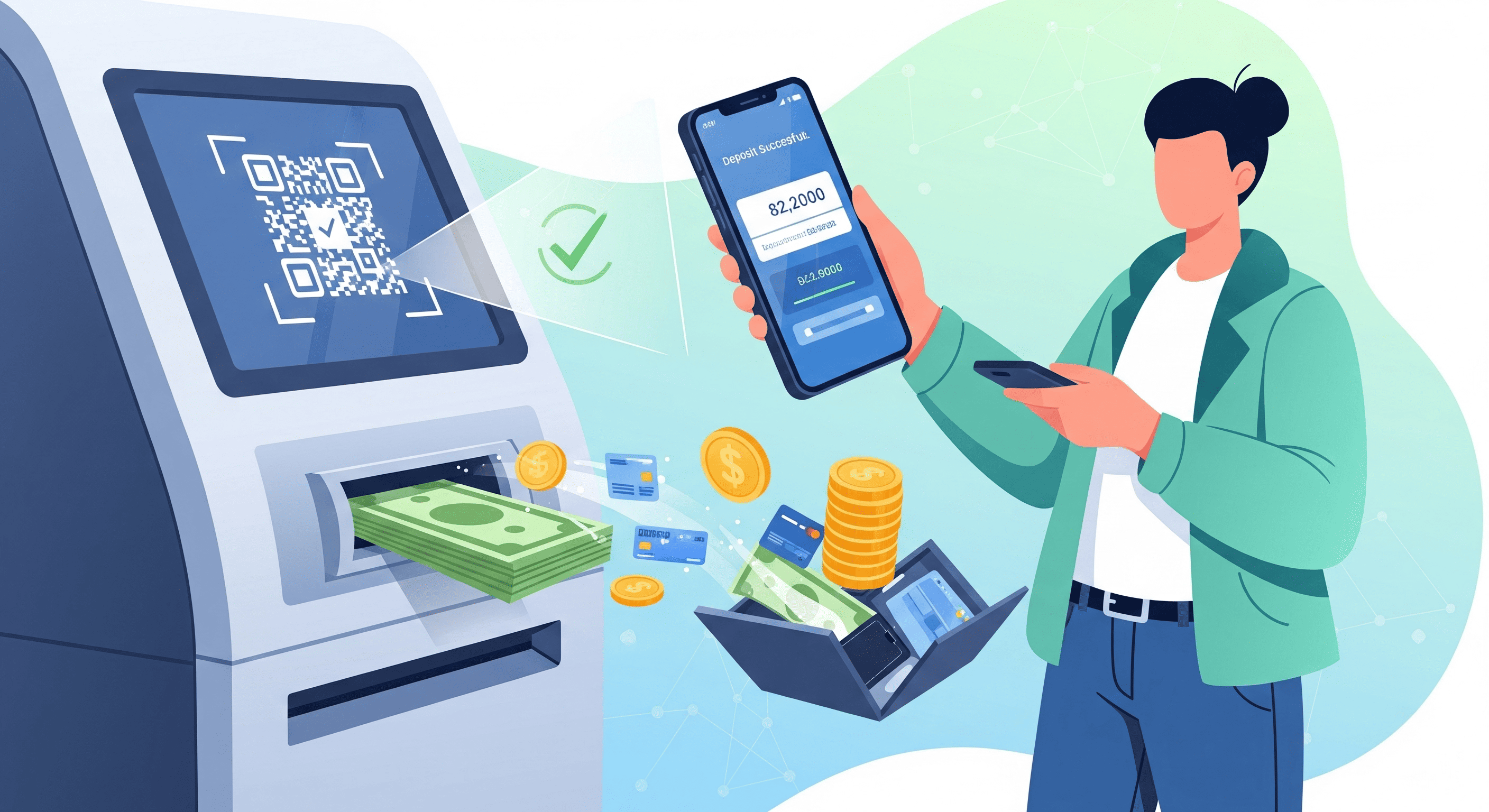

Banking in India has become more convenient with innovations that focus on interoperability, the ability to use services across different banks. One such service is the Card Based Interoperable Cash Deposit (ICD), introduced to make cash deposits easier for customers.

With ICD, customers no longer need to visit only their home branch or bank’s ATM/CDM (Cash Deposit Machine). Instead, they can use any participating bank’s cash deposit machine to credit money into their account using their debit or ATM card.

What is a Card Based Interoperable Cash Deposit (ICD)?

Card Based Interoperable Cash Deposit (ICD) is a facility that enables bank customers to deposit cash into their savings or current accounts using their ATM/debit card at a cash deposit machine (CDM) of another bank.

This feature was introduced under the guidance of the Reserve Bank of India (RBI) and implemented by the National Payments Corporation of India (NPCI) to enhance customer convenience and promote financial inclusion.

Features of Card Based Interoperable Cash Deposit

- Interoperability: Customers can deposit money at any participating bank’s CDM, not just their own bank.

- Debit Card Based Access: The service works through debit/ATM cards linked to the customer’s account.

- Real-Time Credit: Deposited funds are credited instantly to the customer’s account.

- Wide Availability: Service is available at multiple bank CDMs across India.

- Secure Transactions: Authentication is done through PIN verification, ensuring safe deposits.

Benefits of Card Based Interoperable Cash Deposit

Convenience for Customers

No need to locate your own bank’s CDM, use any participating bank’s machine.

Time-Saving

Reduces long queues at a single bank’s branch or CDM by distributing deposits across multiple banks’ machines.

Financial Inclusion

Extends banking services to rural and semi-urban areas where one’s own bank branch/CDM may not be available.

Faster Transactions

Real-time settlement ensures the money reflects in your account immediately.

Safe and Reliable

PIN-based authentication ensures the deposit is secure and linked only to your bank account.

How Does Card Based ICD Work?

- Insert your debit/ATM card into the CDM of any participating bank.

- Select the cash deposit option.

- Enter the amount you wish to deposit.

- Insert the cash notes into the machine.

- Confirm the transaction and collect the receipt.

- The amount will be instantly credited to your linked bank account.

Final Thoughts: The Card Based Interoperable Cash Deposit (ICD) system is a big step toward making banking services more flexible and accessible. By enabling customers to deposit cash at any bank’s CDM using their debit card, it reduces dependency on a single bank’s infrastructure and makes financial transactions more efficient. For people in remote areas, students, small business owners, and professionals, ICD brings unmatched convenience and speed.