Source: NPCI

Unified Payments Interface (UPI) has revolutionized how we manage our own money. But what about managing payments for others? Whether it’s giving pocket money to your college-going child, helping a senior parent with their daily shopping, or handing out petty cash to an employee, we often fall back on physical cash.

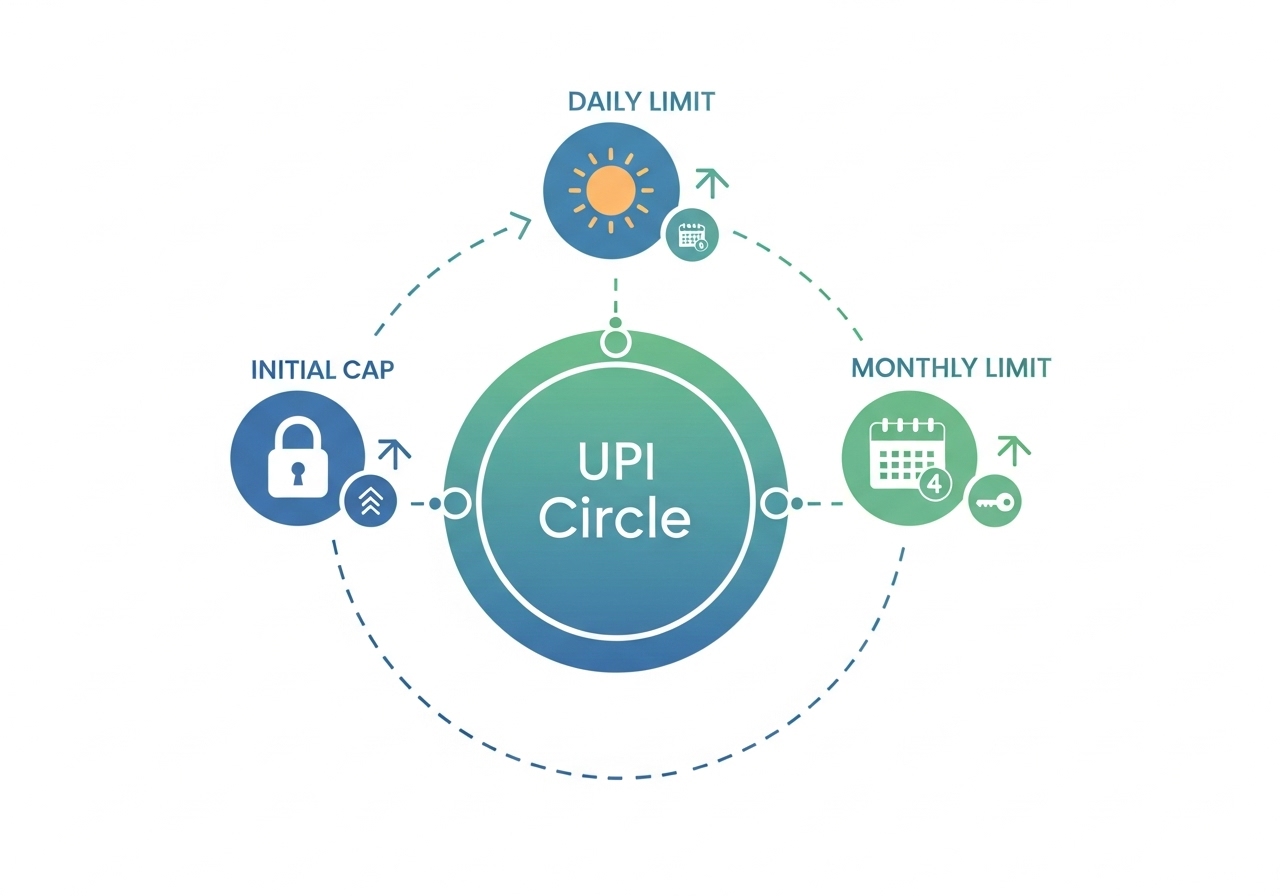

Until now. NPCI has introduced a groundbreaking solution: UPI Circle. This is not just another feature; it’s a new way to think about digital payments. It allows a primary UPI user to delegate payment authority to someone else from their own account, all while maintaining complete control over the spending limits. This guide will break down what UPI Circle is, who it’s for, and the crucial daily and monthly transaction limits you need to know.

What is UPI Circle? The Core Concept

At its heart, UPI Circle is a payment delegation feature. It creates a secure link between two types of users:

- The Primary User: This is the main UPI account holder who wants to delegate payment capability. They link their bank account and set the spending rules.

- The Secondary User: This is the individual (like a child, parent, or employee) who is given the ability to make UPI payments from the Primary User’s account, within the set limits. Crucially, a secondary user does not need to have their own bank account linked to UPI to use this feature.

The insight behind this is simple but powerful: it digitizes the huge number of transactions that are still done in cash because one person is paying on behalf of another.

The Big Question: UPI Circle Transaction Limits

This is where control comes in. The transaction limits for secondary users in a UPI Circle are structured to manage spending effectively. These limits apply when the primary user grants “full delegation,” allowing the secondary user to make payments without needing approval for each transaction.

For a person acting as a Secondary User (like your child or parent), the Primary User sets the spending limit. This provides complete control and flexibility. While NPCI hasn’t published a separate, fixed limit for this type of delegation, the transactions would still operate within the overall UPI framework.

The key feature is that the Primary User can define a specific budget (e.g., ₹5,000 per month) for each Secondary User in their Circle, offering tailored control.

Here are the key limits set by the NPCI:

- Per-Transaction Limit: A secondary user can spend a maximum of ₹5,000 on a single transaction.

- Monthly Limit: The total spending for a secondary user is capped at ₹15,000 per month. The primary user can set a monthly spending limit for the secondary user up to this amount.

- Initial 24-Hour Limit: For the first 24 hours after a new secondary user is added to the Circle, there is a “cool-off” period. During this time, the total transaction amount is restricted to ₹5,000.

It’s important to note that a primary user can add up to five secondary users to their UPI Circle. However, a secondary user can only be part of one UPI Circle at a time.

Understanding Delegation Types and Their Impact on Limits

The UPI Circle feature offers two distinct modes of delegation, which determine how these limits are applied:

- Full Delegation: In this mode, the primary user sets a predefined spending limit for the secondary user. The secondary user can then initiate and complete transactions independently, as long as they stay within the per-transaction and monthly caps (₹5,000 and ₹15,000 respectively). This is ideal for managing regular expenses for family members or staff.

- Partial Delegation: This mode offers tighter control. A secondary user can initiate a payment, but it is sent to the primary user as a request. The transaction is only completed after the primary user approves it using their UPI PIN. For partial delegation, the standard UPI transaction limits of the primary user’s bank account apply, as they are authorizing each payment individually.

Who Should Use UPI Circle? How UPI Circle Empowers Users

These structured limits are a core part of what makes UPI Circle a secure and practical solution for many real-world scenarios:

- Controlled Allowances: Parents can provide their children with a digital allowance without handing over cash or a debit card, knowing the spending is capped.

- Assisting Family: It allows individuals to help elderly parents or relatives with their daily shopping needs in a controlled digital environment.

- Managing Household Staff: Homeowners can delegate funds to household help for groceries and other essentials, with every transaction being transparent and limited.

- Small Business Expenses: Business owners can eliminate petty cash by adding employees to a Circle, allowing them to pay for small, work-related expenses digitally.

A key benefit of the UPI Circle is that the secondary user does not need to have their own bank account linked to UPI to make payments.

How to Set Up and Link a Device to UPI Circle?

Step 1: Open the app on the IoT device (e.g., a smart TV, connected car, etc.) to begin the registration for UPI payments.

Step 2: Select the option labeled “Enable UPI for your device” and enter the primary user’s mobile number. (Note: This must be the same mobile number that the primary user has registered with their main UPI app).

Step 3: An OTP will be sent to the primary user’s mobile phone. Enter this OTP on the IoT device’s app and confirm to proceed.

Step 4: A unique QR code will now be displayed on the screen of the IoT device app. Keep this code visible for the next step.

Step 5: Open your primary UPI app on your mobile phone to start the linking process.

Step 6: Use the app’s QR scanner to scan the code displayed on the IoT device.

Step 7: After scanning, your primary UPI app will show the device details (such as its type and a unique device ID). Review and confirm these details are correct.

Step 8: Provide your consent to link the device. You will then be prompted to set the required spending ‘Limit’ for the IoT device.

Step 9: Authenticate and complete the setup by entering your UPI PIN or using your phone’s biometrics (fingerprint or face ID).

Step 10: Once confirmed, you can initiate payments when needed directly from the linked device or software, which will operate within the limits you have set.

Once linked, the secondary user or device can initiate payments as needed, within the boundaries set by the Primary User.

Note: The option “Enable UPI for your device” or a similar phrase will only appear on apps and smart devices that have specifically integrated this new UPI Circle feature. You will not find this on every app. As this feature rolls out, you will see it appear in two main areas:

- On IoT Devices: Expect to see this on smart TVs, connected cars, smart speakers, and other “Internet of Things” devices whose manufacturers have partnered with NPCI to enable payments.

Within Specific Partner Apps: Financial apps or merchant apps that see a use case for delegated payments may also build this feature in