IMPS, which stands for Immediate Payment Service, is a popular interbank electronic funds transfer system in India. With its real-time and secure money transfer capabilities, IMPS has transformed the way individuals send and receive funds using their mobile phones or Internet banking. In this article, we will explore the basics of IMPS and learn how to transfer funds effortlessly using this convenient payment system.

What is IMPS?

IMPS, which stands for Immediate Payment Service, is an interbank electronic funds transfer system in India. It allows individuals to send and receive money instantly using their mobile phones or internet banking. IMPS facilitates real-time transactions, enabling users to transfer funds conveniently and securely. With IMPS, individuals can make payments, settle bills, send money to friends and family, and conduct various financial transactions swiftly and efficiently.

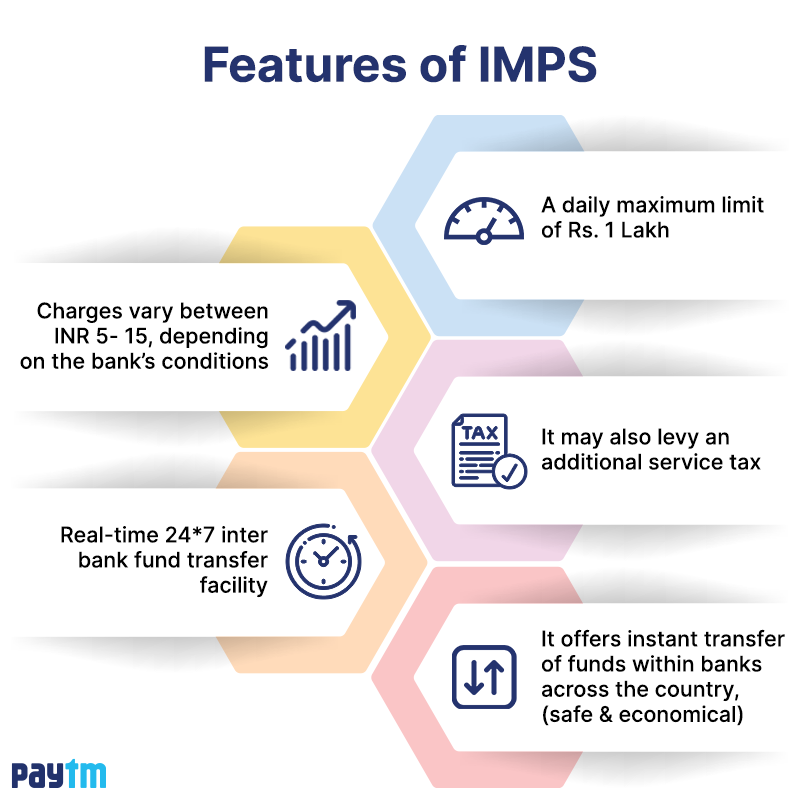

Features of IMPS

Before you begin using IMPS as a method of online money transfer, it’s important to familiarize yourself with its key features and considerations:

- Daily Transaction Limit: IMPS transactions are subject to a daily maximum limit of Rs. 5 Lakh. This limit ensures a balance between convenience and security for users.

- Transaction charges: The charges associated with IMPS transactions may vary between Rs. 5 to Rs. 15, depending on the specific conditions set by the respective banks. It is advisable to check with your bank to understand the applicable charges.

- Service Tax: In addition to transaction charges, IMPS transactions may also levy an additional service tax. This tax is typically governed by the prevailing tax regulations and can vary depending on the specific transaction and bank.

- 24/7 Inter-bank Transfer: IMPS provides a robust and real-time fund transfer option that operates round the clock. It allows users to transfer funds instantly between banks, irrespective of time and location, ensuring enhanced convenience and accessibility.

- Safe and Economical: IMPS offers a secure platform for transferring funds within banks across the country. The system employs robust security measures, such as encryption and authentication protocols, to ensure the safety of transactions. Moreover, IMPS transactions are often considered economical, providing a cost-effective solution for users.

Advantages of IMPS

IMPS, being one of the most commonly used methods of money transfer, offers several advantages that have contributed to its popularity. Here are the key advantages of IMPS:

- Fast, safe, and reliable: IMPS provides a fast and reliable method of transferring money. Transactions are processed in real-time, ensuring immediate transfer of funds between accounts. Additionally, IMPS employs robust security measures to safeguard transactions, providing users with a safe and secure platform for their financial transfers.

- Accessibility on multiple platforms: IMPS can be accessed through both internet banking and mobile platforms, offering convenience and flexibility to users. Whether you prefer using your computer or mobile device, you can easily initiate and manage IMPS transactions, making it a versatile payment option.

- Availability 24/7: One of the significant advantages of IMPS is its availability round the clock. IMPS transactions can be made at any time, including public holidays and bank holidays. This ensures that users can transfer funds whenever the need arises, without being constrained by traditional banking hours.

- Easy beneficiary addition: Adding beneficiaries for IMPS transactions is a hassle-free process. Through IMPS mobile platforms, users can simply provide the receiver’s mobile number and MMID (Mobile Money Identifier) to add them as beneficiaries. This streamlined process eliminates the need for bank account numbers and simplifies the setup for future transactions.

- Instant notifications: IMPS ensures that both the payer and the payee receive immediate notifications from the bank upon completion of a transaction. This real-time notification feature adds transparency and helps users stay updated on the status of their transfers.

- Versatile usage: IMPS offers more than just transferring money between bank accounts. It can also be used for receiving payments, making payments to merchants, performing mobile banking transactions, and more. This versatility expands the utility of IMPS beyond simple fund transfers, making it a comprehensive solution for various financial needs.

Also Read: Difference between IMPS and NEFT Fund Transfer

How to Transfer Funds Through IMPS?

To transfer funds from one bank account to another via IMPS, you should follow these steps:

- Open your mobile banking app or access your internet banking account

- On the main page, look for the option called ‘Fund Transfer’ and tap/click on it

- Choose ‘IMPS’ as the method to transfer funds

- Enter the beneficiary’s MMID (Mobile Money Identifier) and your MPIN (Mobile Personal Identification Number)

- Enter the amount you want to transfer

- Double-check the details and tap/click on ‘Confirm’ to proceed

- In some cases, you may receive an OTP (One-Time Password) on your registered mobile number to authenticate the transaction

- Enter the OTP you received and follow the prompts to complete the transaction successfully

Also Read: Check IMPS Fund Transfer Status