The Pradhan Mantri Mudra Loan Yojana (PMMY) is a significant initiative by the Indian Government, introduced in 2015 to support micro and small enterprises. Its primary goal is to promote entrepreneurship and uplift the socio-economic status of aspiring entrepreneurs across the country. Through PMMY, non-farm sector enterprises engaged in manufacturing, processing, trading or services can access micro-credit loans of up to INR 10 lakhs without collateral. The scheme envisions becoming a top-notch, integrated financial and support services provider, following global best practices and empowering the underserved for their overall economic and social development.

In this article, you will learn about the Pradhan Mantri Mudra Loan Yojana, including its key features, eligibility criteria, application process, benefits, and documentation requirements. This information will help you, as a potential beneficiary, apply for this loan easily and efficiently.

What are the Categories under PMMY?

The PMMY loan scheme’s benefits are classified into three categories, each tailored to cater to different stages of business growth:

- Shishu: For newly established ventures needing initial capital, providing loans up to INR 50,000.

- Kishor: Aimed at entrepreneurs looking to expand their existing businesses, offering loans from INR 50,001 to INR 5,00,000.

- Tarun: Tailored for well-established enterprises seeking substantial financial aid for expansion, with loans ranging from INR 5,00,001 to INR 10,00,000.

To access these loans, applicants must approach banks and lending institutions, which include:

- Public sector banks

- Private sector banks

- State-operated cooperative banks

- Rural banks from regional sector

- Institutions offering micro finance

- Financial companies other than banks

What are the Interest Rates for PMMY?

Under PMMY, the interest rates are reasonable and based on the bank’s policy. Shishu loans (up to INR 50,000) usually have waived processing charges. Remember, there are no agents or middlemen associated with MUDRA for availing the loan. Stay cautious and avoid individuals posing as MUDRA/PMMY agents to prevent potential scams.

What is the Eligibility Criteria for PMMY?

- The applicant must be an Indian citizen.

- The applicant must be between the ages of 18 and 65 years.

- The applicant must have no criminal records.

- The applicant must not have a default history with banks or financial institutions.

Entities eligible for PMMY loans include:

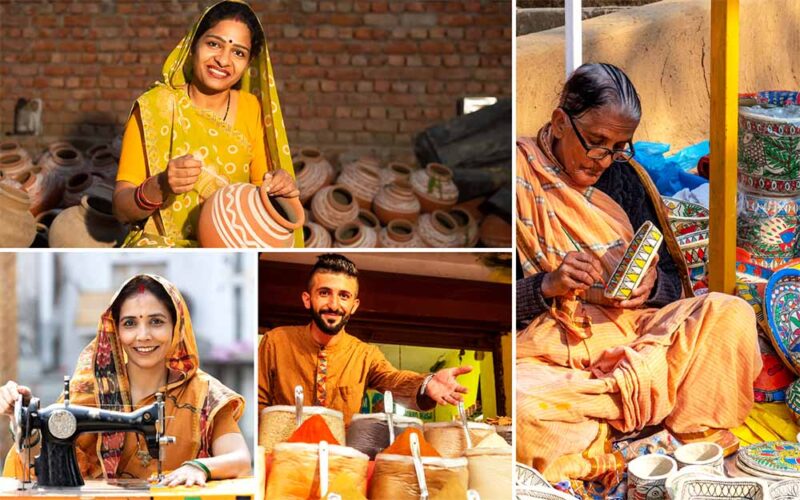

- Individuals, start-ups, artisans, small vendors, shopkeepers, retailers, manufacturers or MSMEs.

- Private or public limited companies, sole proprietorships, partnerships, limited liability partnerships (LLPs), non-governmental organisations (NGOs), trusts or cooperative societies.

PMMY Loans can be Utilised for Which Activities?

PMMY loans can be utilised for:

- Business loans for shopkeepers and traders

- Food products sector

- Transport vehicles used for transporting both goods and passengers

- Communities, social and personal service activities

- Textile products sector and activities

- Agriculture-related activities

- Equipment finance scheme for micro units.

Applicants should also have a satisfactory credit track record, and individual borrowers may be required to possess the necessary skills, experience or knowledge relevant to their proposed activity. Educational qualifications, if required, will be assessed based on the nature and demands of the proposed activity.

What are the Documents Required to Apply for PMMY?

- Identity proof (any one of the following)

- Voter’s ID card

- Driving licence

- PAN card

- Aadhaar card

- Passport (self-certified copy).

- Address proof (any one of the following)

- Recent utility bills (telephone or electricity)

- Property tax receipt (not older than 2 months)

- Voter’s ID card

- Aadhaar card

- Passport

- Bank passbook/account statement (attested by bank officials)

- Domicile certificates or certificates issued by government authorities.

- Category proof (if applicable): SC/ST/OBC/minority certificate.

- Business enterprise information:

- Copies of licences

- Registration certificates and other documents proving ownership, identity and address of the business

- Financial documents:

- Last six months’ statement of accounts from your existing banker.

- For loan amounts INR 2 lakhs and above: Last two years’ balance sheets, income tax/sales tax returns and projected balance sheets (one year for working capital and loan period for term loan).

- Sales achieved during the current financial year until the date of application.

- Project report for the proposed project, outlining technical and economic viability.

- Company/partnership details:

- Memorandum and articles of association (for companies).

- Partnership deed (for Partnership firms).

- Asset & liability statement (if third-party guarantee is unavailable) to assess net-worth.

How to Apply for PMMY?

To begin the application process for a Pradhan Mantri Mudra Loan Yojana (PMMY), it’s crucial to have the necessary documents readily available. The essential documents include your valid ID proof, address proof and business proof.

Follow the steps to apply for the PMMY loan:

- Visit the official PM MUDRA website and access the ‘Udyamimitra’ portal.

- Click on ‘Apply Now’ for Mudra loan and choose your applicant type.

- Provide your personal and professional details.

- Select the loan category and enter the required business information.

- Provide other information, such as director details, existing banking facilities and proposed credit facilities.

- Attach necessary documents required and submit the application. Note down the ‘Application Number’ for future reference.

Alternatively, you can:

- Visit the official website or branch of your chosen financial institution.

- Download or collect the application form.

- Prepare a written business plan (important for loan approval).

- Choose the suitable ‘Mudra Loan Scheme’ based on eligibility and fill the form.

- Submit the form with required documents and photos.

The lender branch will verify the details, assess the feasibility of your business plan and upon confirmation, they will disburse the loan amount to your bank account.

What are the Benefits of PMMY?

As of 24th March 2023, PMMY has sanctioned over 40.82 crore loans worth INR 23.2 lakh crore. Notably, 21% of the loans went to new entrepreneurs, while 69% were granted to women entrepreneurs. Additionally, 51% of the loans were provided to borrowers from SC/ST/OBC categories, promoting social inclusivity and economic growth.

The Pradhan Mantri Mudra Loan Yojana offers several significant benefits to micro and small enterprises:

- Collateral-free loans: Loans up to INR 10 lakhs under PMMY loans are collateral-free, making them accessible to small businesses with limited assets.

- Affordable interest rates: PMMY offers low and affordable interest rates, helping small businesses save money on repayments. These MUDRA loans also provide flexible repayment options

- Government guarantee: These loans come with a government guarantee, ensuring that if a borrower is unable to repay, the government will cover the loss.

- Wide availability: Mudra loans are widely available through banks and non-banking financial institutions, making the application process convenient and straightforward.

- Support for women entrepreneurs: Women entrepreneurs can benefit from discounted interest rates under PMMY, encouraging their business growth.

- Boosting micro enterprises: Mudra loans support micro enterprise activities, fostering job creation and contributing to overall economic growth.

Conclusion

Pradhan Mantri Mudra Loan Yojana has opened doors for aspiring entrepreneurs to pursue their dreams and contribute to the nation’s economic growth. By following the eligibility criteria, preparing accurate documentation, and presenting a well-defined business plan, you can increase your chances of securing a Mudra loan. The transparent and straightforward process of PMMY ensures that India’s micro-businesses can thrive and grow, making a valuable contribution to the nation’s economic progress.