Did you know that people facing challenges with their credit report issues can now approach the Reserve Bank of India (RBI) ombudsman and get a final resolution? A credit report is a breakup of your credit history, and if you find something wrong with it, you can approach the credit bureau or RBI to get it fixed.

What is a Credit Report?

A credit report is the breakdown of the credit history in detail which is prepared by the credit bureau. The credit bureau gathers financial information about a person and compiles reports based on that information. Lenders utilise the reports in addition to other data in order to determine a person’s creditworthiness. Employers, insurance companies and landlords check the credit reports.

What Are Credit Score Issues?

Issues with respect to credit reports are a common occurrence. These range from incorrect personal details to wrong credit accounts. The errors can affect the credit score which hampers the chances of getting credit card or loan approval. This is the reason why one should be fully aware of rectifying errors in the credit report.

How to Contact RBI to Resolve Credit Report Issues?

There may arise a situation wherein you may feel that your credit score has suddenly dropped and the credit bureau hasn’t informed you of the reason. It may also happen that a loan you haven’t taken has suddenly appeared on the credit report and the credit bureau has advised you to approach a financial institution for resolution. In such situations, the Reserve Bank of India can be approached and one can file a complaint against the credit bureaus if they are not able to resolve your problems in a timely manner.

Customers can file online complaints:

- Via email at [email protected]

- Through post to the ‘centralised receipt and processing centre’ in Chandigarh

- Over phone on toll-free number 14448.

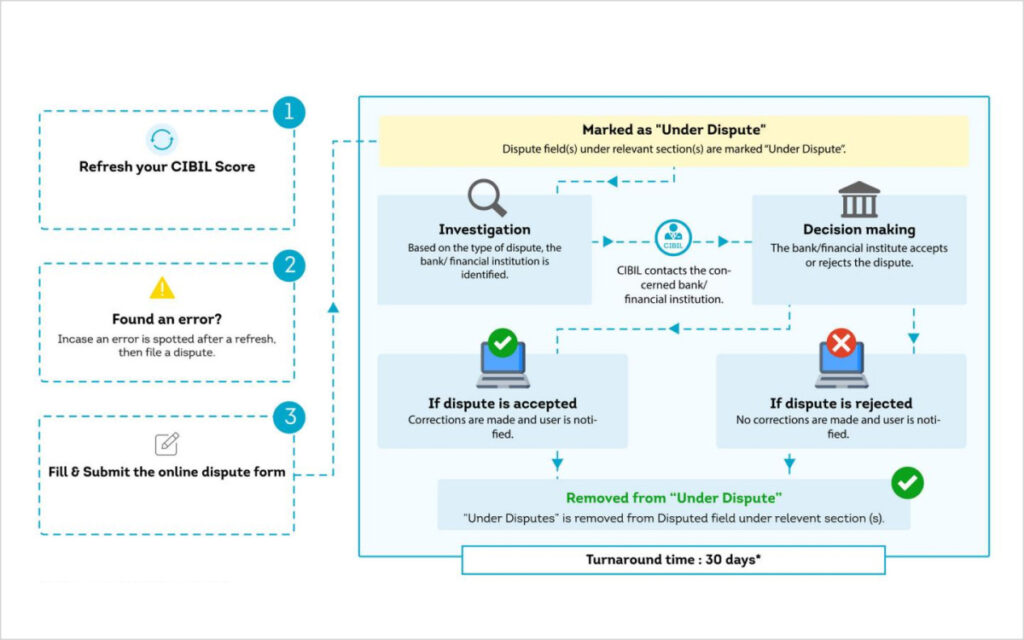

How to Raise Credit Score Issue with CIBIL?

- Login to CIBIL dashboard

- Refresh your CIBIL score & report

- Raise a dispute, you need your bank account details. You can raise multiple disputes at a time

- Wait for NBFC/bank response

What Information is Contained Within the Credit Report?

| Elements | Information |

|---|---|

| Personal information |

|

| Credit accounts |

|

| Credit inquiries |

|

| Public records |

|

Types of Errors in Credit Reports

| Category | Common Errors |

|---|---|

| Identity-Related |

|

| Balance-Related |

|

| Account-Related |

|

It is to be noted that information updates take about two months to process. An account that is not older than two months is likely to reflect on the report. Also, accounts reflect incorrect balances since they might not be updated then.

Disclaimer: Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommended you seek professional advice from someone who is authorised to provide investment advice.