There are various schemes initiated by the Government of India to offer basic healthcare facilities to Indian citizens. The Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Yojana (PMJJBY) are two such schemes initiated by the government.

Both these schemes are specifically designed to provide healthcare facilities to the low-income families in our country. Further in this article, we have discussed in detail the differences and similarities between Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Suraksha Bima Yojana.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Backed by the government of India, Pradhan Mantri Suraksha Bima Yojana is an accidental insurance scheme. Under this scheme, the plan offers death coverage and accidental disability to the life assured in case of an accident. This scheme can be opted by individuals between the age group of 18 years to 70 years with a savings bank account at official banks.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Introduced in the year 2015, Pradhan Mantri Mantri Jeevan Jyoti Bima Yojana offers financial help to the policyholder’s family member in case of his/her demise. PMJJBY is offered by LIC, Indian banking institutes, and other life insurance providers. Individuals from 18 years to 50 years with a savings bank account at an official bank can opt for this scheme.

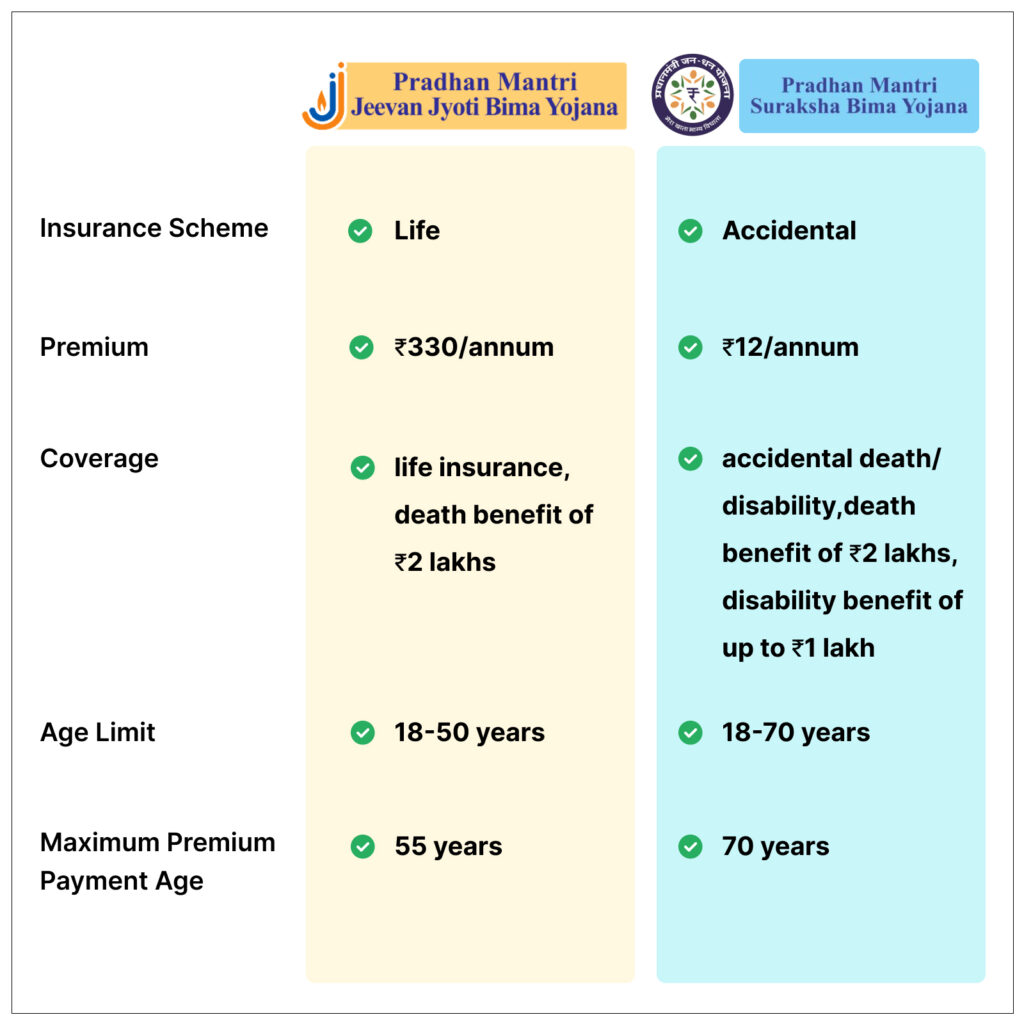

Difference Between PMSBY & PMJJBY

Let’s look at the difference between Pradhan Mantri Suraksha Bima Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana

| Parameters | Pradhan Mantri Jeevan Jyoti Bima Yojana | Pradhan Mantri Suraksha Bima Yojana |

|---|---|---|

| Premium Rate (per annum) | Rs. 330 per individual | Rs.12 per individual |

| Scheme Type | This is a life insurance scheme | This is an accidental insurance scheme |

| Coverage Type | The policy offers life insurance coverage to the insured person. | The policy offers personal accidental coverage to the life insured. |

| Benefits | In the event of the unfortunate demise of the life assured the policy’s beneficiary receives Rs. 2 lakhs as a death benefit. | In case of accidental death of the insured person Rs. 2 lakh is offered to the nominee of the policy as the death benefit. In case the insured suffers from permanent total disability due to an accident, then Rs. 2 lakh is offered to the insured. In case the insured suffers from a permanent partial disability, then Rs. 1 lakh is offered to the insured. |

| Age Limit | The entry age of the scheme ranges from a minimum of 18 years to a maximum of 50 years | The entry age of the scheme ranges from a minimum of 18 years to a maximum of 70 years. |

| Premium Rate (per annum) | Rs. 330 per individual | Rs.12 per individual |

| Scheme Type | This is a life insurance scheme | This is an accidental insurance scheme |

| Maximum Premium payment age | If the insured is 50 years, then he/she can extend the premium payment tenure of the policy up to 55 years | |

| Maximum Premium payment age | If the insured is 50 years, then he/she can extend the premium payment tenure of the policy up to 55 years |

Similarities between PMJJBY and PMSBY

Let’s take a look at the similarity between Pradhan Mantri Jeevan Jyoti Bima Yojana

| Parameters | Similarities |

|---|---|

| Type | Both the policies are government-backed. |

| Minimum Entry Age | The minimum age of entry is 18 years. |

| Eligibility | Any Indian citizen can easily apply for the scheme regardless of income. To enroll in PMJJBY and PMSBY, a savings account is mandatory. |

| Sum Assured | The highest sum assured amount that one could easily avail within these schemes is Rs 2 lakh |

| Period of Insurance | Both schemes’ duration commences from June 1 and ends on May 31 of the coming year. |

| Payment Mode | The premium sum charged towards the plan is deducted from the savings account associated each year on the auto-debit facility. |

| Policy Termination | Once an insured individual, as per the scheme, attains the maximum age, the policy terminates automatically. |

| Number of policies | One person can have one policy number regardless of the number of the savings bank account. |

| Tax Benefit | The premiums paid are entitled to tax benefits |

| Refund | If no claim is raised, then no refund will be issued. |

| Policy lapse | The policies will not lapse even if the insured is unable to pay the premium sum. |

| Reinstatement | In case the balance in the bank associated is insufficient, then the policy will terminate. The insurer can reinstate the scheme once the payment of the outstanding premium sum is made. |

| Convenient | The PMJJBY and PMSBY require minimal documentation. |

| Benefit | In case the policyholder passes away, the nominee of the scheme will receive the sum payable. |

| Buying the scheme | Both schemes are available in private and public banks. You can buy the plan from the same bank where they have a savings account. |

| Flexibility | You are allowed to join the scheme again if they leave it for any reason. |

| Convenient | The PMJJBY and PMSBY require minimal documentation. |