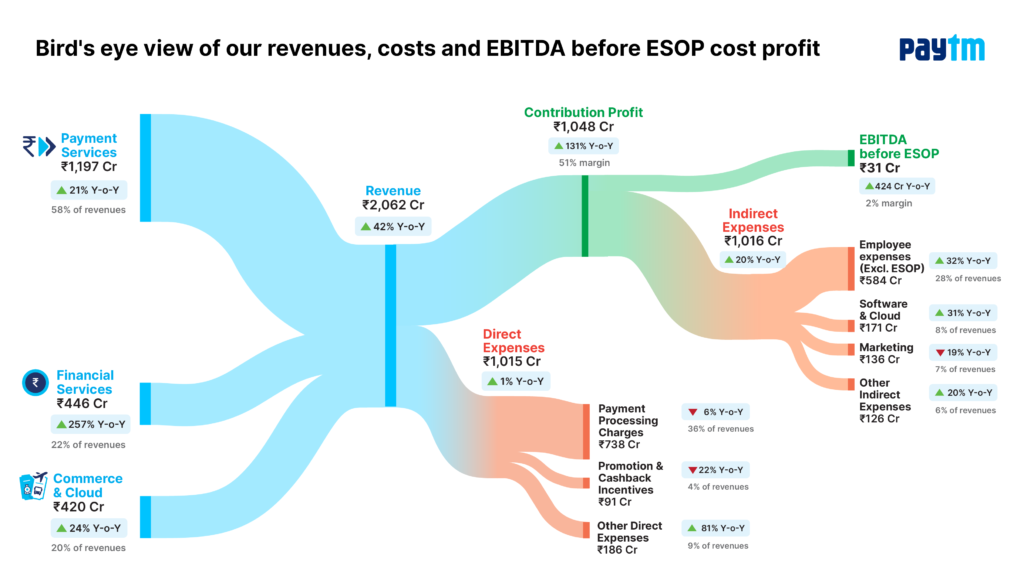

We have announced our Q3 FY 2023 results where we have reported operating profitability significantly ahead of the September 2023 guidance. Our EBITDA before ESOP improved by Rs 424 Cr YoY to Rs 31 Cr due to sustained improvement in contribution profit and strong operating leverage while we made continued investments for long-term growth. Our EBITDA before ESOP margin stood at 2% of revenues as compared to (27%) a year ago.

You can read the full Q3FY23 financial results report here

Our Founder and CEO Vijay Shekhar Sharma wrote a letter to shareholders announcing the achievement. He mentioned this has been possible because of the relentlessly focused execution by our team. “The team was asked to focus on growth with quality revenues that contribute to the bottom line. We have achieved this milestone without losing sight of growth opportunities and keeping all compliances as well as risk factors under a strict watch,” he added.

He said, “With our focus on growth and keeping a tight vigil on operational risk and compliances, I am very confident that we will soon achieve our next milestone of becoming a free cash flow generating company.”

Here’s how we achieved operating profitability:

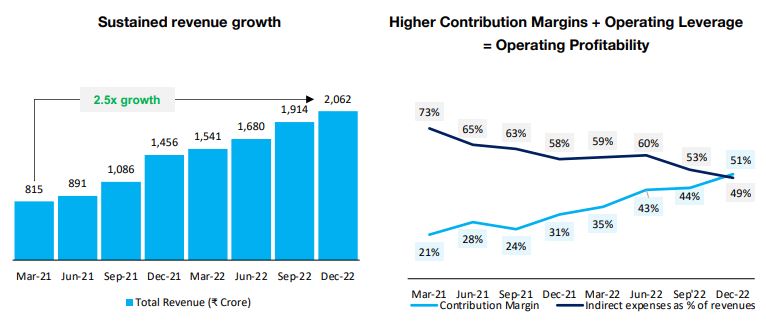

Sustained Revenue Growth with Better Profitability

We continued to witness strong revenue momentum across businesses. Our revenue from operations increased to Rs 2,062 crore (no UPI incentive recorded this quarter), a growth of 42% YoY and 8% QoQ, driven by increased adoption by consumers and subscription services by merchant partners along with sustained growth seen in loan distribution and commerce business. Revenue from financial services, which is majorly loan distribution, now accounts for 22% of total revenues, up from 9% in Q3 FY2022.

Our contribution profit was Rs 1,048 Cr in the quarter, with margins consistently improving from 31% in Q3 FY 2022 to 51% in Q3 FY 2023 on account of improved profitability of the payments business and growth of high-margin businesses such as loan distribution.

Net payments margin grew to Rs 459 Cr (up 120% YoY and 4% QoQ) on the back of improved profitability in the payments business.

The company’s loan distribution business saw further scale with 10.5 million loans amounting to Rs 9,958 Cr disbursed in the quarter (in partnership with our lending partners). The total number of unique borrowers who have taken a loan through the Paytm platform has increased by 1.4 mn during the quarter to 8.1 mn. We believe that the scale-up in the number of users who have taken a loan through our platform provides tremendous upsell and lifecycle benefits.

Our operating leverage is demonstrated by a reduction in indirect expenses (as a % of revenues), to 49% in Q3 FY 2023 from 58% in Q3 FY 2022. Indirect Expenses (excluding ESOP cost) have remained flat over the past three quarters and were Rs 1,016 Cr in the quarter, growing 20% YoY. Our net income stands at (Rs 392) crore, an improvement of 50% from (Rs 779) crore a year ago.

We are focused on sustained growth, monetization opportunities, and discipline in cost management. We continue to make investments in areas where we see attractive growth and monetization opportunities, such as in marketing for user acquisition, and sales team to increase merchant base and subscription services.

We remain grateful for your continuous support and remain committed to our mission to building a profitable company and creating shareholder value while driving digitization and inclusive financial access