As the deadline for filing ITR for the fiscal year 2022-2023 has arrived, you must note that the completion of the income tax return (ITR) filing process necessitates verification by taxpayers. Failure to verify the ITR promptly will render it invalid.

As of July 31, the Income Tax (I-T) department website reported that over 6.7 crore income tax returns for the financial year 2022-23 (assessment year 2023-24) have been filed. Nevertheless, filing the ITR is only half of the process, as taxpayers must also verify their income tax return (ITR) to complete the filing procedure. Failure to verify the ITR within the designated timeframe will result in its invalidation.

To expedite this process, the Central Board of Direct Taxes (CBDT) has reduced the ITR verification time restriction to 30 days from the date of return filing, down from the previous 120 days.

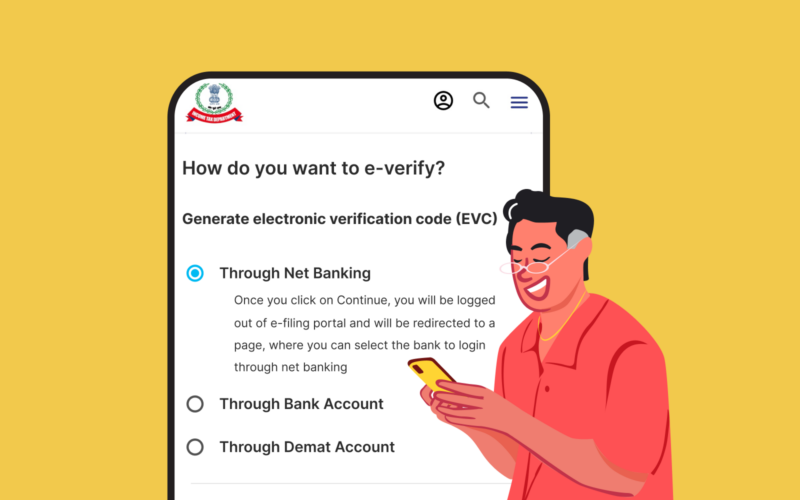

The most straightforward and expeditious method of ITR verification is through e-verification. However, if you prefer not to e-verify, you have the option to send a physical copy of the ITR-V for verification. The income tax department provides multiple e-verification methods, including Aadhaar, bank account, net banking, bank ATM, demat account, and Digital Signature Certificate (DSC).

Ensure Valid Income Tax Return Filing: Understanding ITR E-Verification

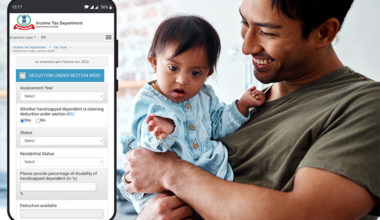

ITR e-verification is a crucial process to electronically verify your Income Tax Return (ITR). It is obligatory to complete this step within 30 days of filing your ITR. Failing to e-verify your ITR will render it invalid. In case you verify your ITR after this designated period, the verification date will be considered as the new filing date, potentially leading to penalties as per the provisions of the Income-Tax Act 1961. For instance, if you file your return on July 31 and fail to verify it by August 30, 2023, the date of verification will be treated as the filing date, and the relevant consequences will be applied accordingly.

Steps to Verify Returns Using Aadhaar OTP

- Log in to the ‘e-Filing’ website incometax.gov.in using your login credentials.

- Navigate to e-File and click on “Income Tax Returns.”

- Go to “e-Verify Return” and click on ‘e-Verify.’

- Choose the Aadhaar option.

- Enter the 6-digit alphanumeric OTP received on the mobile number registered in the Aadhaar card database to e-Verify your return.

(Note: To e-verify the ITR through Aadhaar OTP, your Aadhaar Number must be linked with your PAN.)

Steps to Verify ITR Using Net Banking

- Log in to the ‘e-Filing’ website incometax.gov.in using your login credentials.

- Go to e-File and click on “Income Tax Returns.”

- Proceed to “e-Verify Return” and click on the ‘e-Verify’ link, then select the option ‘I do not have an EVC, and I would like to generate an EVC.’

- Choose the Net Banking option.

- Select your bank and enter the login credentials of your Net Banking.

- Click ‘Login to e-File’ (the e-Filing website dashboard will appear).

- Click ‘e-Verify’ and confirm the Pop-Up to e-Verify your return.

Steps to e-Verify ITR Through Bank Account Number

- Log in to the ‘e-Filing’ website incometax.gov.in using your login credentials.

- Navigate to e-File and click on “Income Tax Returns.”

- Go to “e-Verify Return” and click on ‘e-Verify.’

- Select the Bank account option.

- Choose EVC – Through Bank Account Number.

- Enter the OTP received on the mobile number (Registered with Bank) to e-Verify your ITR.

Failure to verify returns on time may result in the return being deemed invalid, leading to potential repercussions for not filing ITR as per the provisions of the Income Tax Act of 1961. However, taxpayers have the option to seek an excuse for the delay in verification by providing a valid explanation. Only after submitting such a request will they be permitted to e-verify the return. It’s important to note that the return will be considered valid only if the competent Income Tax Authority approves the condonation request.