EPF or the Employee’s Provident Fund is a retirement scheme launched by the Government of India for the benefit of employees thereby helping the working class section of the society to build a retirement corpus for themselves. Under this scheme, both the employer and employee contribute 12% of the employee’s basic salary and dearness allowance to the employee’s EPF. Moreover, the accumulated corpus of the EPF is eligible for an interest at the rate of 8.5%.

The EPF corpus can be withdrawn by the employee only in case of any emergencies, under certain conditions. Otherwise, employees can go for the final settlement of their EPF corpus upon leaving his/her job. To do so, the employee must fill PF Form 19 to withdraw funds from his/her EPF account for the final settlement.

This blog will help you understand how you can fill your EPF form 19 and what else you should consider to do so.

Major Parts of EPF Form 19

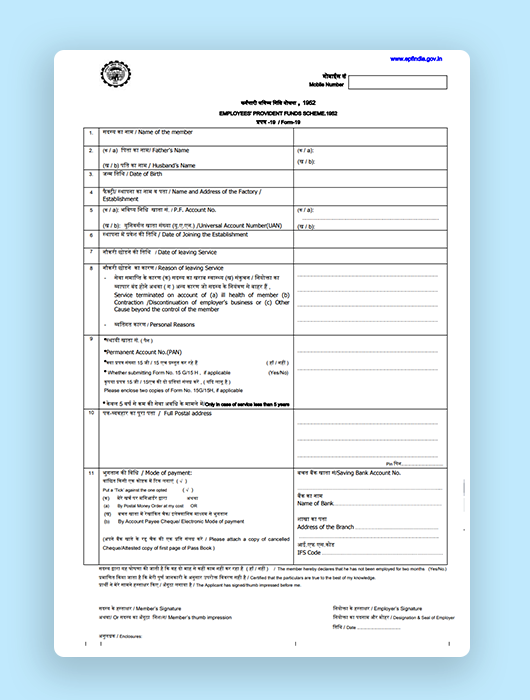

An EPF Form 19 looks like this

Following are the main sections of EPF Form 19:

- Name of the EPF Member

- Employee’s Mobile Number (to be provided at the beginning of the form)

- Father’s/Husband’s Name

- Date of Birth

- Name and Address of the Organization

- PF Account Number & UAN

- Date of Joining the Organization

- Date of Leaving the Organization

- Reason of Leaving the Organization

- PAN

- Complete Postal Address

- Mode of Payment

Apart from the above information, signatures of the member and the employer are required. Additionally, an advance stamp receipt must be filled if the member needs the EPF amount by cheque, through the offline process of settlement claim. Note that an advance stamp means that the member has to affix a revenue stamp of Re. 1 with the form and then sign across the stamp.

Steps to Fill Form 19 for PF Withdrawal

At the time of leaving/changing your job, you can apply to withdraw and/or transfer your EPF corpus. However, to do so, you must fill EPF Form 19. Mentioned below are the steps to fill EPF Form 19 online-

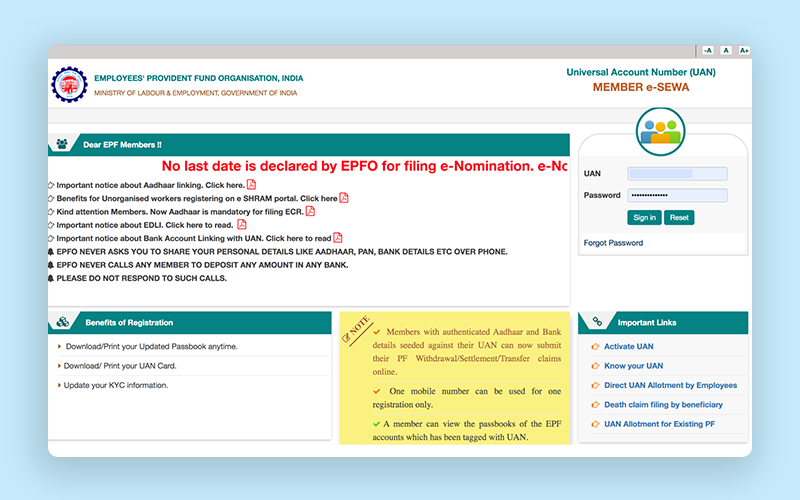

Step 1: Log in to your UAN account using at the EPF Member portal

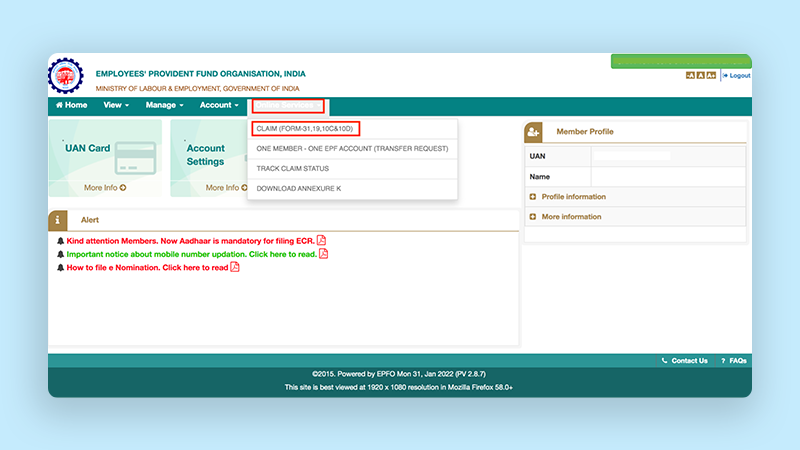

Step 2: Under the ‘Online Services’ tab, Click on ‘Claim (Form 31, 19, 10C & 10D)

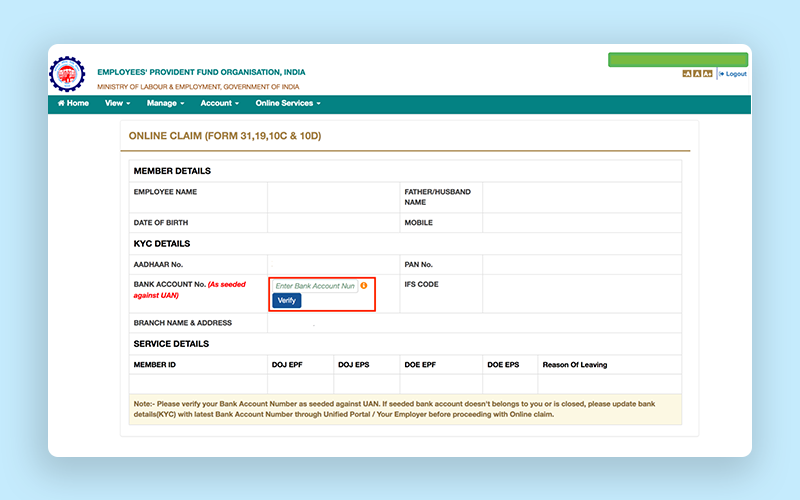

Step 3: On the next screen that opens, enter the last 4 digits of your bank account and click on ‘Verify’ as shown in the image below

Step 4: Tap on the ‘Yes’ option to sign the Certificate of Understanding

Step 5: From the dropdown menu, under the ‘I want to apply for’ section, select the option of ‘Only PF Withdrawal (Form-19)

Step 6: The next screen will open a new section where you need to enter your complete address. Tick mark the disclaimer after entering your address and click on ‘Get Aadhaar OTP’

Step 7: Enter the OTP sent to the number associated with UIDAI and submit your application

Step 8: Upon successful submission of your application, a reference number will be generated and shared with you

Step 9: In the next 15-20 days, the withdrawal amount will be deposited into your bank account linked with your UAN

Points to Consider while Filling Form 19 in EPF

While filling the EPF form 19, you should consider the following points-

- Before submitting the PAN, the employee must first ensure that his/her UAN is activated at the EPF member portal

- Member’s PAN, bank account and mobile number must be mandatorily linked with his/her UAN

- Employee’s Form 19 will not be displayed in his/her withdrawal form if he/she is not eligible for the final settlement

- Member can fill EPF Form 19 only after two months of leaving the job or getting retired

- It is mandatory for the employee to provide his/her mobile number for final settlement

- EPF Form 19 can be filled using both online and offline modes

- To claim the final settlement, the employee must mandatorily submit his/her PAN

- Signature of the employer and the organization’s seal is mandatory for the offline settlement process

What is a Composite Claim Form?

Composite Claim Form is basically a combination of Form 31, 19 & 10C. Members must fill Form 19 for the final settlement of their PF corpus. Form 10C, on the other hand, must be filled for the withdrawal of pension, while Form 31 should be filled for partial PF withdrawal. Composite Claim Form, however, should be the only one to be filled for withdrawal of PF corpus offline.

To Conclude: Employees must fill PF Withdrawal Form 19 in two cases- one, for the full and final settlement of their EPF corpus if they are retiring and second, for the transfer of EPF balance from one account to another if they are switching their jobs. EPF Form 19 can be filled using both the online and offline modes. Upon final submission of the EPF Form 19, the member will receive his/her withdrawal amount within 15-20 days.

What is Form 19 in PF?

How long does it take for the withdrawal amount to be credited to my bank account?

Can I submit the EPF Form 19 online?

When do I need to submit a revenue stamp for an EPF settlement claim?

Is it possible to claim EPF settlement amount through cheque?

- Enter the EPF withdrawal amount in the EPF Form 19

- Attach Re. 1 revenue stamp with the application form

- Sign the application form