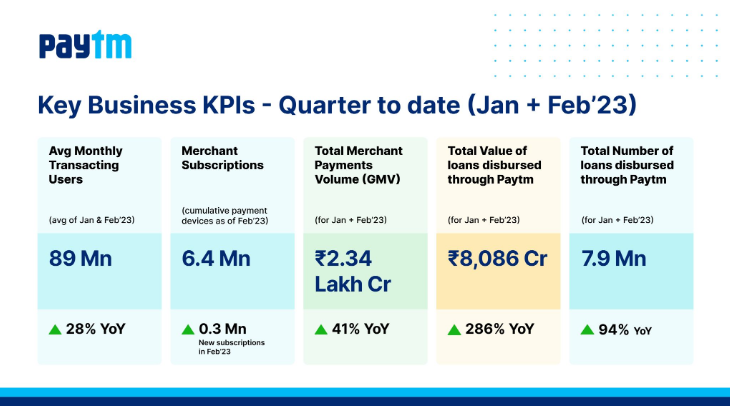

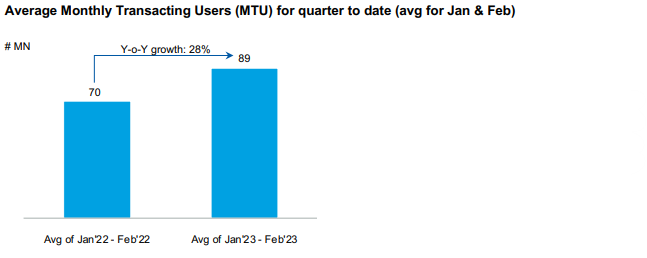

• Continued expansion of consumer base with average monthly transacting users (MTU) at 89 million for quarter to date (average for January & February 2023), up 28% y-o-y

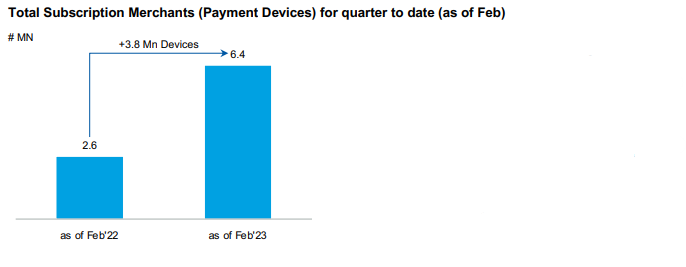

• Our subscription devices like Soundbox and POS machines continue to see increased acceptance by merchants, driving additional payment monetization for us. Number of merchants paying subscription for payment devices has reached 6.4 million as of February 2023, an increase of 0.3 million in the month

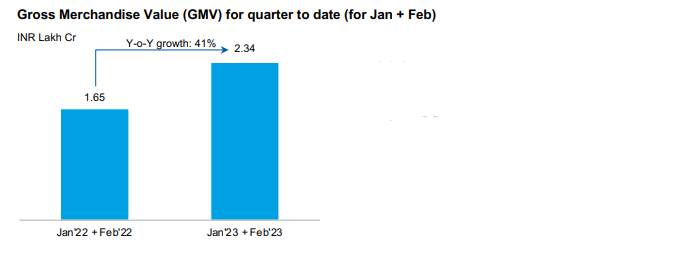

• Merchant Payment Volumes (GMV) for quarter to date (for January & February 2023) stood at Rs 2.34 Lakh Cr ($28.3 billion), y-o-y growth of 41%

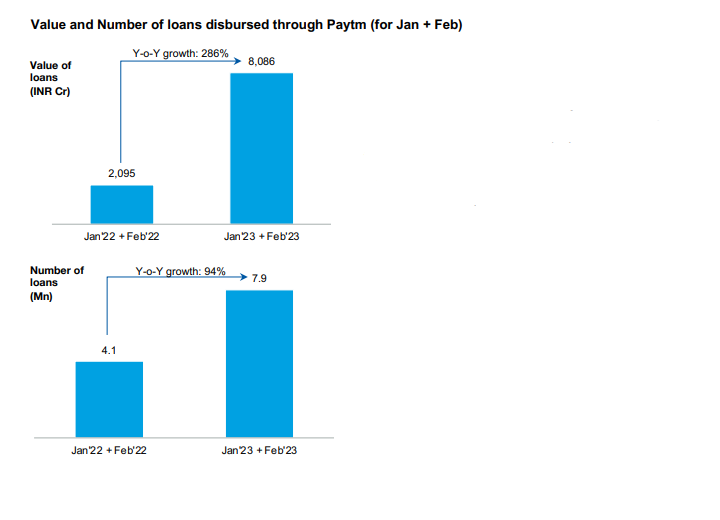

• Continued scale in our loan distribution business with disbursements of Rs 4,158 Cr ($503 million, y-o-y growth of 254%) and 4.0 million loans (y-o-y growth of 86%) disbursed in the month of February 2023

We have achieved sustained growth in our core payments and loan distribution business, with our device deployment, increased to 6.4 million. Consumer engagement is at its highest on Paytm Super App with an average MTU at 89 million for the month of February 2023, up 28% y-o-y.

You can also access our exchange filing here:

Our Super App continues to see growing consumer engagement with the average MTU for the quarter to date (for January & February) at 89 million, registering a growth of 28% y-o-y.

We continue to strengthen our leadership in offline payments, with 6.4 million merchants now paying subscriptions for payment devices, an increase of 0.3 million in the month of February 2023. With our subscription-as-a-service model, the strong adoption of devices drives subscription revenues and higher payment volumes, while increasing the funnel for our merchant loan distribution.

The total merchant GMV processed through our platform for the quarter to date (for Jan & Feb) was Rs 2.34 Lakh Cr ($28.3 billion), marking a y-o-y growth of 41%. Our focus over the past few quarters continues to be on payment volumes that generate profitability for us, either through net payments margin or from direct upsell potential.

Our loan distribution business (in partnership with top lenders) continues to witness accelerated growth with total disbursements through our platform for the quarter to date (for Jan & Feb) growing 286% y-o-y to Rs 8,086 Cr ($979 million). Our payments consumer and merchant base offers a large addressable market, thereby providing a long runway for growth. We continue to work with our partners to remain focused on the quality of the book.