We have introduced automatic spend categorization, along with a smart Monthly Spend Summary, to help users better understand, track and manage their finances. These enhancements are part of our successive new feature rollouts, reflecting its strong commitment to providing user-led innovations and improving payments experience.

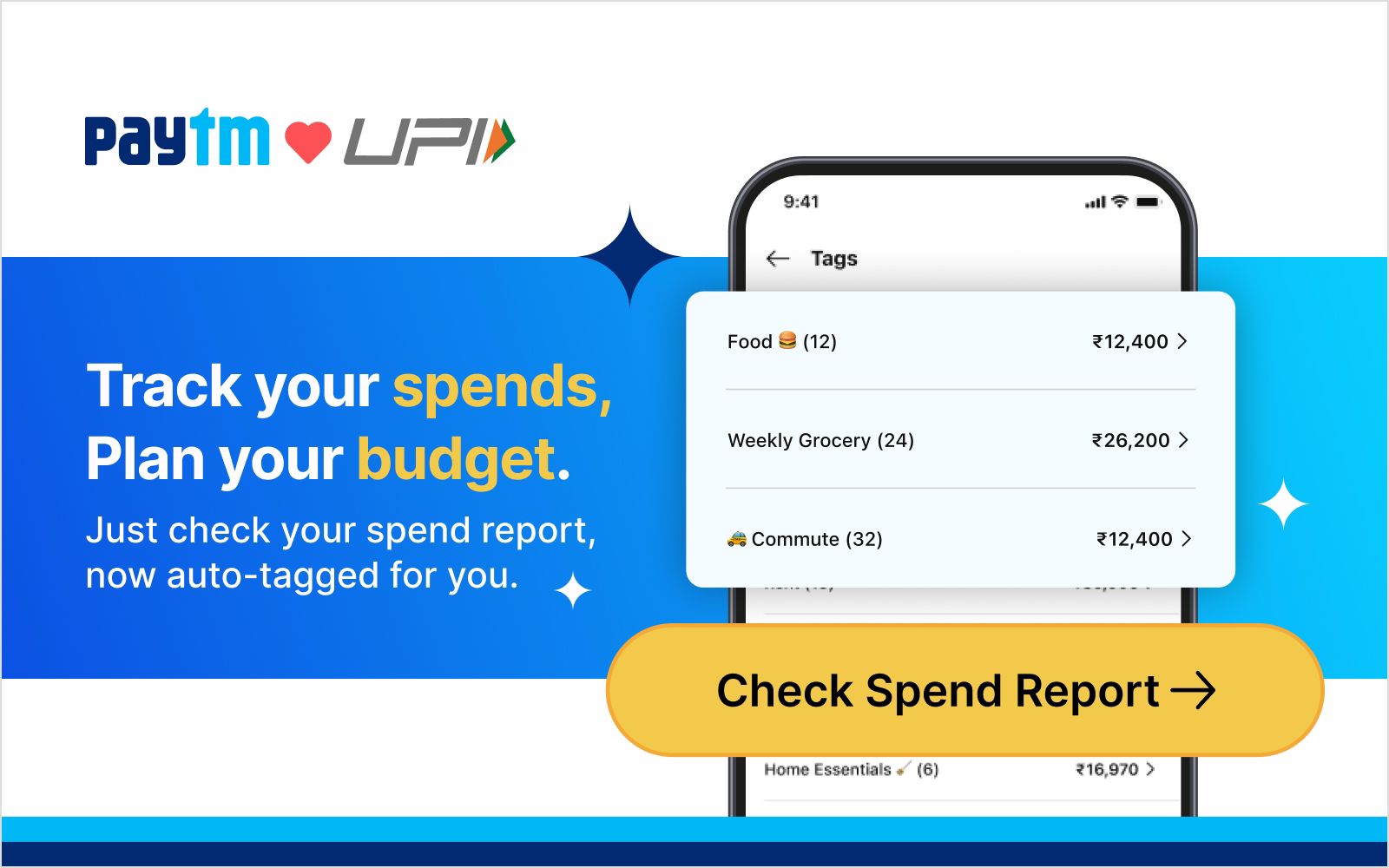

With this update, every payment made through us is automatically tagged under categories like food, travel, shopping, bill payments, money transfers, and more. Displayed in the ‘Balance & History’ section, these smart tags make it effortless to recognize what each payment was for, be it a cab ride, utility bill, or quick meal. This functionality enables a more organised view of transactions, supports deeper insights into an individual’s spending behaviour and gives users even more reason to rely on us for all their daily payments and transactions.

Each tag can be tapped to view all related payments in one place, enabling quick reviews of spending patterns across the month. Our app also now shows the total spends in the month upfront in the ‘Payment History’ section. Additionally, users can access the Monthly Spend Summary by tapping on ‘Total Spent’ in the ‘ Payment History’ section, which provides a visual breakdown of their monthly expenses by tag. This offers a clear picture of how money is being spent across different categories, helping individuals stay informed and make smarter financial decisions.

Tags are also fully customisable. While the app auto-generates tags for most payments, these can be edited with a few taps. Individuals can select from suggested tags or create new custom ones to match specific needs, including tagging for recurring subscriptions, education expenses, or personal savings. This gives more control and flexibility in tracking what matters most. Further, the tags adapt to users’ spending behaviour. If a merchant’s payment is reclassified from “Grocery” to “Food,” all future payments to that merchant will automatically carry the “Food” tag. This ensures that the tagging system evolves to reflect each individual’s unique spending patterns.

“We continue to strengthen our product with thoughtful improvements that enhance the overall experience and simplify money management. In the Balance & History section, transactions are now assigned automated labels to provide instant clarity on where money is being spent. These labels can be customised, and new ones can be created to reflect specific spend types, enabling individuals to track and organise their finances in a way that works best for them. As India’s best UPI payments app, Paytm remains focused on building intuitive tools that give people more control over their spending,” said Paytm spokesperson.

How to view and customise Smart Spend Tags in the Paytm app:

- Open the Paytm app

- Navigate to the ‘Balance & History’ section. Each payment will display a tag below it such as food, travel, shopping, or bills

- Tap on a tag to view all payments grouped under that category

- To change a tag, open the payment and tap the ‘Edit’ button next to the tag name

- Choose a different tag or create a new custom one. All future payments to the same person or merchant will automatically be assigned the new tag

- Tap on ‘Total Spent’ in ‘Balance & History’sectionto view month-wise trends of spends across various categories

We continue to enhance mobile payments with several customer-centric innovations. These include the ability to hide or unhide specific payments for added privacy, home screen widgets like ‘Receive Money’ for faster payments, and personalised UPI IDs that allow creation of unique, memorable handles without revealing mobile numbers. UPI statements can now be downloaded in Excel or PDF formats, and the app also displays the total balance across all UPI-linked bank accounts—providing a clear, consolidated view of one’s finances. Expanding our reach globally, we now supports UPI transactions in countries such as the UAE, Singapore, France, Mauritius, Bhutan, Sri Lanka, and Nepal, enabling smoother payments for Indian travellers abroad.