UPI is increasingly becoming the most desirable mode of payment owing to its quick, easy, and safe process, among multiple other benefits. Unlike other traditional methods of money transfer, you do not need to fill in the account numbers, IFSCs, or other information of the recipient when you pay using UPI.

All you need to do is enter the mobile number of the receiver and the money will be sent within a few seconds! You can also scan the QR code linked to the bank account of the receiver, a merchant, or vendor and send money. Paytm ensures that UPI payments are swift and simple for the customers to enjoy fuss-free transactions. Let’s learn how to transfer money using UPI on Paytm!

Ways to Transfer Money Using UPI on Paytm

You can transfer money using UPI on the Paytm app through various options as listed below-

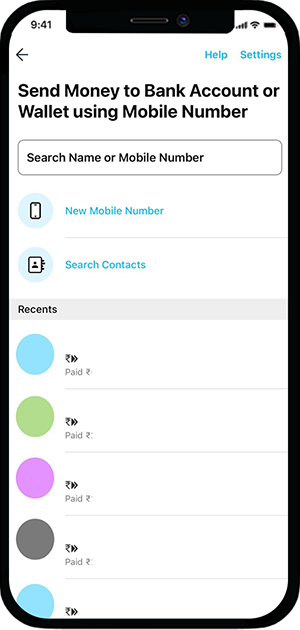

- Selecting a Contact/Entering Mobile number – Sending money is as simple as sending a message. Just select a phonebook contact or enter a mobile number, specify the amount and enter your PIN. That’s it. Your payment will be completed in a few seconds.

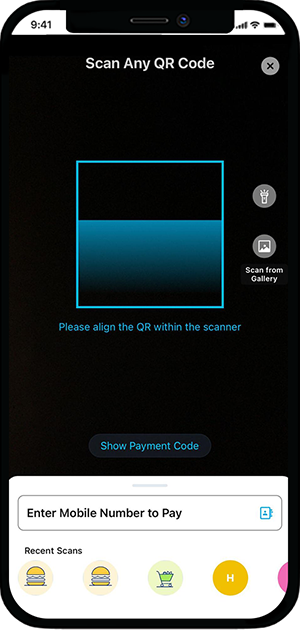

- Scanning a UPI QR code – You can also send money through UPI by scanning the receiver’s QR code. All you need to do is open the mobile payment application like Paytm on your phone, click on ‘Pay’, and select ‘QR code’. Scan the QR code of the receiver and enter the amount to be paid. Now enter your PIN and your payment will be completed in a few seconds.

- Entering UPI ID – To send money through UPI ID, all you need to do so is open the mobile payment application, and enter the receiver’s UPI ID. After this, you need to enter the amount that needs to be transferred and verify the transaction by entering your MPIN. Your transaction will be completed in a few seconds.

- Entering Account Number & IFSC – This is the traditional way of payments and it is also supported on UPI. You may enter the account number & IFSC of the person you want to send money to, specify the amount and enter your PIN. Your payment will be completed in a few seconds.

Each of the above ways allows you to transfer money using UPI on the Paytm app in an equally simple manner. Explained below are the steps to transfer money through the above-mentioned ways-

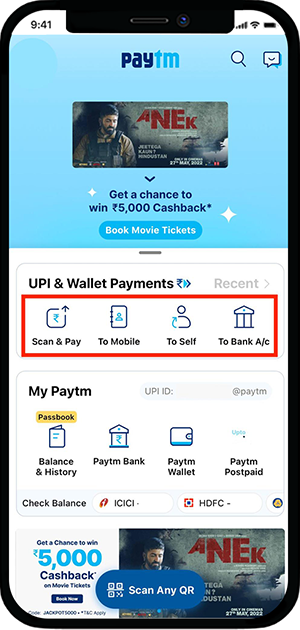

- Login to the Paytm app

- On the main screen that opens, you will find the section to ‘Send Money’

- Under this section, you will find various ways to send money through UPI. These ways include the options through mobile number, Scan & Pay and bank account

- Select any of these options to move further with the money transfer

- If you click on ‘Scan & Pay’, you will have to scan the receiver’s QR code

- If you select ‘To Mobile’, you will be asked to enter the receiver’s mobile number or select the receiver’s contact number from your phone’s contact list

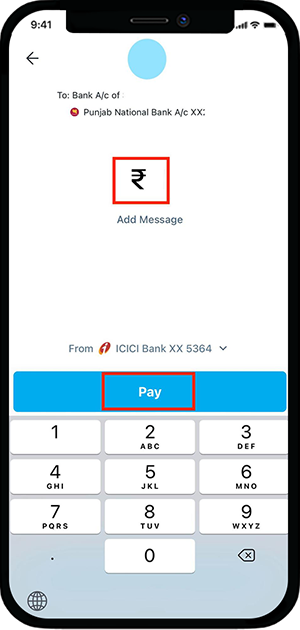

- After selecting the mode of payment, enter the amount to be sent

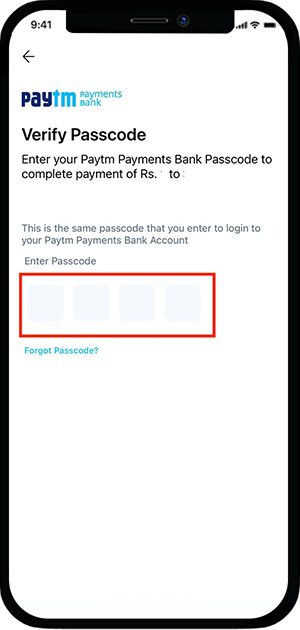

- Confirm the transaction by entering your 4 or 6-digit UPI PIN and clicking on ‘Pay’

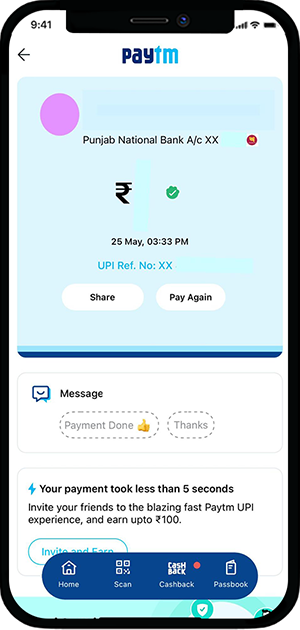

- The amount will be transferred to the receiver’s bank account in a few seconds!

Points to Consider while Making Money Transfer through UPI on Paytm

With Paytm UPI, you can make money transfers through various methods. As per your requirement, you can add or delete multiple bank accounts, create/change your UPI PIN, select a primary account for making/receiving payments, etc. Alternatively, you can also change the bank account from which you want to send the money while making a money transfer through UPI at the time of performing the transaction.

The following options allow you to transfer money using UPI on the Paytm app. Here are some of the important points that you should consider while making the transfer-

Pay through Mobile Number

- UPI money transfers are preferred because you can send/receive money only by sharing your mobile number. This mobile number must be the one that is registered in the bank as well as it is UPI enabled

- All you need to do is create a UPI account on your Paytm app and your UPI ID will be created automatically. Note that in the process of creating your UPI account, you will be asked to link your bank account

- You can share your number to receive payments or ask the sender to share their mobile number to send money via UPI on the Paytm app

- Paytm automatically detects if the phone number of a person is UPI-linked or if it has an active Paytm wallet or none

Pay through QR Code Scan

- You must have seen retail shops, street vendors, and various other merchants who put up a printed QR code that you can scan & pay to

- These are unique codes that are specific to each merchant and his/her bank account

- UPI QR codes are unique to each user, just like UPI IDs, and are linked to the bank accounts of the merchants

- Right when you scan the QR code of a merchant, it automatically fetches their linked bank account’s details, and you can make the payment by entering the amount and confirming the transaction

Pay through UPI ID

- You can transfer money using UPI on Paytm or any other app by entering the UPI ID of the recipient, provided both the sender and the payee have active UPI IDs

- A UPI ID is an identity unique for every UPI user, also known as VPA (Virtual Payment Address)

- VPA is a virtual address, specific to each user where real payments are made

- UPI is facilitated by the Payment Service Providers (PSPs) which are banks and UPI apps that allow interbank money transfers through UPI IDs. You can easily get your UPI ID created on the Paytm app

Pay through Bank Account

- Although it is best to transfer money using UPI on the Paytm app through a mobile number or UPI ID, you can still transfer money by adding all the bank details of the receiver

- On the home screen of the app, you can click on ‘To Bank A/c’ under the ‘Send Money’ section to add all the details of the payee

- Depending on whether the payee is a UPI registered user or not, the payment will be processed likewise

- If the recipient’s bank account is UPI-enabled, the money can be transferred through UPI mode. If not, then it will be transferred via internet banking

- You first need to select the bank and then add the account number, IFSC, and account holder’s name

Wrapping it up: You can transfer money using UPI on the Paytm app in various ways. UPI payments are instant and involve a quick process. So, why go the long way of adding beneficiaries and waiting hours for the bank’s approval, when you can do UPI money transfers in a matter of minutes. For the benefit of users, Paytm keeps a record of all transactions for its users. So, while making a UPI payment, users can see a list of all their latest UPI transactions and track their UPI transaction status.