Buying a home is a big and exciting step in anyone’s life. It’s a place where you create…

Browsing Category

Buying a home is a big and exciting step in anyone’s life. It’s a place where you create…

Buying a home is a significant dream for many, offering a sense of security and a place to…

Imagine a future where the air is cleaner, and your journeys are quieter. Electric Vehicles (EVs) are quickly…

When you think about buying a luxury car, you often imagine sleek designs, powerful engines, and advanced technology.…

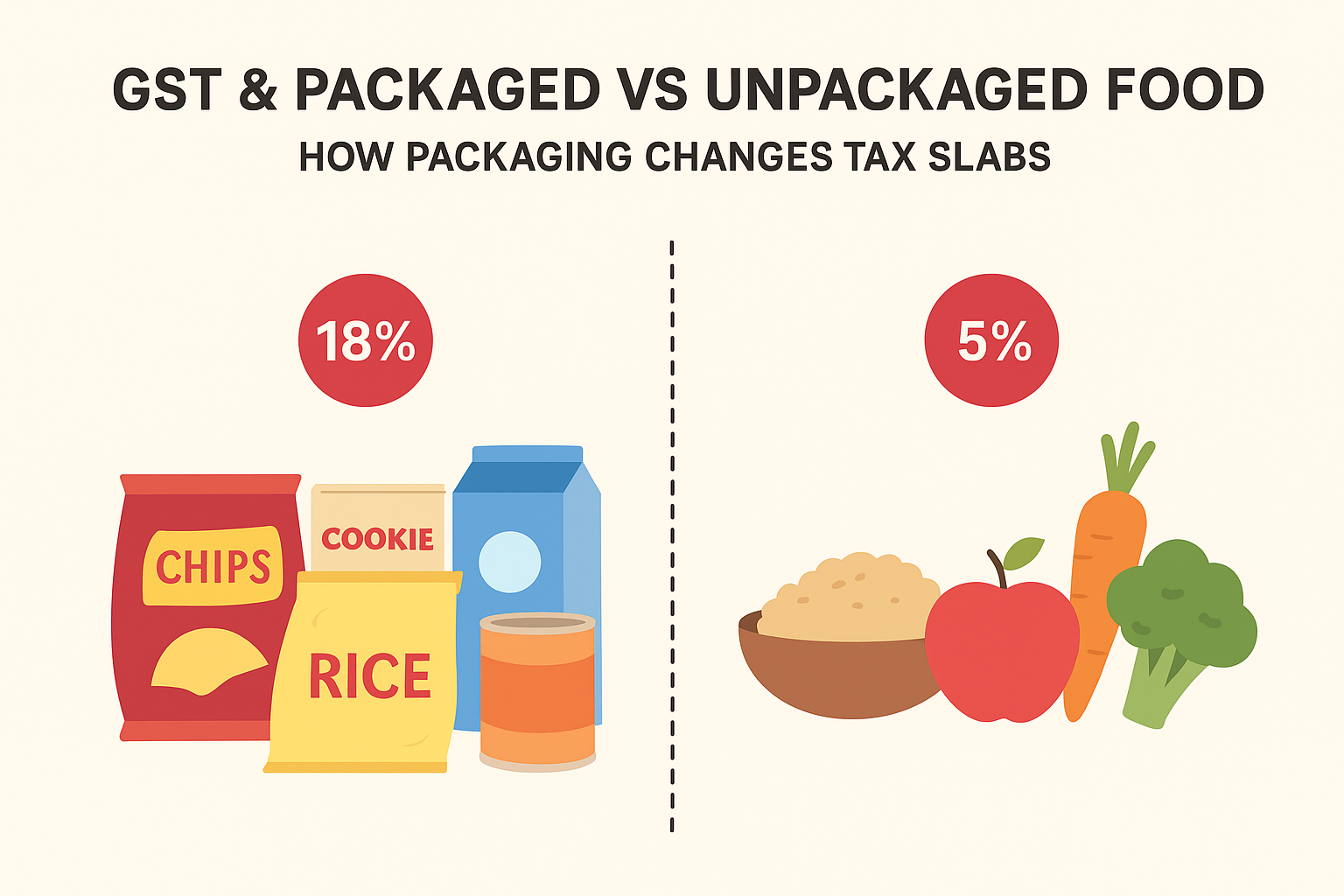

A Simple Look at Goods and Services Tax Goods and Services Tax, commonly known as GST, is a…

Goods and Services Tax (GST) is a crucial part of the tax system in many countries, including the…

Festivals are about sharing joy, and joy often comes in the form of delicious sweets, savory snacks, and…

The way we are taxed on food ordered inside or outside a restaurant has seen major shifts under…

Did you notice your favourite snacks getting slightly cheaper? That’s the Next-Generation GST Reform kicking in! The government has made…

The Goods and Services Tax (GST) aims to simplify India’s tax structure. A crucial part of this “Next-Generation…