We have filed our first annual report as a listed company with the exchanges. In this report, we have highlighted our achievements over the past financial year that have contributed to the growth of our key businesses along with insights into our path to achieving profitability.

Here are the key highlights from our Annual Report FY2021-22

- Message from our Founder and CEO: The Annual Report FY2021-22 includes a letter to shareholders from our Founder and CEO Vijay Shekhar Sharma, stating that we have registered strong growth across all key businesses. “I am proud of what Paytm has achieved in the last year with rapid growth in payments, and a huge scale-up in lending and devices businesses. We remain committed to building a large, profitable company and creating long-term shareholder value,” he wrote.

- On track to profitability: Our CEO further said that we are on track to achieve our profitability target. He said, “I believe that over the past year, our team has done a great job in massively improving our revenues and contribution profits, which allows for investments in our payments and credit businesses while at the same time reducing our EBITDA losses. We are seeing excellent momentum in our businesses and are on track to achieve operating profitability (EBITDA before ESOP costs) by the quarter ending September 2023.”

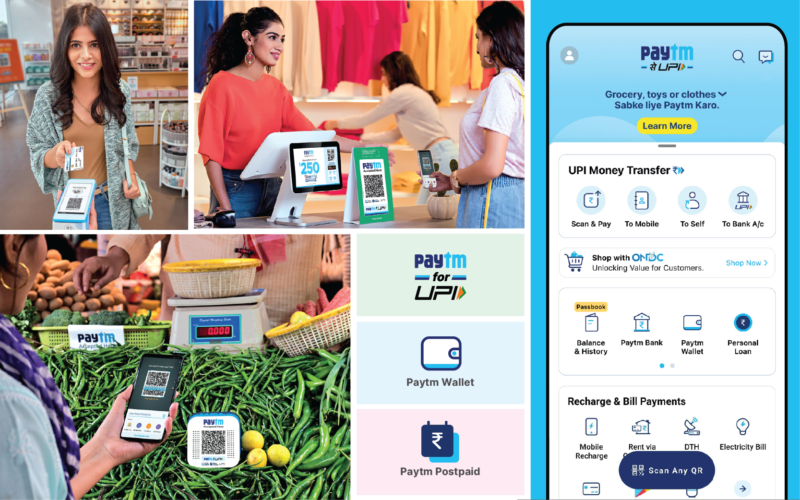

- Pioneer of mobile payments revolution: As pioneers of India’s QR and mobile payments revolution, we continue to empower the grassroots of the country with robust digital payment solutions. Our technology platform is focused on delivering newer ways for payment solutions, including GPS based payment etc. Our offering to the ecosystem is innovative technology and the ultimate business solution that has become mainstream for the industry and the country. We strive to continue delivering innovative funding sources and payment methods, which is also encouraged by Regulators.

- Focused on driving financial inclusion: We firmly believe that technology when combined with a positive intent can create a huge impact. We are constantly working on innovative solutions that can make everyday life simpler: full-stack digital banking to underserved Indians, institutional financial services such as loans and bookkeeping and invoicing to micro, small and medium enterprises, and democratizing access to formal credit.

- Business model gaining momentum: The core of our business model is to acquire consumers and merchants for payments services, and upselling them financial services, by leveraging our distribution, collections and our transactional and behavioural insights. Payments is a major revenue driver for us and lending is one of our fastest growing products. We have sharpened our focus on payments and distribution of lending products, and have prioritised these businesses in our resource allocation.

- Increased monetization through payments and financial services: Our platform growth continues to be impressive, represented by our average Monthly Transacting Users (MTU) and registered merchant base. We have also seen increased monetization of payments, in the form of both MDR and subscription revenues. We have also been able to monetise our platform by upselling financial services to our customers and merchants, and also upselling payment devices to our merchants.

- UPI is a key customer and merchant acquisition channel making way for monetization: We stated that more and more users are coming on our platform for their everyday usage without requiring any incentive. “UPI has emerged as one of the key customers and merchant acquisition channels for us. UPI merchant payments, which are free for the merchant, have now also become economically viable because the government is encouraging digital payments through incentives on UPI P2M transactions. We have been able to monetise our platform by upselling financial services to our customers and merchants, and also upselling payment devices to our merchants,” said our report.

- Merchants are willing to pay for technology and trust: We are the leader in the offline payments segment, supported by a wide merchant base and accelerated adoption of our devices. “We see that merchants intuitively understand the value of digital payments; and increasingly, they are ready to pay for technology that makes digital payments easier and trusted. We are increasingly seeing merchants opt for devices, whether Paytm card machines or Soundbox, on their counter, and this adoption of devices by merchants is almost certainly going to further accelerate,” said our CEO.

- Strong revenue growth: Our revenue from operations grew 77% to Rs. 4,974 Cr in FY2022 from Rs. 2,802 Cr in FY2021, with payments and financial services accounting for the biggest share. Our overall payments revenue (to consumers and merchants) in the previous financial year stood at Rs. 3,421 Cr, while revenue from financial services and others grew to Rs. 437 Cr in FY2022 from Rs. 128 Cr in FY2021, driven by 441% Y-o-Y growth in the value of loans disbursed in FY 2022 to Rs. 7,623 Cr, from Rs. 1,409 Cr in FY2021.

- India in midst of technology revolution: Consumers and small businesses are adopting technology at a rapid pace. The network effect of this adoption across use cases is visible and is having a profound impact. Payments has been at the forefront of this revolution and now consumers and merchants are increasingly using, and indeed demanding, digital financial services. We are proud to say that our businesses are leveraging this opportunity and contributing in further accelerating the pace of technology adoption.

We are thankful for your patronage and continuous support, and remain committed to creating long-term value for stakeholders.

Read the full Annual Report here