We have announced our Q1FY24 results today. We continued our momentum with 39% YoY revenue growth to ₹2,342 Cr, led by an increase in GMV, merchant subscription revenues, and growth of loans distributed through our platform. There are no UPI incentives booked during the quarter as we book UPI incentives after the government issues the gazette notification, which is typically in H2 of the financial year.

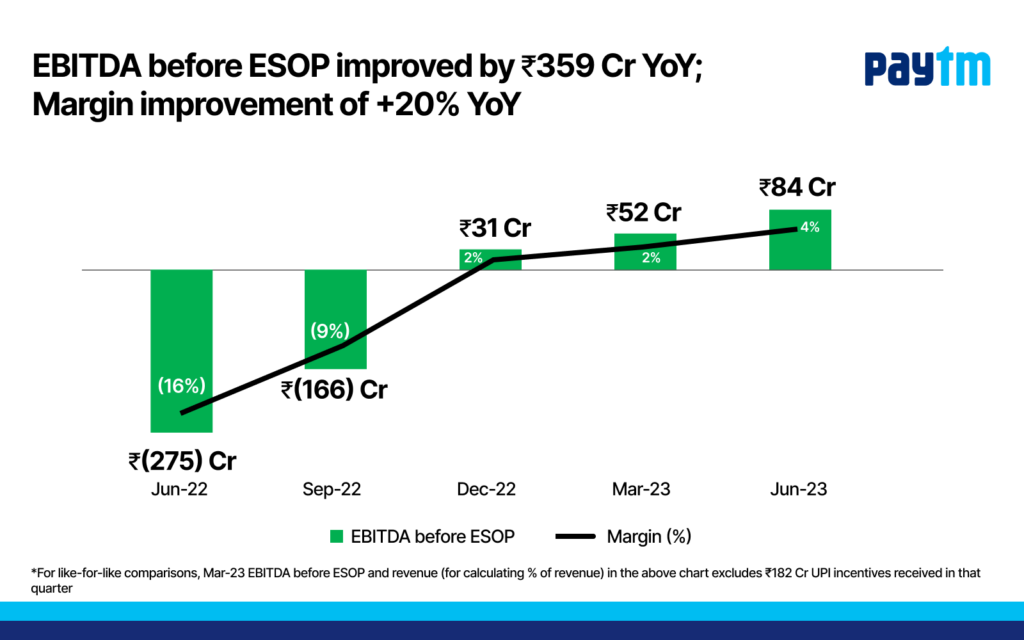

Our EBITDA before ESOP costs grew to ₹84 Cr as compared to ₹52 Cr in Q4FY23 (excluding UPI incentives). On a yearly basis, we posted an improvement of ₹359 Cr in EBITDA before ESOP costs. Our EBITDA before ESOP margin stood at 4% on account of consistent improvement in profitability due to strong revenue growth, increasing contribution margin, and operating leverage. We have managed to increase EBITDA while investing for growth. We expect continued topline growth and operating leverage to drive an increase in profitability.

You can read the full Q3FY23 financial results report here:

https://www.bseindia.com/xml-data/corpfiling/AttachLive/ff3c934e-2a88-41ff-bd7a-ee0d7dd5b752.pdf

Our payments revenue increased 31% YoY to ₹1,414 Cr while the payments profitability improved with net payment margin expanding 69% YoY to ₹648 Cr. Due to an increasing share of non-UPI instruments at point-of-sale and focus on EMI processing through other banks’ credit and debit cards, and lower interchange costs for Postpaid, Wallet, and other payment instruments, our net payment processing margin has further improved and is now at the top end of 7-9 bps. In Q1FY24, our merchant payments volume (GMV) grew 37% YoY to ₹4.05 Lakh Cr.

Revenue for financial services and others grew 93% YoY to ₹522 Cr in Q1FY24 as we continued to expand our credit business. The total number of unique borrowers who have taken a loan through our platform has increased by 49 Lakh over the last year to 1.06 Cr. The number of loans distributed through our platform grew to 1.28 Cr, an increase of 51% YoY while the value of loans distributed grew to ₹14,845 Cr, surging 167% YoY across our three product offerings — Paytm Postpaid, Personal Loans, and Merchant Loans. We disburse loans in partnership with marquee lenders and have recently onboarded Shriram Finance as a new lending partner.

We continue to monetize our app traffic in the Commerce and Cloud segment by providing marketing services to our merchants. In Q1FY24, our Commerce & Cloud revenue grew by 22% YoY to ₹405 Cr. Driven by an increase in net payments margin and loan distribution revenues, our contribution profit of ₹1,304 Cr represents a growth of 80% YoY while the contribution margin improved to 56% from 43% a year ago. Our indirect costs have increased along expected lines (up 21% YoY) due to seasonal increases in marketing costs and the impact of appraisals. Indirect expenses (as a % of revenues) have declined to 52% from 60% in Q1FY23.

We witnessed robust growth in our subscriber base which has nearly doubled in the last one year while our merchant base has grown to 3.6 Cr. Our leadership in payment monetisation continues with 79 Lakh devices, both Soundbox and Paytm Card Machines deployed, increasing 41 Lakh YoY (109% growth YoY) and 11 Lakh QoQ. As the adoption of digital payments for consumers and merchants in India continues, user engagement on the platform continues to grow with average Monthly Transacting Users (MTU) of 9.2 Cr, a jump of 23% YoY.

We remain grateful for your continuous support and remain committed to our mission to building a profitable company and creating shareholder value while driving digitization and inclusive financial access