The National Payment Corporation of India (NPCI) introduced UPI AutoPay on July 22nd, 2020. It enables users to make recurring payments seamlessly through the UPI platform. This feature was specifically designed to enhance buyers’ convenience.

UPI Autopay feature allows auto transactions below 15,000. Users can easily set up automatic monthly payments for various recurring needs such as bill payments, utility recharges, loan repayments, mutual fund investments, content subscriptions, grocery purchases, housing society payments, and membership fees.

Paytm, with its unparalleled platform and dedicated support, emerges as the ideal partner for merchants seeking to leverage the power of UPI Autopay.

UPI Autopay Set Up Process

UPI AutoPay simplifies recurring payments by allowing users to authorize automatic debit mandates through major UPI applications. The process involves a ‘Mandate‘ option within UPI apps, where users can create, modify, approve, revoke, or pause the auto-debit mandate. To enable this feature, users need to provide a one-time approval to merchants on the platform who wish to automate payments.

When setting up a subscription, users must also enter additional details such as the subscription start date, merchant name, and debit frequency. This streamlined process ensures seamless recurring payments for users while providing control and flexibility over their automated transactions.

Paytm UPI Autopay simplifies setting up payments for a wide variety of services:

- Utility bills like electricity, mobile, broadband and gas

- Digital subscriptions like OTT, TV, music, and entertainment apps

- Insurance premium payments

- Mutual fund and SIP payments

- Rent and EMI

- Membership fees like housing society payments

Benefits of UPI Autopay to Consumers

- Secure and convenient recurring payments.

- On-time payment helps prevent late fees and penalties.

- Recurring mandates offer customized payment options (monthly, quarterly, etc.) and flexible amounts (ranging from Rs.1/- to Rs.15,000+) for each customer.

- Modify/Revoke/Pause features allow for easy order changes as required.

- A cashless method and no documentation required.

Why Paytm for UPI Automatic payments

- Over 90 million+ strong monthly transacting user base

- Seamless and user-friendly interface.

- Paytm customers can effortlessly authorize recurring payments, ensuring timely and hassle-free transactions.

- Paytm’s robust security measures instill confidence in customers, safeguarding their sensitive financial information.

Paytm’s outstanding contributions and innovations in the digital payments space have been recognized and rewarded by the Ministry of Electronics and Information Technology (MEITY) award.

Paytm’s recognition by MEITY is a testament to the platform’s excellence in providing cutting-edge payment solutions and its dedication to revolutionizing the digital payment landscape in India. The recognition further strengthens Paytm’s reputation as a leading fintech player and motivates the company to continue pushing the boundaries of innovation and service excellence in the ever-evolving world of digital finance

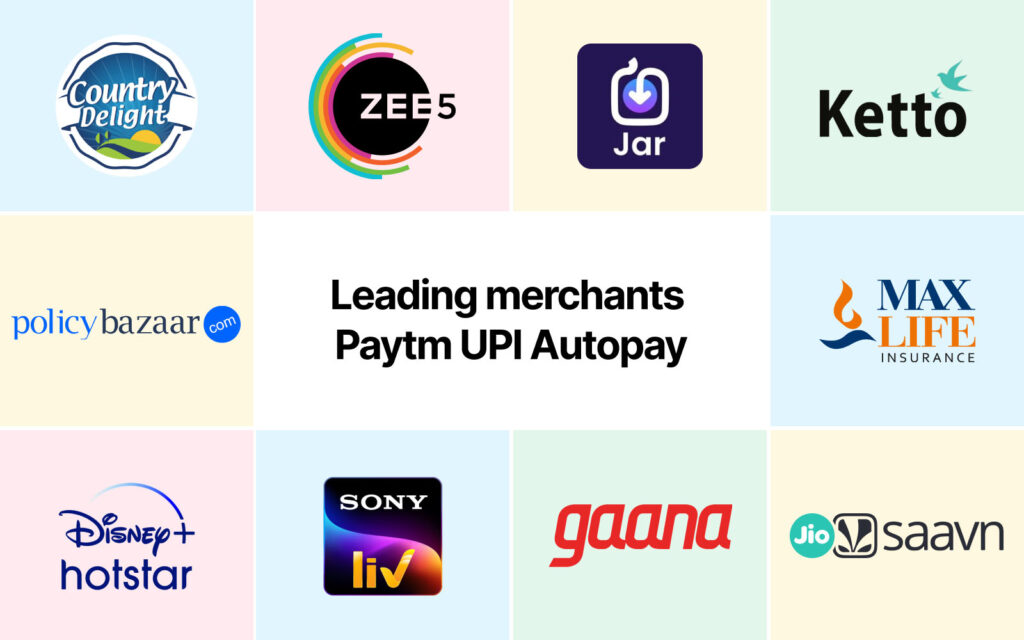

Leading merchants trust Paytm UPI Autopay