Investors are always looking for ways to make money while keeping risks under control. One popular approach is investing in index-linked mutual funds. These funds work differently from actively managed funds, where fund managers pick individual stocks. Instead, index-linked funds follow a particular market index without active decision-making.

Table of Contents Show

In this blog, we’ll explore the concept of index-linked mutual funds, their advantages, potential drawbacks, and why they have become a preferred choice for many investors.

What Are Index Mutual Funds?

Index mutual funds are a type of mutual fund that aims to replicate the performance of a specific market index, such as the S&P 500 or Nifty50. These funds are designed to provide investors with broad market exposure by holding a diversified portfolio of securities that mirror the composition of the underlying index.

Index mutual funds work by investing in the same securities that make up the target index, in the same proportion. For example, if a fund tracks the NIFTY 50, it will invest in all 50 companies in the index, allocating a portion of its assets to each company based on its weight. This strategy allows investors to achieve similar returns to the overall market, as represented by the index.

One of the main advantages of index mutual funds is their low cost compared to actively managed funds. Since index funds aim to replicate the performance of an index rather than trying to outperform it, they do not require extensive research or active trading. This results in lower management fees and operating expenses, making index funds an attractive option for cost-conscious investors.

Note: It is important to note that index mutual funds are passively managed, meaning they do not rely on the expertise of a fund manager to make investment decisions. Instead, they follow a predetermined set of rules based on the composition of the target index. This can be seen as a disadvantage for investors who prefer an actively managed approach, as index funds cannot take advantage of potential market opportunities or make adjustments based on changing market conditions.

How Do Index Mutual Funds Work?

Imagine you want to invest in a special type of mutual fund that follows the Nifty 50 index in India. This index represents the performance of 50 big Indian companies.

When you invest in this fund, your money is combined with money from other investors. A fund manager uses this pooled money to buy a mix of stocks from the 50 companies in the Nifty 50 index. For example, if one company makes up 2% of the Nifty 50 index, the fund will invest about 2% of its money in that company’s stock. The fund manager doesn’t actively choose which stocks to buy or sell. They just follow the rules to match the index.

As the Nifty 50 index changes, the fund manager adjusts the mix of stocks in the fund to match the changes in the index. If a company joins or leaves the Nifty 50, the fund buys or sells that company’s stock to stay in line with the index.

The goal of the fund is to perform similarly to the Nifty 50 index. So if the index goes up by 10%, the fund aims to go up by around 10% too, after taking out any fees or expenses.

You can buy or sell shares of this fund on any trading day at a price called the net asset value (NAV). This price depends on the total value of the fund’s assets minus its costs, divided by the number of shares.

In simple terms, an index mutual fund in India tracks a specific index, invests in a mix of stocks from that index, and aims to perform like the index. It’s an easy way for investors to get broad exposure to the Indian market and potentially earn similar returns to the index they’re tracking.

Who Can Invest In Index Mutual Fund?

Index funds are a good choice for:

- People who want a simple investment approach.

- Long-term investors who don’t want to make frequent changes.

- Beginners who are new to investing.

- Those who want to reduce risk through diversification.

- Investors who want to minimize fees.

- People looking for exposure to a specific market or sector.

How to Invest in Index Mutual Funds?

- Clarify your investment goals: Determine what you want to achieve with your investments, such as long-term growth or retirement planning.

- Select a reputable index fund: Research different index funds, considering factors like the fund’s performance history, expense ratio, and the index it tracks.

- Open an investment account: Choose a brokerage or investment platform that offers index fund options and open a demat account with them.

- Determine your investment amount: Decide how much money you’re comfortable investing in index funds. Consider starting with a manageable amount and gradually increase your contributions over time.

- Automate contributions: Set up automatic transfers from your bank account to your investment account to ensure consistent contributions.

- Monitor and review your investments: Keep an eye on your index fund performance and periodically review your investment strategy. Consider rebalancing your portfolio if needed.

- Stay informed about investing: Stay updated on market trends, economic news, and any changes in the index fund you’re investing in.

Benefits of Investing in Index Funds

Index funds can be considered good investments for several reasons:

| Key Advantages of Index Funds | Details |

|---|---|

| Broad Market Exposure | Index funds provide exposure to a wide range of securities within a specific market index, such as the NIFTY 50. |

| Lower Fees and Expenses | Compared to actively managed funds, index funds typically have lower fees and expenses. This is because they aim to replicate the performance of an index rather than relying on active management and research. |

| Consistent Performance | Index funds generally aim to match the performance of the underlying index they track. While they may not outperform the market, they also tend to avoid significant underperformance. |

| Simplicity and Accessibility | Investing in index funds is straightforward and accessible to a wide range of investors. They are easy to understand and can be purchased through various brokerage platforms. |

| Passive Management | Index funds are passively managed, meaning they do not rely on active decision-making by fund managers. This reduces the impact of human biases and emotions on investment decisions. |

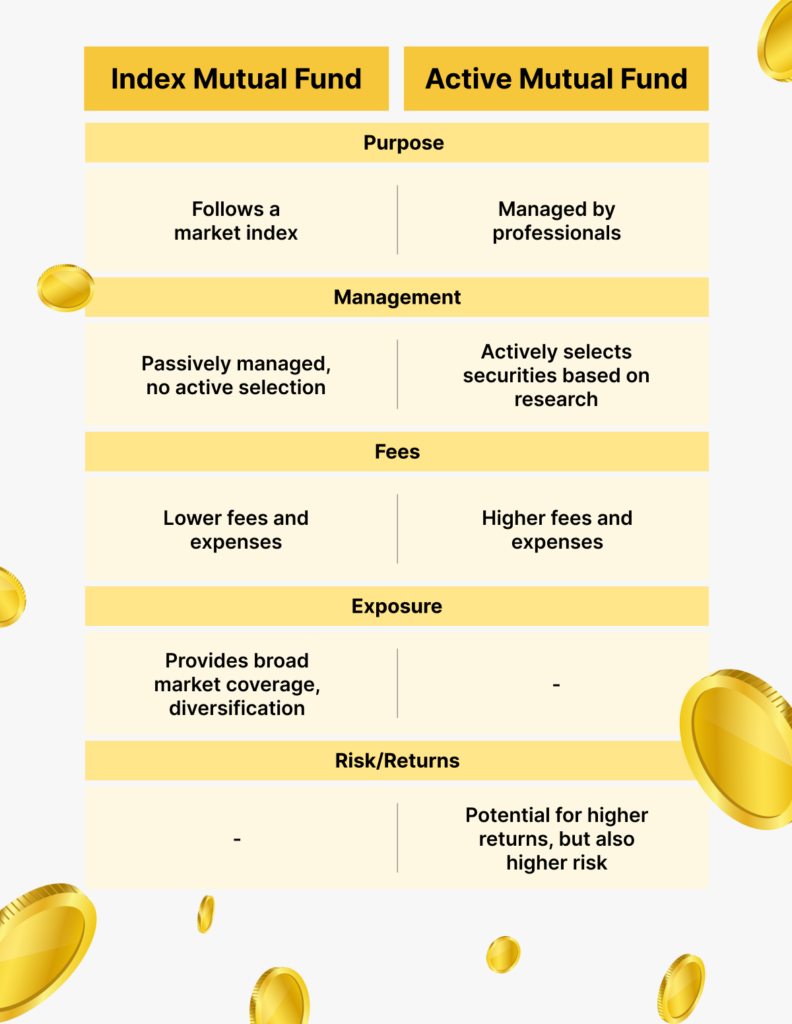

What is the difference between Index Mutual Fund and Active Mutual Fund?

Index Mutual Fund:

- Aims to replicate the performance of a specific market index.

- Passively managed, meaning it tracks the index without actively selecting securities.

- Generally has lower fees and expenses.

- Offers broad market exposure and diversification.

Active Mutual Fund:

- Actively managed by fund managers who select securities based on research and analysis.

- Seeks to outperform the market or achieve specific investment objectives.

- Typically has higher fees and expenses.

- Offers potential for higher returns but also carries higher risk.

Investing in index-linked mutual funds can be a beneficial strategy for many investors. These funds offer broad market exposure, lower fees, and consistent performance by tracking specific market indices. They provide a simple and accessible way to invest, as they are passively managed and can be easily purchased through various platforms. While not risk-free, index-linked mutual funds are a good option for those seeking a diversified and long-term investment approach. However, it’s important to research and consider individual financial goals and risk tolerance before making any investment decisions.

Disclaimer: Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommend you seek professional advice from someone who is authorised to provide investment advice.