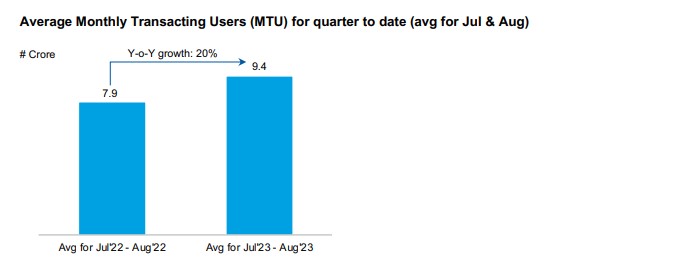

• Average monthly transacting users (MTU) stood at 9.4 crore for the quarter to date (average for July & August 2023) up 20% y-o-y, reflecting the continued expansion of our customer base

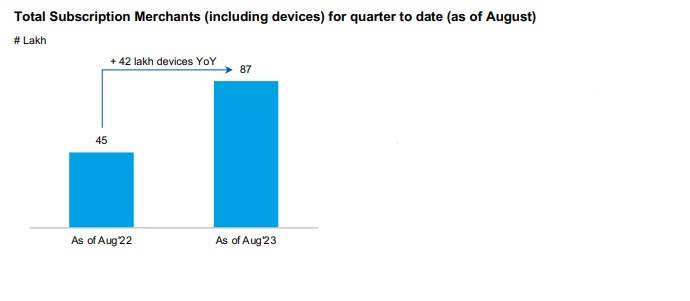

• Our leadership in payment monetization continues with the number of merchants paying subscriptions for payment devices at 87 lakh as of August 2023, an increase of 42 lakh devices y-o-y

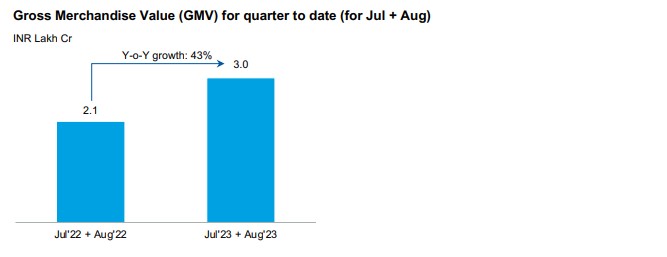

• Merchant Payment Volumes (GMV) for the quarter to date (for July & August) stood at Rs 3.0 Lakh Cr ($36.3 billion), y-o-y growth of 43%

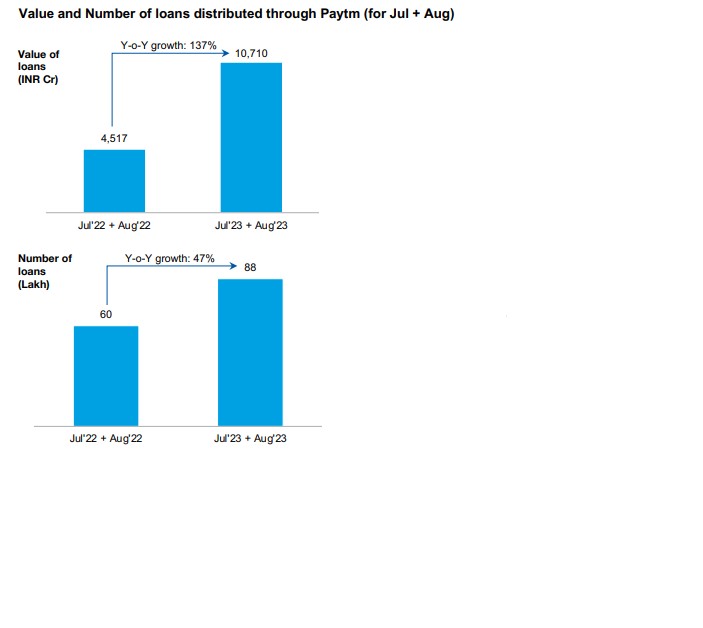

• Our loan distribution business (in partnership with our lender partners) continues to gain scale with disbursements of Rs 10,710 Cr ($1.3 billion, y-o-y growth of 137%) and 88 lakh loans (y-o-y growth of 47%) disbursed in the quarter to date (for July & August 2023) through the Paytm platform

We have achieved sustained growth in the payments and loan distribution business. Our leadership in in-store payments strengthened with 87 Lakh devices deployment and the value of loans distributed through the Paytm platform was at Rs 10,710 Cr ($1.3 billion, y-o-y growth of 137%) and 88 lakh loans (y-o-y growth of 47%) in July & August 2023.

You can also access our exchange filing here:

The Paytm App continues to witness growing consumer engagement with the average MTU for the quarter to date (for July & August) growing 20% y-o-y to 9.4 Crore.

We continue to strengthen our leadership in offline payments, with 87 lakh merchants now paying subscriptions for payment devices, an increase of 4.9 lakh in the month of August 2023. With our subscription as a service model, the strong adoption of devices drives subscription revenues and higher payment volumes, while increasing the funnel for our merchant loan distribution.

The total merchant GMV processed through our platform for the quarter to date (for July & August) was Rs 3.0 Lakh Cr ($36.3 billion), growing 43% y-o-y. We continue to see an increase in GMV of non-UPI instruments like EMI and cards. Growth in payments volumes drives profitability for us, through net payments margin and/or from direct upsell potential.

Our loan distribution business (in partnership with large lenders) continues to witness healthy growth with total loans distributed through our platform for the quarter to date (for July & August) growing 137% yo-y to Rs 10,710 Cr ($1.3 billion).

Over the past several quarters, we have talked about our plans to calibrate growth to further tighten the credit quality of loans distributed on our platform. We have been able to successfully demonstrate improving credit quality for Paytm Postpaid, where the ECL has reduced to a range of 0.65% – 0.85% from a range of 0.75% – 1.00% in Q4 FY 2023.

We remain focused on the portfolio performance of our lending partners, and growth may be subdued until the industry outlook improves. High-quality outcomes for our partners enable us to expand our lending partnerships. We currently have 8 lending partners (including for credit card distribution) and we aim to onboard 3-4 partners in FY 2024.