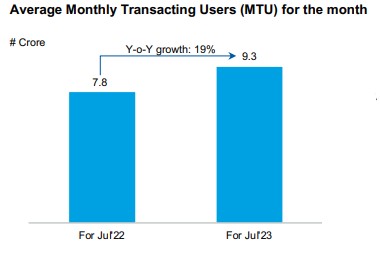

- Average monthly transacting users (MTU) stood at 9.3 crore for the month of July 2023, up 19% y-o-y, reflecting the continued expansion of our customer base

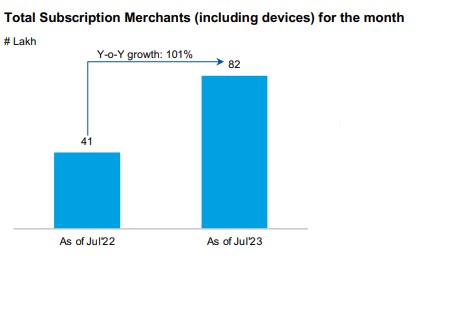

- Our leadership in payment monetization continues with the launch of two new innovative devices – Paytm Pocket Soundbox and Paytm Music Soundbox. The number of merchants paying a subscription for payment devices has reached 82 lakh as of July 2023, an increase of 3.8 lakh devices in the month

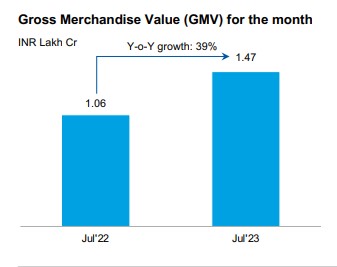

- Merchant Payment Volumes (GMV) for the month of July 2023 stood at Rs 1.47 Lakh Cr ($17.9 billion), y-o-y growth of 39%

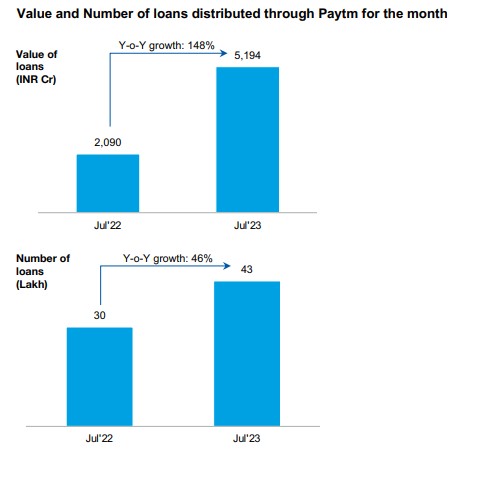

- Our loan distribution business (in partnership with our lender partners) continues to gain scale with disbursements of Rs 5,194 Cr ($632 million, y-o-y growth of 148%) and 43 lakh loans (y-o-y growth of 46%) disbursed in the month of July 2023 through the Paytm platform

We have achieved sustained growth in the payments and loan distribution business. Our leadership in in-store payments strengthened with 82 Lakh devices deployment and the value of loans distributed through the Paytm platform was at Rs 5,194 Cr ($632 million) in the month of July 2023.

You can also access our exchange filing here:

The Paytm App continues to witness growing consumer engagement with the average MTU for the month growing 19% y-o-y to 9.3 crore.

We continue to strengthen our leadership in in-store payments, with 82 lakh merchants now paying subscriptions for payment devices, an increase of 3.8 lakh in the month of July 2023. We are bringing technology to India’s small shops with the launch of two new innovative devices – Paytm Pocket Soundbox, a debit-card sized device for merchants on the go, and Paytm Music Soundbox, which allows merchants to connect their phone to it to play music or listen to match commentary.

The total merchant GMV processed through our platform for the quarter for the month of July 2023 was Rs 1.47 Lakh Cr ($17.9 billion), marking a y-o-y growth of 39%. We continue to see an increase in GMV of non-UPI instruments like EMI and cards. We are focused on payment volumes that generate profitability for us, either through net payments margin or from direct upsell potential.

Our loan distribution business (in partnership with large lenders) continues to witness healthy growth with total loans distributed through our platform for the month of July 2023 growing 148% y-o-y to Rs 5,194 Cr ($632 million).

We continue to work with our partners to ensure superior credit quality for loans distributed through us. To ensure that portfolio performance of our lending partners improves despite economic uncertainties our credit disbursement growth will be deliberately calibrated over the next quarter or two.

High-quality outcomes for our partners enable us to expand our lending partnerships. We currently have 8 lending partners and we aim to onboard 3-4 partners in FY 2024.