Note: Digital gold gifting has been discontinued on Paytm. However, you can still buy and sell 24K digital gold as usual and request delivery of physical gold coins.

Investing in gold has always been a popular choice for Indians looking to secure their financial future. It’s a time-honored tradition that symbolizes wealth, prosperity, and security. However, in recent years, the rise of digital platforms has made investing in gold more accessible than ever before. One such platform that has made waves in the world of digital gold is Paytm.

Paytm’s digital gold offering allows you to buy, store, and sell gold with just a few taps on your smartphone. No more worrying about storage fees or the purity of physical gold. You can start investing in digital gold with as little as INR 1, making it a great option for those who want to dip their toes into the world of gold investment.

What Is Paytm Digital Gold?

Paytm digital gold is a modern investment option that allows users to buy, store, and sell gold electronically without the need for physical possession. In collaboration with MMTC-PAMP, Paytm offers a platform where individuals can purchase 24K 99.99% pure gold starting from as little as Re 1. This makes it an accessible choice for a wide range of investors.

Who is MMTC-PAMP?

Paytm has teamed up with MMTC-PAMP to offer customers the ability to buy and sell 24k gold, which is 99.99% pure. MMTC-PAMP India Pvt. Ltd. is a joint venture between MMTC Limited, a Government of India enterprise, and PAMP Switzerland, a global leader in bullion refining and a key referee for precious metals worldwide. Notably, MMTC-PAMP is India’s first and only refinery accredited by the London Bullion Market Association (LBMA) for both gold and silver. For more information, visit MMTC-PAMP.

The real game-changer came with the recent Union Budget 2024. The government announced a reduction of basic customs duty on gold to 5% from 10%. This move is part of a broader initiative to make gold investment more attractive and accessible to a wider audience. With lower prices and increased demand, now is the perfect time to explore how to invest in digital goldthrough Paytm

How is the Purity of Gold Ensured?

MMTC-PAMP, the gold seller on Paytm, is a BIS-certified refinery, guaranteeing the highest standards of purity. They provide 24k gold with a fineness of 999.9, meaning the gold is at least 99.99% pure.

Key Features of Digital Gold on Paytm

- Convenience: Users can easily buy gold using the Paytm app at any time, making it a flexible investment option. The process is easy: simply log into the app, select the ‘Gold’ option, choose the amount in rupees or grams, and complete the payment using various methods like UPI, net banking, or credit debit card

- Secure Storage: Once purchased, the gold is stored in insured vaults managed by MMTC-PAMP, eliminating concerns about physical storage and security. There are no storage fees for up to five years, making it a cost-effective solution.

- Real-Time Pricing: Paytm provides live updates on gold prices, allowing users to make informed decisions about when to buy or sell their gold holdings.

- Selling Gold: If you wish to sell your digital gold, the process is equally simple. Users can log into the app, select the ‘Sell’ option, and choose to sell their gold for cash or in grams.

How is the Gold Buying Price Determined on Paytm?

The gold buying price on Paytm is determined by the international bullion markets. Our gold partner, MMTC-PAMP, is closely linked with these markets. The price is set based on various market factors, ensuring it reflects current global trends.

What is the Maximum Storage Period for MMTC-PAMP Gold?

You can store your gold with MMTC-PAMP for up to 5 years from the date of purchase. During this period, your gold will be kept in secure custody. You can sell or withdraw your gold at any time within these five years.

When withdrawing, you can choose from a range of minted products. After the 5 years, you must either sell or take delivery of the gold. For multiple purchases, each transaction has a separate 5-year storage period. If you redeem your gold after the 5-year custody period, additional charges will apply.

How to Invest in Paytm Gold?

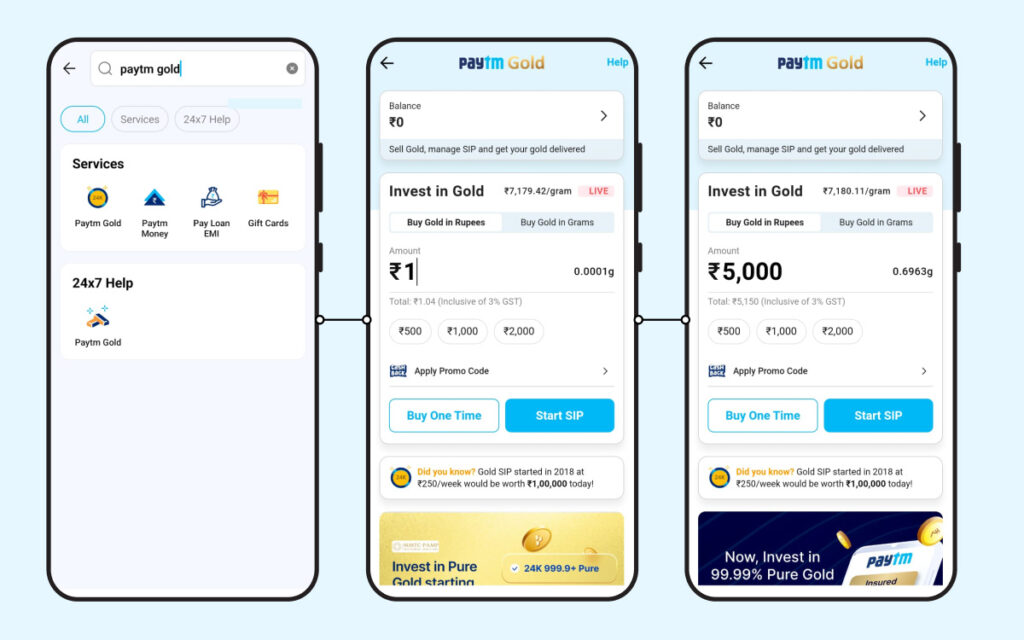

Step 1: Log in to the Paytm app and use the search bar to find “Gold.”

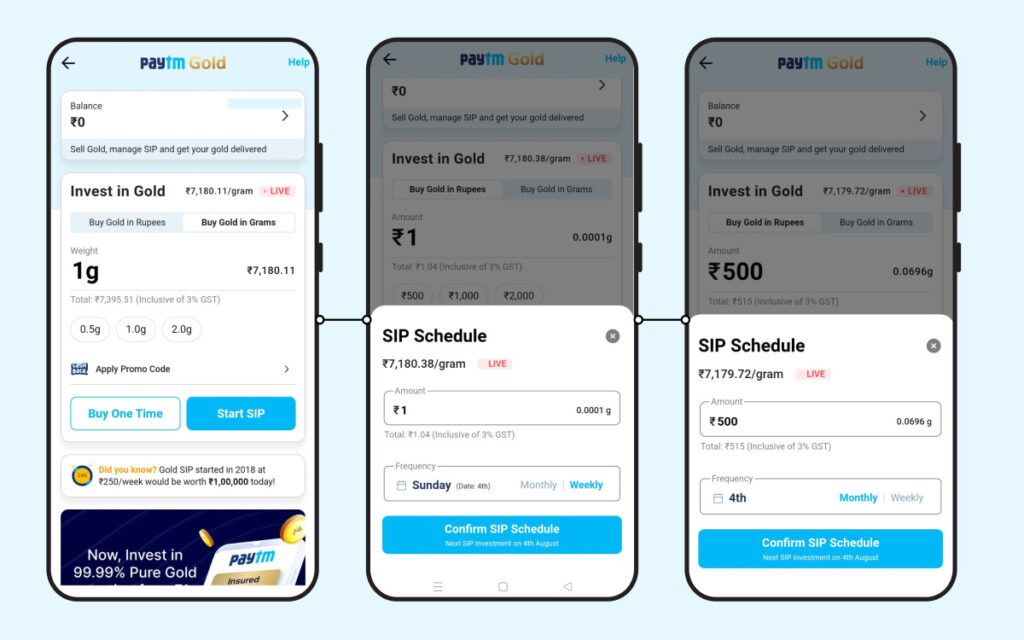

Step 2: Purchase gold by specifying an amount in rupees or selecting the quantity in grams. The minimum investment can start as low as Re 1.

Step 3: Check the current gold price, including GST, displayed on the app. You can pay the amount in lumpsum or start a SIP (Systematic Investment Plan).

*Note: You can even choose monthly and weekly SIP

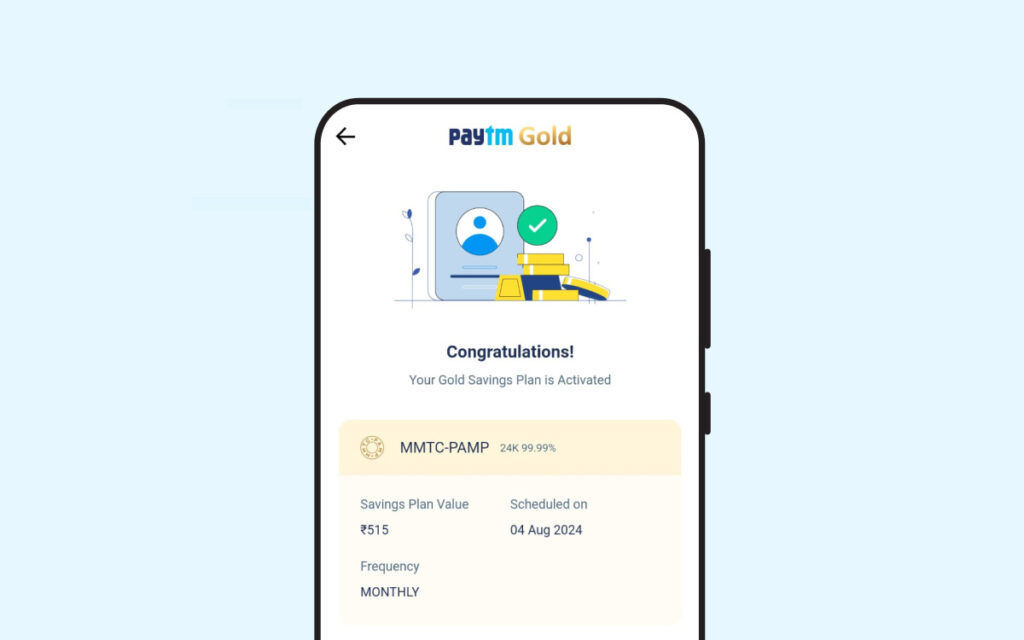

Step 4: Choose your payment method, such as UPI, net banking, or debit/credit cards. After payment, your gold will be securely stored in insured vaults.

Step 5: Receive a confirmation via SMS and email once the transaction is successful.

Where Can I See My Gold Balance?

To view your gold balance, click on the ‘Locker’ icon located on the bottom strip of the Gold homepage. Your balance will be displayed based on the current sell price.

Why Buy Digital Gold on Paytm?

- Effortless Account Setup: Easily open a Paytm account with no fees or hassles.

- Low Minimum Investment: Buy gold starting from just Re. 1.

- Top-Notch Security: Your gold is securely stored in fully insured vaults.

- No Extra Charges: Enjoy zero fees for storage and insurance.

- Convenient Delivery: Get your gold delivered directly to your doorstep.

What is the Minimum and Maximum Amount of Gold You Can Buy on Paytm?

On Paytm, you can buy gold starting from as low as ₹1 and up to a maximum of ₹1 crore.

What is Paytm Gold KYC?

To enhance the security of your gold holdings on Paytm, paytm has introduced a new Gold KYC process. This ensures that only you can manage transactions involving gold in your Paytm account.

When Will KYC Be Required?

- During Transactions: Paytm may request KYC when buying, selling, or redeeming digital gold, based on our internal policies.

- Possible Exceptions: While KYC may not always be required for purchases, it might be necessary during sales or deliveries.

- Purpose: These security checks are designed to protect your gold investments on our platform.

What is the New KYC Process?

Here’s a simple guide to completing the new KYC process for Paytm Gold:

- Receive a Notification: You’ll get a prompt to start your Paytm Gold KYC.

- Enter Details: Click the prompt, then enter your PAN number and confirm your name.

- Aadhar Verification: Complete Aadhar verification through Digio.

- Upload Photo: Take and upload a live photo.

- Provide Bank Details: Enter your bank account information.

- Finish Up: Your KYC is complete!

Note: Ensure that the name on all documents matches to complete the KYC process.

Once done, you can link up to four additional bank accounts to your Gold account, allowing you to use either UPI ID or verified bank accounts for transactions.

Payment Methods for Gold Transactions Post-KYC

After completing your KYC, you can use these payment methods for your gold transactions:

- UPI ID: Quick and convenient.

- Net Banking: Use only verified bank accounts.

What is the Live Gold Price?

The live gold price represents the rate of 999.9 fine gold in Indian rupees per gram. This rate is updated regularly and includes duties and taxes but excludes product manufacturing/making charges and delivery fees.

Where Can I Find My Paytm Digital Gold Invoice?

- In-App Download: Click on the ‘Transaction’ icon at the bottom of the Gold homepage. Locate your transaction and select ‘Download Invoice.’

- Email Attachment: The invoice is also sent as an attachment in your order confirmation email.

Note: Invoices are available for Buy, Sell, Goldback, and Delivery orders only. Gifting, which transfers gold between accounts, does not generate an invoice.

Can I Cancel My Digital Gold Purchase?

Once MMTC-PAMP, the gold seller, has accepted your purchase offer, cancellations or refunds are not permitted.

Where is My Paytm Gold Stored?

Your Paytm gold is securely stored in MMTC-PAMP’s vaults at no additional cost. The gold is kept in insured lockers, ensuring its safety. You can accumulate gold without the hassle and high fees associated with traditional storage solutions.

Will I Lose My Money In Case of a Natural Disaster or Theft?

No, you will not lose your money. MMTC-PAMP stores your gold in fully insured vaults, protecting it against natural disasters and theft. Your investment remains secure even in unforeseen circumstances.

Disclaimer: The purpose of this blog is to simplify complex processes for readers’ understanding. Please note that some information and screenshots provided may become outdated or change over time. However, we strive to keep our blogs updated and relevant to provide accurate and helpful information