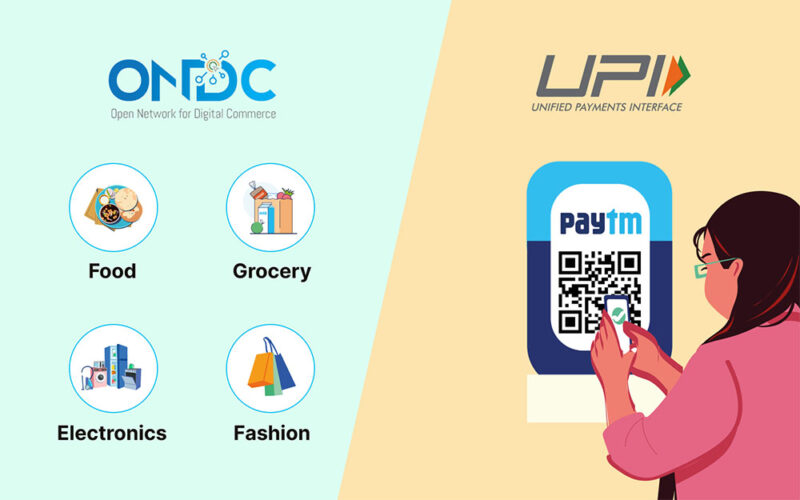

Digital payments have become increasingly popular in India, reshaping the way we make transactions. With technological advancements and the government’s focus on a cashless economy, two significant payment systems have emerged: the Open Network for Digital Commerce (ONDC) and the Unified Payments Interface (UPI).

In this blog post, we will explore the features of ONDC and UPI, discuss their differences and analyze their impact on the Indian economy.

What is ONDC and UPI?

The Open Network for Digital Commerce (ONDC) is a government-supported initiative in India that aims to simplify online shopping by connecting buyers and sellers through a common platform. It functions similarly to the Unified Payments Interface (UPI) but focuses specifically on the e-commerce sector. ONDC provides users with a wide range of products and services from different vendors, allowing them to compare prices and make purchases conveniently. By promoting healthy competition and offering competitive pricing, ONDC aims to enhance the online shopping experience for consumers in India.

UPI, or Unified Payments Interface, is a payment system in India that makes money transfers easy and hassle-free. It simplifies the process by eliminating the need for complex information like bank account numbers and IFSC codes. Instead, users can make payments using a unique UPI ID, mobile number, or QR code. The UPI ID acts as a virtual address for online transactions and money transfers, making it convenient and efficient for users to send and receive money.

Difference Between ONDC and UPI

Here is a table highlighting the differences between ONDC and UPI:

| Feature | Open Network for Digital Commerce (ONDC) | Unified Payments Interface (UPI) |

|---|---|---|

| Purpose | A government-backed initiative that connects buyers and sellers for online shopping. | A payment system that simplifies money transfers and payments across various platforms. |

| Supported by | Supported by the Indian government and the Department for Promotion of Industry and Internal Trade (DPIIT). | Supported by multiple banks and payment service providers in India. |

| Support for Small Businesses | Empowers small businesses by providing a common platform for them to reach a wider customer base and compete effectively with larger e-commerce players. | Focuses primarily on payment functionality rather than supporting small businesses directly. |

| Customer Support | Provides dedicated customer support within the app to address user concerns and queries related to orders and services. | Customer support may vary depending on the platform or service used within UPI. |

| Transaction Options | Offers various transaction options, including online shopping, food delivery, and other services through a single platform. | Provides multiple options for money transfers: QR code scanning, transfer to mobile/contact, UPI apps, and bank accounts. |

| Security | Ensures a secure platform backed by the Indian government, offering trust and reliability to users. | UPI transactions require a secure UPI PIN for authentication, adding an extra layer of security to prevent unauthorized access. |

Features of ONDC

The features of ONDC include:

- Increased choice and competition: With ONDC, users have access to a wide range of products and services from various e-commerce sellers. This allows for more options and competitive pricing, ensuring users can find what they need at the best possible prices.

- Affordability and savings: ONDC offers lower prices compared to other food delivery applications, helping users save money on their orders. This makes it an attractive option for cost-conscious individuals and families looking to make their purchases more budget-friendly.

- Discounts and promotions: ONDC, especially on platforms like Paytm, provides users with promotional deals and discounts. These can include special offers on specific restaurants or menu items, free delivery, or seasonal promotions, enhancing the affordability and value for users.

- Support for small businesses: By integrating small businesses and local vendors, ONDC empowers them to reach a larger customer base. This not only benefits the businesses but also allows users to access a wider range of products that may not be available on traditional e-commerce sites.

- Government backing: ONDC is supported by the Department for Promotion of Industry and Internal Trade (DPIIT) of the Government of India. This government support ensures the credibility and reliability of the platform, giving users confidence in using ONDC for their online shopping needs.

- Dedicated customer support: ONDC provides in-app customer support to address any concerns or queries users may have. This includes assistance with order tracking, payment issues, and general inquiries, ensuring a smooth and satisfactory user experience.

Also Read: Save Big Using ONDC For Food and Groceries

How to Use ONDC on Paytm?

To use ONDC for ordering food and groceries on Paytm, users can follow these steps:

Step 1: Log into the Paytm app using your credentials.

Step 2: In the search bar, type ‘ONDC’ or scroll down to find ‘ONDC’ for quick access.

Step 3: Explore the available options in categories like food, grocery, home decor, and electronics.

Step 4: Choose a specific restaurant or menu and select the desired items to add them to your cart.

Step 5: Proceed to the cart and select your delivery address, confirming it on the map.

Step 6: Apply any applicable coupon code and proceed to the payment stage.

Step 7: Choose your preferred payment method from the available options.

Step 8: Enter the PIN associated with your payment method to complete the food order.

Step 9: After a successful transaction, you will receive a notification on your registered mobile number.

Features of UPI

- UPI ID: Every UPI user has a unique UPI ID, which acts as a virtual payment address (VPA). It eliminates the need to share sensitive information like bank account numbers while making transactions.

- Seamless integration: UPI can be easily integrated into different payment apps, providing users with a single interface to access and manage their bank accounts.

- Multiple transaction options: UPI offers various transaction options, including scanning QR codes, transferring funds to mobile or contact numbers, sending money to other UPI apps, or transferring to bank accounts.

- UPI PIN: To complete UPI transactions, users need to enter a UPI PIN, which serves as a secure authentication method. It adds an extra layer of security to protect the user’s account from unauthorized access.

How to Use UPI ID to Send Money?

Step 1: Log in to the Paytm app.

Step 2: Go to the “Banking & Payments” section.

Step 3: Choose an option: “Scan & Pay,” “To Mobile or Contact,” or “To Bank or Self A/C.”

Step 4: Select the recipient from your phone contacts or enter their mobile number if not saved.

Step 5: If the recipient uses a different app, ask for their UPI ID and enter it.

Step 6: Now, enter the amount and “Pay.”

Step 7: On the next screen, choose your preferred bank account, click on ‘Pay’ and enter your UPI PIN,

Step 8: The amount will be immediately transferred from your bank account to the recipient’s bank account.

Suggested Read – What Is Paytm UPI Reference Number and How Can You Track It?

ONDC and UPI play vital roles in India’s digital payment ecosystem. UPI simplifies money transfers and payments, while ONDC acts as a platform for online shopping. With ONDC, small businesses thrive, offering users more choices, competitive prices, and attractive discounts. UPI streamlines transactions through UPI IDs, mobile numbers, and QR codes. These systems have revolutionized the way transactions are conducted in India, promoting a cashless economy and benefiting both businesses and consumers. Together, ONDC and UPI have transformed the digital payment landscape, making transactions easier, more convenient, and secure.

Disclaimer: This blog is written to make it easy for readers to understand complicated processes. Some information and screenshots may be outdated as government processes can change anytime without notification. However, we try our best to keep our blogs updated and relevant.