Are you eagerly waiting for your income tax refund to arrive? It’s always exciting to get some extra money in your pocket, but it can be frustrating if you don’t know when it’s coming. Fortunately, checking the status of your income tax refund is easier than ever, thanks to the convenience of online portals. In this blog post, we’ll also cover common issues that people may face and offer tips for faster refund processing. So, let’s get started!

What is Income Tax Refund?

An income tax refund refers to the amount of money that the government returns to a taxpayer who has overpaid his/her taxes. When you file your income tax return, you may have paid more taxes than you actually owe due to various reasons such as claiming excess tax deductions, exemptions, or credits. In such cases, the government refunds the excess amount back to you.

The amount of income tax refund you receive depends on various factors such as your income, tax deductions, and tax credits. You may receive the refund as a check or direct deposit into your bank account.

It’s important to note that not everyone is eligible for an income tax refund. If you owe taxes to the government or have outstanding debts such as student loans, the government may use your refund to pay off those debts.

Why is it important to Check the Status of your Income Tax Refund?

- Accuracy: Checking the status of your refund ensures that the refund amount is accurate and has been calculated correctly. If there is an error in the calculation, you can take corrective action by contacting the relevant authorities.

- Timely processing: By checking the status of your refund, you can ensure that your return has been received and is being processed in a timely manner. If there are any delays, you can follow up with the concerned authorities and expedite the process.

- Budgeting: Knowing when to expect your income tax refund can help you plan and budget your finances accordingly. If you’re expecting a significant refund, you can plan to use it towards paying off debts, investing, or making a big purchase.

- Avoiding fraud: Checking the status of your refund can help you avoid falling victim to tax refund scams. If you receive a notification that your refund has been processed but you haven’t filed your return yet, it may be a sign of fraudulent activity.

Steps to Check Income Tax Refund Status Online

- Gather required information: To check your income tax refund status online, you will need certain information such as your Permanent Account Number (PAN) and the Assessment Year (AY) for which you filed the return. You may also need to enter the acknowledgment number or the e-filing login credentials.

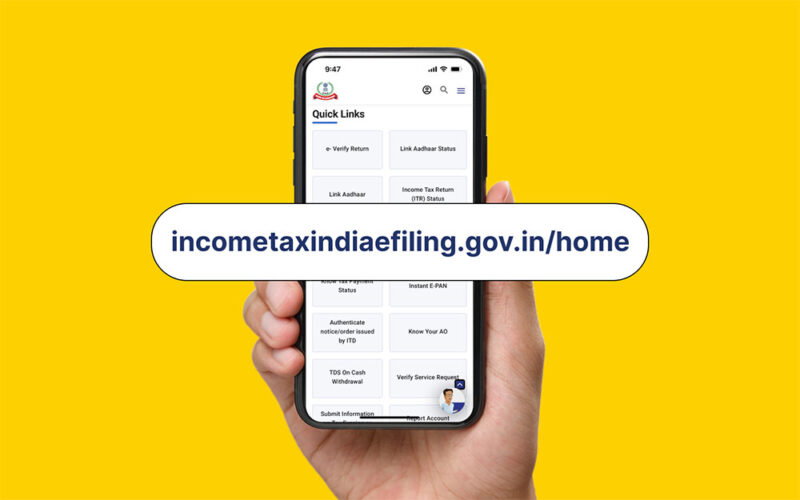

- Visit the income tax e-filing website: Go to the official website of the Income Tax Department of India, i.e., www.incometaxindiaefiling.gov.in.

- Navigate to the refund status page: On the homepage, click on the ‘My Account’ tab, and then select the ‘Refund/Demand Status’ option from the drop-down menu.

- Enter required details: On the refund status page, enter your PAN, AY, and captcha code in the respective fields, and then click on the ‘Submit’ button.

- Check the status: The status of your income tax refund will be displayed on the screen. The status may show whether your refund has been processed, approved, or is pending. It may also show the expected date of the refund if it has been processed.

- Track refund through a bank account: If your refund has been processed and approved, you can track the status of the refund through your bank account. You can check if the refund has been credited to your bank account by logging into your bank’s Internet banking portal or by contacting the bank.

Please note that the above steps may vary depending on the e-filing portal or government website you are using. Always follow the instructions provided on the website to check your income tax refund status online.

Common Issues Faced While Checking Refund Status Online

While checking income tax refund status online, some common issues that taxpayers may face include:

- Incorrect details: If you enter incorrect details such as PAN or AY, you may not be able to view your refund status. Make sure to double-check the information you enter before submitting the form.

- Technical glitches: Sometimes, the website may experience technical glitches or server errors, preventing you from accessing the refund status page. In such cases, you can try again later or contact the e-filing support team for assistance.

- Delayed refunds: Refunds may take some time to process, and it’s possible that your refund is still being processed by the tax authorities. You may need to wait a few days or weeks to receive your refund.

- Refund not processed: If your refund status shows as ‘Not Processed’, it means that the tax authorities have not yet started processing your refund. You may need to wait for some time or contact the concerned authorities to know the reason for the delay.

- Refund already credited: In some cases, your refund may have already been credited to your bank account, but the status on the website may not reflect the same. In such cases, you can check your bank account statement to verify if the refund has been credited.

If you face any of these issues while checking your income tax refund status online, it’s best to stay patient and contact the relevant authorities for assistance.

Conclusion

Checking the status of your income tax refund is important to ensure accuracy, timely processing, budgeting, and to avoid fraudulent activities. Filing your return on time, verifying and validating the return, providing accurate bank details, opting for e-verification, and keeping track of refund status are some of the tips that can help in the faster processing of your income tax refund.