Also termed as “plastic money”, debit cards and credit cards are financial instruments that have become a complete alternative to cash. With the ever-increasing benefits of cashbacks, reward points, safe transactions, and easy handling, these financial tools have now become the most preferred way of handling money.

While both these instruments seem to be more or less similar, the fact is that they are not. Let us first understand what is a debit card and what is a credit card, and then we will look at the major similarities and difference between credit card and debit card.

What is a Debit Card?

A Debit card is issued by a bank against your current account or savings account. The major point to be noted about a debit card is that it allows you to use only the amount of money that’s available in your bank account at the moment. This implies that as you make payment using your debit card, the amount of purchase will directly be debited from your current or savings account.

What is a Credit Card?

A Credit card is a financial tool that allows you to borrow funds from your credit card issuer at the luxury of making purchases as and when required. Additionally, to repay the borrowed amount, you get a grace period of around 45 days without any interest charges on the billed amount. When you buy a credit card, you get a customized credit limit, which indicates the maximum amount that you can spend using your credit card. A credit card also

Read More: How to Activate a Debit Card- Few Easy Steps to Follow

Similarities in a Debit Card and Credit Card

A lot of people mistake credit cards for debit cards and vice versa. Well, both these types of card actually have a lot of similarities between them. Let’s look at a few of these factors that justify this confusion-

- Both of these cards look identical and have a 16-digit card number written on them

- A debit card and a credit card have expiration date that’s mentioned on the card itself

- In order to make a transaction, using either of these cards, you must enter a PIN (Personal Identification Number) code

- Both, debit card and credit card can be used to make online and offline purchases

- Both these cards can be used at an ATM in order to withdraw money

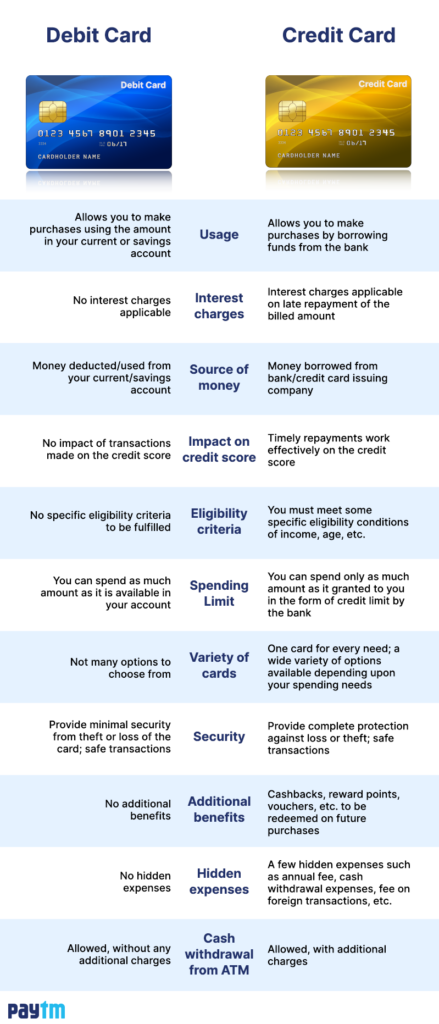

Difference Between Debit Card and Credit Card

While both, the debit and credit cards look identical, there may be a lot of features that make them absolutely different. It is advised that you have at least one of each of these cards to fund any urgent expenses that you may have to make and to balance your finances with ease. To do so, it is important to understand how a debit card and a credit card are different from each other.