UPI has made paying directly from your bank accounts easier than ever before. Open Paytm, scan the QR, pay directly from your savings account. And now you can make instant and secure UPI payments even from your RuPay credit card! Link it to your Paytm app and use it just like you would use your bank account.

Here’s why you should use your RuPay credit card on UPI:

- More Credit Card Rewards

From big purchases to paying your local chaiwala, earn more credit card reward points by making every payment with your UPI Linked Credit Card

- Maintain more bank balance, earn more interest

By making all your UPI spends using your RuPay credit card, you will maintain a higher bank balance and earn more monthly interest.

- No need to enter CVV or wait for OTP

To make UPI payments using your RuPay credit card, you do not need to enter your CVV or wait for OTP SMSes. Simply select your credit card, enter your UPI PIN and that’s it.

- Check your credit card limit

Just like you check your bank balance on UPI linked accounts, you can check your total and available limit on your UPI linked RuPay Credit Cards.

Thousands of Indians have linked their Credit Cards on Paytm UPI, the most popular ones being:

- HDFC Bank RuPay Credit Card

- Punjab National Bank RuPay Credit Card

- Axis Bank RuPay Credit Card

- Canara Bank RuPay Credit Card

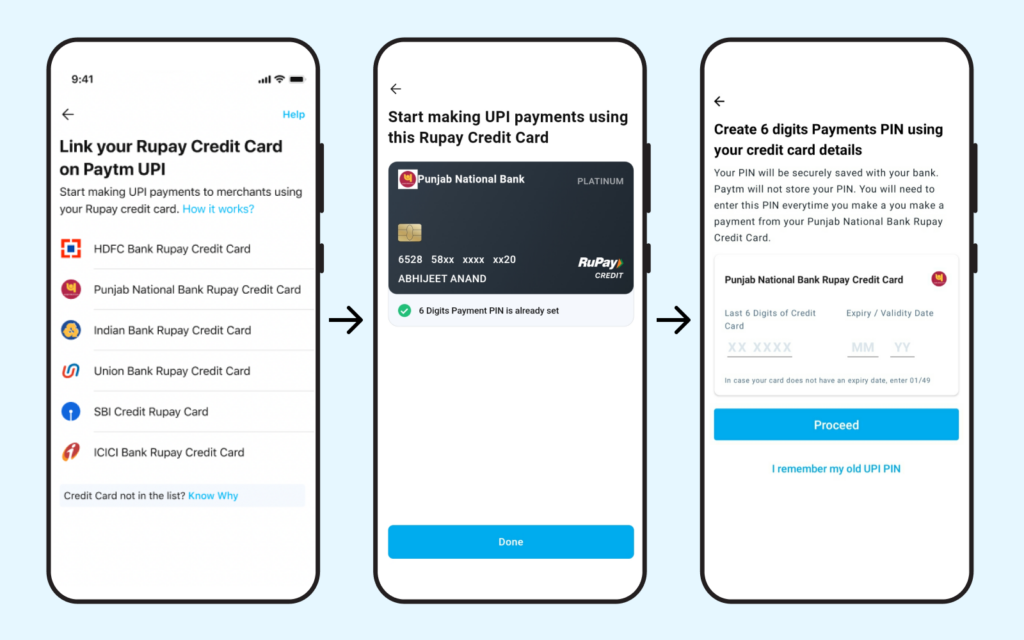

To link your RuPay Credit Card on Paytm:

- Tap the top left corner of the Paytm home page

- Scroll to find “UPI & Payment settings”

- You will then find the option that says “Link RuPay Credit card on Paytm UPI” in “Other Settings”

- Select your bank name

- Eligible Credit Card(s) will appear automatically

- If you have not set a UPI PIN, you can create one with your Credit Card details. Once done, tap on Proceed.

- Enter 6 digit OTP received on your linked mobile number

- You can now set a 4/6 digit UPI PIN and start making payments right away!

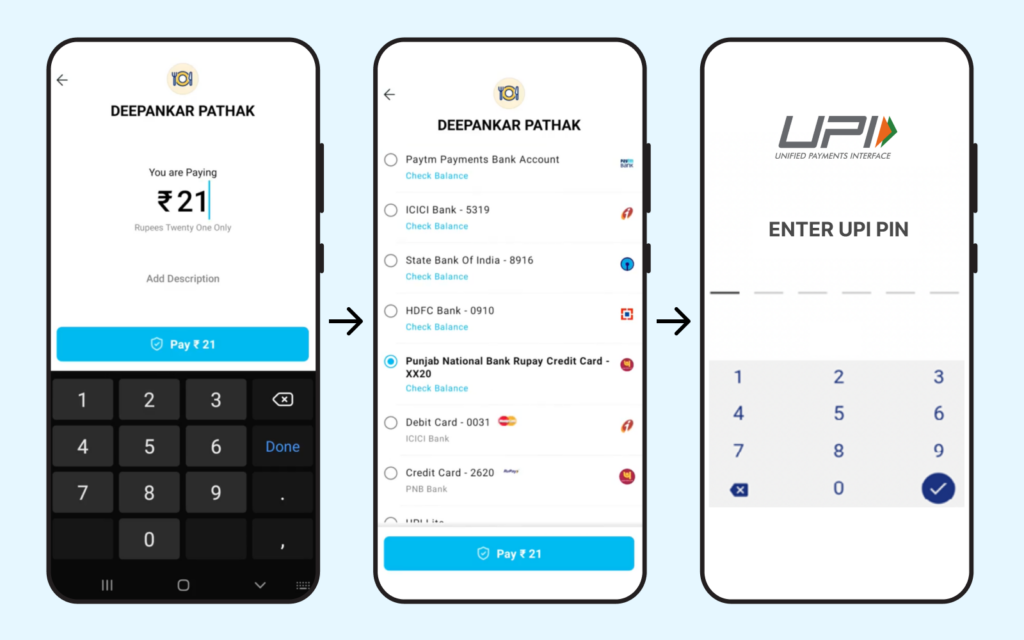

To make payments through your credit card using Paytm UPI:

- Scan the QR code of the store and enter the amount to be paid

- Select the RuPay Credit card you have linked to your Paytm app

- As always, enter your UPI PIN to make a fast and secure UPI payment through your credit card!

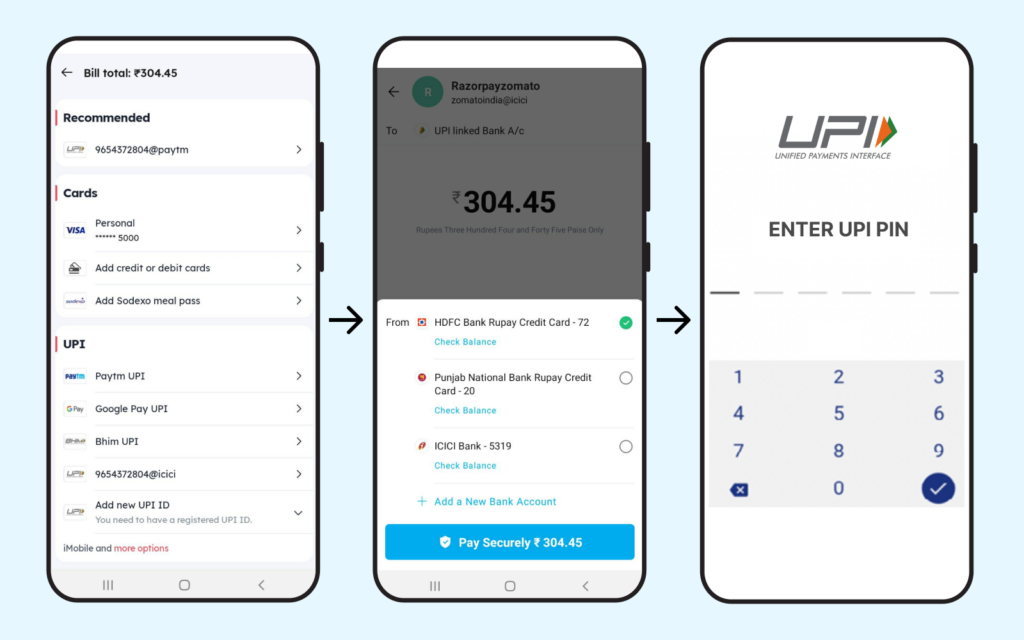

When you make an online purchase through a website or mobile app, use your RuPay Credit Card on Paytm for a hassle-free payment-

- Enter your UPI ID on the checkout page or Choose Paytm UPI as a payment option

- Select the Credit Card that you have linked to your Paytm App

- Enter the UPI PIN you have set and that’s it!