A decade ago, it was unbelievable to imagine a cashless economy and now digital payments have become key to most of the transactions taking place in the country. Our pioneering QR code has been empowering India’s small shops who are now used to customers saying ‘Paytm le aao’ for every other payment. India is rapidly becoming a digital economy, much ahead of many developed countries so much so that we are now capable of exporting these innovative technologies to other countries.

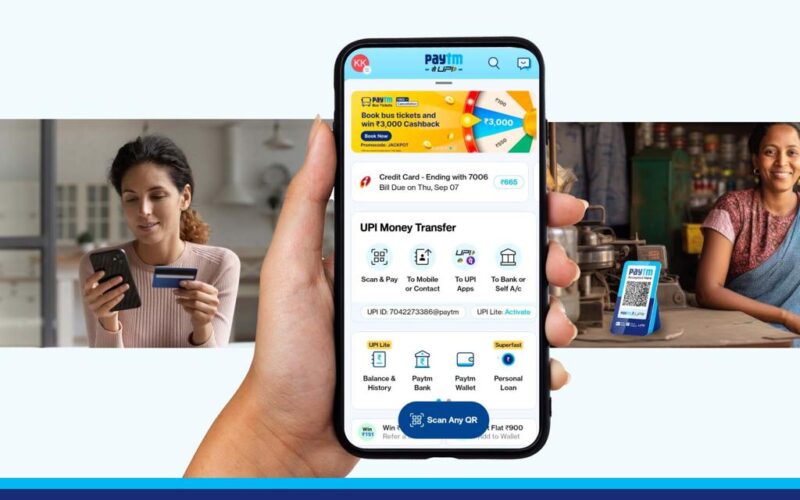

In India, we have revolutionised the payments landscape through our wide range of payments and financial services products. Teaching ‘scan and pay’ to millions of users in the country is one of our biggest achievements. We expect 500 million payment consumers and 100 million merchants to transact through mobile payments in the coming future as all sectors accept digital payments gradually.

With our innovative products and technology, we have the potential to build a digital infrastructure for any nation. We are also building an artificial general intelligence (AGI) software stack. AGI would be a machine capable of learning and thinking like a human.

“I believe India has an opportunity to become a net exporter of payment technology, software and hardware, and I expect Paytm to lead the way in this. Our R&D design and software capabilities are the best in the world, in which Paytm Labs is constantly building various AI and big data features that enhance payment trust, when consumers or merchants use Paytm,” said Vijay Shekhar Sharma, Founder & CEO. Paytm Labs is an advanced research and development division in Canada since 2014.

Meanwhile, we are already exporting our innovative payment solutions in a country like Japan through a joint venture with Softbank, and Yahoo. PayPay is a QR-based smartphone payment settlement service in Japan to both merchants and customers. PayPay has rapidly become a super app with more than 30 million customers and counting. With this, approximately 1 in 3 people in Japan use our app.

“Paytm is investing in AI with an eye on building Artificial General Intelligence software stack. We believe by building it in India we are not only making our country’s tech capability, also creating something that could be leveraged outside India. With a disciplined and result oriented approach in all our selected investment areas, we are sure we will be able to capitalize and build strong differentiators in the market and in turn a business that scales efficiently without linearly adding to costs. Having PayPay Japan as a partner and customer adds to our advantage as the system costs are shared between two countries,” said Sharma.

We are betting big on AI and other technologies as it will lead us to the future and help financial institutes capture risks and frauds.