According to the official data, around 7.4 crore Indians filed an ITR in FY23. If you are one of them, you must know about different forms related to income tax, which prove your income tax liability for a particular financial year. Form 26AS is one such document that is important for filing ITR in India.

Since the information that Form 26AS carries is essential in calculating your tax payable, you must know all about it. This blog will help you understand what is Form 26AS, how you can view and download it, and what are the different components of Form 26AS.

What is Form 26AS?

Form 26AS refers to a combined document that records all tax-related details and transactions against your PAN number in an assessment year.

Form 26AS is also referred to as the Tax Credit Statement in India. It contains details like the TDS/TCS information, advance tax or self-assessment tax you paid, as well as the high-value transactions you made in a particular income tax cycle.

Taxpayers are provided with Form 26AS income tax to update the financial and tax-related activities against their respective PAN numbers. In short, taxpayers can get an overall picture of the tax paid and tax refund against their incomes in a particular financial year through this form.

How to View and Download Form 26AS?

There are three ways to view and/or download Form 26AS-

- Download Form 26AS Through TRACES Portal

Step 1: Visit the e-filing website

Step 2: Enter your user ID (PAN or Aadhaar number)

Step 3: Enter the password

Step 4: Go to ‘e-file’ and select ‘Income Tax Returns’ and ‘View Form 26AS’

Step 5: Click on ‘Confirm’ to redirect to the TRACES website

Step 6: Select the box on the TRACES website and click ‘Proceed’

Step 7: Click on the link at the bottom of the page to view Form 26AS

Step 8: Choose the Assessment Year and format (HTML or PDF) to view or download Form 26AS

Step 9: Open the downloaded file to view Form 26AS

You can finally download Form 26AS in PDF form and save it for future reference.

- Download Form 26AS Via Internet Banking

PAN holders with a net banking account from any authorized bank can view Form 26AS. Form 26AS can only be viewed if the PAN number is linked to the net banking account. This service is free of charge.

- Download Form 26AS Through E-Filing Portal

Step 1: The first step is to log in or register on the e-filing website.

Step 2: Enter your PAN number under the ‘Taxpayer’ tab to check if you’re already registered.

Step 3: If you have e-filed before, check your email inbox for ‘incometax.gov.in’ for relevant information.

Step 4: Log in using your user ID (PAN number) and password to access income tax-related compliances.

Step 5: Reset your password if you don’t remember it.

Read more: 5 Financial Updates from the Government of India You Must Know

What Information is Available on Form 26AS?

Form 26AS has the following information-

- Tax deducted on income by all tax deductors

- Details of tax collected at source by all tax collectors

- Advance tax payments made by the taxpayer

- Self-assessment tax payments

- Regular assessment tax deposited by PAN holders

- Details of income tax refunds received during the financial year

- Details of high-value transactions involving shares, mutual funds, etc.

- Details of tax deducted on the sale of immovable property

- Details of TDS defaults made during the year (after processing TDS return)

- Turnover details reported in GSTR-3B

Note: Additional information under the new AIS from 1 June 2020, including specified financial transactions, pending and completed assessment proceedings, tax demands, and refunds, in addition to existing data in the form.

What are the Different Components of Form 26AS?

Form 26AS is divided into 7 parts, from Part A to Part G. Each of these sections deals with different components of tax.

Part A: Details of Tax Deducted at Source

- Part A1: Details of Tax Deducted at Source for 15G/15H

- Part A2: Details of Tax Deducted at Source on the Sale of Immovable Property u/s194(IA)/TDS on Rent of Property u/s 194IB/TDS on Payment to Resident contractors and professionals u/s 194M (For Seller/Landlord of Property/ Payee of resident contractors and professionals)

Part B: Details of Tax Collected at Source

Part C: Details of Tax Paid (other than TDS or TCS)

Part D: Details of Paid Refund

Part E: Details of SFT Transaction

Part F: Details of Tax Deducted at Source on the sale of Immovable Property u/s194(IA)/TDS on Rent of Property u/s 194IB/TDS on payment to resident contractors and professionals u/s 194M (For Buyer/Tenant of Property/Payer of resident contractors and professionals)

Part G: TDS Defaults* (processing of Statements)

Part H: Details of Turnover as per GSTR-3B

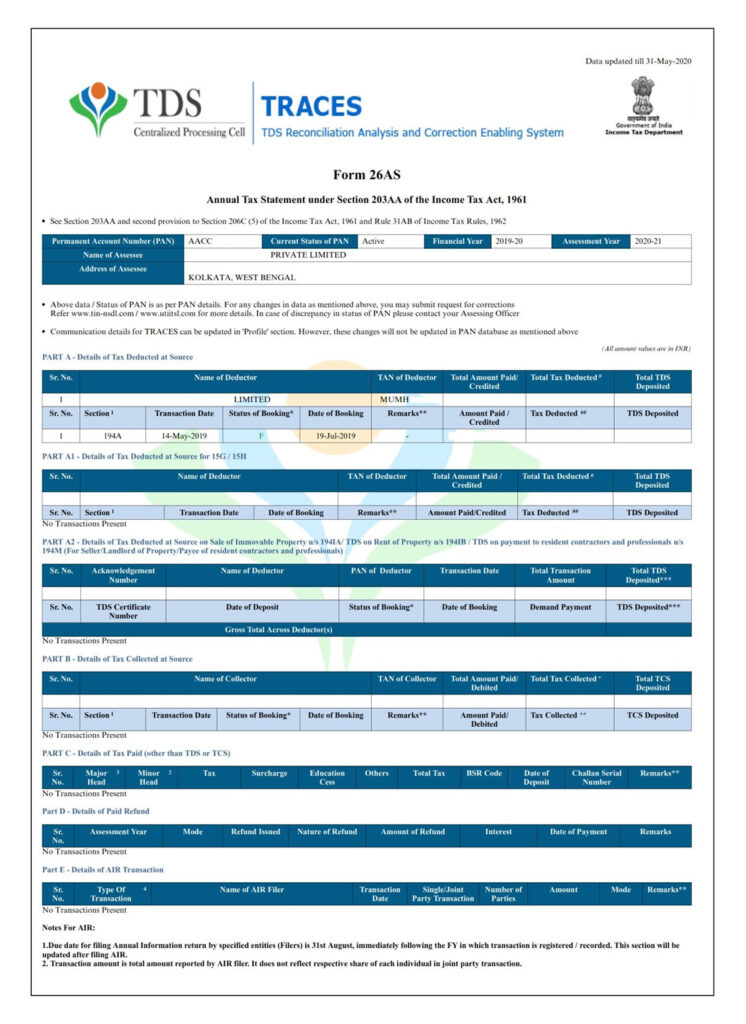

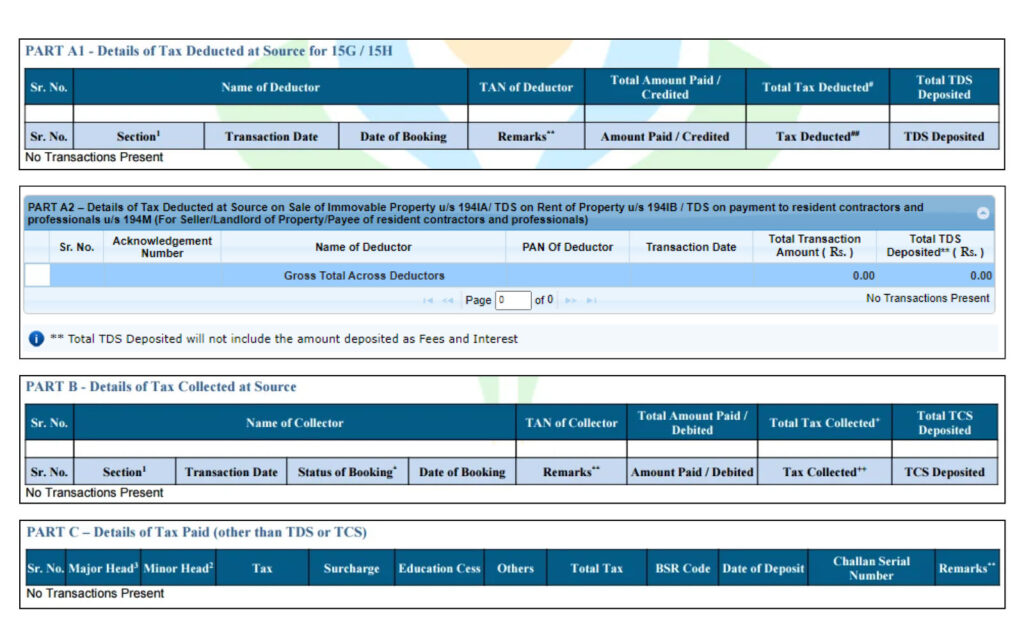

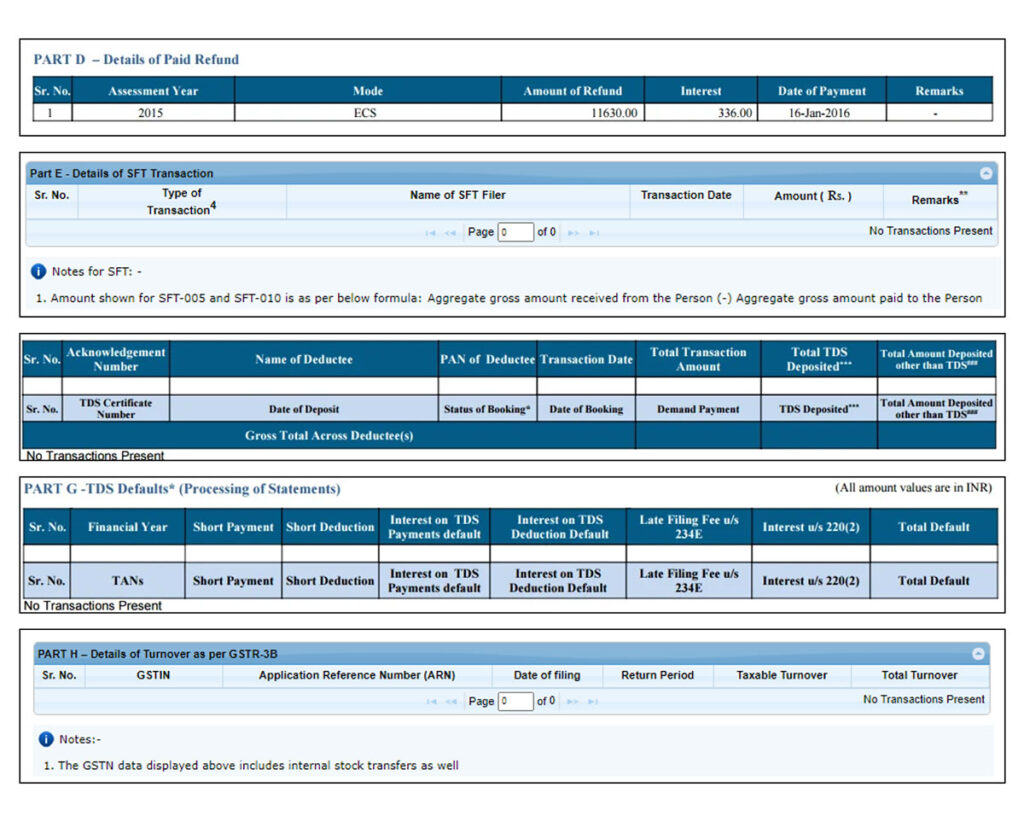

How Do Form 26AS and Its Components Look Like?

Form 26AS looks something like this-

The images below show the various components of Form 26AS-

Latest Updates on Form 26AS

The government made a few changes in the information provided in Form 26AS in May 2020 as listed below-

- Tax return information or demands (if applicable) against your PAN.

- Details of specific financial transactions, including the purchase and sale of stocks, credit card bill payment details, and transactions related to real estate.

- Any status related to income tax proceedings.

Note that you also need to have form 26AS login details to access your statement.

Read more: How to Effectively Declare Housing Loan Interest in Your ITR

Conclusion

Form 26AS can be considered as a tax log book that records all the details that act as proof of your income tax liability. Besides the income tax details, this form also contains sensitive and confidential details like your name, address, PAN, Aadhaar Number, etc. Therefore, you must protect this statement to avoid any breach of privacy. At the same time, any errors or absence of any details on the 26AS form should be corrected immediately to maintain transparency.

Disclaimer: This blog is written to make it easy for readers to understand complicated processes. Some information and screenshots may be outdated as government processes can change anytime without notification. However, we try our best to keep our blogs updated and relevant.