In a recent meeting with a group of analysts in Mumbai, our top management including Vijay Shekhar Sharma, Founder, MD and CEO, Madhur Deora, President and Group CFO, and Bhavesh Gupta, Chief Operating Officer, came together to provide deeper insights into our business model. The management not only highlighted the key margin drivers of our business but also elaborated on the future growth roadmap. You can view our updated investor presentation here

Before we dive in, let us take a brief look at our key revenue metrics:

Payments Services to Consumers: Revenue from payments made by consumers on Paytm App (Consumers pay platform fee for certain use cases and merchants pay MDR)

Payments Services to Merchants: Revenue from processing payment in a merchant store or app or website, and subscriptions from merchants for payments devices including Soundbox and POS machines (Merchants pay MDR for cards, wallet and net banking payments whereas devices merchants also pay a subscription fee. For UPI Peer-to-Merchant transactions, the Government pays out incentives)

Financial Services and Others: The revenue from Financial Services and Others business primarily comes from loan distribution. It also includes revenue from Paytm Money, our equity trading service, as well as revenue from other services offered by Paytm

Commerce and Cloud Services to Merchants: Revenue from enabling commerce for merchants is generated through various offerings, including advertising, ticketing, and deal vouchers. Credit card services are also included in this category.

Here is the detailed management commentary as discussed at the meeting:

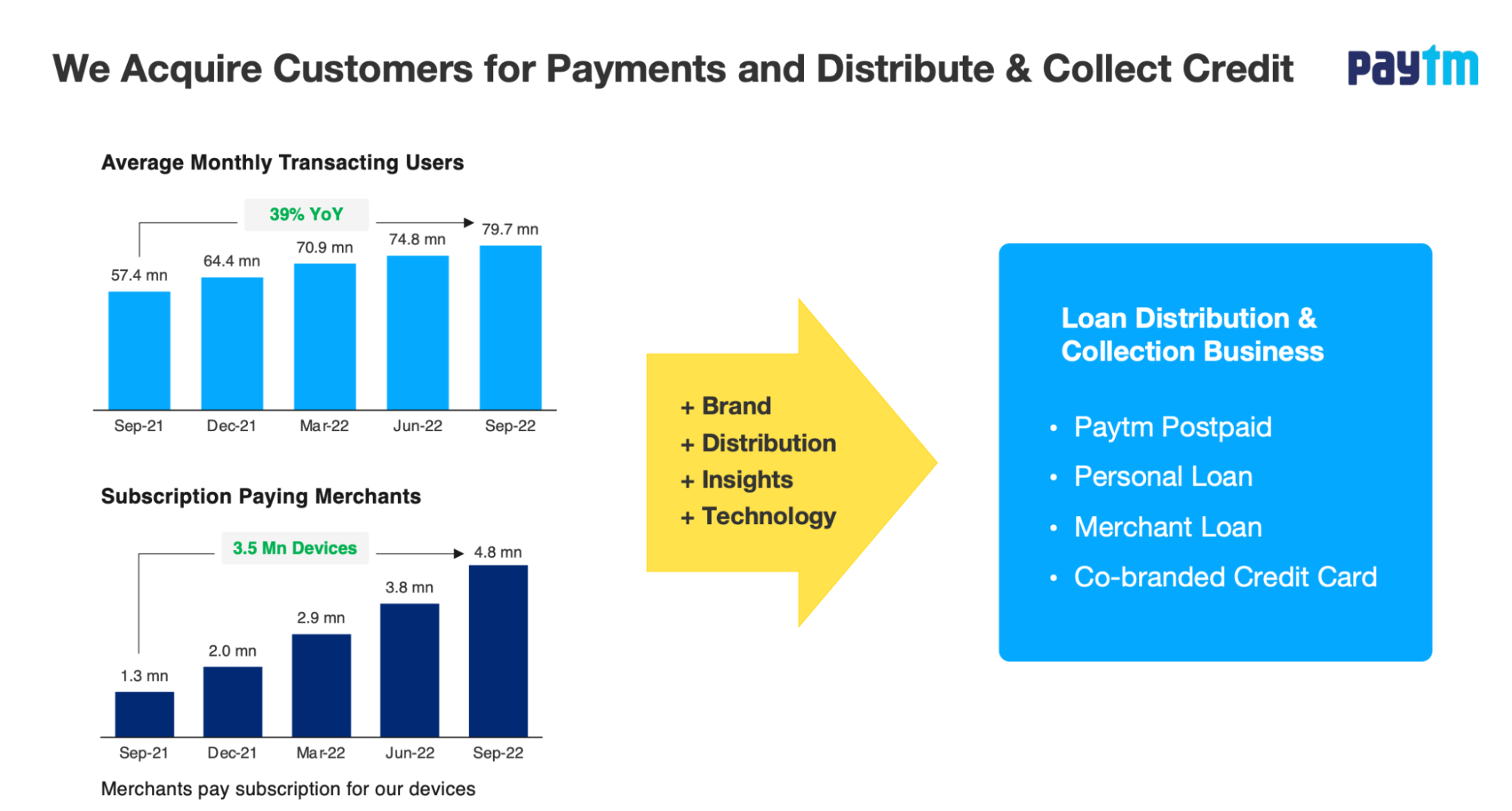

Our payments business is an important customer acquisition tool, which in turn is also an attractive funnel for our credit distribution business. We define a transacting user as someone who completes a successful payment transaction, not just someone who visits the site/app or signs up for an account. This approach is taken in order to remain conservative and provide a more accurate representation of the company’s user base and their level of engagement with the platform. For consumers, we enable payments for a variety of purposes like mobile recharges, utility bills, rent, education, adding funds to the wallet, and money transfers.

On the merchant side of our platform, we help our partners grow their businesses by providing solutions that allow them to seamlessly accept payments through a variety of instruments and by deploying devices that assist with reconciling transactions. Leveraging our insights into the merchants’ payment flow, we are able to offer them the opportunity to seamlessly obtain a loan from our financial institution partners. Our ecosystem’s unique self-reinforcing flywheels create strong network effects and drive consumer and merchant engagement on our platform.

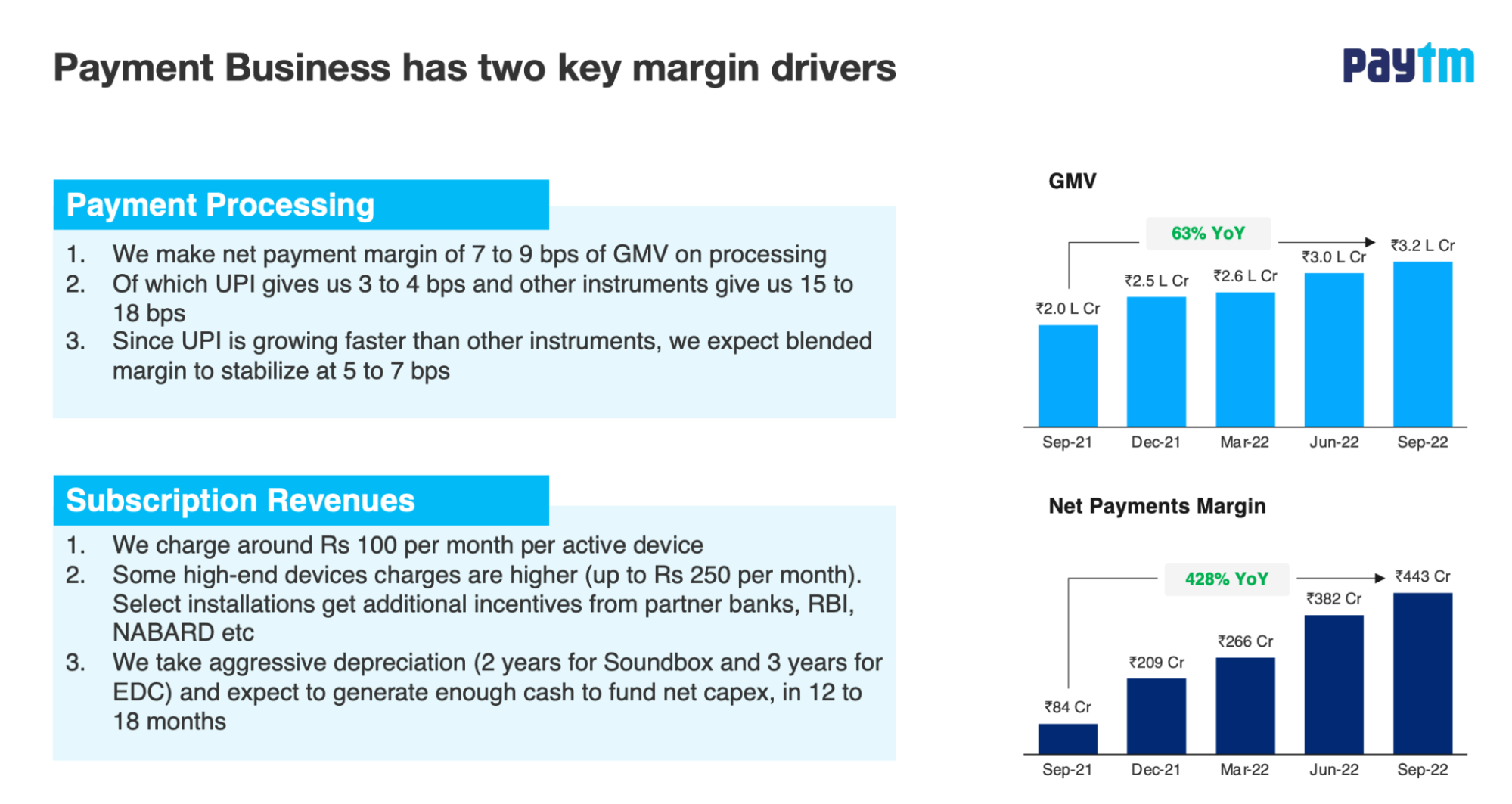

Having established our revenue metrics and how our payments business has become a strong customer acquisition tool, let’s understand how our payments business is experiencing compounding growth. Our management defined two distinct revenue streams: payment processing and subscription.

We offer flexibility and convenience to consumers and merchants with our own range of Paytm Payment Instruments like Paytm Wallet and Paytm UPI as well as debit & credit cards and net banking. In payment processing, we make a net payment margin of 7-9 bps on the Gross Merchandise Value (GMV). We earn revenues on processing all kinds of payments, including those made with UPI (Unified Payments Interface), in the form of incentives from the government. We believe that government incentives for UPI (in absolute terms) may increase this year due to a surge in transaction volumes.

Further, the implementation of a charge for customers adding funds to their Paytm Wallet via credit card is helping drive a positive net payment margin. This approach is particularly profitable due to the limited availability of credit card acceptance in comparison to the widespread use of QR codes at a larger number of stores. Each quarter, there has been a steady increase in the number of customers opting to fund their wallets through credit card usage. Through this practice, we are not only improving our own wallet economics but also contributing to the overall growth of credit card spending in India. In fact, our ecosystem is a significant contributor to total credit card expenditure in the country.

Apart from earning revenues on processing payments, we also earn subscription revenue from merchants who use our payment devices, such as Soundbox and EDC machines. As of Q2, our subscription-paying merchants crossed 4.8 million. We earn subscription revenue through device deployment with an average fee of ₹100 per month per active device.

To assist merchants in increasing their sales, we offer the affordability and convenience of EMIs on Paytm POS devices. This allows businesses to leverage Paytm’s wide partner network to offer products on EMIs directly at the point of sale. We are working towards monetizing EMI aggregation on our POS devices.

Merchants use our devices not only to accept payments but also for fraud avoidance and reconciliation services that we offer. We produce both the hardware and software for Paytm Soundbox in India and have an exclusive domestic manufacturer. We envision that the adoption of Soundbox will expand beyond traditional merchants to a wider range of payment-accepting service providers such as auto and cab drivers due to the benefits of cashless transactions and instant reconciliation.

To enhance the payment experience for both consumers and merchants, we are working towards adding the ‘UPI on credit card’ facility to our QR codes. This would allow for a more cost-effective form of payment acceptance, potentially resulting in higher merchant coverage.

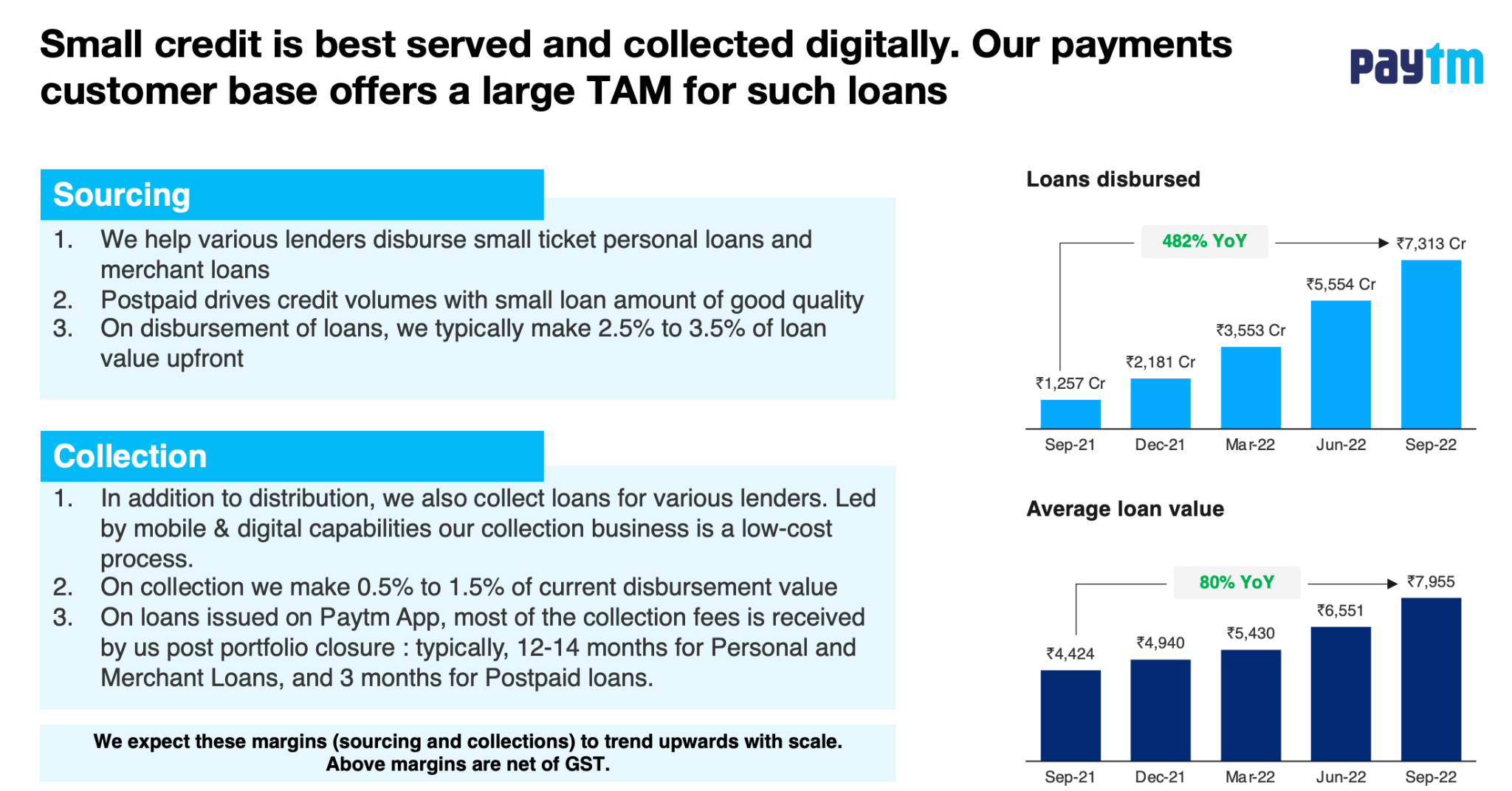

As the payments businesses achieve scale, it also acts as an attractive funnel for our loan distribution business. In partnership with our lending partners, we view significant growth opportunities in the small credit market. We not only handle distribution but also collect loans for various lenders, leveraging our technological and digital capabilities, thereby ensuring that our collection business is a low-cost process. By providing small credit to high-quality consumers, Paytm is able to service a segment that previously did not have access to this type of financing. This is a significant opportunity in the rapidly growing Indian market.

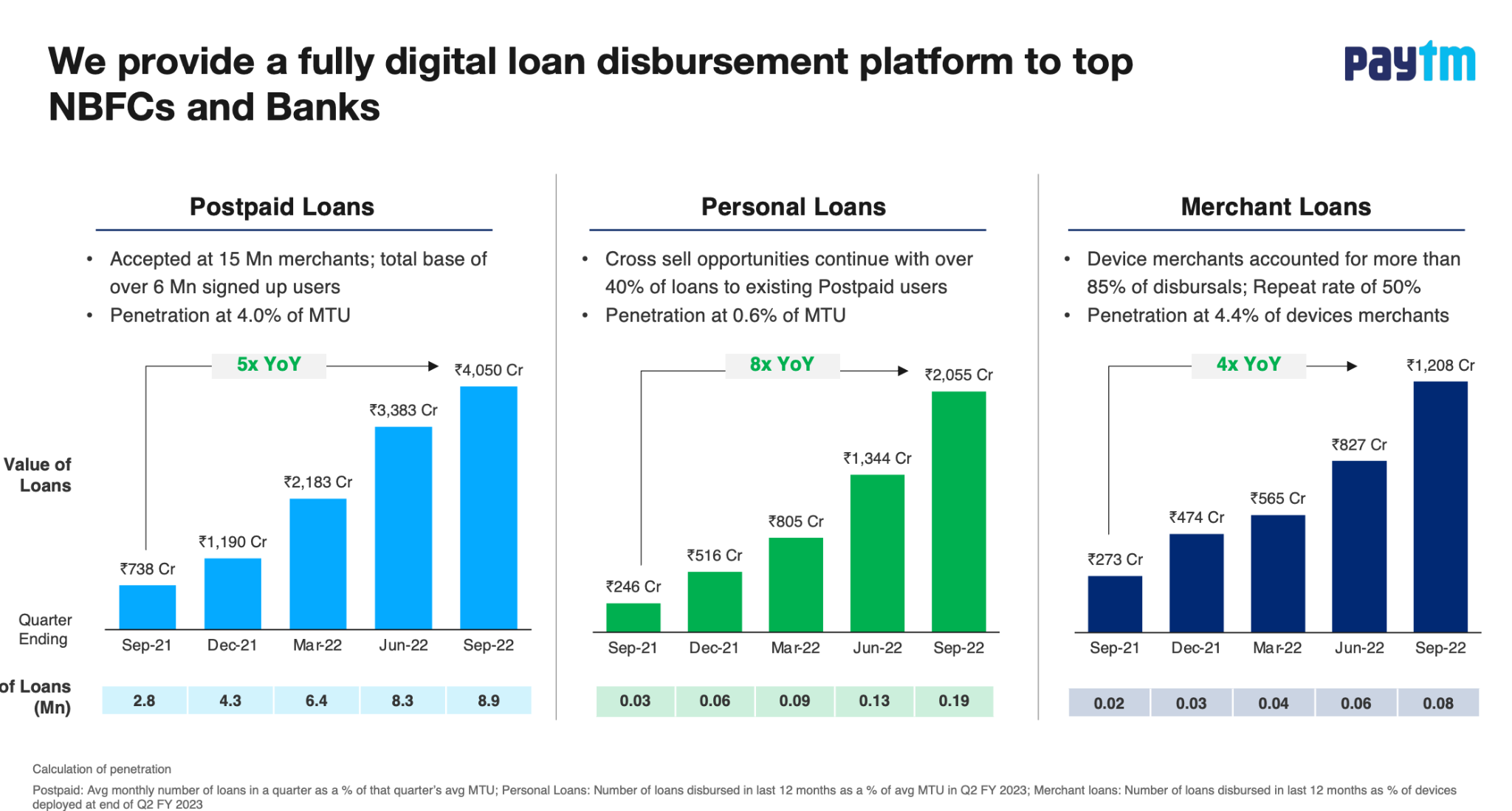

Our credit business, where we distribute loans in partnership with top financial institutions, has three components – Paytm Postpaid (Buy Now, Pay Later or BNPL), Personal Loans and Merchant Loans. We believe that small credit can be scaled without compromising on the asset quality. Given the short tenor nature of loans, the loan book (in partnership with our lenders), is fairly fast-moving. This high rate of turnover has increased lenders’ confidence in our collection abilities and in maintaining asset quality.

We have partnerships with marquee financial institutions like Aditya Birla Capital, Hero FinCorp, Fullerton India, Clix Capital and Suryoday Small Finance Bank to provide end-to-end digital loans across the three categories. Currently, we have 7 million unique customers who have obtained a loan through our platform. Additionally, we are actively seeking opportunities to partner with highly rated lenders in the future to further expand our reach and impact as we enable financial inclusion in India.

In addition to facilitating payments and financial services, we also generate revenue through marketing services provided to other businesses on the Paytm App by monetizing app traffic. Our commerce business offers digital products such as tickets, deals, and gift vouchers, which serve to make the Paytm App a destination for merchants to drive additional business. In the second quarter, our Gross Merchandise Value (GMV) for the commerce business was ₹2,021 crore, with revenue at ₹125 crore, equating to approximately 6% of the GMV. This business operates with cash profitability and offers the opportunity for us to engage with merchants and cultivate valuable relationships.

The distribution of co-branded credit cards falls under our cloud business. We currently have a total of 300,000 active cards with SBI Card and HDFC Bank. It is noteworthy that 90% of customers who obtain a credit card through Paytm remain active users driven by the variety of use cases on the Paytm App. This enables us to generate upfront revenue on card activation and receive a portion of the interchange fee for the lifetime of the card. As more and more banking customers prefer to use non-bank apps for their transactions, we are well-positioned to capitalize on this trend.

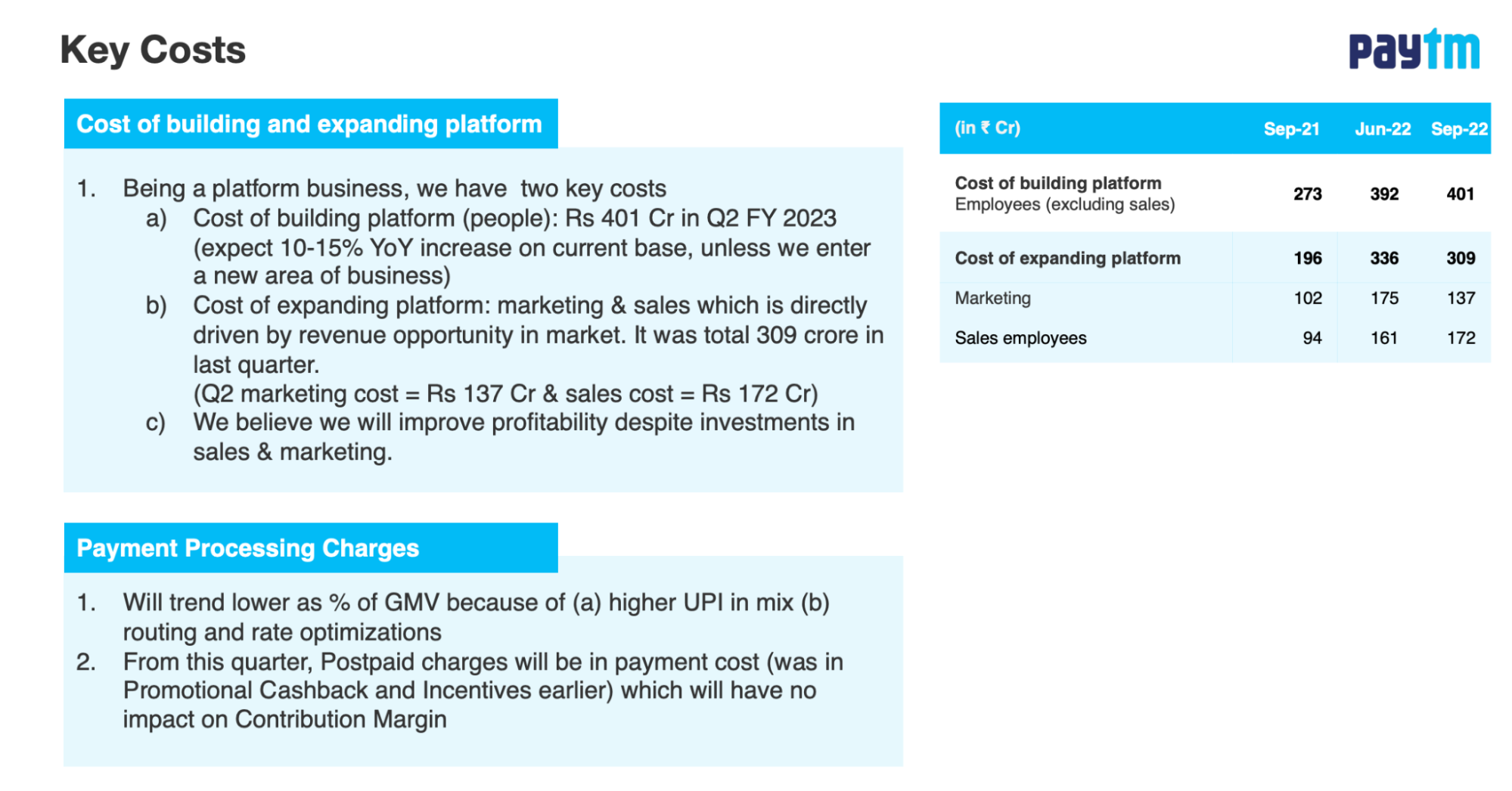

As we continue to grow and strengthen our Paytm ecosystem through the acquisition of consumers and merchants and providing them with greater access to technology and financial services, our management identified two key costs – the cost of building and expanding the platform, and Payment Processing Charges.

The cost of building the platform which includes employee expenses is anticipated to increase by 10-15% annually unless we enter a new area of business. The cost of expanding the platform through marketing and sales will be driven directly by potential revenue opportunities in the market. We expect to see an improvement in profitability despite investments in sales and marketing and Payment Process Charges to trend lower as a percentage of GMV with the rise in the adoption of UPI.

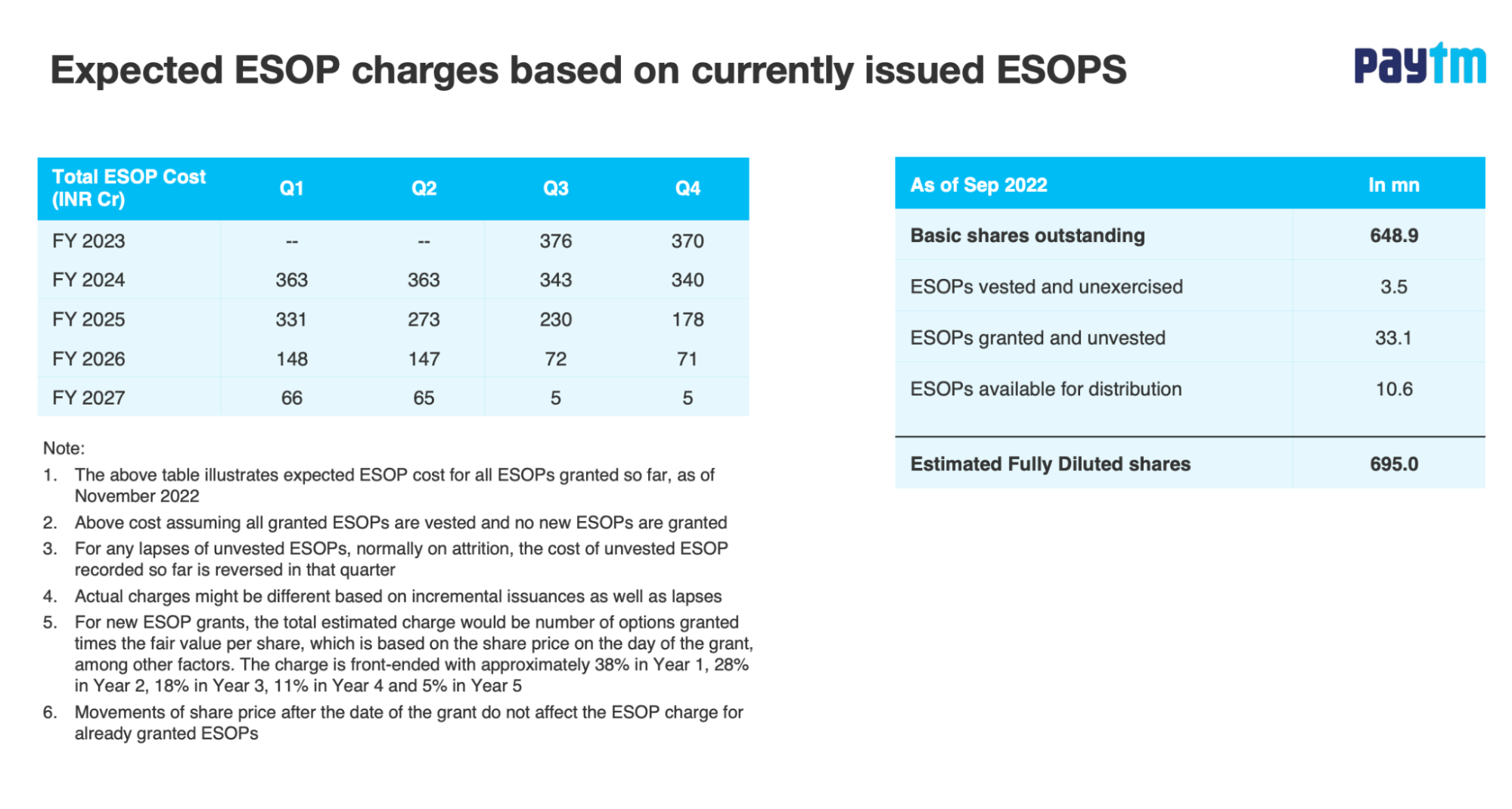

We provided detailed disclosure on the likely trajectory of ESOP costs for all ESOPs granted till November 2022. The expected costs were clearly outlined, based on the assumption that all ESOPs are vested and no new ESOPs are granted. We reiterated that Founder Vijay Shekhar Sharma’s ESOPs will not vest until Paytm’s market cap crosses the IPO level on a sustained basis.

Lastly, the management highlighted growth drivers within various business segments. We see a vast potential market in India, as there are currently only 250 million registered UPI users and 10 million total devices.

We will support merchants in growing their businesses by offering coupons, deals, marketing, and loyalty programmes, which will generate more revenue and profit for our commerce business. We also see great potential in partnering with banks to sell their products. FASTag and co-branded credit cards have already proven successful, and we believe that EMI aggregation on Payment Gateway and remittance services have the potential to be successful as well. In financial services, we will focus on expanding our loan and stock brokerage offerings.

Overall, the meeting demonstrated Paytm’s strong focus on growth and monetisation opportunities. The insights shared by the management provided a clear understanding of Paytm’s business model and growth drivers across business segments. We highlighted the large growth potential for the payments business in India as well as the opportunity to cross-sell financial services and commerce offerings to merchants. We reiterated our sustained focus on enhancing profitability and achieving a positive EBITDA before ESOP costs by the second quarter of FY24.