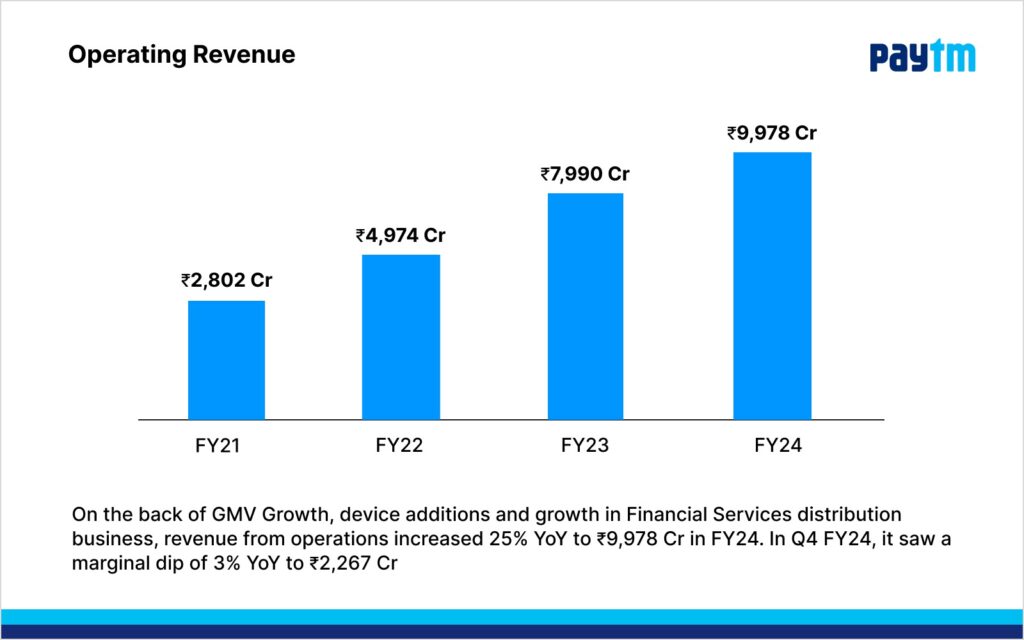

We have announced the Q4FY24 and FY24 results. During the financial year (FY24), we continued to build on our strong growth momentum across core payments and financial services distribution business with revenue from operations increasing 25% YoY to ₹9,978 Cr in FY24. GMV growth, device addition and growth in financial services contributed significantly to the revenue push.

FY24 has also been a landmark year for us, marking our first full year of profitability since the IPO, with an EBITDA before ESOP at ₹559 Cr, up ₹734 Cr from last fiscal.

We have received UPI incentives of ₹288 Cr for FY24 (recorded in Q4 FY24), as compared to ₹182 Cr in the previous fiscal.

Overall loss for FY24 fell by ₹354 Cr YoY to (₹1,423 Cr), on the back of improved growth and increased operational profitability.

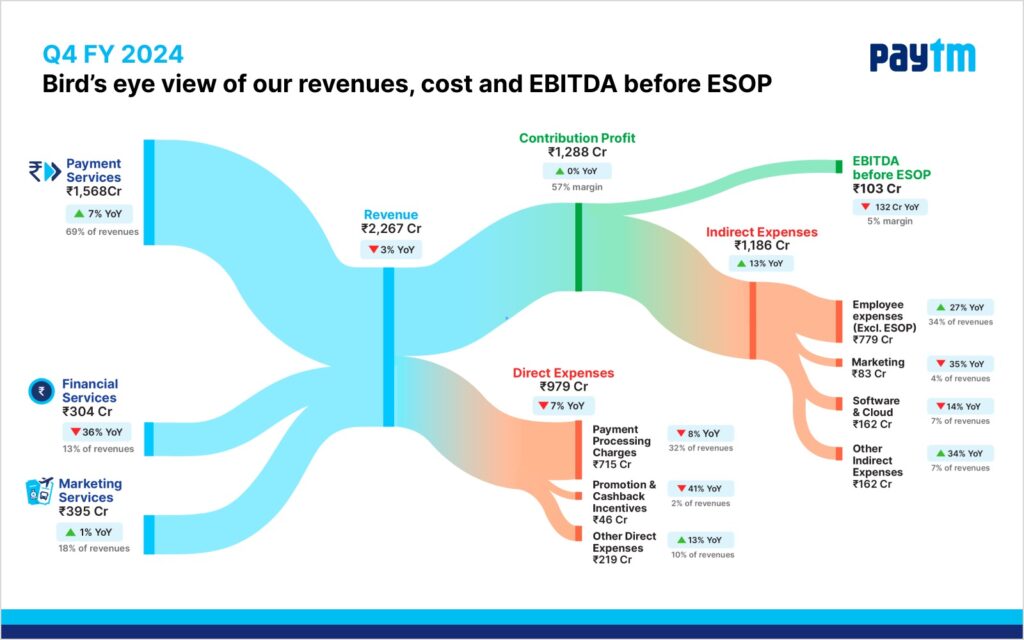

Meanwhile, the contribution profit increased 42% to ₹5,538 Cr in the fiscal year 2024, led by growth in net payment margin and higher-margin financial services business. Our revenue from Payment Services grew by 26% YoY to ₹6,235 Cr in FY24. While it increased by 7% YoY to ₹1,568 Cr in Q4FY24. The overall loan distribution value was up 48% to ₹52,390 Cr in FY24.

Our Gross Merchandise Value (GMV) increased 39% YoY at ₹18.3 Lakh Cr in FY24. With a focus on creating payment monetisation, our subscription revenues continue to grow with 1.07 Cr merchants paying for device subscriptions as of March 2024, increasing by 58% YoY from 68 Lakh as of March 2023.

However, in Q4FY24, the revenue declined marginally by 3% to ₹2,267 crore, impacted by temporary disruptions in business operations.

“I am happy to share that we have successfully transitioned our core payment business from PPBL to other partner banks. This move de-risks our business model and also opens up new opportunities for long-term monetization, given our platform’s strength around customer and merchant engagement. It has been possible in such a short period of time with extensive support from the Regulator, NPCI, Bank partners and our committed team mates. The unwavering commitment of our government and regulator to support innovation and financial inclusion, keeps us true to our mission and committed to our long-term sustainable growth opportunity,”

Paytm founder & CEO Vijay Shekhar Sharma said in the annual shareholder letter

While we would see the full financial impact in Q1 FY 2025 of prudent operations risk policies and temporary disruptions, we are confident to see meaningful improvement starting Q2 FY 2025. We expect EBITDA before ESOP of (₹500) – (₹600) crore in Q1 FY2025, and recovery thereafter as we restart certain paused products and achieve steady growth in operating metrics.

You can read the Q4FY24 and FY24 results here:

Here are the top highlights from Paytm’s annual document:

- Focusing on distribution-only credit disbursement model

We are also focusing on driving credit growth through a distribution-only disbursement model, owing to a much bigger TAM (total addressable market), wider interest from large banks and non-banks, and easier tech integration and more regulatory clarity. The collections under this model will be managed directly by lending partners. The distribution only loans have continued to scale well and we have added more lending partners during the quarter, including pilots with banks.

- Doubling down focus on insurance and wealth to improve bottomline

In FY25, our key focus will be leveraging significant consumer opportunities in embedded insurance and wealth product distribution. Tapping on the significant opportunity in embedded insurance, we recently launched a unique health insurance product combining Healthcare, OPD and cashless hospitalisation on a monthly subscription. With product innovation, leveraging data for underwriting and providing a seamless claims experience across automobile, health, shop, life and embedded insurance.

- Focus on AI-led efficiency leading to savings

Our focus on AI-led efficiency is expected to drive operating leverage, with annualised savings of ₹400 – ₹500 Cr expected to materialise in due course. The user engagement on the platform continues to grow with average Monthly Transacting Users (MTU) for Q4FY24 increasing by 7% YoY to 9.6 Cr.

- Operating metrics see stability

In the short term, while we saw temporary disruptions in operating metrics (MTU, merchant base, GMV, and loan distribution), the growth in consumer and merchant base metrics is stabilising in Q1 FY25.

Excluding payment products such as digital wallets, we are now seeing a positive growth trend in payment GMV since the month of April. We expect subscription merchant net additions to improve to fully recover past trend lines by Q3 FY 2025.

- Paytm becomes a TPAP

We have become a Third-Party Application Provider (TPAP) with NPCI for the UPI channel. We have partnered with Axis Bank, HDFC Bank, State Bank of India (SBI), and YES Bank and have started transitioning our UPI users to these banks, ensuring seamless UPI payments.

We partnered with Axis Bank for the nodal account and escrow account to continue seamless merchant settlements. Yes Bank acts as a merchant acquiring bank for existing and new UPI merchants for us. Other services such as nodal, escrow, BIN, etc, also migrated seamlessly. With completion of this migration, we have already started new merchants onboarding process. Multiple bank partnerships will strengthen our business model and open-up new monetization opportunities.

The cash balance for the quarter ending March 2024 stood at ₹8,650 Cr, indicating robust financial health for the business. It includes Paytm Money Ltd (PML) customer funds of ₹462 Cr for December 2023 and ₹339 Cr for March 2024. For FY 2024, we have added ₹375 Cr cash (₹254 Cr excluding PML customer funds) even without cash flow of UPI incentive.

We remain grateful for your continuous support and remain committed to our mission to building a profitable company and creating shareholder value while driving digitization and inclusive financial access