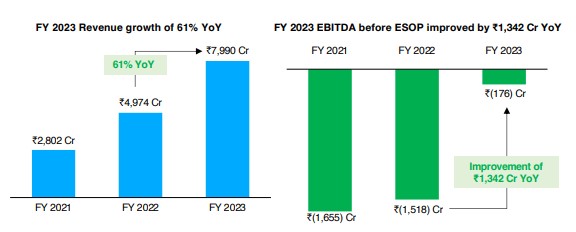

We exited FY 2023 on a strong note with our revenue surging 61% to ₹7,990 Cr, with EBITDA profitability before ESOP in the last two quarters of the year. The company’s contribution margin plunged from 30% in FY 2022 to 49% in FY 2023, due to improved payments profitability, and growth in high margin loan distribution business.

As India’s leading payments and financial services company, we have been driving the country’s digital revolution through our products which are trusted by millions of our merchants and users. With the country still in the nascent stages of digital payments, we believe we have extensive growth potential ahead of us with untapped opportunities in payments and financial services.

We have been relentless in our pursuit of building cutting-edge solutions to expand our two-way ecosystem for the acquisition of both consumers and merchants. Starting from online mobile recharges to movie tickets to buying shares to short-term credit, Paytm has been at the forefront of innovations, creating disruptive technology solutions to leverage its growth potential.

Through Paytm-pioneered QR Codes, ‘scan and pay’ has become the most common mode of payment. We have revolutionised mobile payments, by expanding the reach and access to the farthest corners of the country. Our iconic Paytm Soundbox, an industry-first solution that gives real-time payment confirmations to merchants, has emerged as the sound of mobile payments in India. With our All-in-One Paytm PoS machines, we have empowered merchants and consumers with the flexibility of payments while also ensuring convenience for businesses through the comprehensive device.

We have strengthened our leadership in merchant payments with 79 Lakh devices, both PoS and Soundbox, deployed at the end of June 2023. The access to a large number of merchants and customers just with the reach of our transformative products like the Soundbox gives us ample opportunities to cross-sell other lending and payment services products.

Bringing further convenience to millions of our users, we launched UPI Lite for small-value transactions of up to ₹200. In a short span, it has become a popular payment method for users for single-click transactions. We have also empowered RuPay credit card users with UPI payments, marking another milestone in the growth of UPI in the country.

During the Q4 earnings call, our Founder and CEO Vijay Shekhar Sharma said, “We continue to see a tremendous amount of growth thanks to the new monetisation methods like subscription revenue from Soundbox, EDC devices revenue, and we have now added commercials towards enabling commerce. So we continue to see the payment line item of our revenue and merchant relationship continuously growing.”

Our payments business offers a huge bank of potential customers to cross-sell various financial & commerce services. We leverage the access to these customers to showcase other products in the credit line – Personal loans, Merchant loans, and small ticket consumption credit which includes Postpaid and Credit cards. Through our partnership with large NBFCs and banks, we market and distribute credit products. We believe there is a long runway for growth as our payments consumer and merchant base offers a large addressable market. Our growing borrower base offers us tremendous upsell and lifecycle benefits.

We also offer marketing services to our merchants by monetising the traffic on Paytm Super App. Commerce and cloud services form another flywheel of our business model. Our commerce business includes travel, movie, entertainment ticketing, deals, and gift vouchers while the cloud business includes advertising, co-branded credit cards, marketing cloud, and loyalty business. We recently launched our co-branded credit card in partnership with SBI Card which will further boost the credit ecosystem in India.

Since monetising our customer base is one of the key drivers taking our business to the next phase of growth, we continue to invest in consumer marketing and expand merchant-acquiring sales teams. Our sales team has more than 28,000 members and caters to nearly 550 towns and cities. In the near future, we believe that India has the potential of at least 10 Cr merchants and more than 50 Cr payment users, which offers us a huge opportunity to monetise our customer base and become a free cash flow generating company with a robust revenue stream.