Aadhaar Enabled Payment System (AePS) is a secure and convenient payment mechanism that leverages the Aadhaar infrastructure to enable financial transactions. It allows individuals to use their Aadhaar number and biometric authentication to access various banking services, including cash withdrawals, balance inquiries, fund transfers, and more.

This article provides a comprehensive overview of the Aadhaar Enabled Payment System, covering its features, benefits, usage, and the role it plays in promoting financial inclusion and digital payments in India.

What is AePS?

AePS, or Aadhaar-enabled payment system, is a service developed by the National Payments Corporation of India. It allows users to conduct transactions on a micro-ATM by providing their Aadhaar number and biometric information. Here are the key features of AePS:

- Aadhaar-linked transactions: AePS enables Aadhaar card holders to make transactions through their Aadhaar-linked bank accounts, similar to debit/credit card transactions.

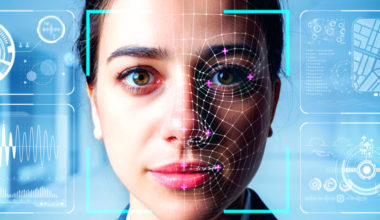

- Biometric authentication: Transactions are completed by submitting the Aadhaar number and biometric details (iris or fingerprint scan) at Points of Sale (PoS) or micro ATMs, using Aadhaar authentication.

- Bank account privacy: Users are not required to share their bank account details during the transaction, enhancing privacy and security.

- Fund transfers: AePS allows users to transfer funds between bank accounts, providing a convenient way to send and receive money.

- Secure transactions: AePS transactions are considered safe and secure as they require biometric authentication, ensuring the identity of the user.

By leveraging the Aadhaar infrastructure, AePS simplifies and secures financial transactions, making it accessible to a wide range of individuals, particularly those who may not have access to traditional banking services.

Benefits of AePS or Aadhaar Enabled Payment System

The Aadhaar-enabled payment system (AePS) offers several advantages for all segments of society:

- User-friendly: AePS is designed to be user-friendly, making it easy for individuals to understand and use the system for various financial transactions.

- Biometric authentication: The system requires the submission of biometric data (such as fingerprints or iris scans) and the Aadhaar card number for authentication, ensuring secure and reliable transactions.

- Empowering the underprivileged: AePS plays a significant role in empowering the underprivileged sections of society by providing them with access to banking services and enabling digital financial transactions.

- Bank account privacy: Users can complete transactions without having to disclose their bank account details, enhancing privacy and security.

- Convenient Access to Bank Accounts: AePS allows users to conveniently access their bank accounts using Aadhaar authentication, eliminating the need for physical bank visits.

- Enhanced security: The submission of biometric data and Aadhaar number adds an extra layer of security to AePS transactions, making them highly secure and reliable.

- Reach to remote areas: AePS enables the deployment of micro Point of Sale (PoS) machines to remote villages and areas, facilitating easy and accessible transactions for users in underserved regions.

Features of AePS

The AePS facility exhibits the following primary characteristics:

- Account deduction: The transaction amount is deducted directly from the Aadhaar-linked bank account of the user, ensuring a seamless and straightforward transaction process.

- Basic banking transactions: AePS allows Aadhaar card holders to perform various basic banking transactions, including cash deposits, interbank and intrabank fund transfers, cash withdrawals, balance inquiries, and obtaining mini bank statements. These transactions can be conducted through a banking correspondent.

How Does AePS Work?

Access to crucial financial services can be obtained by simply recalling the 12-digit Aadhaar number, which is linked to your bank account. To verify a transaction or utilize the AePS (Aadhaar-enabled Payment System) facility, your fingerprint must be authenticated with your Aadhaar. The transaction will be processed by the bank only after the UIDAI (Unique Identification Authority of India) verifies your fingerprint.

Let’s consider a scenario where an individual, claiming to be Anvay, presents an Aadhaar number associated with Anvay’s name. In order to complete a transaction and pay for his purchases from a merchant, Anvay needs to provide his fingerprint for verification. If the fingerprint matches, the bank will proceed with the transaction. Consequently, a significant number of entities are involved in facilitating such transactions:

- The individual wishing to carry out the transaction.

- The intermediary, which could be a merchant or store owner, or a banking correspondent, through whom the transaction is conducted.

- The Aadhaar-enabled bank.

- UIDAI, responsible for fingerprint authentication.

- NPCI (National Payments Corporation of India), responsible for transaction settlement.

How to Use the AePs Facility?

To utilize the AePS facility, an Aadhaar card holder with a linked bank account can follow these steps:

- Visit a local banking correspondent.

- Enter the Aadhaar number into the Point of Sale (PoS) machine.

- Select the transaction type and specify the bank’s name.

- Enter the transaction amount to proceed with the transaction.

- Provide biometric authentication (fingerprint or iris scan) to confirm the payment.

- Upon successful completion, a receipt will be issued for the transaction.

Note: A banking correspondent acts as an intermediary appointed by the bank to provide banking services in areas where the bank does not have a branch.

What Is Required to Use the AePs Facility?

To use the AePS facility, the essential requirements are:

- An Aadhaar card should be linked with the bank account

- Aadhaar number

- Fingerprint biometric of the Aadhaar card holder

- Micro ATM

Read More: How to Verify an Aadhaar Mobile Number

Objectives of AePS Service

The objectives of the AePS service include:

- Access to Aadhaar-linked bank accounts: Enable customers to conveniently perform banking tasks such as cash deposits, withdrawals, fund transfers, balance inquiries, and mini statements using their Aadhaar-linked bank accounts.

- Streamlining fund distribution: Simplify the distribution of funds for government programs like NREGA, Social Security pension, and others by directly depositing funds into Aadhaar-linked bank accounts.

- Promoting payment digitization and financial inclusion: Contribute to the government’s initiatives to promote digital payments and increase financial inclusion by providing easy access to banking services through Aadhaar authentication.

- Establishing Aadhaar-based banking: Lay a strong foundation for Aadhaar-based banking services, leveraging Aadhaar as a unique identification and authentication mechanism for secure and reliable transactions.

AePS Cash Withdrawal Limit

The maximum transaction amount for a single AePS financial transaction has been set by NPCI at Rs. 10,000.

AePS Funds Transfer Limit

The Reserve Bank of India (RBI) does not impose any restrictions on AePS transactions. However, some banks have implemented a daily limit of Rs. 50,000 on the total number of transactions.

Also Read: Check Aadhaar Linking Status with Bank Online & Offline

Charges for AePS Transactions

AePS transactions are slightly more expensive compared to UPI transactions. The cost of an AePS transaction can range up to Rs. 15 per transaction. The transaction cost is divided as follows:

- The UIDAI has not currently imposed any fees, but it may do so in the future.

- The bank may charge a fee of up to 1% of the transaction, with a minimum fee of Rs. 5 and a maximum fee of Rs. 15.

- NPCI may levy a settlement fee ranging from 15 to 25 paise.

As of now, the Union government covers the cost of AePS payments until December 2019, including debit card, UPI, and AePS MDR fees. Therefore, AePS transactions are currently free of charge.

Banking Services Offered by AePS

- Cash Deposit

- Cash Withdrawal

- Balance Enquiry

- Mini Statement

- Aadhaar to Aadhaar Fund Transfer

- Authentication

- BHIM Aadhaar Pay

Other Services Offered by AePS

- eKYC

- Tokenization

- Aadhaar Seeding Status

Things to Keep In Mind While Using AePs

Here are the key points to keep in mind while using the AePS facility:

- Aadhaar linkage: To utilize the AePS service, it is essential to have a bank account linked to your Aadhaar number. Ensure that your bank account is properly linked to Aadhaar before attempting to use AePS.

- PIN or OTP: To complete a transaction through AePS, you will need to provide either a Personal Identification Number (PIN) or a One-Time Password (OTP), depending on the bank’s authentication process. Make sure you have the necessary PIN or OTP available for the transaction.

- Primary account usage: If multiple bank accounts are linked to your Aadhaar number, note that AePS transactions can only be conducted using the primary account associated with Aadhaar. Ensure that the primary account is selected for your transactions.

- Aadhaar-linked bank accounts: The AePS facility is exclusively available for Aadhaar-linked bank accounts. It is important to have an active bank account linked with your Aadhaar in order to access and utilize AePS services.