In the fast-paced world of financial markets, traders constantly seek innovative tools and techniques to gain a competitive edge. One such tool that has gained significant popularity is the Cover Order. Cover orders are a type of trading order that combines a stop-loss order with a market or limit order, providing traders with several benefits. In this blog, we will explore the concept of cover orders and delve into how they can benefit traders.

Understanding Cover Orders

In trading, a cover order is a combination of two types of orders: a primary order and a stop-loss order.

- Order price (Primary order): This is the order that you place to enter a trade. It can be either a market order or a limit order. A market order means you want to buy or sell a security at the best available price in the market. A limit order, on the other hand, means you set a specific price at which you want to buy or sell the security.

- Stop-loss Order: This is an order that helps protect you from potential losses. You set a price level at which you are willing to exit the trade if the market moves against you. If the market reaches that price level, the stop-loss order is triggered and turns into a market order, ensuring that you exit the trade to limit your potential losses.

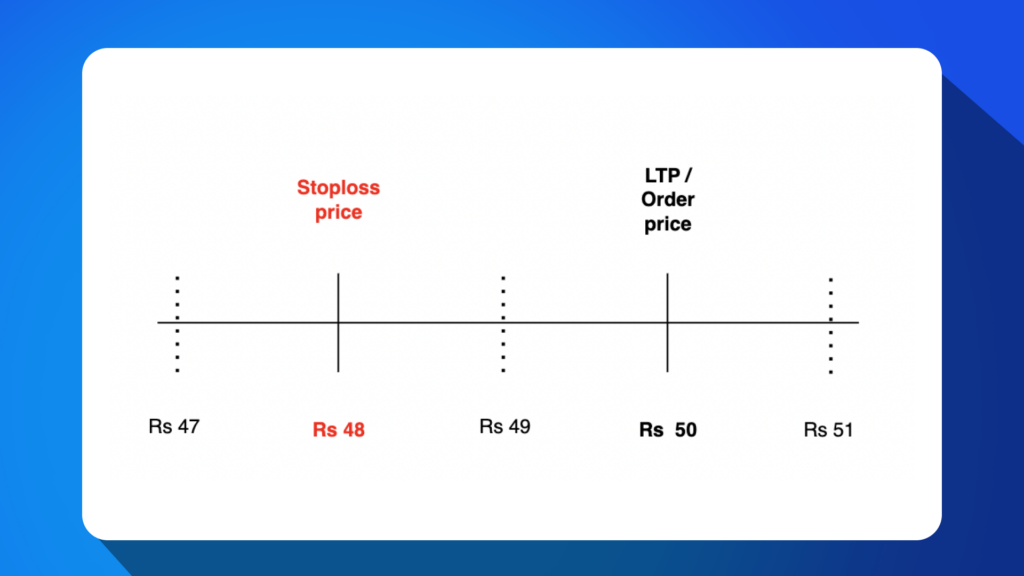

Here’s an example to illustrate how Cover order works:

Suppose you’re a trader interested in buying shares of XYZ Company, which is currently trading at Rs 50 per share. You believe that the stock has the potential to increase in value, but you also want to limit your potential losses in case the trade doesn’t go as planned.

- Primary Order: You decide to place a limit order to buy 100 shares of XYZ Company at Rs 50 per share. This means you’re willing to buy the shares if the price reaches or goes below Rs 50.

- Stop-loss Order: To protect yourself from significant losses, you set a stop-loss sell order at Rs 48 per share. This means that if the price of XYZ Company drops to Rs 48 or below, the stop-loss order will be triggered, and you will automatically sell your shares to limit your potential losses.

By using a cover order, you have predefined your entry point (Rs 50) and your exit point (Rs 48) based on your risk tolerance. This allows you to protect yourself from excessive losses and provides a disciplined approach to your trading strategy.

Why Use Cover Orders?

- Risk Management:

One of the most significant advantages of cover orders is their ability to manage risk effectively. By combining a primary order with a stop-loss order, traders can define their maximum acceptable loss upfront. This provides them with a predefined exit strategy and helps protect their capital in volatile markets.

- Protection against adverse price movements:

Cover orders act as a safety net against sudden and adverse price movements. If the market moves against the trader’s position, the stop-loss order is triggered, limiting potential losses. This feature is particularly useful for day traders and short-term traders who cannot constantly monitor the markets.

- Discipline and emotional control:

Emotions can often cloud a trader’s judgment, leading to impulsive decision-making and irrational trades. Cover orders help traders maintain discipline and emotional control by automating the exit strategy. This eliminates the need for constant monitoring and allows traders to stick to their predefined trading plans.

- Quick execution:

Cover orders ensure quick execution in volatile markets. When the stop-loss order is triggered, it is executed as a market order, guaranteeing that the trade is closed as close to the specified price level as possible. This rapid execution can be crucial in fast-moving markets where prices can change within seconds.

How to Place a Cover Order on Paytm Money?

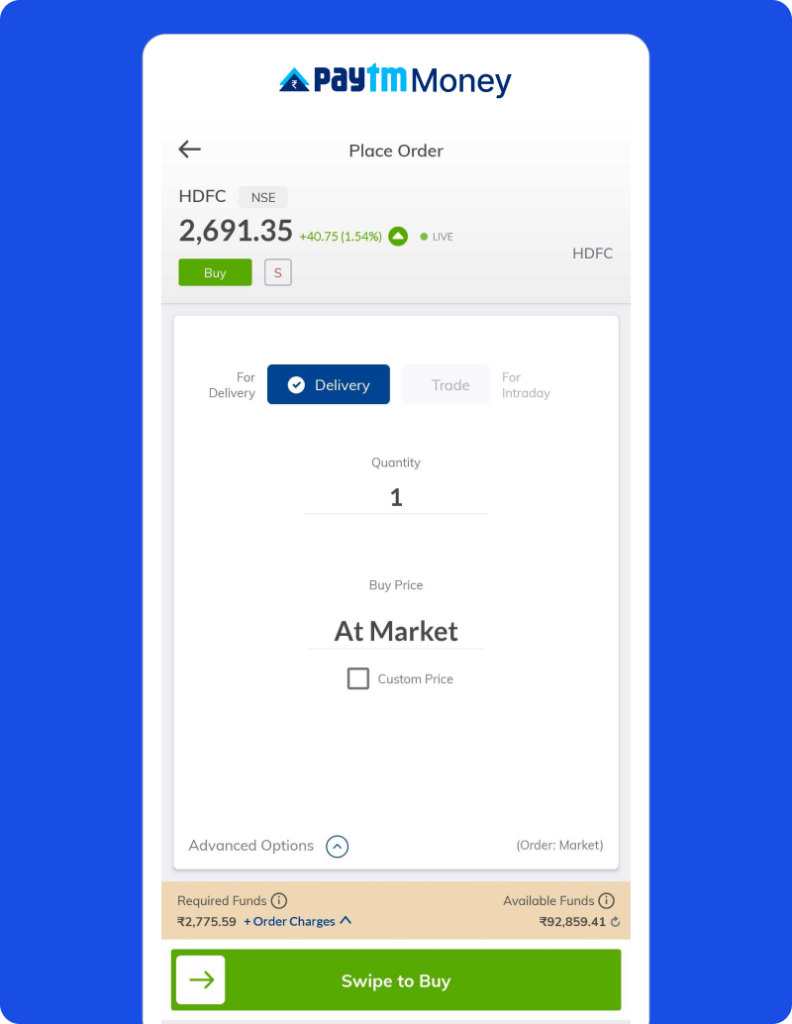

- Click on any stock you want to place a Cover order for

The securities are quoted as an example and not as a recommendation

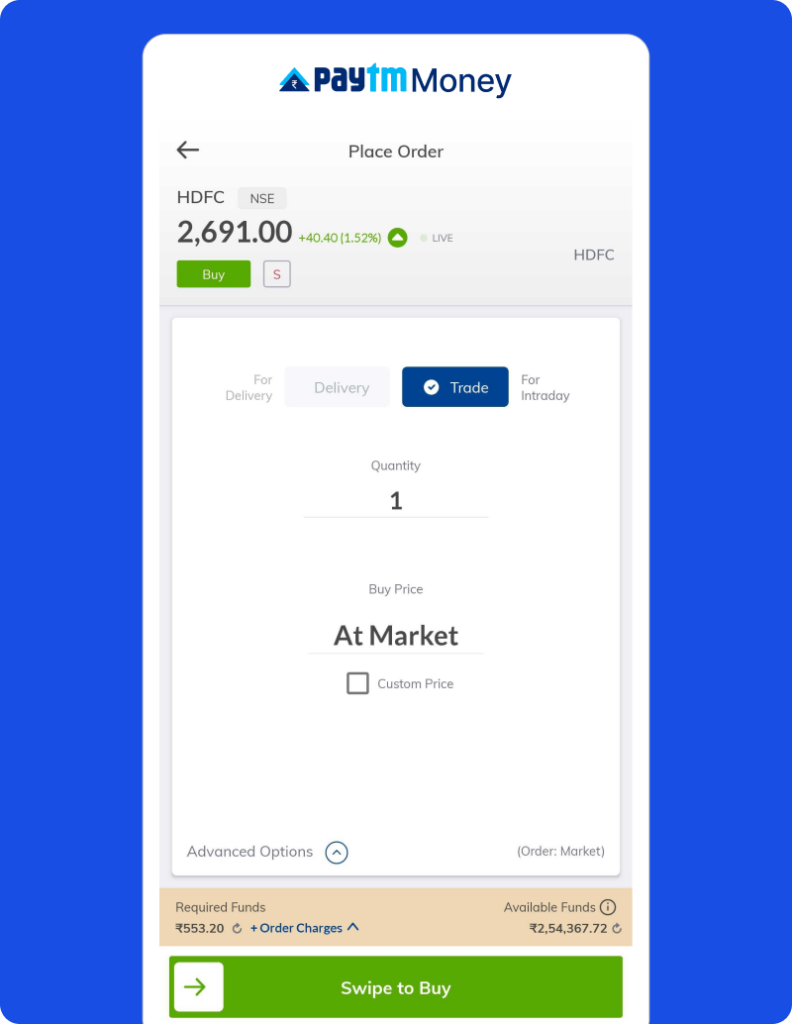

- Tap on For Intraday/Trade section

The securities are quoted as an example and not as a recommendation

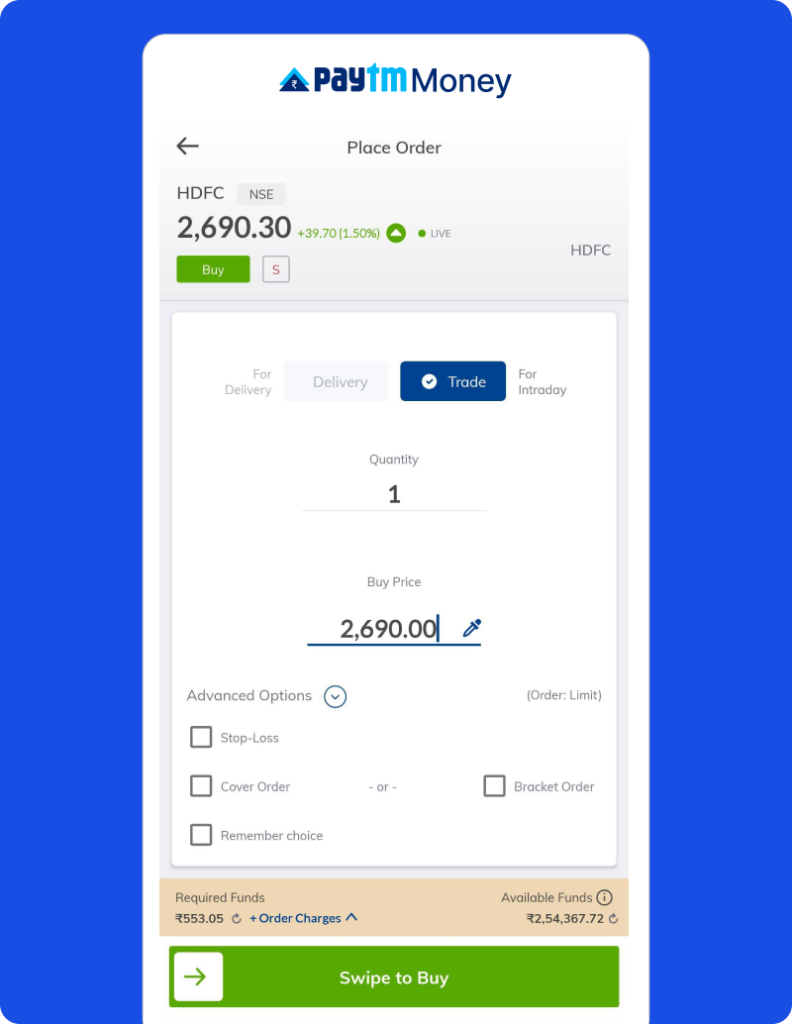

- Tap on Advanced options

The securities are quoted as an example and not as a recommendation

- Select Cover order

The securities are quoted as an example and not as a recommendation

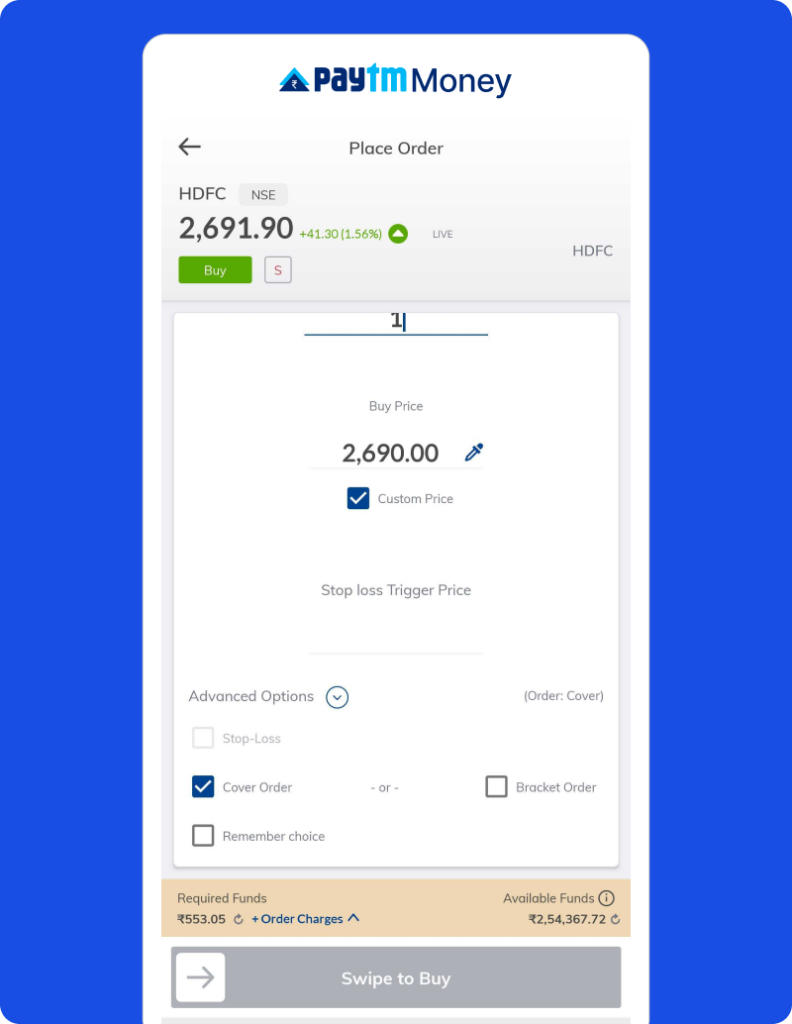

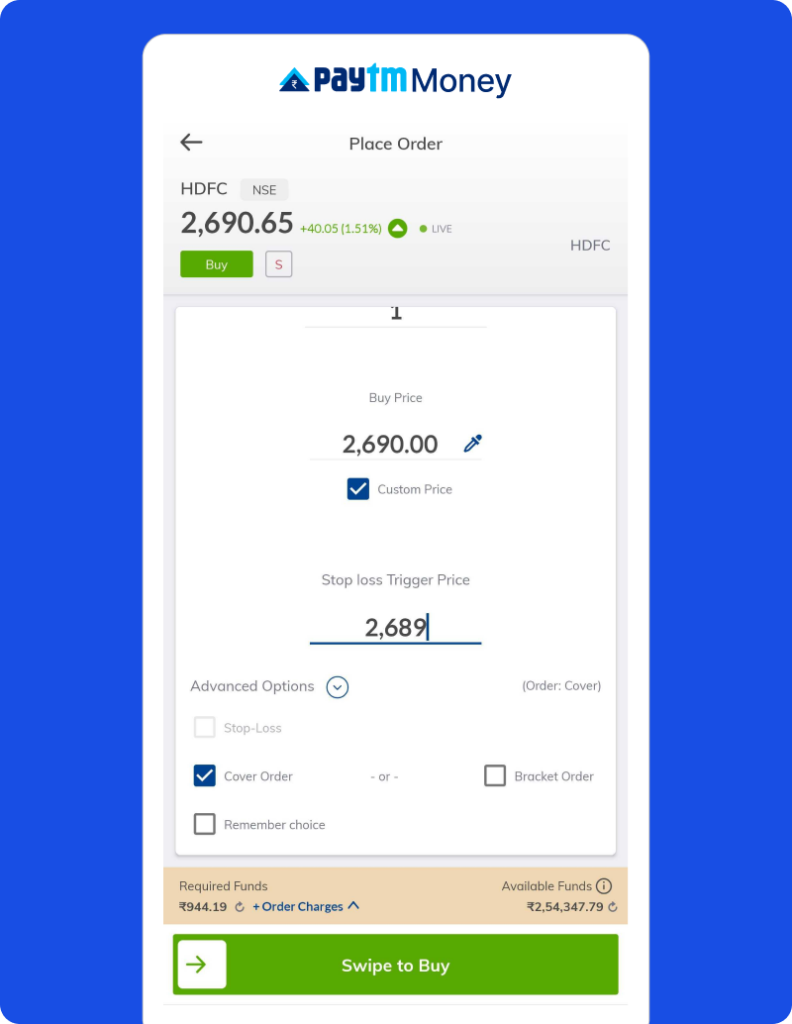

- Now set the desired quantity, execution price (Market/Limit), Stop Loss price

The securities are quoted as an example and not as a recommendation

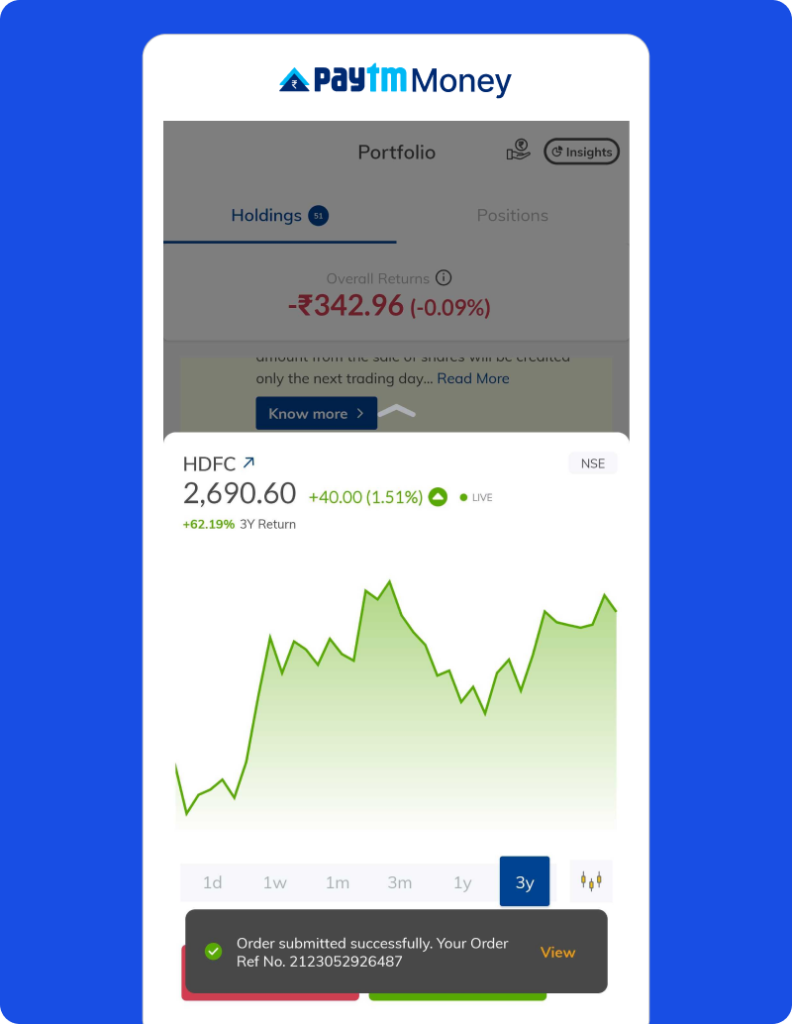

- Voilà. Happy Trading!

The securities are quoted as an example and not as a recommendation

Where Are Cover Orders(CO) Applicable?

Segments allowed:

1) Equity stocks which aren’t under any surveillance measure or blocked

2) Stock Futures

3) Index Futures : Nifty, Bank Nifty and FinNifty

4) Index Options : Nifty and Bank Nifty

Please note no Stock options and FinNifty Options allowed in CO

CO allowed contracts:

Futures: 2 Monthly expiry contracts will be allowed

Options: 2 weekly and 1 monthly expiry contract will be allowed (2 days before the expiry risk team will allow Near Month expiry contract)

Maximum Stop loss & Target Range in CO:

Futures: +/-10% from the entry price

Options: +/- 50% from the entry price

Minimum Stop loss & Target Range:

Futures: 0.1%

Options: 1%

Please note:

1.Once the cover order has been placed and the first leg has been traded, you won’t be able to cancel the cover order. You can only exit the current one-sided position.

2.If the first order has not been traded, you can cancel the cover order.

3.The stop-loss order can be modified within the stipulated price range. After the order has been modified, the margin will be recalculated.

By incorporating cover orders into their trading strategies, traders can enhance risk management, protect capital, maintain discipline, execute trades efficiently without the need of regular monitoring. The utilization of cover orders empowers traders with the confidence to make informed decisions, reduce losses, and improve overall trading performance.

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation. This content is purely for information purpose only and in no way to be considered as an advice or recommendation. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit: https://www.paytmmoney.com/stocks/policies/terms