Online PAN verification, also known as ‘Know Your PAN,’ is a service provided to taxpayers and individuals who want to check the authenticity of their PAN Card.

In this blog, we’ll show you how to easily perform PAN verification. Before we go any further, here is a list of people and entities who can use the PAN Card verification service.

Who can Opt for a PAN verification Facility?

The following individuals/entities can apply for PAN verification-

- Banks

- Insurance company

- Insurance Web Aggregators

- Companies and Government deductor

- Non-Banking Financial Companies approved by RBI

- DSC issuing Authorities

- Credit Information companies approved by RBI

- Department of Commercial Taxes

- Goods and Services Tax Network

- KYC Registration Agency

- Prepaid Payment Instrument Issuers approved by RBI

- Housing Finance Companies

- Insurance Repository

- Depository Participants

- Payment And Settlement System Operators authorized by RBI

- Educational Institutions established by Regulatory Bodies

- Any entity that requires to furnish Annual Information Return/Statement of Financial Transactions

- Mutual Funds

- Credit card companies/Institutions

- Government Agencies (State/Central)

- Stock Exchanges/Clearing Corporations/Commodity Exchanges

- Reserve Bank of India

Ways to do Online PAN Verification

There are 3 ways to do online PAN verification-

Screen-based PAN Card Verification

An applicant can use the screen-based PAN Card verification method to verify at least 5 PAN Cards at the same time. An applicant must follow the instructions:

- Log to your account on the Income Tax Department e-filing website

- Enter all the PAN Card details

- Click on ‘Submit’ to view PAN Card details

File-based PAN Card Verification

An applicant can verify 1,000 PAN Cards at once using the file-based method of PAN Card verification. Organizations and government agencies, in general, prefer this method. The steps that an applicant should take to verify their PAN cards are as follows:

- Log in to your account on the Income Tax Department e-filing website

- Upload the file as per the given instructions

- Click on ‘Submit’

- PAN Card details will be generated within 24 hours

*It should be noted that the website may reject the file if it is not uploaded in the specified format.

API-based PAN Card Verification

An applicant can verify the PAN Card details on verification sites by using a software application.

How to do PAN Verification in Few Easy Steps?

An applicant can do PAN verification in three ways-

- PAN verification by date of birth and name

- PAN verification by AADHAAR number

- PAN verification by PAN number

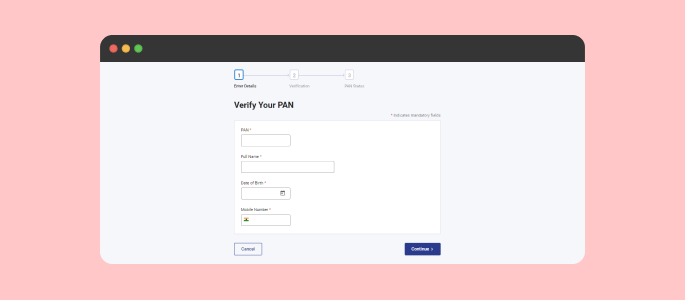

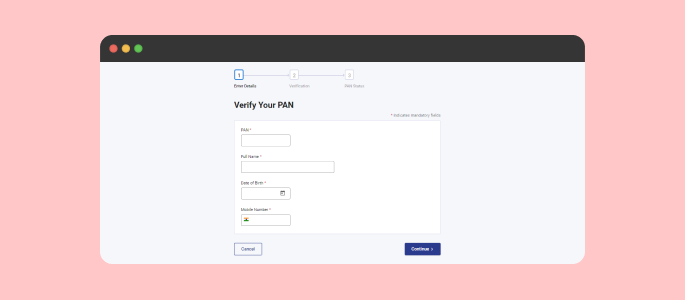

PAN Verification by Date of Birth and Name

An applicant needs to go through the following steps to do PAN verification swiftly-

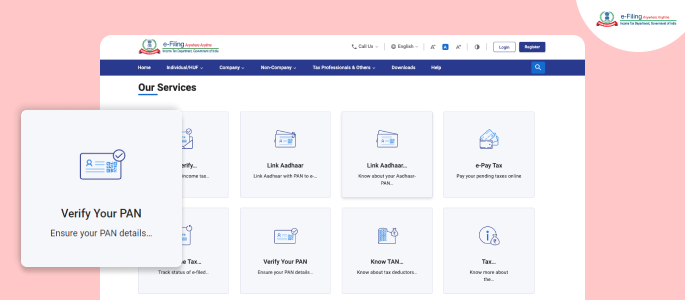

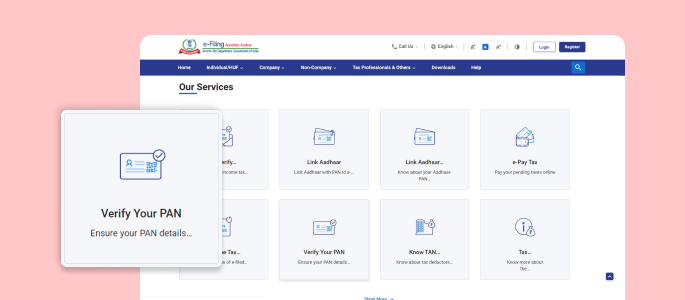

- Log in to the official Income Tax Department e-filing website (www.incometax.gov.in)

- Select ‘Verify Your PAN’

- Enter the required details and click on ‘Continue’

- You will be redirected to another page to verify PAN details

- Check your PAN status by following the instructions provided

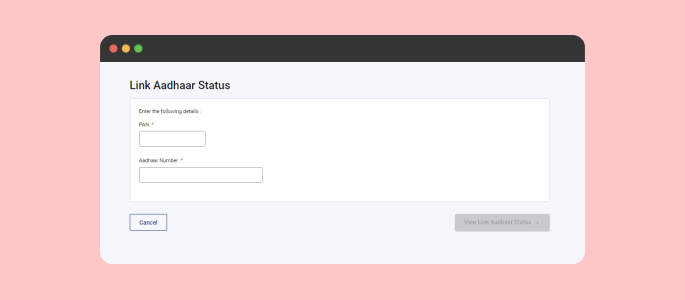

PAN Verification by Aadhaar Card

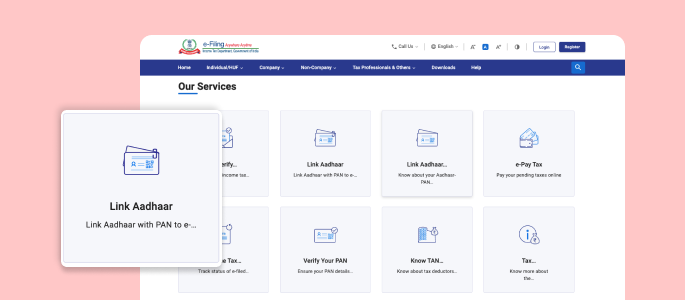

Below are the steps an applicant should follow to verify PAN details-

- Visit the official Income Tax Department e-filing website (updated as www.incometax.gov.in)

- Click on ‘Link Aadhaar’ under the section ‘Our Services’

- Enter the details under ‘Link Aadhaar Status’

- Check ‘View Link Aadhaar Status’

- The details will be provided on the screen

PAN Verification by PAN Number

A PAN number can also be used to validate PAN information. An applicant can perform PAN verification by following the instructions provided:

- Visit the official Income Tax Department e-filing website

- Click on ‘Verify Your PAN Details’

- Enter all the details and click on ‘Continue’

- Your PAN verification status will be displayed on the screen

What are the Documents Required for Online PAN Card Verification?

The list of documents that an organisation must submit for online PAN Card verification is as follows:

Organizational Details

- PAN and TAN of the entity

- Name of the entity

- Personal details of the entity

- Contact details of the entity

- Category of the entity

Payment Details

- Mode of payment

- Payment amount

- Number of instrument

Signature Details

- Serial number of digital signature certificate

- Name of the certifying authority

- Class of digital signature certificate

Read also- ‘Documents required for PAN card‘