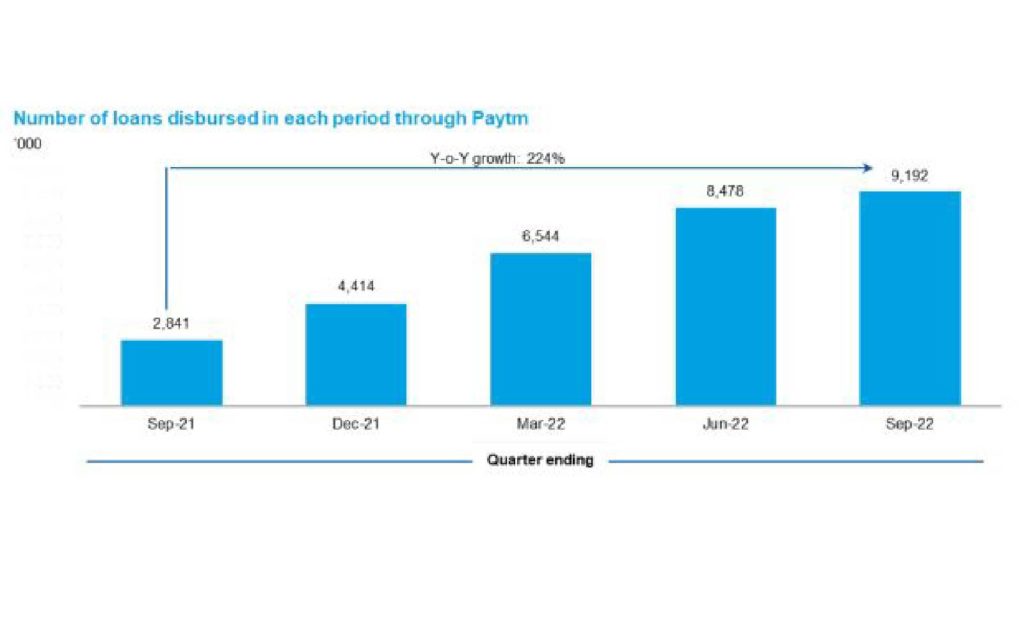

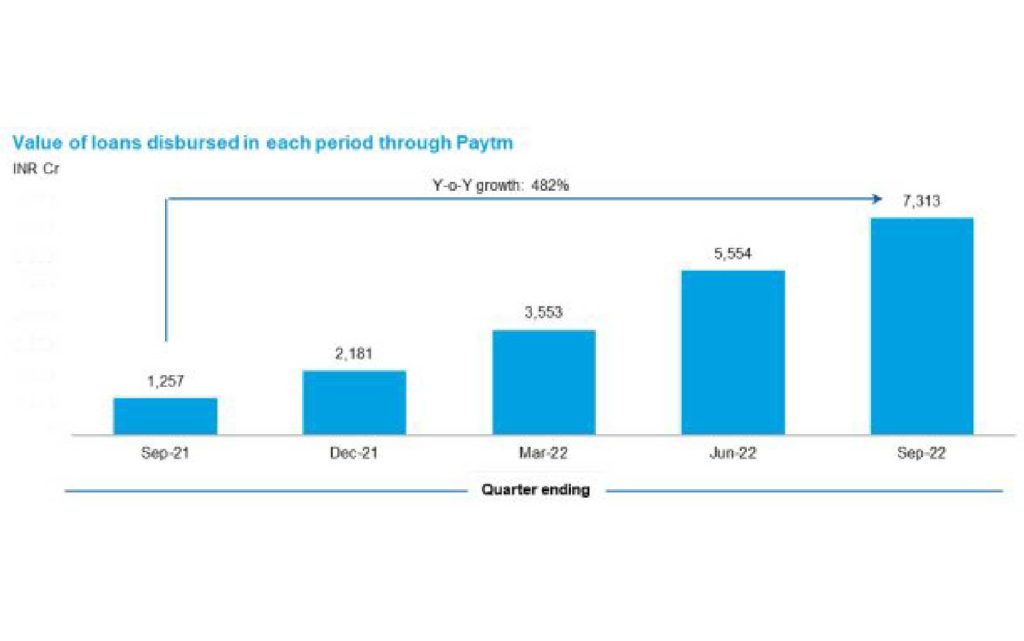

- Loan distribution business scales to 9.2 million loan disbursals during the quarter ended September 2022 (y-o-y growth of 224%), aggregating to loan disbursements of Rs 7,313 Cr ($894 million, y-o-y growth of 482%)

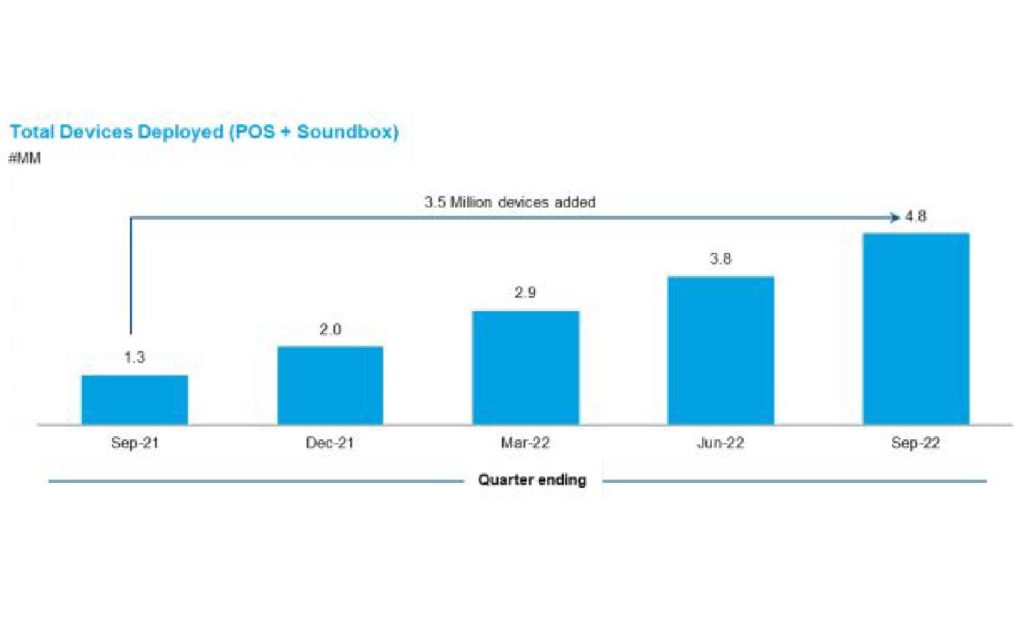

- Leadership in offline payments strengthens with total number of devices deployed exceeding 4.8 million

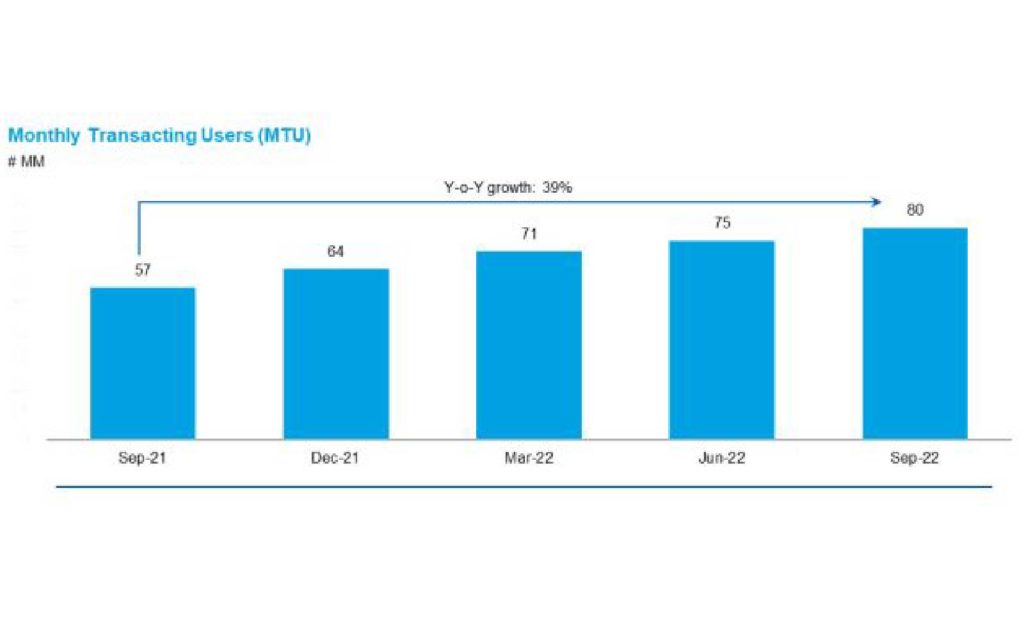

- Consumer engagement is at its highest on Paytm Super-App with average monthly transacting users (MTU) at 79.7 million for the quarter ending September 2022, up 39% y-o-y

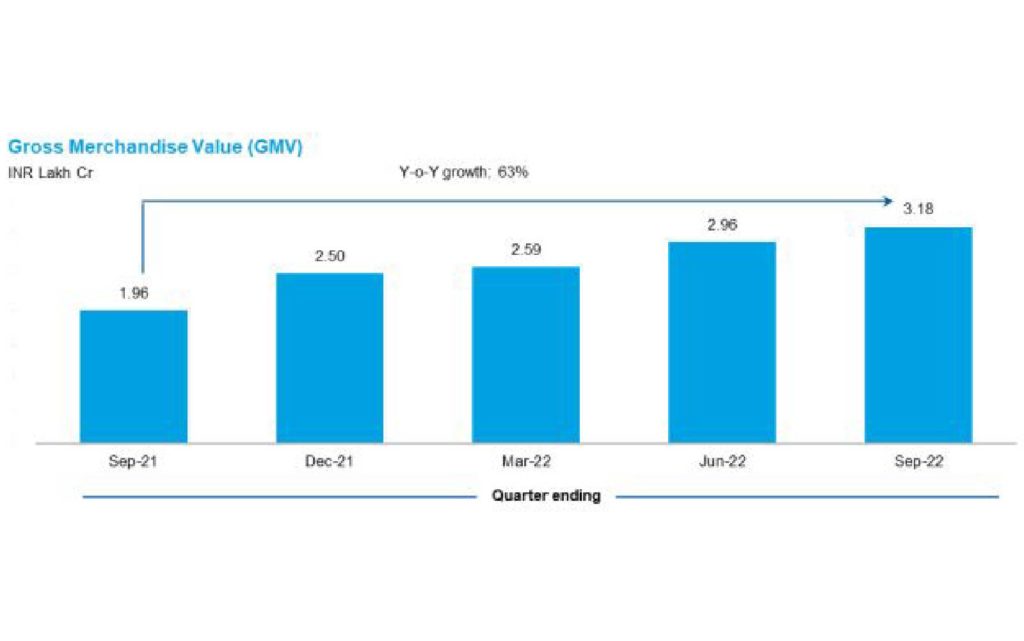

- 63% Y-o-Y increase in merchant payment volumes (GMV) for the quarter ended September 2022 at Rs 3.18 Lakh Cr ($39 billion)

Our operating business numbers for Q2 FY23 are out.

We have achieved sustained growth in payments and credit business with 9.2 million loans disbursed and over 4.8 million devices deployed.

You can read more about our operating update here

Loan distribution business continues to scale: Our loan distribution business (in partnership with top lenders) continues to witness accelerated growth with disbursements through our platform now an annualised run rate of ₹34,000 crore in September. The number of loans disbursed grew 224% y-o-y to 9.2 million loans in the quarter ended September 2022, while the value of loans disbursed grew 482% y-o-y to Rs 7,313 Cr ($894 million). While we continue to work with our partners to review the evolving macro environment, some moderation may be expected in our growth. That said, we continue to see ample growth and upsell opportunities in this business and are focusing on the quality of the book.

Consistent growth in total merchant payments volume: The total merchant GMV processed through our platform for the quarter ended September 2022 aggregated to Rs 3.18 Lakh Cr ($39 billion), marking a y-o-y growth of 63%.

Robust growth in MTU: The Paytm Super App continues to see heightened consumer engagement for the company’s comprehensive payment offerings. We continue to drive user engagement, with the average MTU for the quarter ended September 2022 at 79.7 million, registering a growth of 39% Y-o-Y.

New milestone in offline payments leadership: We continue to strengthen our leadership in offline payments, with deployment of 4.8 million devices at merchant stores across the country. With our subscription as a service model, the strong adoption of devices, drives higher payment volumes, subscription revenues as well as merchant loan distribution.

We remain grateful for your continuous support, and remain committed to our mission to build a profitable company and create shareholder value while driving digitization and inclusive financial access