Form 16A is important because it helps you calculate your taxes correctly and file your income tax returns (ITR) smoothly. Your employer should provide you with Form 16A regularly, either every three months or at the end of the year. It’s crucial to keep a copy of this document handy for when you need to file your taxes or have any future tax inquiries. In this blog, we will simplify the complexities of Form 16A and provide you with all the essential information you need to know. Whether you are an employee receiving a salary or earning income from other sources, understanding Form 16A is essential for accurate tax calculations and hassle-free ITR filing.

What is Form 16A?

Form 16A, also known as a TDS certificate, is a document provided by your employer that shows the amount of tax deducted from your salary or other income sources. It serves as proof that the correct amount of tax has been deducted and remitted to the government. This certificate contains information about taxes deducted from various earnings, such as salary or interest from savings and investments. It is essential for accurately calculating your taxes and filing your income tax returns (ITR). Your employer should provide you with Form 16A regularly, either every quarter or at the end of the year. It is crucial to keep a copy of this document for future tax inquiries or when filing your taxes.

Form 16A TDS Certificate Format

The format of Form 16A typically includes the following information:

- Name and address of the deductor (employer)

- Name and address of the deductee (employee)

- Permanent Account Number (PAN) of the deductor and deductee

- Unique TDS certificate number

- Assessment year for which the certificate is issued

- Period for which the certificate is issued

- Summary of TDS deducted and deposited

- Details of income subject to TDS, such as salary, interest, etc.

- TDS challan details, including BSR code, date of deposit, and challan identification number

- Any other relevant information or disclosures

It’s important to note that the exact format may vary slightly based on updates and changes made by the Income Tax Department. Employers are responsible for ensuring that the information provided in Form 16A is accurate and matches the details reported to the tax authorities.

Here is an example format of Form 16A TDS Certificate:

[Logo/Name/Address of the Employer]

Form No. 16A

(TDS Certificate under Section 203 of the Income Tax Act, 1961)

[Employer’s TAN (Tax Deduction and Collection Account Number)]

[PAN (Permanent Account Number) of the Deductor]

[PAN (Permanent Account Number) of the Deductee]

Name and Address of the Deductor:

[Employer’s Name]

[Employer’s Address]

Name and Address of the Deductee:

[Employee’s Name]

[Employee’s Address]

Assessment Year:

[Year for which the TDS is being reported]

Period:

[Duration for which the TDS is being reported]

Particulars of Payment:

[Details of payment on which TDS is deducted, such as salary, interest, etc.]

Receipt Numbers:

[Receipt numbers of TDS returns filed]

Details of Tax Deducted and Deposited:

Sl. No. Date of Payment Amount Paid/Credited Date of Deduction Amount Deducted Date of Deposit Amount Deposited Challan Details

Total Tax Deducted:

[Total amount of tax deducted]

Total Tax Deposited:

[Total amount of tax deposited]

Verification:

I, [Name of the Employer], hereby certify that the information provided in this certificate is true and correct based on the records maintained by the deductor.

Date:

[Date of issuing the TDS certificate]

Place:

[Place of issuing the TDS certificate]

Signature:

[Signature of the Employer or Authorized Signatory]

Designation:

[Designation of the Employer or Authorized Signatory]

Note: This is just an example format. The actual format of Form 16A may vary depending on the requirements and guidelines issued by the Income Tax Department.

Types of Payments for Which Form 16A Is Issued

Form 16A is issued for various types of payments on which tax is deducted at source (TDS). Some common types of payments for which Form 16A is issued include:

| Type of Payment | Description | Form |

|---|---|---|

| Salary | Form 16A issued by the employer to summarize the salary and tax deductions | Form 16A |

| Interest on Fixed Deposits | Form 16A issued by banks/financial institutions for TDS on interest income | Form 16A |

| Rent | Form 16A issued by the landlord for TDS on rent exceeding the specified threshold | Form 16A |

| Commission/ Brokerage |

Form 16A issued by the payer for TDS on commission or brokerage income | Form 16A |

| Professional Fees | Form 16A issued by the payer for TDS on professional fees | Form 16A |

| Winnings from Lotteries, etc. | Form 16A issued for TDS on winnings from lotteries, crossword puzzles, etc. | Form 16A |

Note: The table provides a general overview, and there may be additional types of payments for which Form 16A is issued, depending on specific tax regulations and requirements.

Also Read: Guide to Understanding Form 16

Significance of TDS or Form 16A

The Form 16A TDS certificate holds significant importance for both the deductor (employer) and the deductee (employee). Here are some key reasons why the Form 16A TDS certificate is significant:

- Proof of TDS Deduction: Form 16A acts as proof that tax has been deducted from the deductee’s income at the source.

- Income Tax Filing: Form 16A is essential for individuals when filing their income tax returns. It helps in accurately calculating their tax liability.

- Claiming Tax Credits: The TDS certificate allows individuals to claim tax credits for the tax deducted at source, reducing their overall tax liability.

- Compliance with Tax Regulations: Issuing Form 16A is mandatory for deductors (employers) as per the Income Tax Act. It ensures that employers fulfill their obligations to deduct TDS and provide the necessary documentation to employees.

- Financial Record Keeping: Form 16A helps individuals maintain accurate financial records by providing a summary of TDS deductions made by the employer. This promotes transparency and proper record-keeping.

Also Read: Complete Guide to Understand Form 26AS

How to Get TDS Certificate/Form 16A?

Form 16A can be downloaded from TRACES (TDS Reconciliation, Analysis and Correction Enabling System), a web-based application system. It is considered a valid TDS certificate and you can only generate Form 16A if you have a valid PAN.

Here’s the step-by-step procedure to download Form 16A:

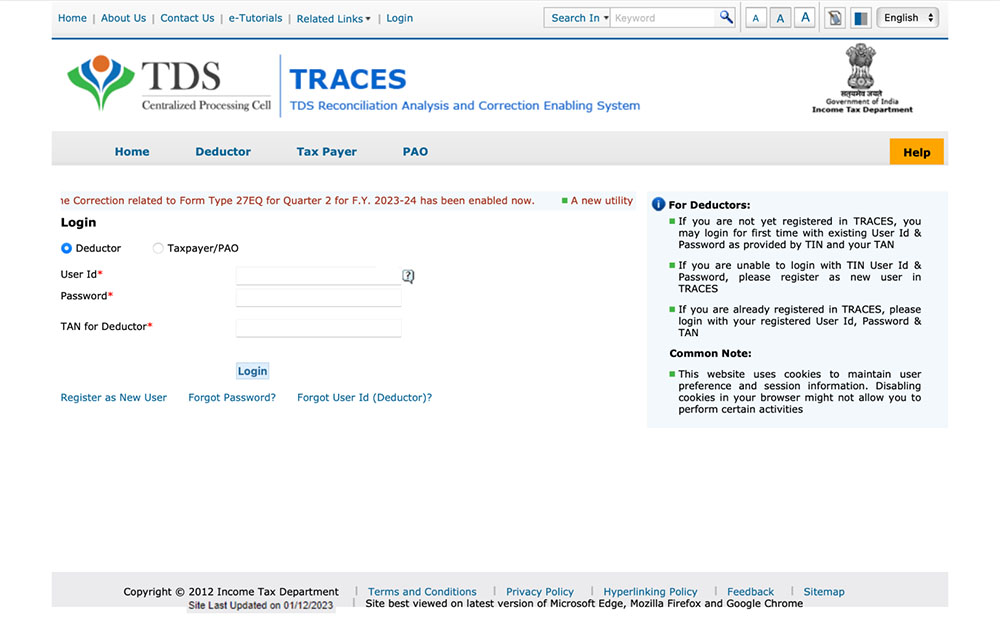

Step 1: Log in to the TRACES official portal using your user ID, TAN, PAN, password, and the captcha code.

Step 2: In the ‘Downloads’ section, choose Form 16A from the dropdown menu.

Step 3: Select the financial year and quarter for which you want to download the TDS certificate, the form type, and PAN. Click on ‘Go’.

Step 4: Verify all the details displayed on the screen and in Form 16A. Click on ‘Submit’.

Step 5: There are two ways to do KYC validation:

- With DSC (Digital Signature Certificate): Click on the ‘Validate’ option, enter the DSC password, and click on ‘Sign’.

- Without DSC: Enter details such as the Token number of IT return filed, challan details, PAN, and TDS amount deposited. Click on ‘Proceed’.

Step 6: After the KYC details have been validated, a success message and a request number will appear. Wait for 24-48 hours after the request status is ‘Submitted’. Form 16A can be accessed and downloaded from the ‘Downloads’ section using the request number when the status is ‘Available’.

Step 7: Enter the request number or request date and select ‘view all’. If the status is ‘Available’, click on the download option.

Step 8: Download the TRACES Utility to convert the text file to PDF. Go to ‘Downloads’, click on ‘Files Requested For Download’, select ‘Click Here’, and enter the captcha code on the next page.

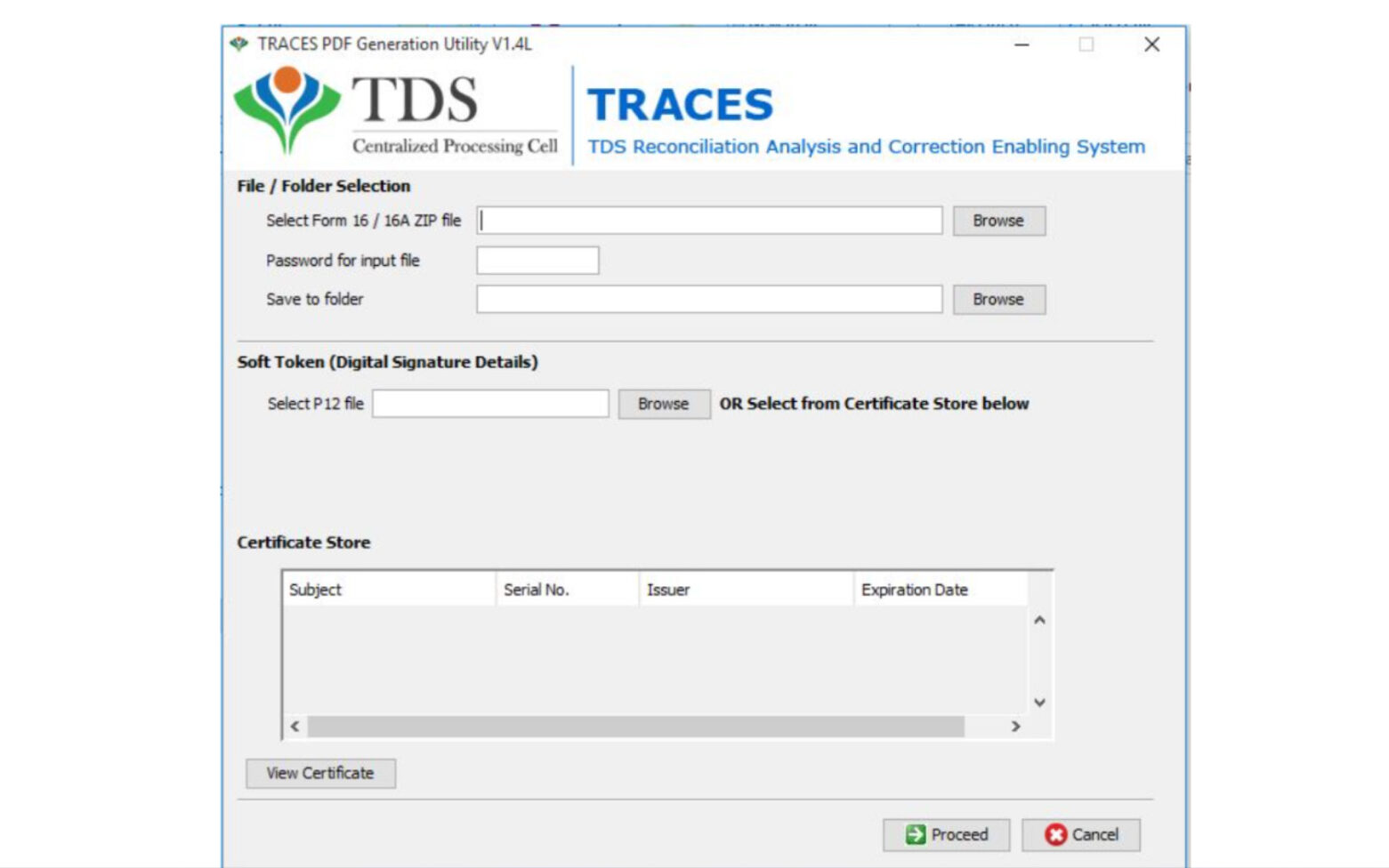

Step 9: Download the TRACES PDF converter V 1.5 light version to convert Form 16A to PDF.

Step 10: Steps to download Form 16A PDF:

- Open the utility.

- Browse and select the zip folder.

- Enter TAN as the password for the input file.

- Select the folder where you want to save the form.

- Click on ‘Proceed’ to save the PDF version of Form 16A in the selected folder.

How to Fill Form 16A?

Step 1: Get the Form 16A format from the Income Tax Department’s website or use the format provided by the deductor’s software.

Step 2: Fill in the deductor’s details, including their name, address, PAN (Permanent Account Number), and the unique TDS certificate number.

Step 3: Provide the deductee’s information, including their name, address, PAN, and the assessment year for which the certificate is issued.

Step 4: Specify the quarter in which the TDS deduction was made, describe the nature of the payment on which TDS was deducted, and record the relevant dates.

Step 5: Enter the amount of TDS deducted and deposited with the government, along with the challan number and deposit date.

Step 6: Include any additional information or details that may be required.

Step 7: Sign and print Form 16A, and make sure to issue it to the deductee within 15 days from the due date of furnishing the TDS statement.

Also read: How to Claim TDS Refund Online?

Difference Between Form 16, Form 16A and Form 16B

| Aspect | Form 16 | Form 16A | Form 16B |

|---|---|---|---|

| Purpose | Provided by the employer to employees | Contains TDS details on salary income | Contains details of TDS on sale of property |

| Source | Issued by the employer | Issued by deductors other than the employer | Issued by the buyer of immovable property |

| Information | Details of salary, taxes deducted, exemptions | Details of TDS on non-salary income | Details of TDS on sale of property |

| Applicability | For salaried individuals | For income sources other than salary | For sale of immovable property |

Conclusion: Form 16A is an important document for taxpayers as it helps in calculating taxes accurately and facilitates smooth filing of income tax returns (ITR). Employers are responsible for providing Form 16A regularly to their employees, either on a quarterly basis or at the end of the year. It is crucial to keep a copy of this document for future tax inquiries and while filing taxes. Understanding Form 16A is essential for accurate tax calculations and hassle-free ITR filing, whether you are an employee receiving a salary or earning income from other sources. It is recommended to familiarize yourself with the components, generation process, and verification of Form 16A to ensure compliance with tax regulations.

Disclaimer

This blog is written to make it easy for readers to understand complicated processes. Some information and screenshots may be outdated as government processes can change anytime without notification. However, we try our best to keep our blogs updated and relevant.