When you step into the world of investment, staying informed and making educated decisions can significantly enhance your financial success. Whether you’re a seasoned investor or just beginning your journey, understanding the performance of your mutual funds is crucial. What if you could access a comprehensive report on your investments with just a few taps on your smartphone? Now you can with Paytm’s MF Report, absolutely free. Let’s find out how easy it is to stay on top of your investments, make informed decisions, and achieve your financial goals.

What is an MF Report?

- An MF report is a document that gives an overview of a mutual fund scheme, with a focus on disclosing the scheme’s performance and portfolio details.

- It is a monthly report published by each mutual fund, acting as a “report card” on the health and performance of the mutual fund.

- The MF report is a concise, easy-to-understand document that provides crucial information for both potential and existing mutual fund investors.

What to Read in a Mutual Fund Report?

- Fund Details

The mutual fund report on Paytm will first provide the basic details about the fund, including:

- Scheme name: The name of the specific mutual fund scheme you have invested in.

- Scheme type: The category of the mutual fund, such as equity, debt, or hybrid.

- Benchmark index: The index to show the fund’s performance is compared against.

- Fund manager: The name of the fund manager responsible for managing the investments.

2. Folio Number

Each of your mutual fund investments is assigned a unique folio number. This serves as an identifier for your specific investment account with that fund house. You can use this folio number to track your holdings and transactions.

3. Scheme NAV

The Net Asset Value (NAV) represents the per-unit market value of the mutual fund’s investments. This is an important metric as it reflects the current worth of your investment.

4. Units Held

This section shows the number of units you own in the mutual fund scheme. The number of units you hold, multiplied by the latest NAV, gives you the current value of your investment.

5. Amount Invested

This is the total amount of money you have invested in the mutual fund scheme over time, either through lump sum investments or Systematic Investment Plans (SIPs).

6. Current Value

The current value of your mutual fund investment is calculated by multiplying the number of units held by the latest NAV. This represents the market value of your investment at the time of the statement.

7. Gain/Loss

This section shows the absolute and percentage gain or loss on your mutual fund investment, based on the current value compared to the total amount invested.

8. Dividend History

If the mutual fund has paid any dividends, this section will provide the details, such as the dividend amount and the payment date.

9. Portfolio Holdings

The report includes information on the fund’s portfolio composition, showing the percentage allocation to different sectors, industries, and individual stocks. This helps you assess the fund’s diversification.

10. Expense Ratio

The expense ratio represents the annual operating costs of the mutual fund, expressed as a percentage of the fund’s assets. Lower expense ratios are generally preferred as they allow for higher net returns.

11. Exit Load

This is the charge that may be applicable if you redeem your mutual fund units within a certain period, as specified by the fund. Understanding the exit load can help you plan your investments accordingly.

Why Should You Measure the Performance of a Mutual Fund?

Here are the key reasons why one should measure the performance of a mutual Fund:

- Evaluating Fund Performance

- Understand Returns: Measuring the mutual fund’s returns over different periods (1 year, 3 years, 5 years) allows you to assess how the fund has performed and whether it has generated satisfactory returns.

- Compare to Benchmarks: Comparing the fund’s returns to its benchmark index and the category average helps evaluate the fund’s performance relative to its peers and the broader market.

- Assess Risk-Adjusted Returns: Metrics like the Sharpe ratio* indicate the fund’s risk-adjusted returns, helping you understand the tradeoff between risk and return.

- Monitor Consistency: Reviewing the fund’s performance over multiple periods can help you assess the consistency of its returns and identify any significant fluctuations.

*The Sharpe ratio is a measure of the risk-adjusted return of a financial investment. It is calculated as the ratio of the investment’s excess return over the risk-free rate to its standard deviation. The Sharpe ratio provides a way to evaluate whether a portfolio’s returns are due to smart investment decisions or a result of excess risk.

- Informed Investment Decisions

- Align with Goals: Analyzing the fund’s performance lets you determine if it aligns with your investment objectives and risk tolerance.

- Select Appropriate Funds: Evaluating performance data can help you identify the best-performing funds within a particular category or asset class.

- Time Entry/Exit: Understanding a fund’s performance trends can inform your decisions on when to invest, hold, or redeem your investment.

- Portfolio Optimization: Regularly monitoring fund performance enables you to make adjustments to your portfolio to maintain the desired asset allocation and risk profile.

- Ongoing Portfolio Management

- Track Progress: Measuring fund performance allows you to track the growth of your investments and monitor the progress towards your financial goals.

- Identify Underperformance: Regularly reviewing performance can help you identify any underperforming funds in your portfolio that may need to be replaced.

- Rebalance Portfolio: Performance analysis can guide you in rebalancing your portfolio to maintain the appropriate risk-return profile.

- Tax Planning: Understanding the fund’s performance can help you make informed decisions about the timing of your investments for tax optimization.

How to Read Mutual Fund Report on Paytm?

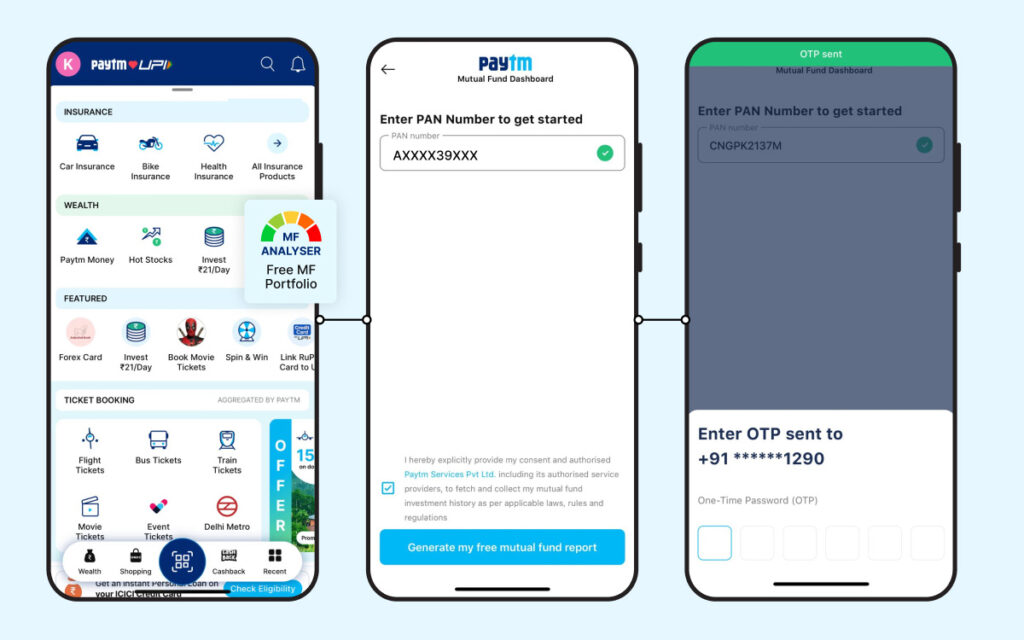

Step 1: Open Paytm app, scroll the home page screen, reach to the ‘Wealth’ section and click on ‘Free MF Portfolio”

Step 2: Enter your PAN number and click on ‘Generate my free mutual fund report’

Step 3: Enter the OTP received via SMS

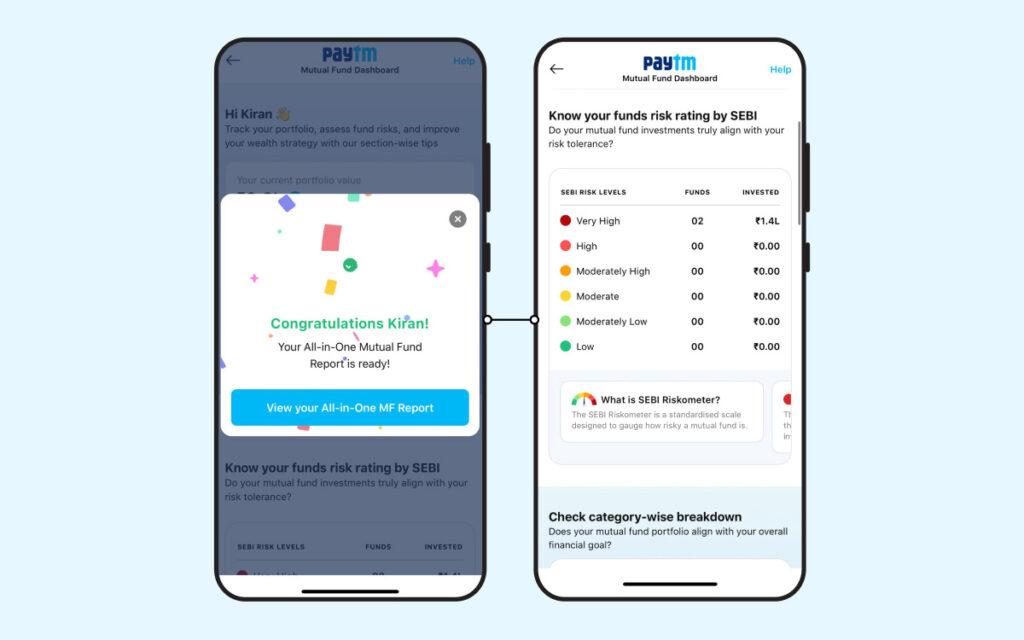

Step 4: On the pop-up screen, click on ‘View you all-in-one MF report’

Step 5: You will be able to see all your MF investments and their risk levels

Mistakes to Avoid When Reading Your Mutual Fund Statement

Here are the key mistakes to avoid when reading your mutual fund statement:

- Chasing Past Performance

Don’t invest in funds solely based on their past returns. Past performance does not guarantee future results. Evaluate the fund’s investment strategy and portfolio attributes before investing for potentially long-term gains.

- Neglecting to Diversify

Don’t just invest in one or two funds. Diversify across fund houses, market cap categories, sectors, and investment styles to manage risks effectively. Avoid overexposure to a single fund.

- Overlooking Regular Investing

Invest regularly, like through SIPs, to benefit from rupee cost averaging and compounding over long periods.

- Failing to Review and Rebalance

Review your funds periodically to check if your asset allocation matches your goals. Rebalance to bring your portfolio in line with original targets. A portfolio review helps identify underperforming funds and optimize returns.

By understanding the key components of a mutual fund statement like the scheme name, transaction date, NAV, transaction type (lumpsum, SIP, STP, SWP), units, amount, and closing balance, you can effectively track your investments and make informed decisions.

Know the Difference Between SIP and STP

Avoid common mistakes like chasing past returns, not diversifying, and failing to review regularly. By following best practices and regularly monitoring your mutual fund statement, you can work towards achieving your financial objectives.

Disclaimer: Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommend you seek professional advice from someone who is authorized to provide investment advice.