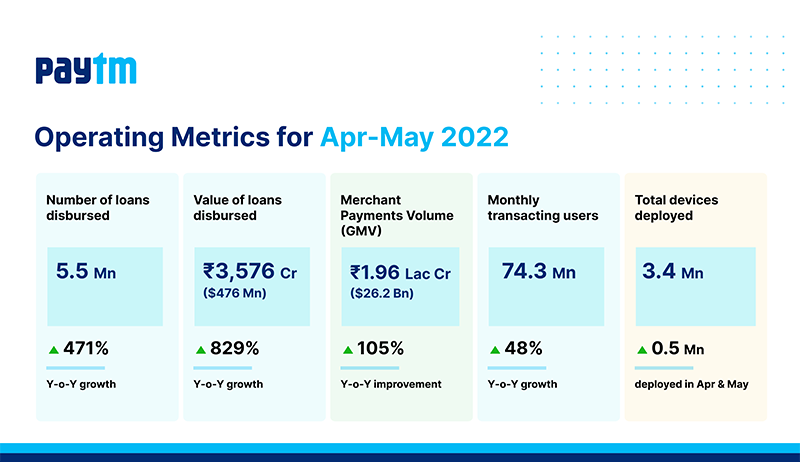

Our operating performance gains further momentum in April and May, 2022 and we continue to register robust growth across businesses.

Our lending business (in partnership with blue-chip lenders) continues to grow at a rapid pace and is now at an annualised run rate of over Rs 23,000 crore (approximately $3 billion) of loan disbursements through our platform. The number of loans disbursed through our platform grew 471% y-o-y to 5.5 million loans in two months ending May 2022, while the value of loans disbursed grew 829% y-o-y to Rs 3,576 Cr ($476 million). We are also seeing increases in average ticket size due to the scale-up of the personal loans business in particular

The merchant GMV processed through our platform for the two months ending May 2022 aggregated to approximately Rs 1.96 Lakh Cr ($26.2 billion), marking a y-o-y growth of 105%.

The Paytm Super App with its comprehensive offerings is the one-stop destination for diverse payments needs of millions of users in India. This has also led to new milestones achieved in user engagement, with the average monthly transacting users (MTU) for the two months ending May 2022 at 74.3 million, registering a growth of 48% Y-o-Y.

Our leadership in offline payments continues with deployment of 3.4 million devices at merchant stores across the country. The strong adoption of devices also has a correlation with the rise in merchants eligible for loans from our platform.