Key Takeaways

- The Reserve Bank of India (RBI) uses monetary policy to regulate the money supply in the economy.

- One of the primary objectives is to maintain price stability and control inflation.

- The RBI aims to promote economic growth by ensuring adequate credit availability.

- Financial stability is crucial, and the RBI actively manages systemic risks within the financial sector.

- Key tools of monetary policy include the repo rate, cash reserve ratio (CRR), and open market operations.

- There are two main types of monetary policy: expansionary (to stimulate growth) and contractionary (to control inflation).

- Understanding these policies helps individuals and businesses navigate the financial landscape effectively.

The Reserve Bank of India (RBI) plays a significant role in shaping the economic landscape of the country through its monetary policy. This policy is crucial as it impacts everything from interest rates to the availability of credit, directly influencing business operations and growth opportunities. Let us understand how it affects individuals and their financial journey.

What is the Monetary Policy of RBI?

The Monetary Policy of the Reserve Bank of India (RBI) refers to the process through which the RBI manages the supply of money in the economy to achieve specific economic objectives. The primary focus of this policy is to control inflation and foster stable economic growth. By adjusting the availability of money and credit, the RBI aims to create a conducive environment for sustainable economic development.

Objectives of RBI’s Monetary Policy

- Price Stability: One of the primary objectives is to maintain price stability to protect the purchasing power of the currency and control inflation.

- Economic Growth: The RBI aims to promote growth by ensuring that adequate credit is available to productive sectors of the economy.

- Financial Stability: Ensuring a stable financial system is crucial for sustaining economic growth. The RBI monitors and manages systemic risks in the financial sector.

- Exchange Rate Stability: The RBI also aims to manage the exchange rate to stabilize the economy and prevent excessive volatility.

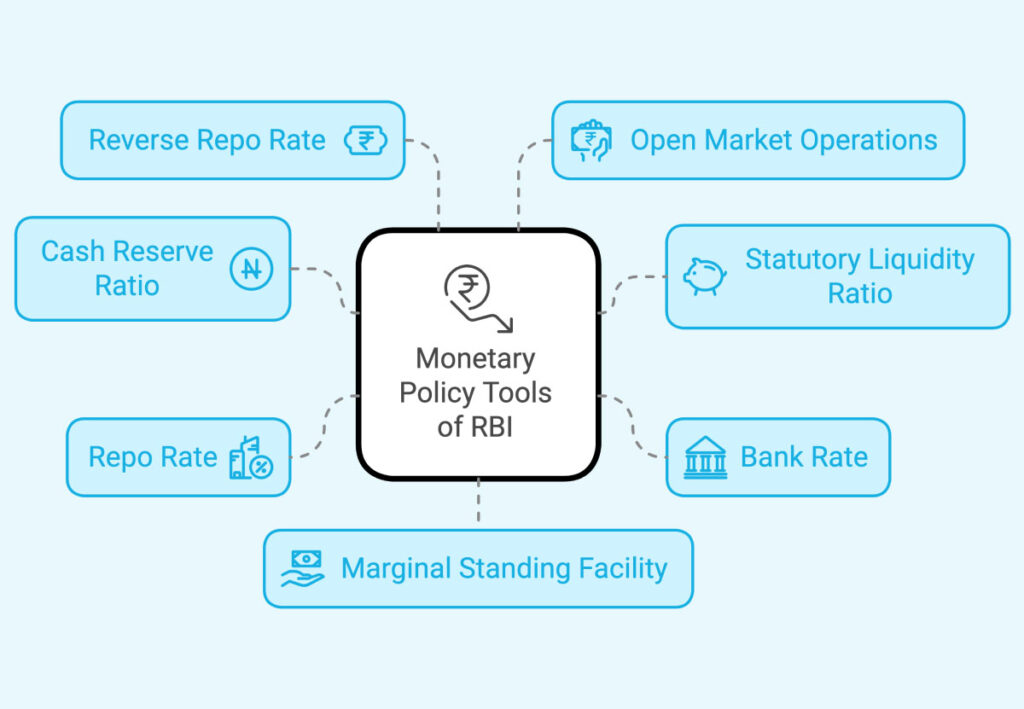

Tools of Monetary Policy

The RBI uses various tools to implement its monetary policy, which can be classified into two main categories: Quantitative Tools and Qualitative Tools.

1. Quantitative Tools

- Repo Rate: The rate at which the RBI lends money to commercial banks. A lower repo rate makes borrowing cheaper, encouraging spending and investment, while a higher rate can help control inflation.

- Reverse Repo Rate: The rate at which the RBI borrows money from banks. This helps absorb excess liquidity in the banking system.

- Cash Reserve Ratio (CRR): The percentage of a bank’s total deposits that must be maintained as reserves with the RBI. A higher CRR means less money available for banks to lend, impacting money supply.

- Statutory Liquidity Ratio (SLR): The minimum percentage of a bank’s net demand and time liabilities that must be held in liquid assets. Similar to CRR, changes in SLR influence the money supply.

- Marginal Standing Facility (MSF): A facility that allows banks to borrow overnight funds from the RBI at a higher interest rate than the repo rate, usually used in emergencies.

Read more: Repo Rate vs Reverse Repo Rate

2. Qualitative Tools

- Moral Suasion: The RBI uses persuasive communication with banks to encourage them to adhere to policy objectives.

- Direct Action: The RBI may take direct action against banks that do not comply with monetary policy guidelines.

Role and Objectives of Monetary Policy in India

Monetary Policy of the Reserve Bank of India (RBI)

The Monetary Policy of the Reserve Bank of India (RBI) is a crucial framework through which the RBI manages the economy’s money supply to achieve specific economic objectives. It involves a strategic approach to control inflation, stimulate economic growth, and maintain financial stability.

Role of Monetary Policy

- Implementation of Monetary Control: The RBI utilizes various tools to influence the money supply and interest rates, thereby shaping economic conditions.

- Regulation of Financial Institutions: The RBI ensures that banks and financial entities operate within regulatory standards, promoting a safe and sound financial environment.

- Monitoring Economic Indicators: Continuous assessment of key economic indicators—such as inflation rates, GDP growth, and employment statistics—guides the RBI in making informed policy decisions.

- Crisis Management: The RBI plays a vital role in responding to economic shocks, providing necessary liquidity to stabilize the economy during financial crises.

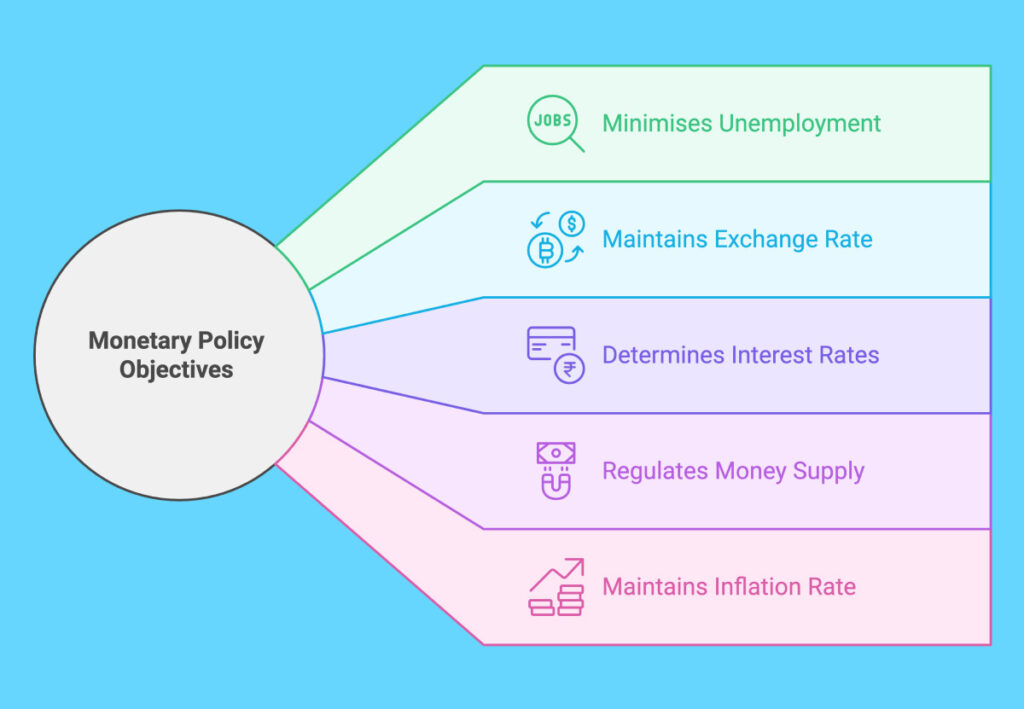

Objectives of Monetary Policy

- Price Stability: A primary objective is to maintain low and stable inflation, protecting the purchasing power of the currency and enhancing economic certainty.

- Economic Growth: The RBI aims to promote sustainable economic growth by ensuring that adequate credit is available to productive sectors of the economy, encouraging investment and consumption.

- Financial Stability: Ensuring a stable financial system is critical for sustaining growth. The RBI actively manages systemic risks within the financial sector to prevent disruptions.

- Exchange Rate Stability: The RBI seeks to manage the exchange rate of the Indian Rupee to mitigate excessive volatility, supporting international trade and investment.

- Employment Generation: Indirectly, by fostering economic growth and investment, the RBI’s monetary policy also supports job creation and overall economic welfare.

Types of Monetary Policy in India

Monetary policy in India is primarily managed by the Reserve Bank of India (RBI) and can be classified into two main types: Expansionary Monetary Policy and Contractionary Monetary Policy. Each type serves distinct purposes based on the prevailing economic conditions.

1. Expansionary Monetary Policy

Objective: The primary aim is to stimulate economic growth, especially during periods of recession or economic slowdown.

- Definition: This policy involves increasing the money supply and reducing interest rates to encourage borrowing and spending by consumers and businesses.

- Tools Used:

- Lowering Repo Rate: Makes loans cheaper for banks, leading to lower interest rates for consumers and businesses.

- Reducing CRR and SLR: Allows banks to have more funds available for lending, increasing the overall money supply in the economy.

- Purchasing Government Securities: Through open market operations, the RBI buys government bonds, injecting liquidity into the financial system.

- Effects:

- Encourages consumer spending and business investments.

- Aims to reduce unemployment and boost economic activity.

2. Contractionary Monetary Policy

Objective: The main aim is to control inflation and stabilize the economy during periods of excessive growth.

- Definition: This policy involves decreasing the money supply and increasing interest rates to curb excessive spending and inflation.

- Tools Used:

- Raising Repo Rate: Increases borrowing costs, which discourages spending and investment.

- Increasing CRR and SLR: Requires banks to hold a larger portion of their deposits in reserves, reducing the funds available for lending.

- Selling Government Securities: The RBI sells government bonds to absorb excess liquidity from the banking system.

- Effects:

- Reduces inflationary pressures by discouraging excessive borrowing and spending.

- Aims to stabilize prices and maintain the value of the currency.

Comparison of Expansionary and Contractionary Monetary Policy

| Aspect | Expansionary Monetary Policy | Contractionary Monetary Policy |

|---|---|---|

| Definition | A policy aimed at increasing the money supply and lowering interest rates to stimulate economic growth. | A policy aimed at decreasing the money supply and raising interest rates to control inflation. |

| Objective | To boost economic growth, reduce unemployment, and increase spending during economic slowdowns. | To curb inflation, stabilize prices, and prevent an overheating economy. |

| Key Tools | Lowering the repo rate- Reducing Cash Reserve Ratio (CRR)Reducing Statutory Liquidity Ratio (SLR)Purchasing government securities in open market operations | Raising the repo rate- Increasing Cash Reserve Ratio (CRR)Increasing Statutory Liquidity Ratio (SLR) Selling government securities in open market operations |

| Impact on Interest Rates | Lowers interest rates, making borrowing cheaper for consumers and businesses. | Raises interest rates, increasing borrowing costs for consumers and businesses. |

| Effect on Money Supply | Increases the money supply, encouraging banks to lend more. | Decreases the money supply, making funds less available for lending. |

| Effects on Economy | Increases consumer spending- Encourages business investmentReduces unemployment- Can lead to higher inflation if overused | – Reduces consumer spending- Discourages business investment- Aims to control inflation- Can lead to higher unemployment if overly restrictive |

| When Used | During economic recessions, high unemployment, or when economic growth is sluggish. | During periods of high inflation or when the economy is overheating due to excessive growth. |

| Long-term Effects | Can lead to sustained economic growth if managed carefully, but may result in inflation if not monitored. | Helps maintain price stability and protects the currency’s value, but can hinder growth if applied too rigidly. |

In summary, the Monetary Policy of the Reserve Bank of India (RBI) is vital for managing the economy’s money supply, controlling inflation, and promoting sustainable growth. By adjusting interest rates and using various tools like the repo rate and cash reserve ratio, the RBI strives to maintain financial stability and support economic development. Understanding these aspects helps individuals and businesses navigate the financial landscape more effectively.

Disclaimer: Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. You should not use this blog to make financial decisions. We highly recommend you seek professional advice from someone who is authorised to provide investment advice.