following these steps on how to link Aadhaar with PAN card online:

Step 1: Pay the Late Penalty

Before submitting your Aadhaar-PAN link request, you need to pay a penalty. Here’s how to do it:

- Go to the Income Tax e-Filing Portal.

- Click on ‘e-Pay Tax’ under the ‘Quick Links’ section on the homepage.

- Enter your PAN number, confirm it, and provide your mobile number. Then click ‘Continue’.

- After verifying the OTP sent to your mobile, you’ll be redirected to the payment page. Click ‘Continue’.

- Under the ‘Income Tax’ tab, click ‘Proceed’.

- Select the following:

- Assessment Year: ‘2025-26’

- Type of Payment (Minor Head): ‘Other Receipts (500)’

- Payment Sub-Type: ‘Fee for delay in linking PAN with Aadhaar’

- The penalty amount will be pre-filled. Click ‘Continue’ to make the payment.

You can pay the penalty through options like net banking, debit card, NEFT/RTGS, or payment gateway, depending on your bank.

Step 2: Submit Aadhaar-PAN Link Request

Once you’ve paid the penalty, proceed to link your Aadhaar with your PAN:

- Use the same portal and follow the steps for linking PAN and Aadhaar.

- Ensure your Aadhaar-linked mobile number is ready for OTP verification.

Completing this process ensures compliance with tax regulations, even after missing the initial deadline.

What to Do If You Can’t Link Your Aadhaar to PAN Due to Name Mismatch?

If you’re unable to link your Aadhaar to your PAN due to a name mismatch, it’s crucial to correct the error first. Here’s how to link Aadhaar with PAN by updating your name on the PAN card:

How to Correct Your Name on PAN Card:

- Visit the official NSDL e-filing portal.

- Under the ‘Application Type’ section, choose ‘Changes or Correction in PAN Data.’

- Select ‘Individual’ as your category and fill in the required information.

- Enter the captcha code and click ‘Submit.’

The updated PAN card will be sent to your registered address.

Important Note: The name correction process for both PAN and Aadhaar may take a few weeks. Once you receive your updated PAN card, you can then retry to link Aadhaar with PAN card online.

How to Correct Your Name on Aadhaar Card?

If there’s a misspelling or error in your name on the Aadhaar card, follow these steps to make the correction:

- Visit an Aadhaar Enrolment Centre: Locate the nearest enrolment center using the official UIDAI website.

- Bring Required Documents: Carry your original Aadhaar card along with valid identity proof, such as a passport or voter ID.

- Fill Out the Aadhaar Update Form: Obtain the form at the center and fill in your details.

- Submit the Form and Documents: Hand over the form and necessary documents to the official for review and correction.

- Receive Acknowledgement: You’ll receive an acknowledgement slip containing a unique request number (URN), which can be used to track your update status on the UIDAI website.

Also Read: How to Change the Name on the PAN Card?

How to Check Aadhaar PAN Linking Status?

Follow these steps to check Aadhaar PAN linking status:

- Visit the Income Tax e-filing portal and click on the ‘Link Aadhaar Status’ under the quick links on the homepage.

- Enter your PAN and Aadhaar numbers and click ‘View Link Aadhaar Status’.

A pop-up message will appear if your PAN and Aadhaar are not linked. You can then follow the steps provided above to complete the linking process.

Linking your Aadhaar with your PAN is essential for keeping your financial details up-to-date and compliant with tax regulations. The last date to link was June 30, 2023, but if you missed it, you can still link them by paying a penalty of ₹1,000. Once the penalty is paid, the linking process can be completed online, offline, or through SMS. Completing this ensures you avoid higher TDS rates, filing issues, or trouble claiming refunds. Make sure to link them as soon as possible to avoid any inconvenience!

Disclaimer: This blog is written to make it easy for readers to understand complicated processes. Some information and screenshots may be outdated as government processes can change anytime without notification. However, we try our best to keep our blogs updated and relevant.