Go for gold investments! Here’s why!

Gold is indeed a sought-after asset, the world over. Consider an Olympian seeking out that -glistening gold medal. This elusive gold medal is more than just a piece of metal – it actually is a golden ticket to achieve so much more – from its prestige value; means to global recognition for the athlete; to its ability to throw up a world of monetizable opportunities. Just as a gold medal is so much more than just its shine to an athlete, for investors too, gold offers so much more than just simple aesthetic value.

Consider gold as an investment tool offering a mixed bag of benefits – to get you more than one step closer to achieving a podium finish for your investments.

How so? Let’s take a closer look at the value gold brings to your portfolio:

- The ‘safety net’

Economic circumstances keep changing – as a result business and their worth keeps changing too; in fact, companies and its stocks too may come and go. But gold… it stays on forever!

Historically, gold’s near-indestructibility and rarity has given it the title of a ‘store of value’.

It is in fact this very feature that makes investors flock to it in uncertain times. Over the years, gold has performed considerably better in times of economic, market or political uncertainty – giving your portfolio a shelter in volatile times.

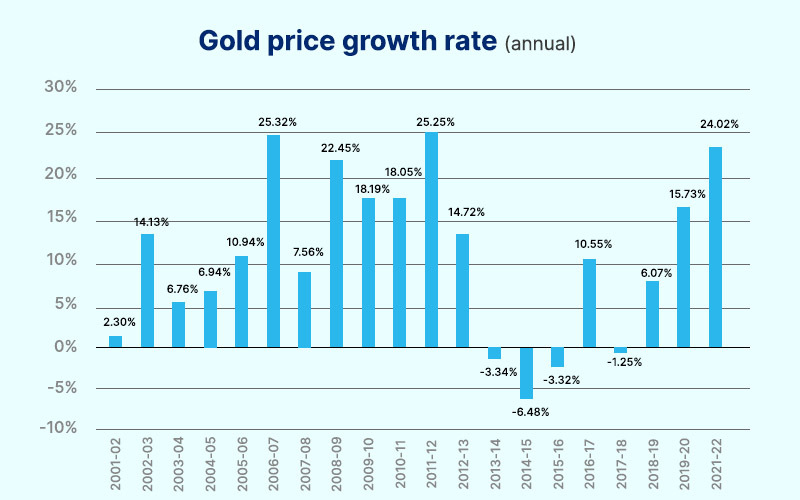

(Source – graph from https://www.gold.org/goldhub/data/gold-prices)

- The ‘silent and consistent performer’

Gold as an investment tool works consistently to give reasonable growth across periods.

As can be seen, gold has given positive growth numbers in 16 out of the last 20 years. In fact, when held on to for longer terms, this position gets consolidated and has earned consistent returns over 3, 5- and 10-year periods.

(Source – graph derived from data from RBI’s Annual Report – Handbook of Statistics on Indian economy dated September 15, 2021)

| CAGR over 3 year periods | CAGR over 5 year periods | CAGR over 10 year periods |

|---|---|---|

| 8.53% | ||

| 17.34% | ||

| 19.47% | 9.05% | |

| 24.17% | 22.75% | |

| -4.18% | 6.65% | 15.70% |

| 5.54% | 12.92% | 9.74% |

(Source – table derived from data from RBI’s Annual Report – Handbook of Statistics on Indian economy dated September 15, 2021)

- The ‘balancer’

Gold gives your portfolio a hedge against both inflation as well as market uncertainty. It is typically seen that when other asset classes, especially those linked to the stock market are experiencing volatility; gold steps up as a safe haven investment and provides stable performance.

This inverse correlation of gold price performance with performance of other asset classes can provide a balancing factor to your portfolio.

- Your ‘911’ at times of emergency

Gold trades at high volumes, making it a highly liquid asset. This means that in exigent times, gold can be easily monetised to provide a much-needed emergency fund.

Gold in a better form

Holding gold has many advantages, but holding it in its traditional physical forms comes with some disadvantages such as its making costs, storage costs, cost at the time of liquidation, authenticity concerns etc.

Digital gold can allay these drawbacks to cement the case for gold in your portfolio

- Ease of trading – traded at real time prices, 24/7 and can be liquidated easily

- Zero storage costs – no locker rent or fear of loss / theft

- Low minimums – With gold scaling 50k/10gm; not all investors may be able to afford buying it. But digital gold makes gold affordable to all – with minimum investments as low as Re. 1

- Get delivery if you want – and if you ever want to get your gold investment in hand, simply convert your digital gold and get 24karat, hallmarked gold delivered to your doorstep

An Olympian embodies discipline, drive, fitness and practice to finally achieve that desirable podium finish. In the same way gold incorporates a host of benefits which taken together can give your portfolio that winning touch!