The GST Composition Scheme is a simplified tax system for small businesses, providing relief from complex procedures. This blog will delve into its features, eligibility criteria, and tax rates, making it easier for you to understand and utilize this scheme for your business.

Table of Content

- What is GST Composition Scheme?

- Who Can Avail Composition Scheme?

- Who Cannot Opt For Composition Scheme?

- How to Opt For GST Composition Scheme?

- How to Check GST Composition Scheme Status?

- What are GST Composition Rates?

- What is the Billing Process of GST Composition for Dealers?

- What Are the Drawbacks of the Composition Scheme?

What is the GST Composition Scheme?

The Composition Scheme is a simplified tax scheme offered by the government to small businesses. Under this scheme, eligible businesses can pay taxes at a fixed rate based on their turnover, rather than dealing with the complexities of regular GST filing. The Composition Scheme aims to reduce the compliance burden for small taxpayers and provide them with a more straightforward method of tax payment.

Who Can Avail Composition Scheme?

The Composition Scheme under GST can be availed by the following categories of taxpayers:

- Small businesses: Individuals, partnerships, or any other entity that sells goods and has an annual turnover up to Rs 1.5 crore (or Rs 75 lakh for special category states) in a financial year.

- Service providers (excluding restaurants): Individuals, partnerships, or any other entity that provides services (except restaurants) and has an annual turnover up to Rs 50 lakh in a financial year.

Also Read: Different Types of GST

Who Cannot Opt For Composition Scheme?

- Inter-state suppliers: Individuals who supply goods or services between different states cannot opt for the Composition Scheme under GST.

- Manufacturers of specific goods: The GST council maintains an exclusion list for the Composition Scheme, which includes certain manufacturing activities that are not eligible for the scheme. The list is based on the nature of the goods.

- Casual taxable persons: Individuals registered as casual taxable persons*, who require GST registration for a temporary period, are not eligible for the Composition Scheme.

- Non-Resident Individuals: NRIs registered under GST are not allowed to opt for the Composition Scheme.

- Individuals selling goods on an e-commerce platform and collecting Tax Collected at Source (TCS): Previously, individuals selling goods on e-commerce platforms and collecting TCS were not eligible for the Composition Scheme. However, this restriction has been removed from October 1, 2023.

*A casual taxable person, as per GST (Goods and Services Tax) regulations, refers to an individual or business entity that occasionally supplies goods or services in a state or union territory where they do not have a fixed place of business

Note: It is always advisable to refer to the official GST guidelines or consult with a tax professional to determine eligibility for the Composition Scheme, as the exclusion list may be subject to change.

Also Read: How to do GST Return?

How to Opt For GST Composition Scheme?

To opt for the Composition Scheme under GST, you can do the following:

- At the beginning of the financial year: If you want to avail of the Composition Scheme from the start of the financial year, you need to file the GST CMP-02 form. You can do this through the GST portal or with the help of a GST practitioner.

- During GST registration: If you are a new taxpayer registering for GST, you can choose the Composition Scheme during the registration process itself. Just select the option that indicates your intent to opt for the Composition Scheme.

Remember, once you have opted for the Composition Scheme, you cannot switch to the regular scheme during the financial year. You can only opt for the Composition Scheme at the beginning of the financial year or during GST registration.

For more detailed and specific guidance, it is advisable to consult a tax professional or refer to the official GST guidelines.

Calculate GST Amount Effortlessly with Online GST Calculator

How to Check GST Composition Scheme Status?

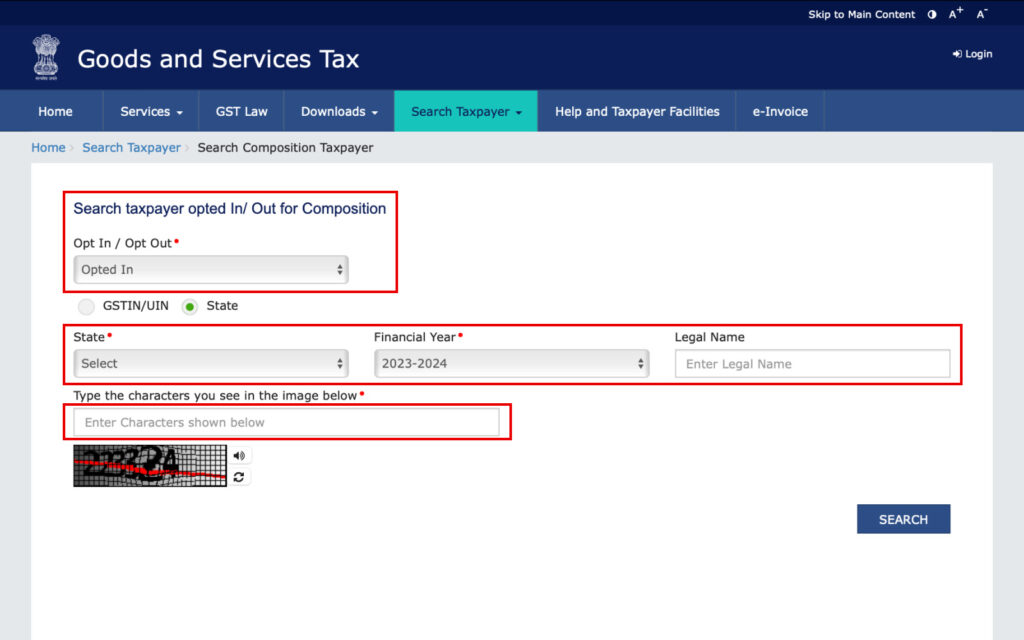

Step 1: Log in to the official GST Portal page.

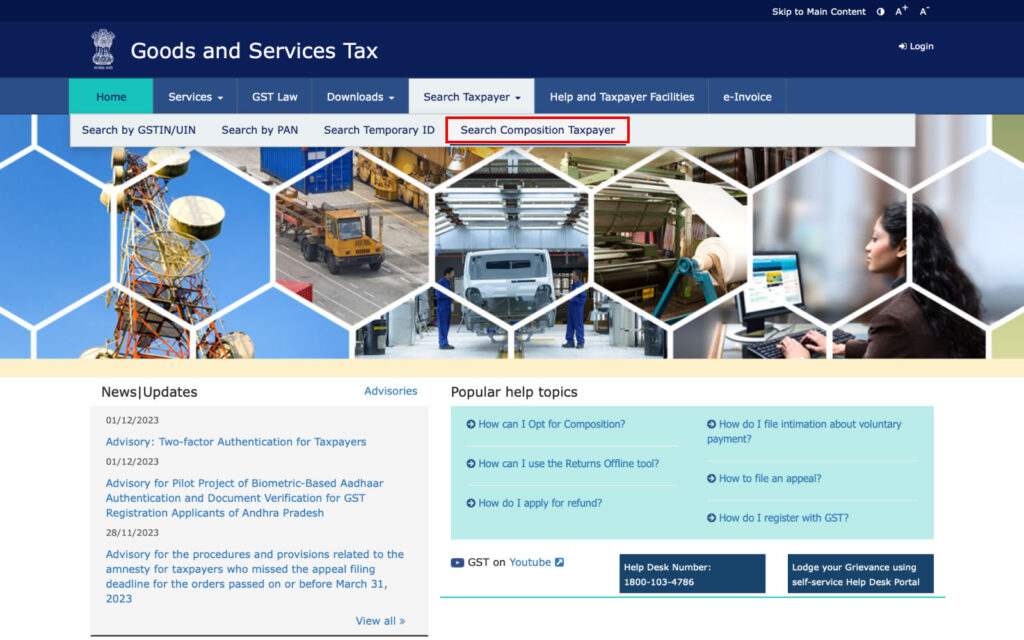

Step 2: Locate and click on the ‘Search Taxpayer’ tab, then select ‘Search Composition Taxpayer’.

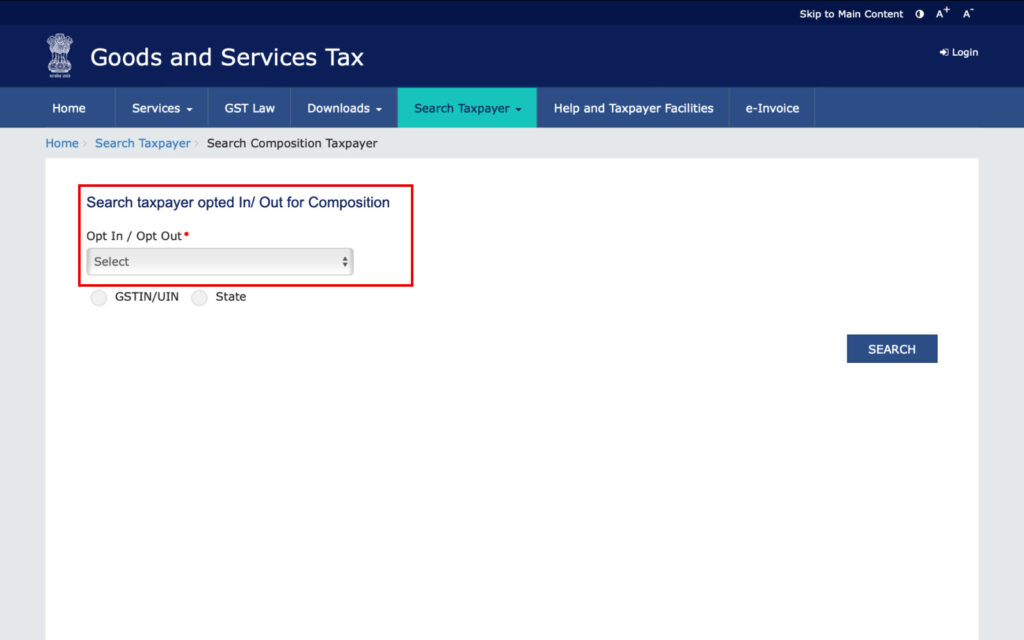

Step 3: On the following page, find taxpayers who have opted In or Out for Composition. Then, you’ll have the choice to select either GSTIN/UIN or your state.

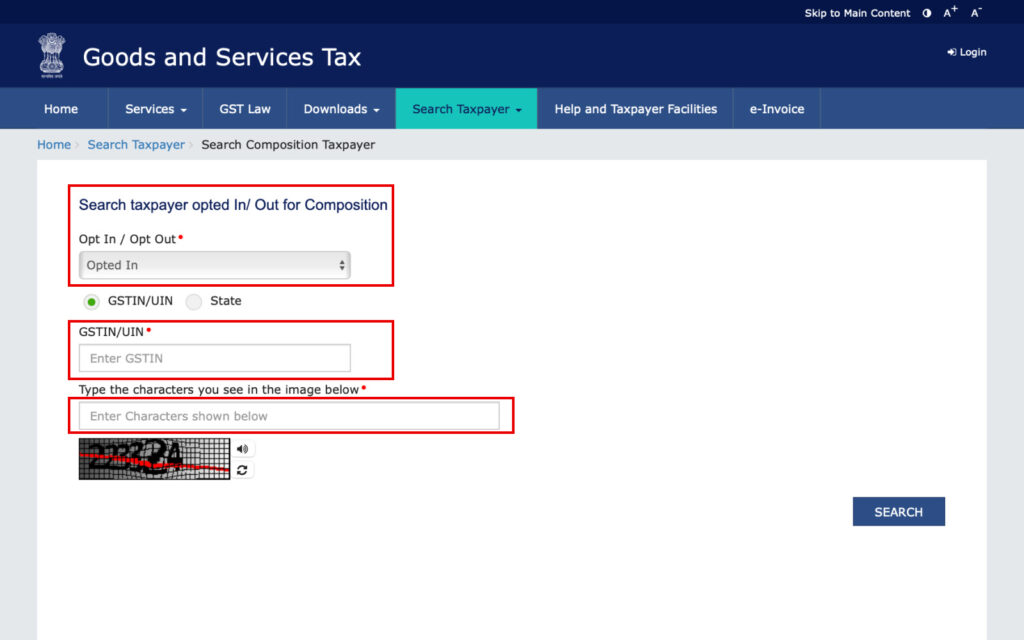

Step 4: If you opt for GSTIN/UIN, you’ll need to provide the GSTIN/UIN code and enter the captcha. If you choose the State option, you’ll also have to input additional details such as the financial year and legal name.

Step 5: Upon making your selection, the portal will display your GST Composition scheme status.

What are GST Composition Rates?

| Category of Registered Person | Rate of Tax |

|---|---|

| Manufacturers (excluding notified goods*) | 2% (1% Central tax + 1% State tax) of the turnover |

| Restaurant Services | 5% (2.5% Central tax + 2.5% SGST) of the turnover |

| Traders or other suppliers eligible | 1% (0.5% Central tax + 0.5% State tax) of the turnover |

*Notified goods refer to specific categories or types of goods that have been officially announced or listed by the government under the GST (Goods and Services Tax) regulations. These goods are subject to different tax rates or may have specific regulations applicable to them. Examples of notified goods can include items like tobacco products, pan masala, aerated drinks, luxury goods, and certain types of high-value items.

What is the Billing Process of GST Composition for Dealers?

When it comes to billing, composition dealers have a different way of doing things compared to regular taxpayers. Here’s a simple breakdown of how composition dealers should handle their billing:

- No Tax Invoice: Composition dealers cannot charge taxes to their customers, so they don’t issue a tax invoice like regular taxpayers do.

- Bill of Supply: Instead, composition dealers create a “Bill of Supply” for their transactions. It’s a document that serves as an alternative to a tax invoice and is given to their customers.

- Specific Declaration: On the Bill of Supply, composition dealers must clearly state: “Composition taxable person, not eligible to collect tax on supplies.” This declaration lets the customer know that the dealer is operating under the composition scheme and isn’t charging any taxes on the transaction.

What Are the Drawbacks of the Composition Scheme?

There are a few disadvantages associated with registering under the GST composition scheme:

- Limited business territory: Dealers registered under the composition scheme are restricted from conducting inter-state transactions, limiting their market reach.

- No Input Tax Credit: Composition dealers are not eligible to claim Input Tax Credit, which means they cannot offset the tax paid on their purchases against the tax collected on sales.

- Ineligibility for certain supplies: Taxpayers under the composition scheme are not permitted to supply non-taxable goods such as alcohol or sell goods through an e-commerce portal.

The GST Composition Scheme offers certain advantages and disadvantages for eligible taxpayers. It provides a simplified compliance process, reduced tax liability, and increased liquidity. However, it comes with restrictions such as limited business territory, ineligibility for Input Tax Credit, and limitations on certain supplies. Therefore, businesses considering the Composition Scheme should carefully evaluate their eligibility, tax rate implications, and features to make an informed decision that aligns with their specific needs and goals.

Disclaimer: Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommend you seek professional advice from someone who is authorised to provide investment advice.