Are you having trouble applying for a PAN card? Don’t worry, we’re here to help! In this guide, we will explain the process of applying for a PAN card in a simple and easy-to-understand way. Whether you are an Indian citizen or a foreigner, and whether you want to apply online or offline, we have all the information you need to get your PAN card without any hassle.

How to Apply for a PAN Card Online?

To apply for your PAN online, you have two options: the NSDL portal or the UTIITSL portal. To get started, follow the steps below after logging in to the NSDL or UTIITSL web portal.

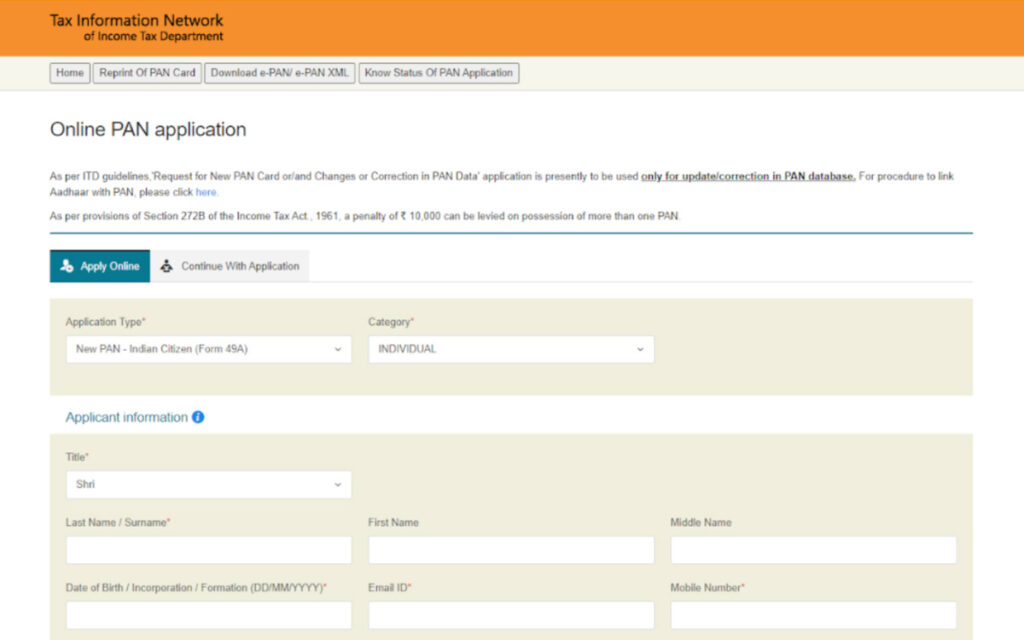

Apply for PAN Card through NSDL

Step 1: Visit the official page of NSDL. Click on the given link: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

Step 2: Choose either ‘New PAN – Indian Citizen (Form 49A)’ or ‘New PAN – Foreign Citizen (Form 49AA)’ under ‘Application Type’. Select ‘Individual’ for the ‘Category’.

Step 3: Fill in your name, date of birth, email ID, and mobile number. Agree to the consent terms and click ‘Submit’.

Step 4: A Token Number will be sent to your email or registered mobile number. Click on ‘Continue with PAN Application Form’ to proceed.

Step 5: Select one of the three options to submit your documents:

- Digital submission through e-KYC & e-Sign (Paperless): Use your Aadhaar card to complete the process online without uploading any documents.

- Scanned image submission through e-Sign.

- Physically forwarding documents.

Step 6: Decide if you want a physical PAN card. If not, you will receive it digitally via email. The application fee varies depending on the document submission method and card preference.

Step 7: Enter your Aadhaar number. Provide your name, gender, date of birth, and parents’ names, then click ‘Next’.

Step 8: Fill in your income sources, communication address, residential address, and office address (required for salary, business, or profession income sources). Include your phone number and email ID, then click ‘Next’.

Step 9: Enter your AO (Assessing Officer) code and click ‘Next’. Upload the necessary documents, complete the declaration, and submit the form.

Step 10: After submitting your application, proceed to the payment page to pay the required fees. An acknowledgment with a 15-digit number will be generated upon payment.

If you selected ‘Forward application documents physically’ in Step 5, print the acknowledgment, attach your photo and signature, and send it with the required documents to the following address:

Income Tax PAN Services Unit, Protean eGov Technologies Limited, 4th Floor, Sapphire Chambers, Baner Road, Baner, Pune – 411045

Once your application is received by the PAN unit or submitted online, it will be processed within 15-20 days, and the PAN card will be sent to the address you provided.

Also Read: How to Download an NSDL PAN Card Easily?

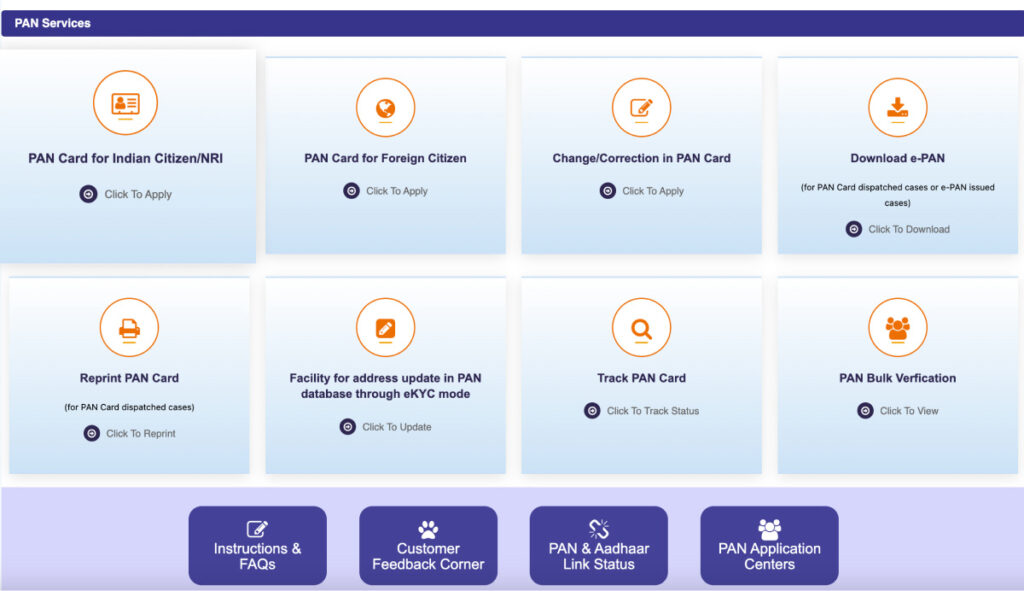

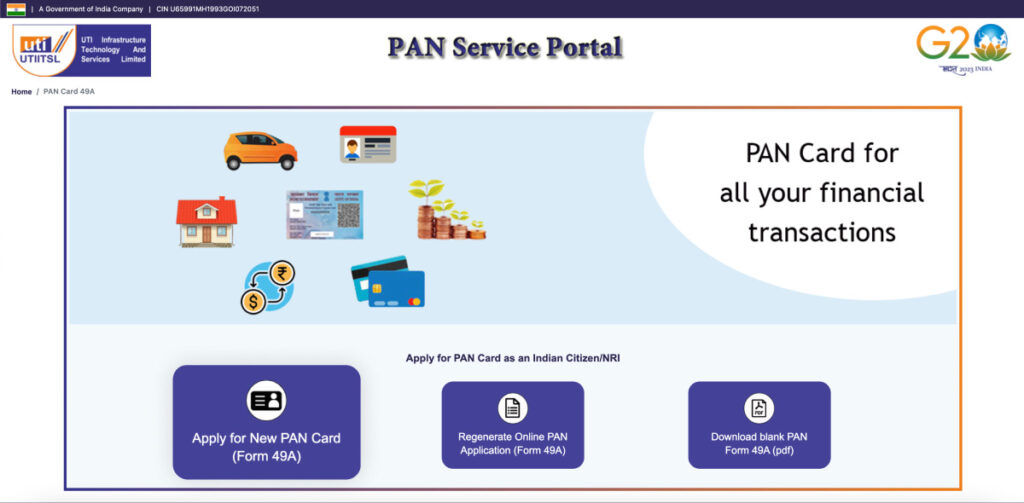

Apply for a PAN Card through UTIITSL

Step 1: Visit the UTIITSL website.

Step 2: Scroll down the page and locate the ‘PAN Services’ section. Click on either ‘PAN Card for Indian citizen/NRI’ or ‘PAN Card for foreign citizen’ tab.

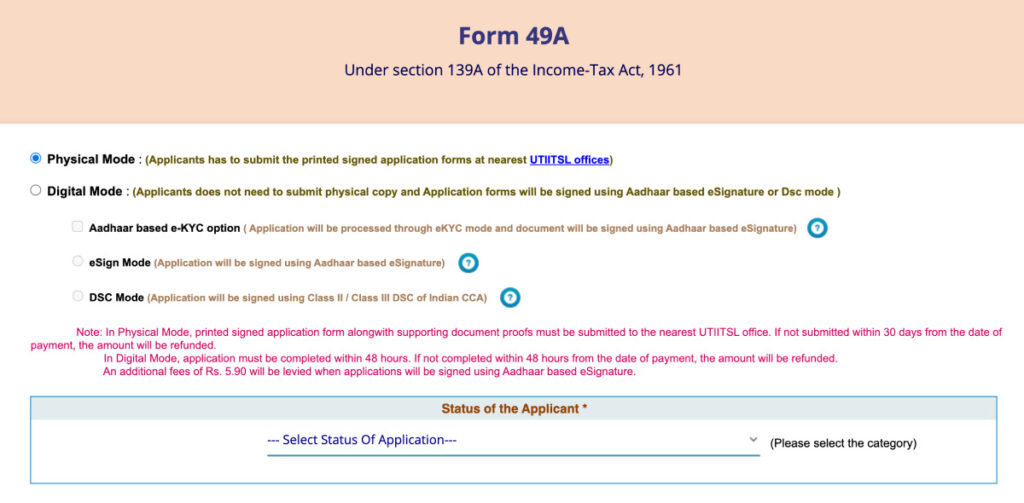

Step 3: Select the ‘Apply for New PAN Card’ tab.

Step 4: Choose the mode of submission of documents. Under ‘Status of Applicant’, select ‘Individual’. Select the PAN card mode and click ‘Submit’.

Step 5: Once your request is registered, you will receive a reference number. Simply click ‘OK’ to proceed.

Step 6: Fill in your personal details, document information, contact and parents’ details, address details, and any other required information. When finished, click ‘Next Step’.

Step 7: Upload the necessary documents and submit the form. Before moving forward, double-check all the details on the form.

Step 8: Click on the ‘Make Payment’ button to proceed with the payment process. Choose your preferred mode of online payment and complete the transaction. You will receive a confirmation message upon successful payment.

Step 9: After completing the payment, make sure to take a print out of the form for your reference and records.

Also Read: How to Apply for a Duplicate PAN Card?

How to Apply for a PAN Card Offline?

Step 1: Download ‘Form 49A’ for Indian citizens or ‘Form 49AA’ for foreign citizens from the NSDL website

Step 2: Fill in the AO code and area code in the first column of the form. These codes can be found on the NSDL website.

Step 3: Complete the form using BLOCK letters and a black ink pen.

Step 4: Affix two recent color passport-sized photographs with a plain background in the designated boxes at the top of the first page.

Step 5: Sign the form in the specified places labeled “Signature / Left Thumb Impression of Applicant” and sign across the photograph on the top left side of the form.

Step 6: Attach self-attested copies of your proof of identity, address, and date of birth to the form.

Step 7: Submit the completed form and documents at the nearest PAN center, pay the required fees, and receive an acknowledgment number from the PAN center officials.

List of Documents to Submit for a PAN Card

To ensure a hassle-free PAN card verification process, it is important to have the following documents readily available and submit them along with your PAN card acknowledgement receipt:

Indian Citizens (including those located outside India)

Proof of Identity

- Copy of any of the following documents bearing name of the applicant as mentioned in the application:

- Aadhaar Card issued by the Unique Identification Authority of India; or

- Elector’s photo identity card; or

- Driving License; or

- Passport

- Ration card having photograph of the applicant; or

- Arm’s license; or

- Photo identity card issued by the Central Government or State Government or Public Sector Undertaking; or

- Pensioner card having photograph of the applicant; or

- Central Government Health Scheme Card or Ex-Servicemen Contributory Health Scheme photo card

- Certificate of identity in Original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer

- Bank certificate in Original on letterhead from the branch(along with name and stamp of the issuing officer) containing duly attested photograph and bank account number of the applicant

Note:

- In case of Minor, any of the documents mentioned above as proof of identity and address of any of parents/guardians of such minor shall be deemed to be the proof of identity and address for the minor applicant.

- For HUF, an affidavit made by the Karta of Hindu Undivided Family stating name, father’s name and address of all the coparceners on the date of application and copy of any of the above documents in the name of Karta of HUF is required is required as proof of identity, address and date of birth.

Proof of Address:

- Copy of any of the following documents bearing the address mentioned in the application:

- Aadhaar Card issued by the Unique Identification Authority of India; or

- Elector’s photo identity card; or

- Driving License; or

- Passport

- Passport of the spouse; or

- Post office passbook having address of the applicant; or

- Latest property tax assessment order; or

- Domicile certificate issued by the Government; or

- Allotment letter of accommodation issued by the Central Government or State Government of not more than three years old; or

- Property Registration Document; or

- Copy of the following documents not more than three months old

- Certificate of address signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted officer

- Electricity Bill; or

- Landline Telephone or Broadband connection bill; or

- Water Bill; or

- Consumer gas connection card or book or piped gas bill; or

- Bank account statement or as per Note 2; or

- Depository account statement; or

- Credit card statement; or

- Employer certificate in original

Note:

- Proof of Address is required for residence address mentioned in item no. 7.

- In case of an Indian citizen residing outside India, copy of Bank Account Statement in country of residence or copy of Non-resident External (NRE) bank account statements (not more than three months old) shall be the proof of address.

Proof of date of birth:

Copy of any of the following documents bearing the name, date, month and year of birth of the applicant as mentioned in the application:

- Aadhaar card issued by the Unique Identification Authority of India;or

- Elector’s photo identity card; or

- Driving License; or

- Passport

- Matriculation certificate or Mark sheet of recognized board; or

- Birth certificate issued by the municipal authority or any office authorised to issue birth and death certificate by the Registrar of Birth and Deaths or the Indian Consulate as defined in clause (d) of sub-section (1) of section 2 of the Citizenship Act, 1955 (57 of 1955); or

- Photo identity card issued by the Central Government or State Government or Central Public Sector Undertaking or State Public Sector Undertaking; or

- Domicile certificate issued by the Government; or

- Central Government Health Service Scheme photo card or Ex-servicemen Contributory Health Scheme photo card; or

- Pension payment order; or

- Marriage certificate issued by the Registrar of Marriages; or

- Affidavit sworn before a magistrate stating the date of birth.

Foreign Citizen located within/outside India at the time of application for PAN (For Individuals and HUF)

Proof of Identity:

Attestation not required

- Copy of passport, or

- Copy of Person of Indian Origin (PIO) card issued by Government of India, or

- Copy of Overseas Citizen of India (OCI) card issued by Government of India, Or

Attestation required

- You need to provide a copy of your identification number or taxpayer identification number from your country. It should be verified by an official stamp called “Apostille” if your country is part of the Hague Convention of 1961. Otherwise, it can be verified by the Indian Embassy, High Commission, Consulate, or authorized officials of overseas branches of Indian banks in the country where you are located. The verification should be done according to the required format.

Proof of Address (Proof should contain the address mentioned in the PAN application form)

Attestation not required

- Copy of Passport, or

- Copy of Person of Indian Origin (PIO) card issued by Government of India, or

- Copy of Overseas Citizen of India (OCI) card issued by Government of India, or

- Copy of Bank account statement in the country of residence, or

- Copy of Non-resident External (NRE) bank account statement in India, or

- Copy of Certificate of Residence in India or Residential permit issued by the State Police Authorities, or

- Copy of Registration certificate issued by the Foreigner’s Registration Office showing Indian address, or

- Copy of Visa granted & Copy of appointment letter or contract from Indian Company & Certificate (in original) of Indian address issued by the employer.

Attestation required

- You need to provide a copy of your identification number or taxpayer identification number from your country, and it should be verified by an official stamp called “Apostille” (if your country is part of the Hague Convention of 1961) or by the Indian Embassy, High Commission, Consulate, or authorized officials of overseas branches of Indian banks (using the required format).

Note:

If a foreign citizen mentions an office address in India in their PAN card application, they need to provide the following additional documents as proof of the office address:

- A copy of the appointment letter or contract from the Indian company.

- The original certificate of address in India, issued by an authorized signatory of the employer. This certificate should be on the employer’s letterhead and should mention the PAN of the employer.

- A copy of the PAN card for the PAN mentioned in the employer’s certificate.

These documents are required to verify the office address mentioned by foreign citizens in their PAN card application.

For Categories other than Individuals & HUF i.e. Firm, BOI, AOP, AOP (Trust), Local Authority, Company, Limited Liability Partnership, Artificial Juridical Person

- Having an office of their own in India:

| Type of Applicant | Document to be submitted |

|---|---|

| Company | Copy of certificate of registration issued by Registrar of Companies. |

| Partnership Firm | Copy of certificate of registration issued by Registrar of firms or Copy of Partnership Deed. |

| Limited Liability Partnership | Copy of Certificate of Registration issued by the Registrar of LLPs |

| Association of Persons (Trust) | Copy of trust deed or copy of certificate of registration number issued by Charity Commissioner. |

| Association of Person, Body of Individuals, Local Authority, or Artificial Juridical Person | Copy of Agreement or copy of certificate of registration number issued by charity commissioner or registrar of cooperative society or any other competent authority or any other document originating from any Central or State Government Department establishing identity and address of such person. |

2. Having no office of their own in India:

| Type of Applicant | Document to be submitted |

|---|---|

| Company/ Firms/ Limited Liability Partnership/ AOP (Trusts)/AOP/ BOI/ Local Authority/ Artificial Juridical Person | (1.1) Copy of Certificate of Registration issued in the country where the applicant is located, duly attested by “Apostille” (in respect of the countries which are signatories to the Hague Convention of 1961) or by the Indian Embassy or High Commission or Consulate in the country where the applicant is located or authorised officials of overseas branches of Scheduled Banks registered in India.(1.2) Copy of registration certificate issued in India or of approval granted to set up office in India by Indian Authorities. |

Also Read: How to Link Aadhaar Card with PAN Card?

In summary, you can apply for a PAN card online or offline, but it’s important to submit the correct documents and provide a registered email address and phone number. Failing to do so or providing incorrect information can delay or prevent you from obtaining a PAN card.

Disclaimer: The purpose of this blog is to simplify complex processes for readers’ understanding. Please note that some information and screenshots provided may become outdated or change over time. However, we strive to keep our blogs updated and relevant to provide accurate and helpful information.