What are bracket orders?

A Bracket order (BO) in trading allows traders to set their entry, target, and stop-loss level prices in the same order. These orders are triggered automatically when these levels are reached. Therefore, the advantage of bracket order is that the mental involvement is reduced for a trader. Simply put the target and stop loss in the same order and live in peace. One way or the other, the market will move; so either it will hit the target OR it will hit the stop loss. If the target gets hit the stop loss order will be cancelled automatically and if the stop loss gets hit the target order will be cancelled automatically.

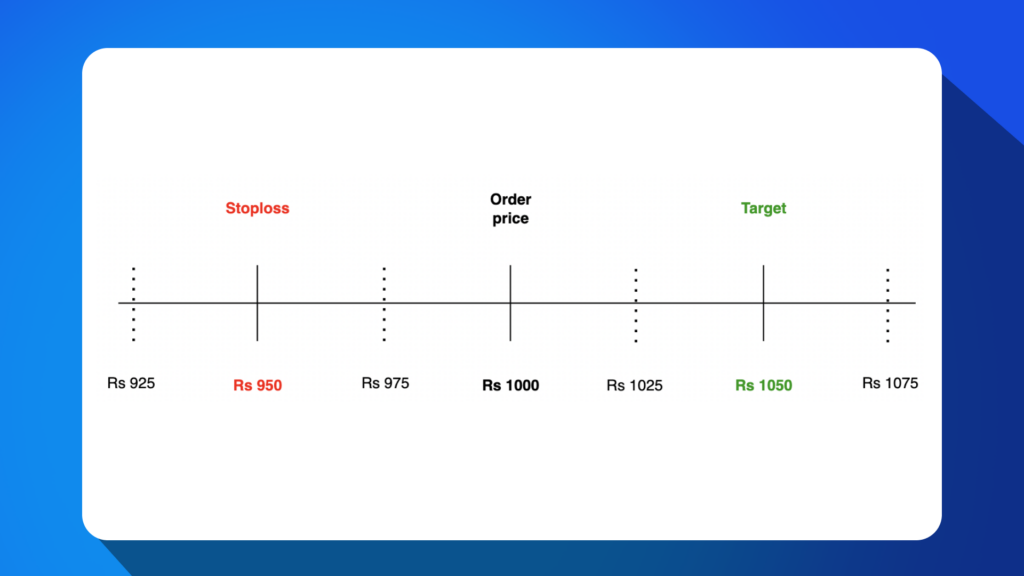

Here’s an example to illustrate how Bracket order works:

Let’s say, you want to buy 100 shares of XYZ stock, which is currently trading at Rs 1000 per share. You want to limit your potential losses, so you decide to use a bracket order to set your entry, target, and stop-loss levels.

You place a bracket order with the following parameters:

- Order Entry price: Rs 1000 per share

- Target price: Rs 1050 per share

- Stop-loss price: Rs 950 per share

Happy flow: With this order, if the price of ABC stock rises to Rs 1050 per share, your order will be automatically filled, and you will make a profit of Rs 50 per share.

Control flow: Conversely, if the price of XYZ stock falls to Rs 950 per share, your stop-loss order will be triggered, and you will limit your losses to Rs 50 per share.

Hence, the main order can be a buy/sell order and the stop loss and target legs will be of the opposite order type which will be triggered only if the corresponding prices are triggered. Hence, the name Bracket order: [Stop-loss (max loss), Execution price, Target (max profit)].

The benefit of using a bracket order is that it allows you to set your target and stop-loss levels in advance, without needing to actively monitor the market. This can help to limit your potential losses and maximize your profits.

Why use Bracket Orders?

Now that we have an understanding of what Bracket Orders are, let’s explore the reasons we should place these orders:

- Minimizes Risk

A bracket order is a three-part order that includes a market/limit order, a stop-loss order, and a target (intended profit) order. With this order, you can set a specific price range for buying and selling a stock. This ensures that your losses are limited in case the stock price falls, and the trade doesn’t go as planned.

- Automates the Trading Process

Once you set your desired price range, the order executes automatically depending on whichever leg- stop loss/ target—is reached first. This saves you time and effort. You don’t need to monitor the stock price continuously, the bracket order does it for you.

- Helps to Lock-in Targeted Profits

Bracket orders can also help you lock in profits. You can set a target price, which automatically sells (or buys) the stock once it reaches a certain price. This ensures that you don’t miss out on potential profits if the stock price moves in your favoured direction.

- Keeping Emotions Aside in Trading

Trading can be an emotional experience, and emotions can often cloud one’s judgment. Since these orders execute automatically, we don’t have to make a decision based on emotions, thereby preventing poor decision-making.

- Provides Efficiency

You are placing three orders simultaneously via single bracket order, thereby efficiently placing the parent order while shielding it within the loss-profit range you’re comfortable in.

Points to keep in mind while investing in Bracket orders

DOs of using Bracket Orders

- Use the stop-loss and target legs carefully

One of the main benefits of using bracket orders is that they help manage risk. By using a stop-loss order, you can limit your losses if the market moves against you. By using a target order, you can lock in profits and ensure that you don’t miss out on potential gains. Choose these leg trigger prices carefully.

- Use Bracket Orders in Volatile Markets

In volatile markets, the stock price can move rapidly, making it difficult to manage risk unless monitored continuously. By using bracket orders, you can automate the trading process and manage risk more effectively.

DON’Ts of using Bracket Orders

- Don’t place orders too close to the Market Price

Placing your orders too close to the market price can be risky. If the market moves against you, your stop-loss order can be triggered too quickly, resulting in a loss.

- Don’t miss out to square off your Bracket order position

Since you need to complete the position on the same trading day, ensure to square off your orders to prevent auto square off charges.

Be aware that Bracket order cannot be opted out in between

Be cautious in dealing with bracket orders as once the first order is placed, it cannot be shut half-away. The only way is to exit the parent position itself.

How to place a Bracket order on Paytm Money?

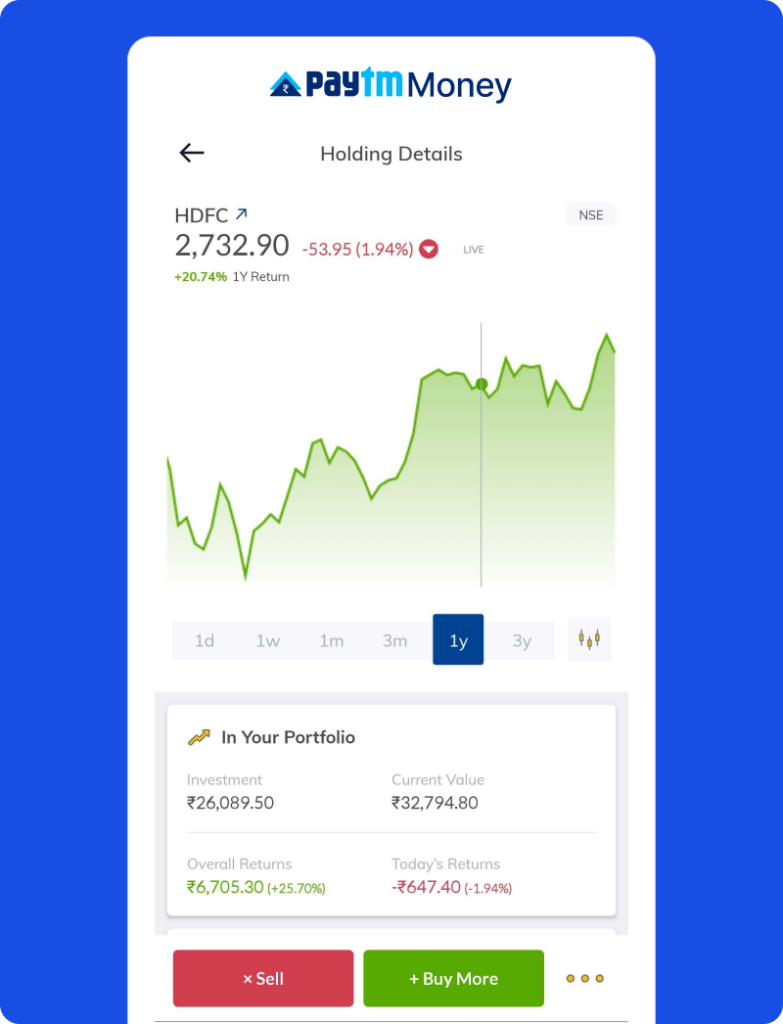

Click on any stock you want to place a Bracket order for

The securities are quoted as an example and not as a recommendation

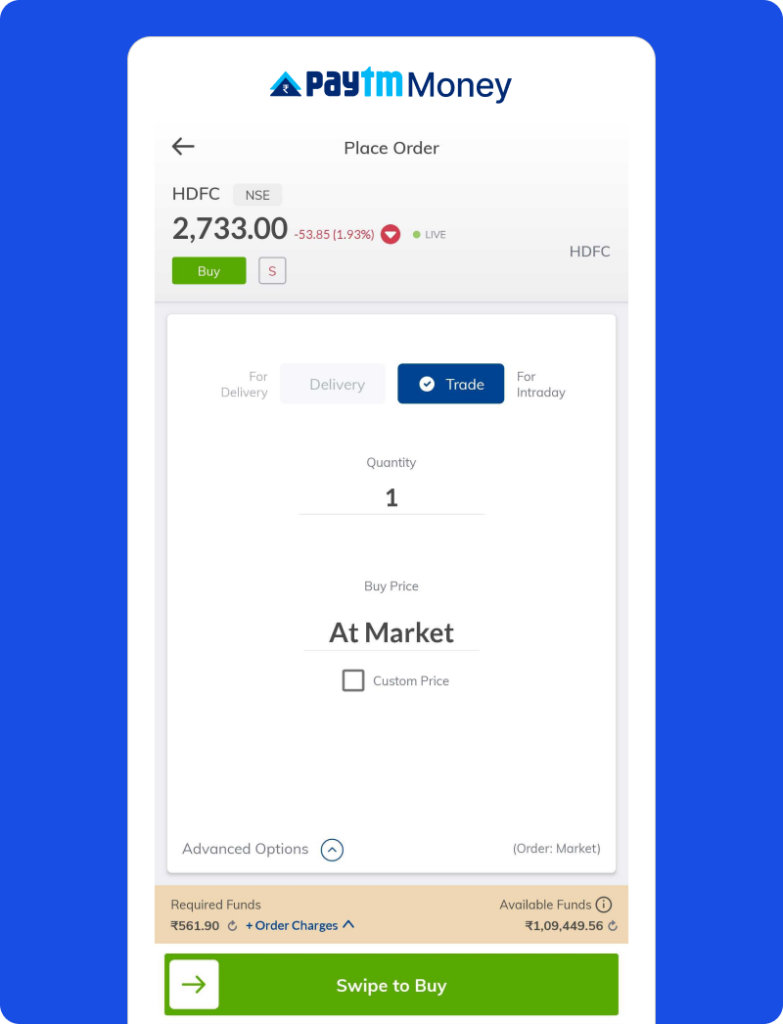

Tap on Intraday/Trade section

The securities are quoted as an example and not as a recommendation

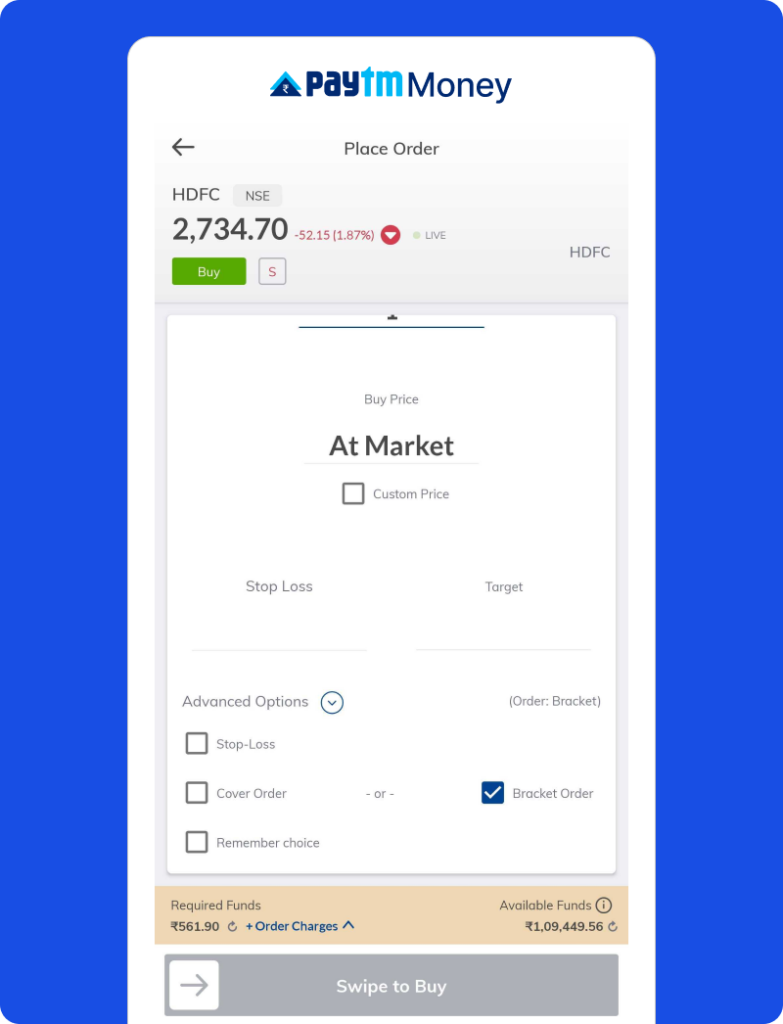

Tap on Advanced options

The securities are quoted as an example and not as a recommendation

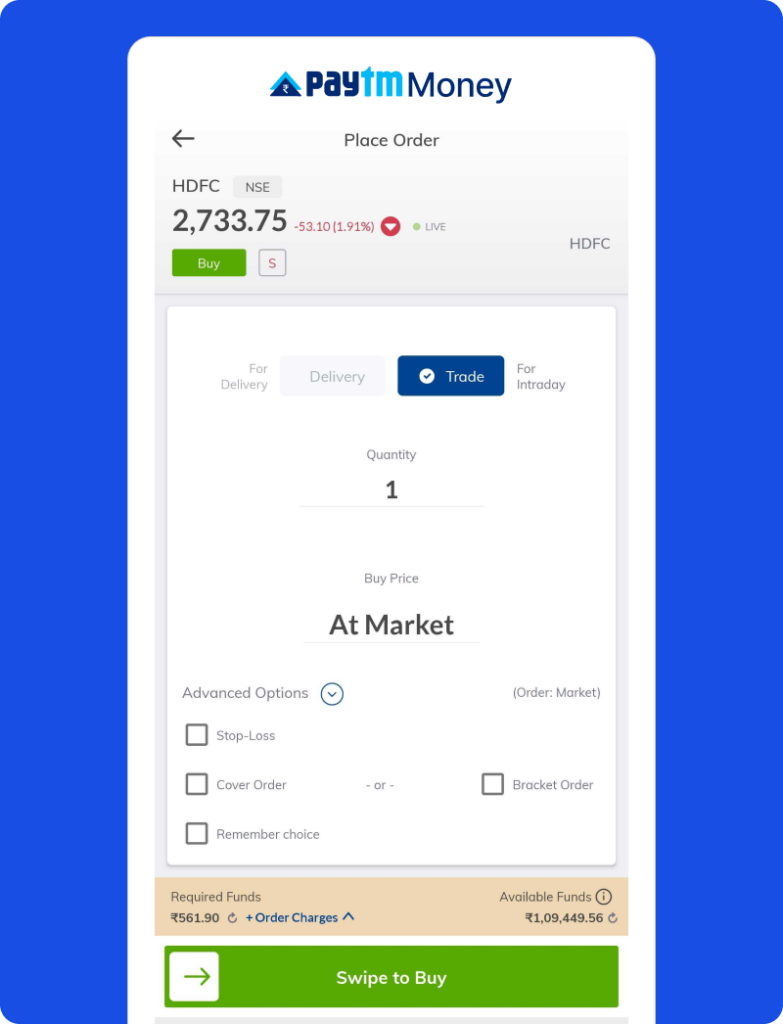

Select Bracket order

The securities are quoted as an example and not as a recommendation

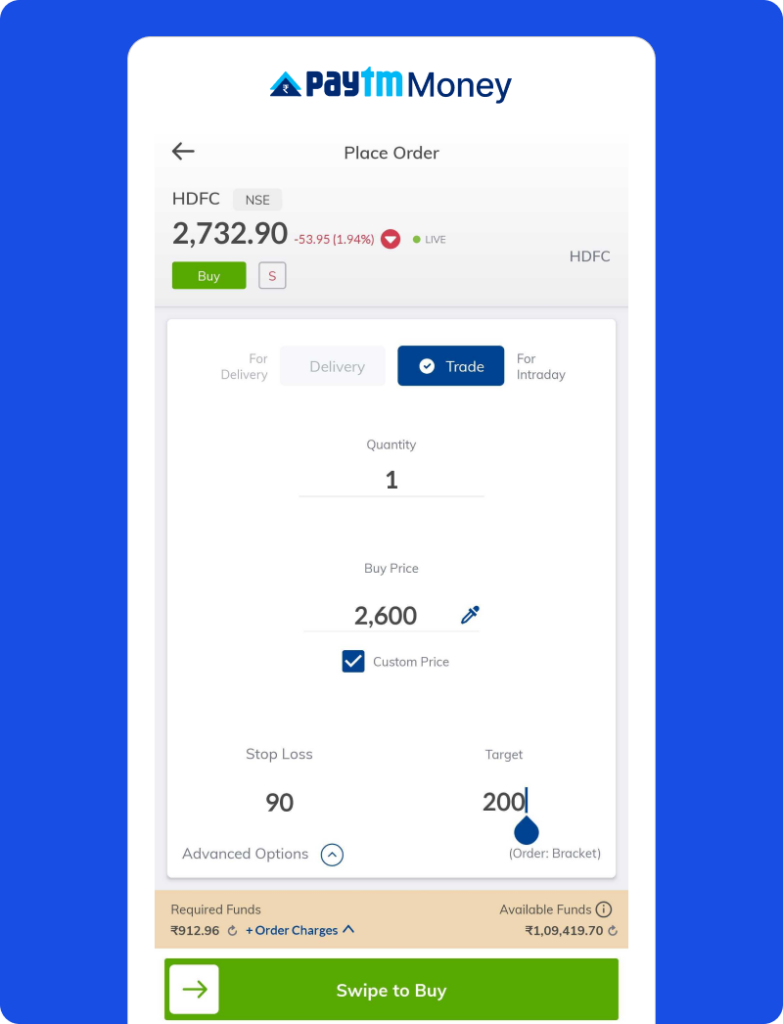

Now set the desired quantity, execution price (market/limit), Stop loss delta and Target delta

The securities are quoted as an example and not as a recommendation

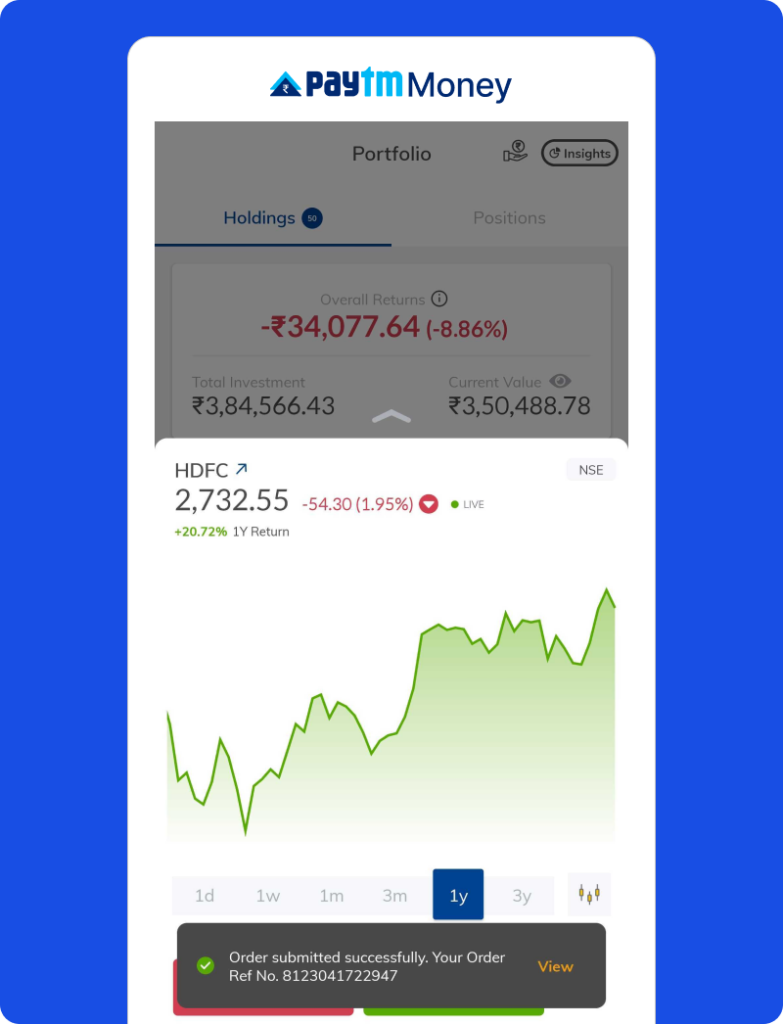

Voilà. Happy Trading!

The securities are quoted as an example and not as a recommendation

Where are Bracket Orders(BO) applicable?

Segments allowed:

- Equity stocks which aren’t under any surveillance measure or blocked

- Stock Futures

- Index Futures : Nifty, Bank Nifty and FinNifty

- Index Options : Nifty and Bank Nifty

Pls note no Stock options and FinNifty Options allowed in BO

BO allowed contracts:

Futures: 2 Monthly expiry contracts will be allowed

Options: 2 weekly and 1 monthly expiry contract will be allowed (2 days before the expiry risk team will allow Near Month expiry contract)

Maximum Stop loss & Target Range in BO:

Futures: +/-10% from the entry price

Options: +/- 50% from the entry price

Minimum Stop loss & Target Range:

Futures: 0.1%

Options: 1%

Please note the stop-loss order can be modified within the stipulated price range. After the order has been modified, the margin will be recalculated.

In conclusion, bracket orders can be a powerful tool for traders looking to manage their risks and automate their trading strategy. By setting predefined entry, stop loss, and target profit levels, you can ensure that they are protected from excessive losses while also maximizing their potential profits without involving any emotional biases in order entry.

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation. This content is purely for information purpose only and in no way to be considered as an advice or recommendation. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit: https://www.paytmmoney.com/stocks/policies/terms