The income tax return (ITR) filing due date is a deadline that all taxpayers in India must adhere to. However, it’s not uncommon for individuals to miss this important deadline. Whether it’s due to a busy schedule, unexpected circumstances, or simply a lack of awareness, missing the ITR filing due date can have serious consequences.

If you find yourself in this situation, don’t panic. While penalties and fees are associated with filing your ITR after the due date, it’s still better to file late than not at all. In this blog post, we’ll go through the step-by-step process of filing income tax returns after the due date.

What is Belated Income Tax Return?

A belated income tax return refers to an income tax return that is filed after the due date specified by the Income Tax Department. The due date for filing income tax returns (ITR) is July 31st of the assessment year.

If you miss the due date for filing your ITR, you can still file a belated return, but you may have to pay a late filing fee and interest on any outstanding tax liability.

Step-by-Step Process to File IT Returns After Due Date Online

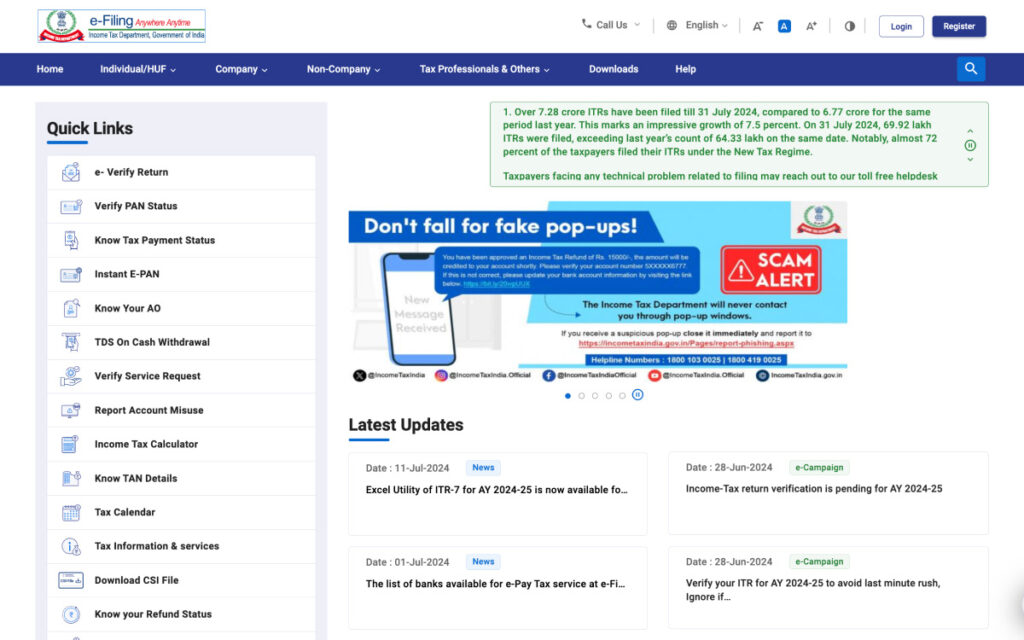

Step 1: Log in to your Income Tax e-Filing portal account using your credentials.

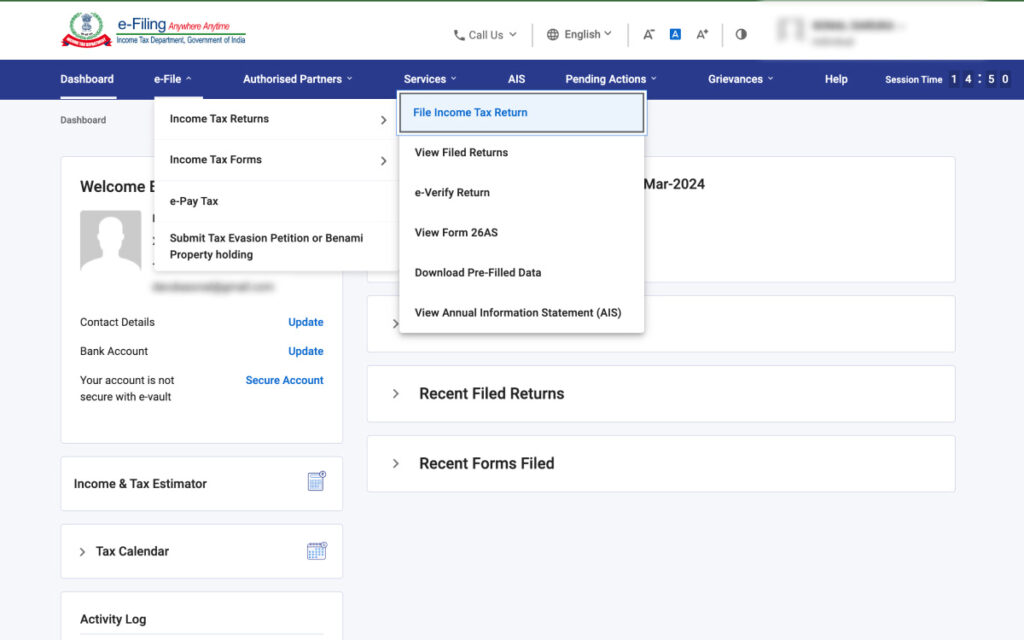

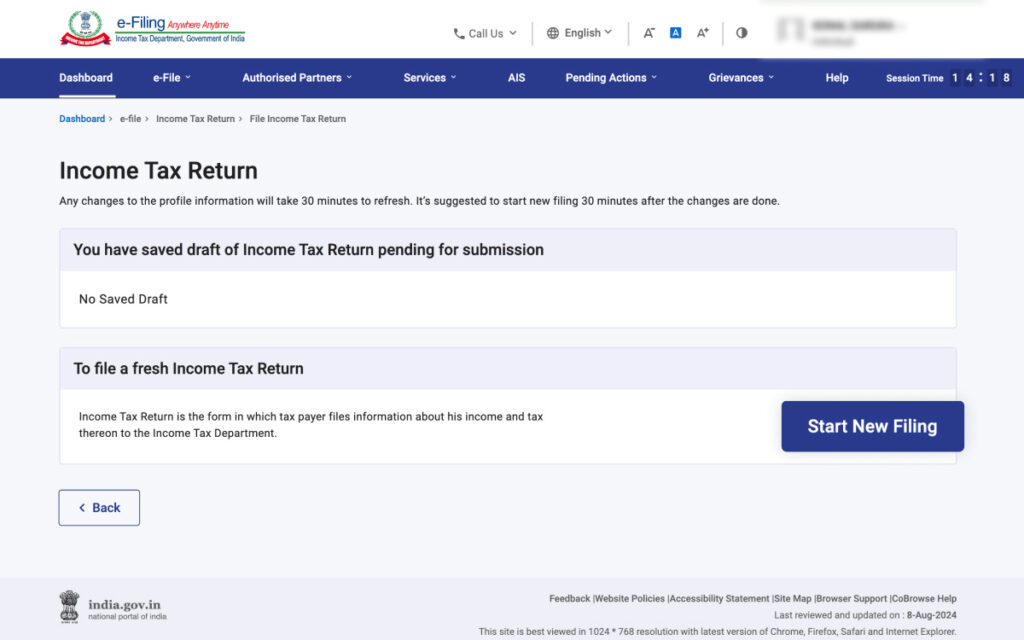

Step 2: Go to the ‘e-File’ menu, select ‘Income Tax Returns’, and then choose ‘File Income Tax Return’.

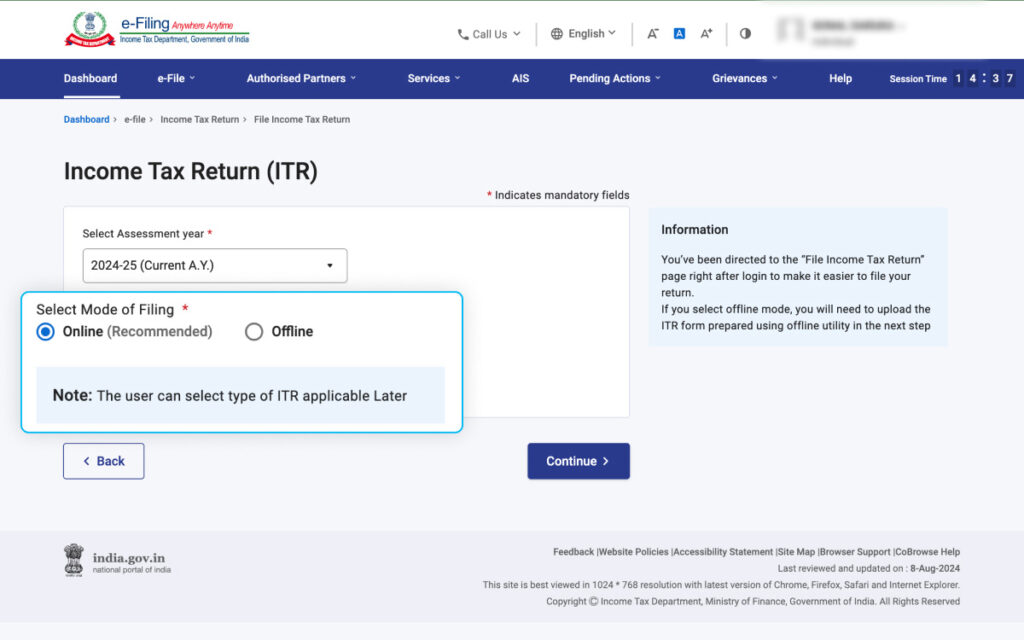

Step 3: Select the assessment year for your return.

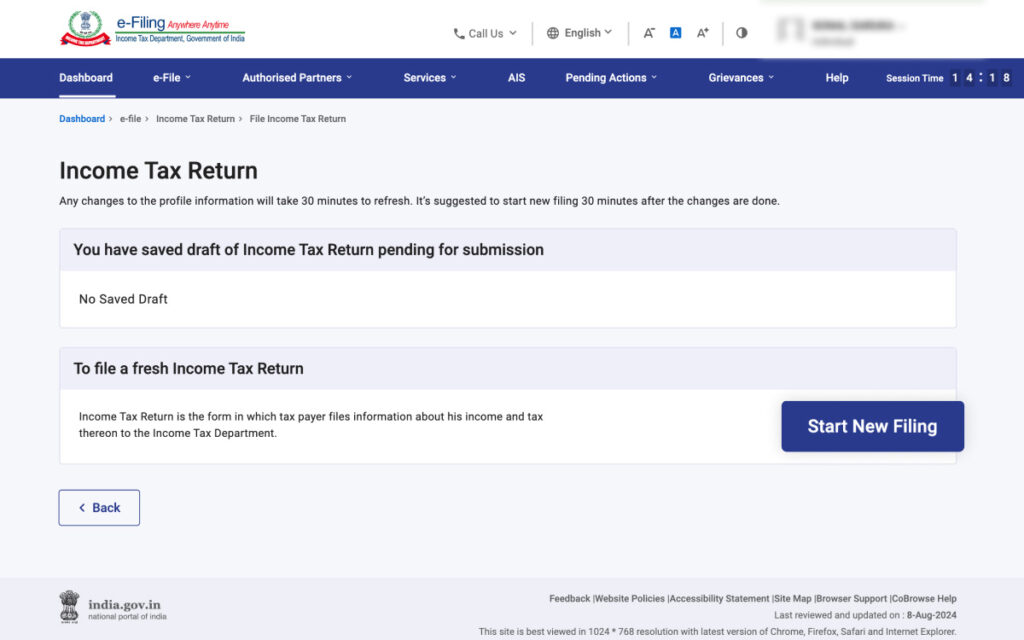

Step 4: Click on ‘Start New Filing’ to initiate the process.

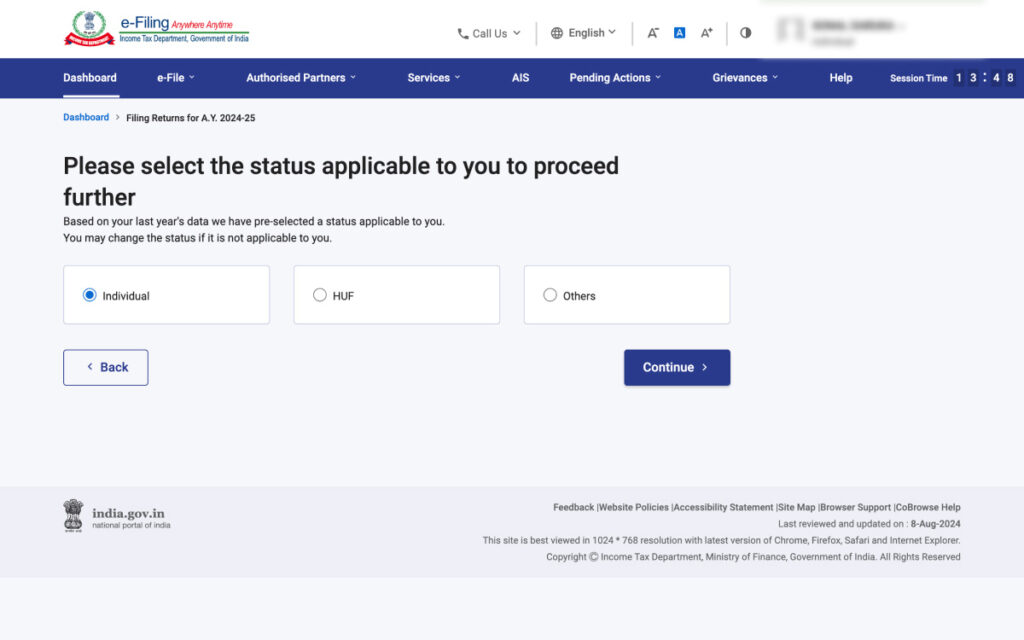

Step 5: Select the filing status that best applies to your situation.

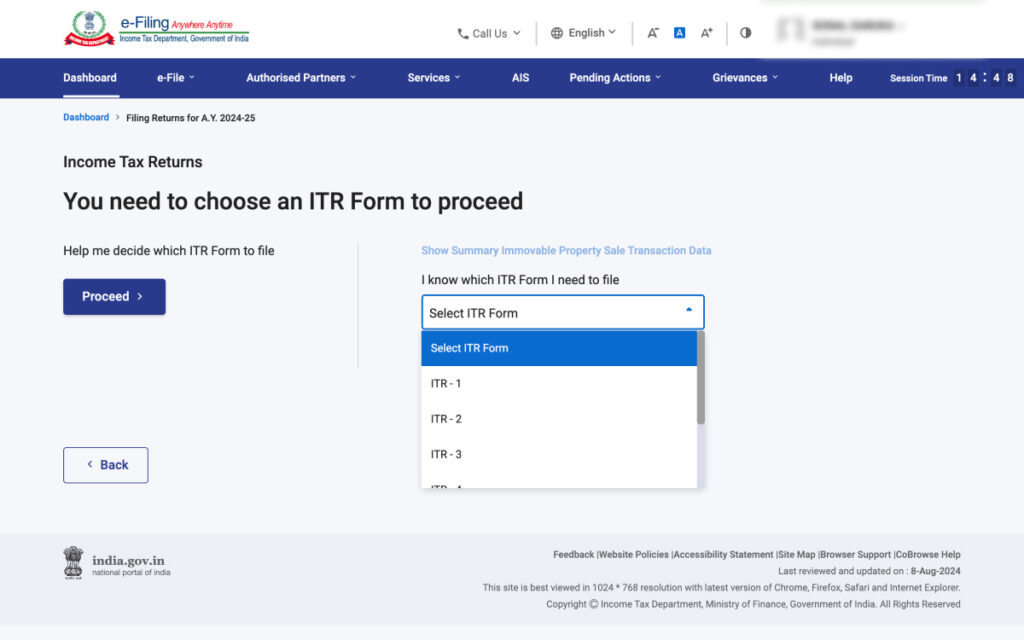

Step 6: Choose the ITR form that you need to file.

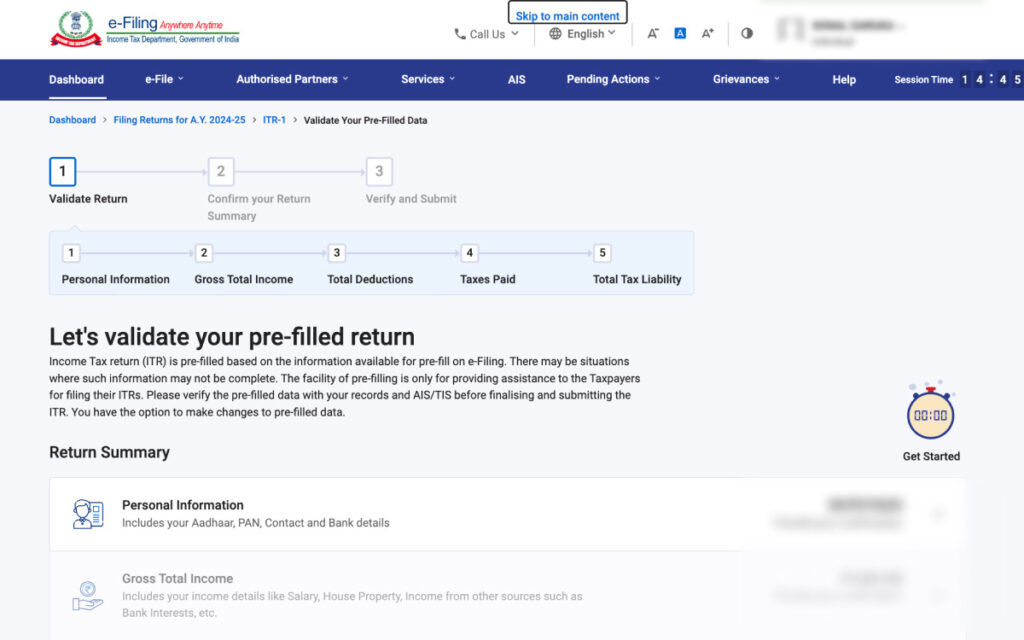

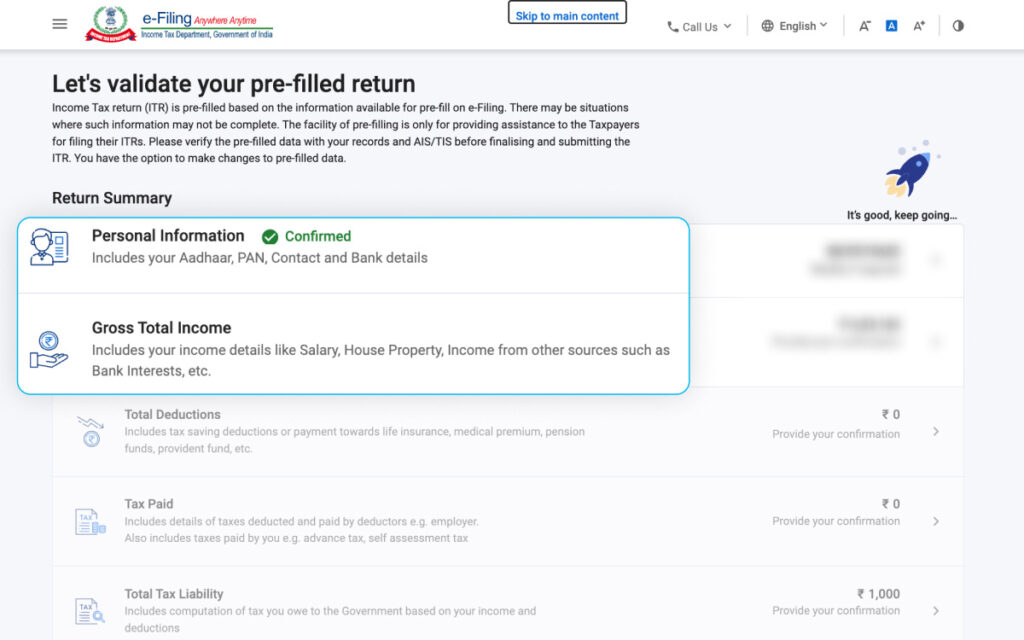

Step 7: Verify your personal details in the ‘Personal Information’ section to ensure they are correct.

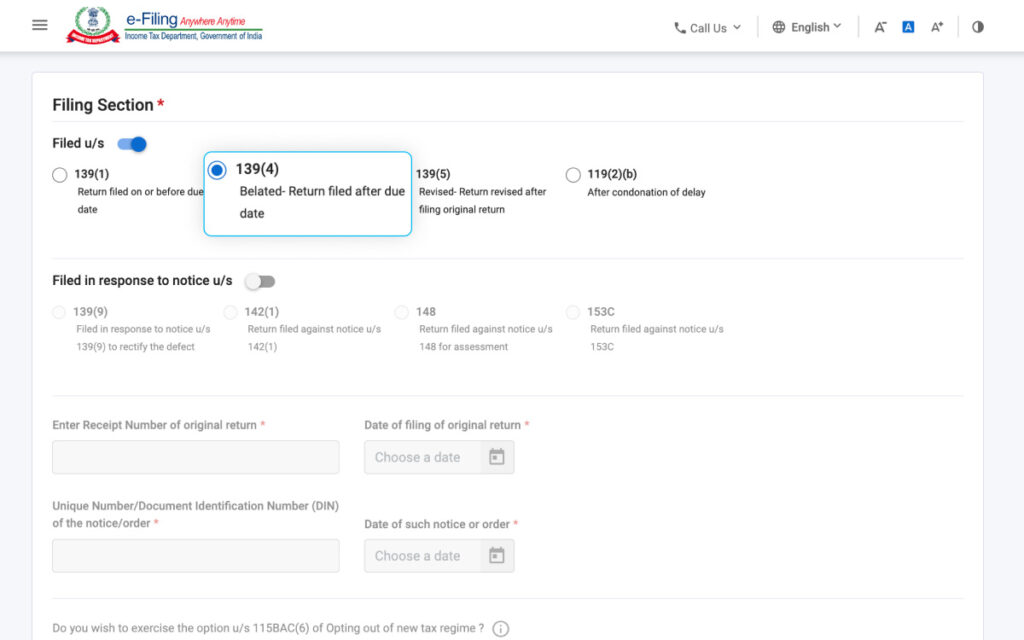

Step 8: In the filing section, select Section 139(4) to indicate you are filing a belated return.

Step 9: Enter all your income details under the respective heads and proceed to make any necessary tax payments.

Due Dates for Filing ITR for FY 2023-2024 (AY 2024-2025)

Here are the key due dates for filing income tax returns (ITR) for the financial year 2023-24 (assessment year 2024-25) in India:

- Individuals, HUFs, AOPs, BOIs: July 31, 2024

- Businesses (requiring audit): October 31, 2024

- Businesses requiring transfer pricing reports: November 30, 2024

- Revised return: December 31, 2024

- Belated/late return: December 31, 2024

- Updated return: March 31, 2027 (within 2 years from the end of the relevant assessment year)

What Happens If You Miss the ITR Filing Deadline?

Here’s what happens if you miss the income tax return (ITR) filing deadline:

- Belated ITR Filing: If you miss the ITR filing due date, you can still file a belated return, but you must do so by December 31st of the particular assessment year. For example, if you miss the July 31, 2024, due date for the financial year 2023-24 (assessment year 2024-25), you can file a belated return by December 31, 2024.

- Late Filing Fee: If you file your ITR after the due date, you will have to pay a late filing fee.

- Interest on Tax Liability: If you have any outstanding tax liability, you must pay interest on the unpaid tax amount.

- Disallowance of Deductions: Certain deductions and exemptions, such as the deduction under Section 80G (donations) and Section 80C (investments), may not be available if you file your ITR after the due date.

- Delay in Refund: If you are entitled to a tax refund, the processing of your refund may be delayed if you file your ITR after the due date.

Who Is Required to File ITR After Due Date?

Individuals and entities who miss the due date for filing their income tax returns (ITRs) are required to file belated ITRs.

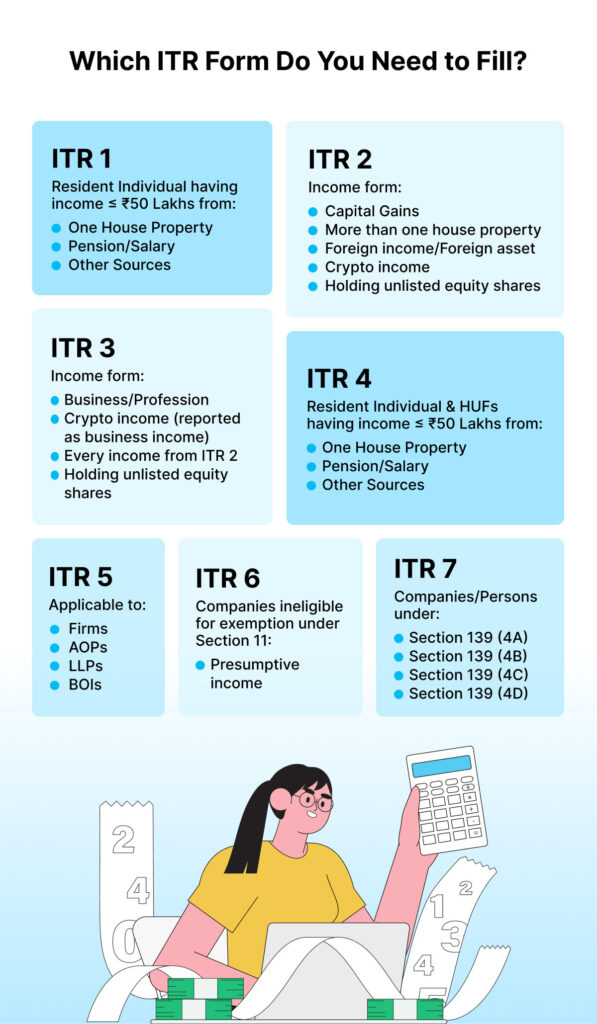

Which ITR Form Do You Need to Fill?

ITR-1 (SAHAJ) Return Form

The ITR-1 (SAHAJ) Return Form is specifically designed for resident individuals who meet certain criteria regarding their income sources. Here are the key points to note:

Eligible Income Sources:

- Salary or pension income

- Income from a single-house property (excluding losses carried forward)

- Income from other sources (excluding lottery winnings and income from racehorses)

- Agricultural income up to Rs 5,000

Ineligible Situations:

- Total income exceeds Rs 50 lakh

- Agricultural income exceeds Rs 5,000

- Taxable capital gains

- Income from a business or profession

- Income from more than one house property

- Director in a company

- Brought forward losses or losses to be carried forward under any income head

- Investments in unlisted equity shares

- Tax deducted under Section 194N

- Deferred payment or deduction of tax on ESOP

- Assets or signing authority in accounts outside India

- Resident not ordinarily resident (RNOR) or non-resident

- Foreign income

- Assessable for someone else’s income with tax deducted at source

ITR-2

ITR-2 is designed for individuals or Hindu Undivided Families (HUF) whose total income for the Assessment Year (AY) 2024-25 includes any of the following sources:

Eligible Income Sources:

- Income from Salary/Pension

- Income from House Property

- Income from Other Sources (including winnings from lotteries and income from racehorses)

- Income from Capital Gains

- Agricultural Income exceeding Rs 5,000

- Any Foreign Income

Additional Criteria for Using ITR-2:

You should use the ITR-2 form if any of the following apply to you:

- You are an individual director in a company.

- You have made investments in unlisted equity shares during the financial year.

- You are a Resident Not Ordinarily Resident (RNOR) or a non-resident.

- Any brought forward loss or loss to be carried forward under any income head.

- The income of another person, such as a spouse or child, is to be clubbed with your income and falls into any of the above categories.

- You own assets (including financial interests) or have signing authority in accounts located outside India.

- Tax has been deducted under Section 194N.

- You have deferred payment or deduction of tax on ESOP.

Income Threshold:

- The total income can exceed Rs 50 lakh.

Who Cannot Use ITR-2?

The ITR-2 form is not suitable for individuals whose total income for the Assessment Year (AY) 2024-25 includes:

- Income from Business or Profession

If you need to declare income from business or profession, you should use ITR-3 or ITR-4 instead.

ITR-3

ITR-3 is designed for individuals or Hindu Undivided Families (HUF) who earn income from their own business or profession. You should use ITR-3 if:

- You run a business or profession without opting for presumptive income taxation.

- You need to maintain books of accounts or undergo audit as per tax regulations.

- You have invested in unlisted equity shares during the year.

- Your income includes earnings from House Property, Salary/Pension, and other sources.

- You receive income as a partner in a partnership firm.

ITR-4 (Sugam)

ITR-4, commonly known as Sugam, is meant for residents who are individuals, Hindu Undivided Families (HUFs), or partnership firms (excluding LLPs). It applies to those whose total income includes:

- Business income under the presumptive taxation scheme as per sections 44AD or 44AE.

- Professional income under the presumptive taxation scheme as per section 44ADA.

- Salary or pension income up to Rs 50 lakh.

- Income from one house property, within Rs 50 lakh (excluding any carried forward losses).

- Other sources of income within Rs 50 lakh (excluding earnings from lottery and racehorses).

Freelancers earning within Rs 50 lakhs in gross receipts can also opt for this presumptive scheme. This scheme assumes income at a minimum rate based on a percentage of gross receipts/turnover or based on commercial vehicle ownership. If business turnover exceeds Rs 2 crore, filing ITR-3 is required.

Who Should Not Use ITR-4 Form?

The ITR-4 form is not suitable for individuals in the following situations:

- Total income exceeds Rs 50 lakh.

- Have income from more than one house property.

- Deferred payment or deduction of tax on ESOP.

- Have any carried forward loss under any income head.

- Invested in unlisted equity shares during the financial year.

- Classified as a Resident Not Ordinarily Resident (RNOR) or non-resident.

- Receive foreign income.

- Own any foreign assets.

- Have signing authority in accounts located outside India.

- Earn income from any source outside India.

- Serve as a Director in a company.

- Assessable for another person’s income where tax is deducted at the source.

ITR-5 Form

ITR-5 is meant for entities such as firms, LLPs (Limited Liability Partnerships), Business trusts, Artificial Juridical Persons (AJPs), Estates of deceased individuals, AOPs (Association of Persons), BOIs (Body of Individuals), Estates of insolvent individuals and investment funds.

ITR-6 Form

ITR-6 is specifically designed for companies, excluding those claiming exemption under section 11 (related to income from property held for charitable or religious purposes). It must be filed electronically without exception.

ITR-7 Form

ITR-7 is intended for individuals and entities required to file returns under various sections:

- Section 139(4A): Individuals receiving income from property held under trust or other legal obligations wholly or partly for charitable or religious purposes.

- Section 139(4B): Political parties with total income exceeding the maximum amount not chargeable to income tax.

- Section 139(4C): Entities including scientific research associations, news agencies, institutions under sections 10(23A) and 10(23B), funds, universities, and medical institutions.

- Section 139(4D): Universities, colleges, or institutions not required to file returns under any other provision.

- Section 139(4E): Business trusts not required to file returns under any other provision.

- Section 139(4F): Investment funds referred to in section 115UB, not required to file returns under any other provision.

| Form | Applicable to | Salary | House Property | Business Income | Capital Gains | Other Sources | Exempt Income | Lottery Income | Foreign Assets /Foreign Income | Carry Forward Loss |

|---|---|---|---|---|---|---|---|---|---|---|

| ITR-1 (SAHAJ) | Individual, HUF (Residents) | ✓ | ✓ | X | X | ✓ | ✓ | X | X | X |

| ITR-2 | Individual, HUF | ✓ | ✓ | X | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ITR-3 | Individual or HUF, Partner in a Firm | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ITR-4 (Sugam) | Individual, HUF, Firm | ✓ | ✓ | ✓ | X | ✓ | ✓ | X | X | X |

| ITR-5 | Partnership Firm/LLP | X | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ITR-6 | Company | X | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ITR-7 | Trust | X | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Points to Consider While Filing Income Tax Returns

- Determine the Appropriate ITR Form: Identify the correct ITR form based on your income sources and other relevant factors. For example, ITR-1 is for individuals with income from salary, one house property, and other sources, while ITR-2 is for individuals with income from sources other than business or profession

- Gather Required Documents: Collect all necessary documents, such as Form 16, investment statements, and any other income-related documents. This ensures you have all the information required to accurately calculate your total income and tax liability

- Calculate Your Tax Liability: Determine your total income and calculate the applicable tax liability, including any late filing fees or interest. Use online tax calculators or seek the help of a tax professional to ensure accurate calculations

- File the ITR Online or Offline: You can file your ITR online through the Income Tax Department’s official portal or offline by submitting a physical copy of the ITR form. Ensure you use the correct mode of filing based on your preference and the requirements of your ITR form

- Verify the ITR: After filing your ITR, verify it within the specified time frame. You can e-verify your return using methods like Aadhaar OTP, electronic verification code (EVC), net banking, or by sending a physical copy

- Keep Records: Maintain a copy of the filed ITR and all supporting documents for future reference. This will be helpful if the tax authorities require any additional information or clarification

- Check for Errors: Double-check your ITR for any errors before submitting it. Ensure all details are accurate and complete to avoid any issues during the processing of your return

- File by the Due Date: The due date for filing ITR is July 31st for individuals and October 31st for businesses requiring audit. File your ITR on or before the due date to avoid late filing fees and penalties

- Understand the Consequences of Late Filing: If you miss the ITR filing due date, you will have to pay a late filing fee and interest on any outstanding tax liability. Additionally, certain deductions and exemptions may not be available if you file your ITR after the due date

While filing income tax returns after the due date may attract penalties and interest charges, it is still possible to fulfill your tax obligations by filing a belated return. By following the procedures mentioned above, paying any outstanding taxes, and submitting the necessary documents, you can ensure compliance with tax regulations.

It is important to act quickly, seek professional guidance if needed, and stay updated with the latest rules and regulations to avoid any complications and penalties in the future. Remember, even if you miss the deadline, it’s important to file your IT returns and fulfill your tax obligations to stay on the right side of the law and maintain financial transparency.

Disclaimer: This blog is written to make it easy for readers to understand complicated processes. Some information and screenshots may be outdated as government processes can change anytime without notification. However, we try our best to keep our blogs updated and relevant.