Prioritizing our health often takes a back seat. Between home, work, family, and other responsibilities and commitments, neglecting regular checkups and a healthy lifestyle can have a significant impact on our well-being and finances. But what if we say there is a way to safeguard both your health and finances at the same time?

Paytm health insurance in collaboration with Aditya Birla Insurance provides a one-stop solution for all healthcare needs. With their comprehensive health insurance plans, Paytm ensures you prioritize your health while getting peace of mind too.

So, whether you are an individual seeking personal coverage or a family looking for collective protection, Paytm Health Insurance offers a variety of plans to suit your specific needs and budget. Check out the guide and buy the best Paytm health insurance that suits you!

What is Health Insurance?

Health insurance is a type of insurance coverage that helps individuals pay for medical expenses and services. It is a contract between the insured person and the insurance company, where the insured pays regular premiums in exchange for coverage for healthcare services. Health insurance can provide financial protection by covering a portion or all of the costs associated with medical treatments, doctor visits, hospital stays, prescription medications, and preventive care. The specific coverage and benefits vary depending on the insurance plan and provider. Health insurance can be obtained through employers, government programs, or purchased individually.

Why Buy a Health Insurance Plan at an Early Age?

- Lower Premiums: Younger individuals are considered lower underwriting risks, leading to lower insurance premiums. This means that the cost of comprehensive coverage is significantly lower when purchased in one’s 20s or early 30s compared to later in life

- No Pre-Medical Check-Ups: Most insurance companies do not require medical check-ups for individuals under a certain age.

- Comprehensive Coverage: Health insurance plans at an early age often include extensive coverage, such as daycare expenses, maternity benefits, OPD expenses, and more.

- Financial Protection: Health insurance provides financial security against unexpected medical expenses, which can be a significant burden.

- Tax Benefits: Premiums paid for health insurance are eligible for tax deductions under Section 80D of the Income Tax Act. This can result in significant tax savings over the years.

- No-Claim Bonus: Many health insurance plans offer a no-claim bonus, where a percentage of the sum insured is added to the next year if there are no claims. This can help increase the coverage amount over time

What is Paytm Health Insurance?

Paytm Health Insurance refers to health insurance plans provided by Paytm, a leading digital payments and financial services company based in India. Paytm has partnered with Aditya Birla Insurance and various other insurance providers to offer health insurance policies through its platform. These policies provide coverage for medical expenses, hospitalization, treatments, and other healthcare-related services. Paytm Health Insurance aims to provide customers with a convenient and digital way to purchase and manage their health insurance policies, making it easier for individuals and families to access quality healthcare services and financial protection in case of medical emergencies.

Paytm Health Insurance vs Others

Here is a comparison of Paytm’s health insurance offerings versus other traditional health insurance plans:

| Feature | Traditional Health Insurance Plans | Paytm Health Insurance |

|---|---|---|

| Coverage | Only covers hospitalization expenses | Covers hospitalization, doctor visits, and unlimited video/tele-consultations with specialists |

| Consumables | You pay out of pocket for consumables | Consumables are covered by default |

| Buying Process | Requires medical tests and approval time | No medical tests needed; policy issued instantly after 3-step buying process |

| Pricing | Expensive | ~13% cheaper than similar plans in the market |

| Exclusivity | Generic plans available to all | Curated plans exclusive to Paytm customers |

1. Comprehensive Coverage:

- While traditional health insurance plans typically only cover hospitalization expenses, Paytm’s health insurance plans also provide coverage for regular doctor visits, unlimited video/tele-consultations with specialists, and other outpatient care.

- This ensures policyholders can access a wide range of healthcare services without worrying about out-of-pocket expenses.

2. Inclusion of Consumables:

- Traditional health insurance plans often exclude consumables like surgical items and housekeeping charges from coverage, leaving policyholders to pay for these out-of-pocket.

- Paytm’s plans, on the other hand, cover these consumables by default, providing more comprehensive financial protection.

3. Simplified Buying Process:

- Paytm’s health insurance plans can be purchased through a quick 3-step process without the need for any medical tests.

- This allows for instant policy activation, unlike the lengthy approval times associated with traditional health insurance plans.

4. Competitive Pricing:

- Paytm’s health insurance plans are priced around 13% lower compared to similar offerings in the market.

- This makes quality healthcare coverage more accessible and affordable for Paytm customers.

Features of Paytm Health Insurance Policy

Paytm health insurance offers several features and benefits, including:

| Feature | Description |

|---|---|

| IPD Sum Insured | ₹3 Lakh / ₹5 Lakh / ₹10 Lakh / ₹20 Lakh |

| Family Definition & Eligibility Criteria | – Individual (1A) – Two Adults (2A) – Two Adults and One Child (2A+1C) Two Adults and Two Children (2A+2C) Available to group subscribers onlyMust be between 18 and 55 years oldCovers legally wedded spouseCovers biological children up to 25 years |

| Age Band | 18 to 55 years |

| PED Cover | Covered after a waiting period of 36 months |

| Initial Waiting Period | 30 days waiting period applicable |

| Specified Disease / Procedure Waiting Period | A 2-year waiting period is applicable |

| Room Rent | Single standard room for normal hospitalization & ICU with no cap. All other charges are according to room rent limits. |

| Co-Pay / Deductible | Not Applicable |

| Ambulance | Road ambulance charges covered up to ₹1000 per incident in case of emergency |

| Day Care | Daycare procedures are covered |

| Domiciliary Hospitalization | Covered as defined in GHI policy wordings |

| Pre-Post Hospitalization | 30 days before hospitalization and 60 days after hospitalization |

| Special Condition 1 | Cost of stents and implants as per prices decided by the National Pharmaceuticals Pricing Authority |

| Disease Sublimit | Not Applicable |

| Reload of SI | Applicable for unrelated ailments |

| Non-Medical Expenses | Covered |

| Health Returns (Apply on GHI Premium) | Self and spouse will earn Health Returns @ 30% based on their Healthy Heart Score and number of Active Days recorded in a month. A unique mobile number and email ID are required for each member. |

| Super No Claim Bonus | 10% increase per year, maximum up to 100% |

| AYUSH Treatment | Medical expenses for AYUSH treatments covered up to ₹100,000. Comfort treatments involving steam baths, saunas, or oil massages are excluded. Treatments combined with stay packages at resorts are not covered. |

| Modern Treatment | Specified modern treatments covered up to 50% of SI on an IPD basis:

|

| Special Condition 2 | All terms and conditions as per group Activ health policy wordings |

| TPA | In-house claim service |

| OPD Cover | Unlimited GP Teleconsultations + Unlimited Specialist Teleconsultations (12 specialties) + 1 Free Annual Health Check-up (31 Parameters) |

| Special Condition 3 | Unlimited GP Teleconsultations + Unlimited Specialist Teleconsultations (24 specialties) + 1 Free Annual Health Check-up (31 Parameters) + 12 GP/Specialist consultations (1 per month) |

*Domiciliary hospitalization refers to medical treatment or care provided to a patient at their home, which would normally require hospitalization in a medical facility.

Additional Benefit

Health Returns: You and your spouse have the chance to earn HealthReturns at a rate of 30% based on your Healthy Heart Score and the number of Active Dayz you record each month. To avail this benefit, you will need to provide a unique mobile number and email ID for each member. This feature rewards you for maintaining healthy habits and engaging in activities that promote well-being.

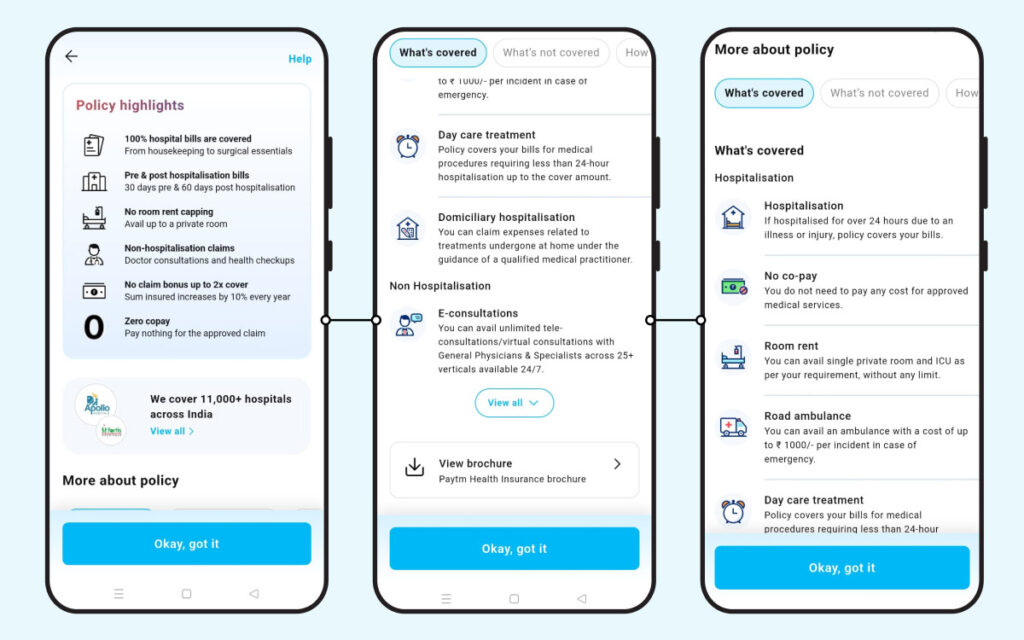

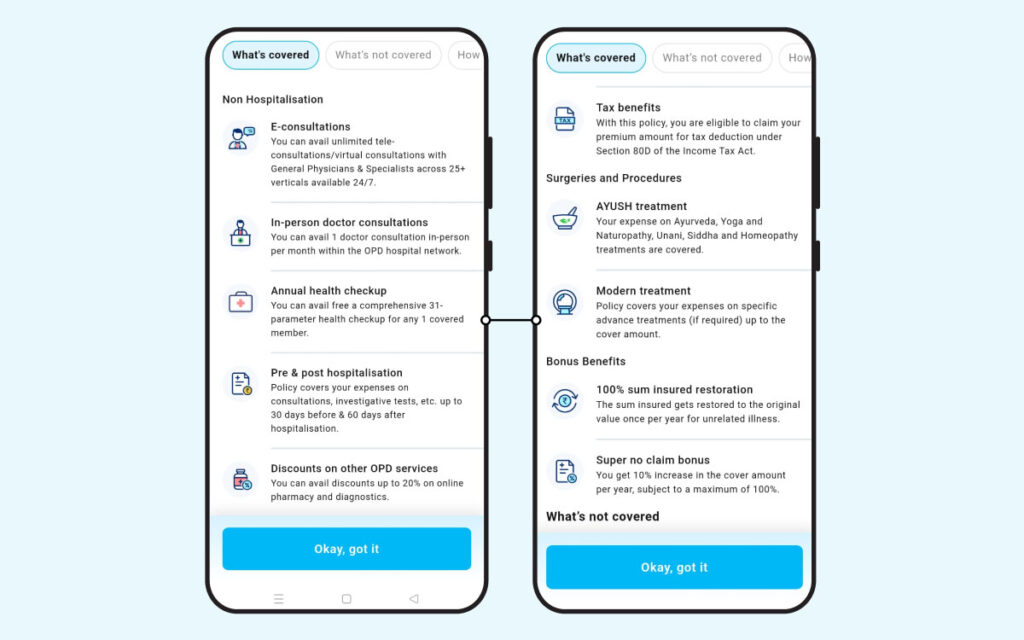

What’s Included and What’s Not in Paytm Health Insurance?

Paytm health insurance provides coverage for various medical expenses.

| What’s Included | What’s Not Included |

|---|---|

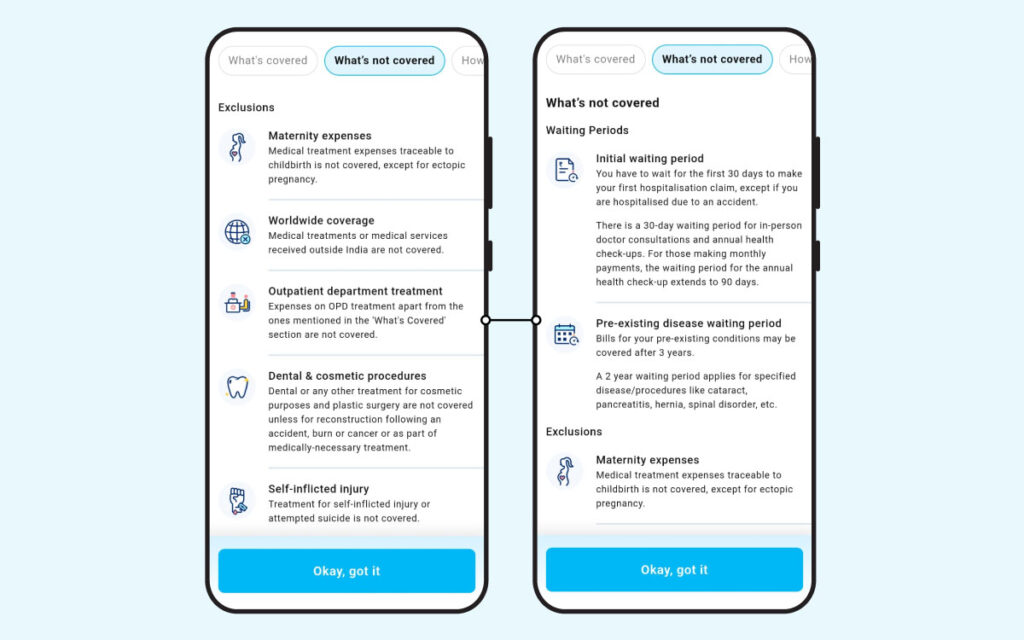

| Hospitalisation: Coverage for hospital stays over 24 hours due to illness or injury. | Initial waiting period: First 30 days for hospitalisation claims except for accidents. |

| No co-pay: No additional costs for approved medical services. | Waiting period for in-person consultations and health check-ups: 30 days for consultations, 90 days for health check-ups if paying monthly. |

| Room rent: Single private room or ICU without limits. | Pre-existing disease waiting period: Coverage after 3 years. |

| Road ambulance: Ambulance service cost up to Rs. 1000 per incident. | Waiting period for specified diseases/procedures: 2 years for specified diseases/procedures like cataracts, pancreatitis, hernia, spinal disorders, etc. |

| Day care treatment: Coverage for procedures requiring less than 24-hour hospitalisation. | Maternity expenses: Not covered except for ectopic pregnancy. |

| Domiciliary hospitalisation: Treatment at home under medical guidance is claimable. | Worldwide coverage: Treatments or services outside India are not covered. |

| E-consultations: Unlimited tele-consultations with general physicians and specialists 24/7. | Outpatient department treatment: OPD treatments not mentioned in the ‘What’s Included’ section are not covered. |

| In-person doctor consultations: One in-person consultation per month within the OPD network. | Dental & cosmetic procedures: Not covered unless for reconstruction after an accident, burn, cancer, or as part of medically necessary treatment. |

| Annual health checkup: Free comprehensive health checkup once a year for one covered member. | NA |

| Pre & post-hospitalisation: Coverage for expenses 30 days before and 60 days after hospitalisation. | NA |

| Discounts on OPD services: Up to 20% off on online pharmacy and diagnostics. | NA |

| Tax benefits: Deduction under Section 80D of the Income Tax Act. | NA |

| Surgeries and Procedures: Coverage for specific advanced treatments and surgeries. | NA |

| AYUSH treatment: Coverage for Ayurveda, Yoga, Naturopathy, Unani, Siddha, and Homeopathy. | NA |

| Bonus Benefits: Sum insured restored once a year for unrelated illnesses, 10% yearly increase in cover amount up to 100% (super no-claim bonus). | NA |

How to Calculate Health Insurance Premiums?

Here are the key factors to consider when calculating health insurance premiums:

- Age: Premiums are generally lower for younger individuals, as they are considered lower health risks. Premiums increase as you get older.

- Gender: Premiums may be slightly lower for women compared to men, as women tend to have higher life expectancies and different medical needs.

- Policy Tenure: Premiums are generally lower for longer-term policies (2-3 years) compared to annual renewals.

- Policy Type: Premiums vary based on the type of health insurance plan, such as individual, family floater, or top-up plans. Comprehensive plans tend to have higher premiums.

Apart form that, there are more factors like health condition, coverage amount, add ons, lifestyle factors, no claim bonus, network hospitals etc.

You can use Paytm Health Insurance Premium Calculator to check your monthly/annual premium.

This gives you a good starting point to understand the approximate cost of the health insurance coverage you need. You can then compare premiums across different insurance providers and plans to find the most suitable and affordable option for your needs.

The key use of a health insurance premium calculator is to get an upfront estimate of the premium you would need to pay based on your specific details. This helps you plan your health insurance budget and make an informed decision when purchasing a policy.

How to Claim Paytm Health Insurance Policy?

Here are the steps to claim Paytm health insurance policy in few easy steps:

Step 1: Contact the Paytm Priority Claims Desk if you have a claim.

Step 2: A claims manager will be assigned to help you with your claim.

Step 3: The claims manager will communicate between the insurance company and the hospital, ensuring your claim is handled smoothly.

What Are the Factors That Affect Health Insurance Premiums?

The key factors that affect health insurance premiums in India are:

Health Factors

- Age: Premiums are generally lower for younger individuals as they are considered lower health risks. Premiums increase as you get older.

- Gender: Premiums may be slightly lower for women compared to men, as women tend to have higher life expectancies and different medical needs.

- Health Condition: Pre-existing medical conditions or a history of critical illnesses can lead to higher premiums. Insurers assess the risk and adjust the premium accordingly.

- Habits and Lifestyle: Bad habits like smoking, chewing tobacco or snuff will also impact your premium. These habits increase the chance of lung infections, cancer and other critical illnesses.

- Body Mass Index (BMI): People with higher BMI are charged higher premiums than those with a normal BMI. This is because people with high BMI are at a high risk of suffering from various diseases like diabetes and heart-related problems.

Policy-Related Factors

- Sum Insured: The higher the sum insured (coverage amount), the higher the premium. Choosing the right coverage amount based on your needs is important.

- Policy Type: Premiums vary based on the type of health insurance plan, such as individual, family floater, or top-up plans. Comprehensive plans tend to have higher premiums.

- Add-ons and Riders: Opting for additional coverage like maternity, critical illness, or dental care can increase the premium.

- Co-payment: A higher co-pay will lower your total premium, but you will have to pay a larger amount during claims. A lower co-pay means a slightly higher premium but less out-of-pocket expenses during claims.

- Policy Duration: If you choose a policy with a longer duration, the premium will be less compared to a policy with a shorter duration.

- Geographical Location: The location where you stay determines your policy premium cost. For certain geographic locations, the premium rates are high due to lack of healthy food options, climate and health issues.

Get more information on How to Buy the Right Health Insurance Plan for Yourself?

Key Factors to Consider Before Buying Health Insurance Plans

| Factor | Description |

|---|---|

| Coverage | Ensure the plan covers the healthcare services you need, such as hospitalization and treatments. |

| Network | Check if the plan has a wide network of hospitals and providers in your area. |

| Pre-existing Conditions | Understand how the plan covers pre-existing medical conditions. |

| Premiums | Consider the affordability of the plan’s premium. |

| Deductibles | Know the amount you need to pay out of pocket before the insurance coverage kicks in. |

| Policy Terms | Review the renewal terms and any restrictions or limitations of the plan. |

| Additional Benefits | Look for any extra benefits offered, such as preventive care or dental coverage. |

| Customer Service | Research the insurer’s reputation for customer service and claim settlement. |

| Exclusions | Understand what medical conditions or treatments are not covered by the plan. |

| Comparison | Compare multiple options to find the best fit for your needs and budget. |

What Is Paytm Health Insurance Eligibility Criteria?

To be eligible for the policy, you must meet the following criteria:

- Age: You must be between 18 years and 55 years of age to be eligible.

- Subscriber: The policy is available only for subscribers, meaning you must be the primary policyholder.

- Spouse: Your legally wedded spouse can also be covered under the policy.

- Children: Biological children up to the age of 25 years can be included in the policy.

How to Buy Health Insurance on Paytm?

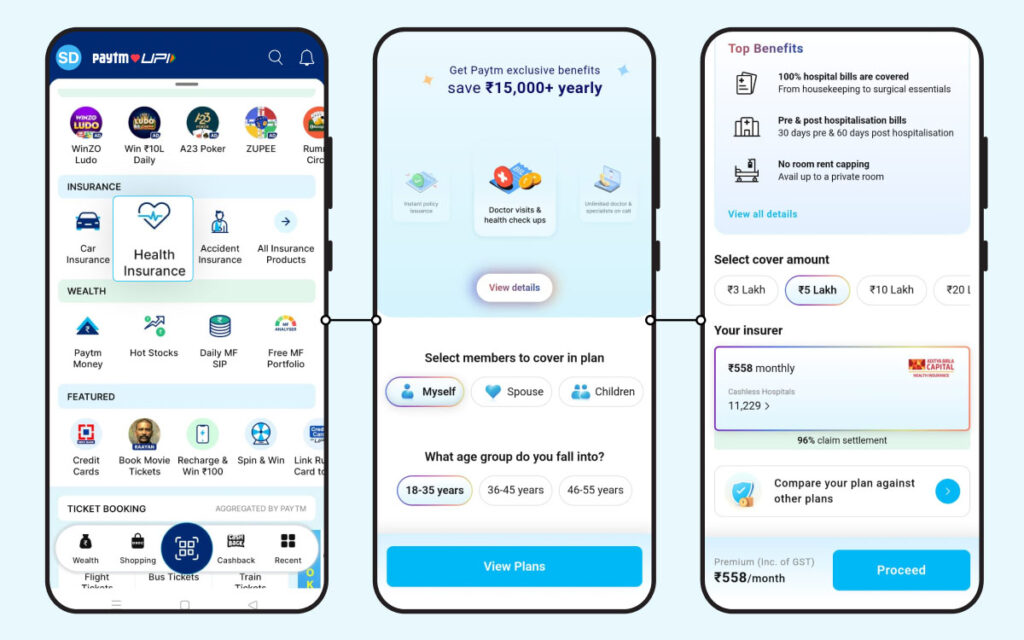

Step 1: Open the Paytm app on your device.

Step 2: Navigate to the insurance section and click on ‘Health Insurance.’

Step 3: Now select the plan either for yourself, spouse or children and select the age

group you fall into and click on ‘View Plans.’

Step 4: On the next screen, select your health insurance coverage from 3 lakh, 5 lakh, 10 lakh, 20 lakh,. Once done, tap on ‘Proceed.’

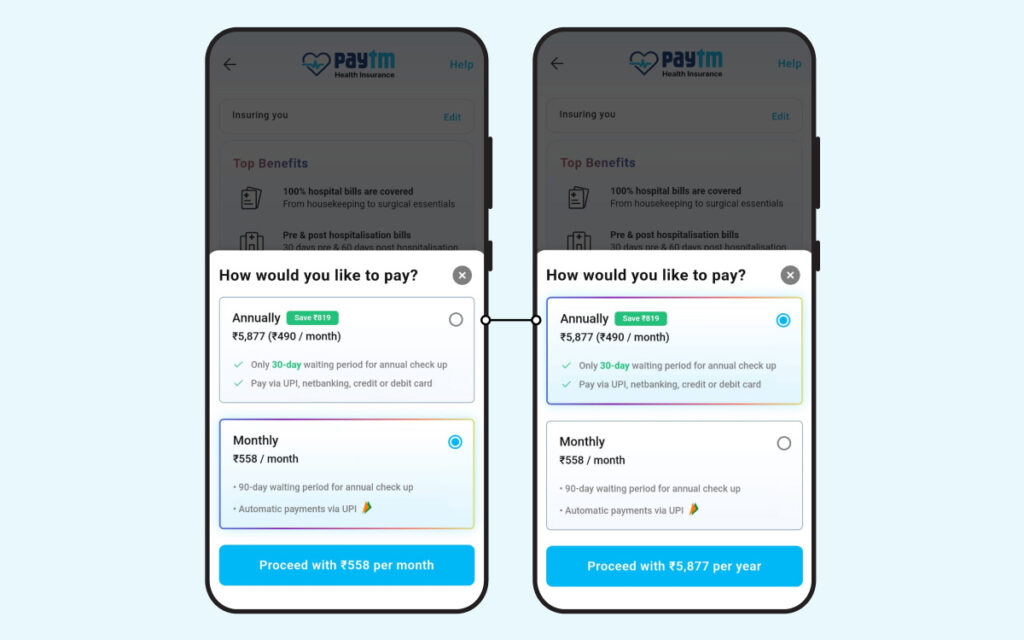

Step 5: Now, choose how you want to pay the subscription, either annually or monthly and click on ‘Proceed.’

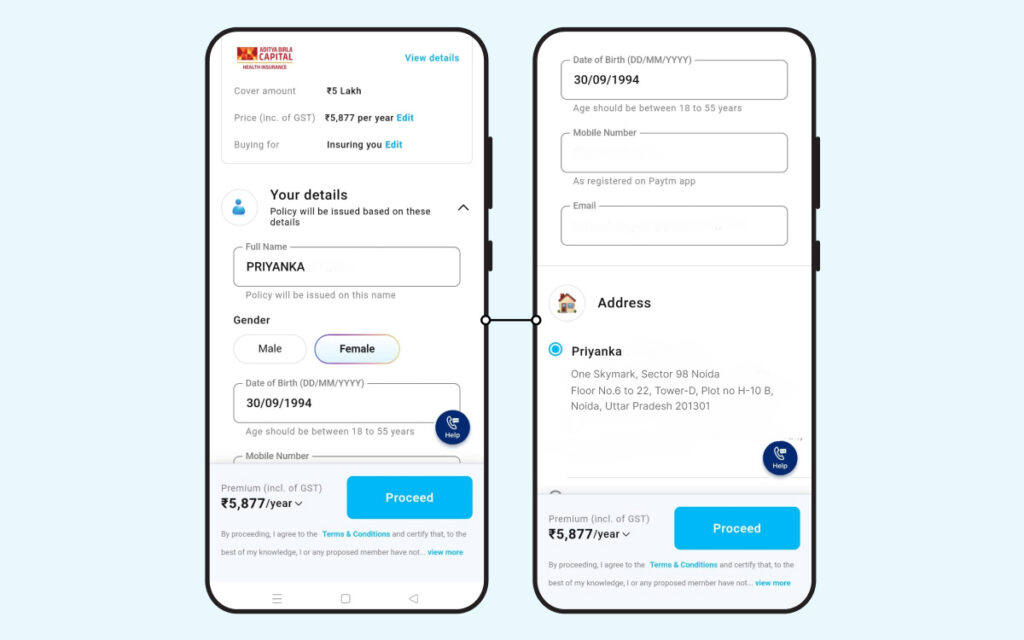

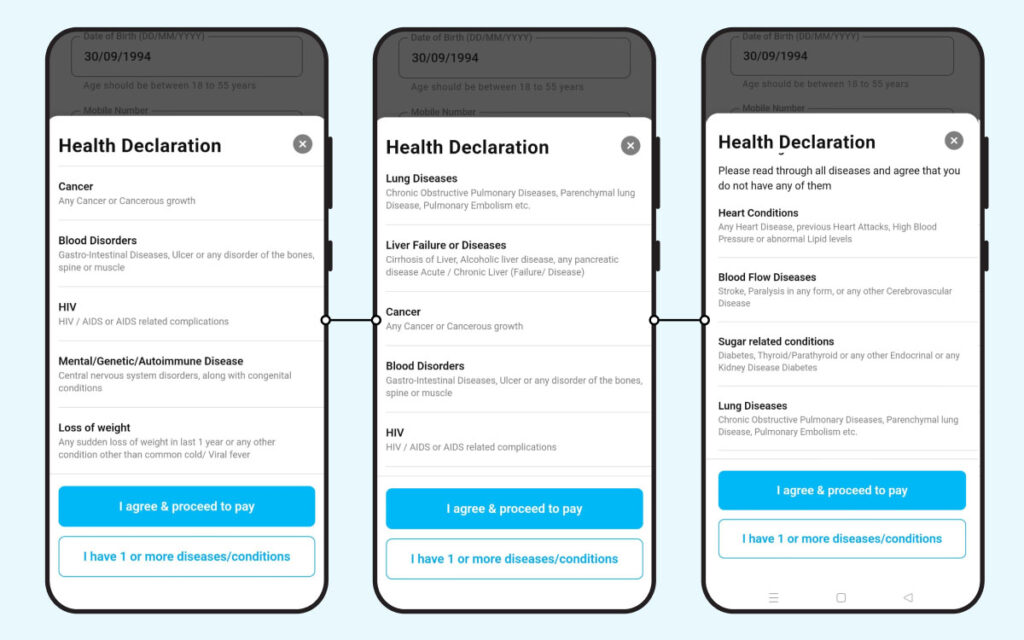

Step 6: Enter all the required information and review all the information. Also, you can click on the ‘View Policy Details’ to get a look at what your chosen policy covers.

Step 7: Click on ‘Proceed.’

Step 8: On the following screen, check out all the diseases and conditions the policy does not cover. Once done, click on any of the two options: ‘I don’t have any of these,’ ‘I have 1 or more disease/conditions.”

Step 9: Now, choose your preferred mode of payment and click on ‘Pay Securely.’

Step 10: The amount will be deducted from your chosen bank account and a notification regarding the policy purchase will be shown.

Step 11: Also, you can check out your policy detailed information through the profile or by again navigating to the insurance section.

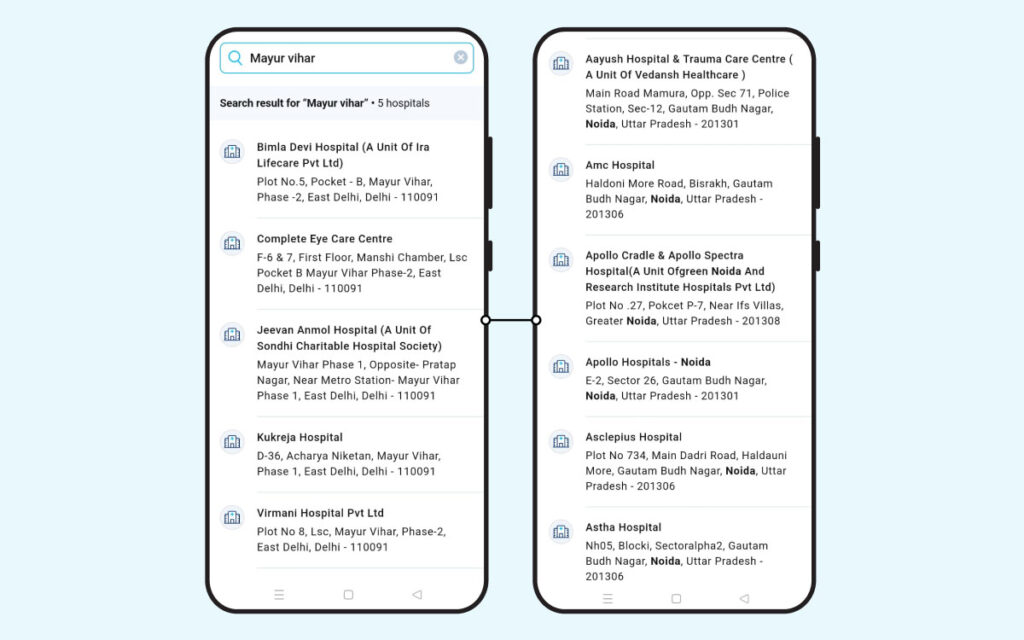

How to Find Hospitals Covered Under the Paytm Health Insurance Scheme?

Step 1: Open the Paytm app and go to your health insurance scheme.

Step 2: Click on ‘View Hospitals List’ and then select ‘View All.’

Step 3: On the next screen, enter your city or PIN code.

Step 4: A list of hospitals, along with their addresses, will be displayed on the screen.

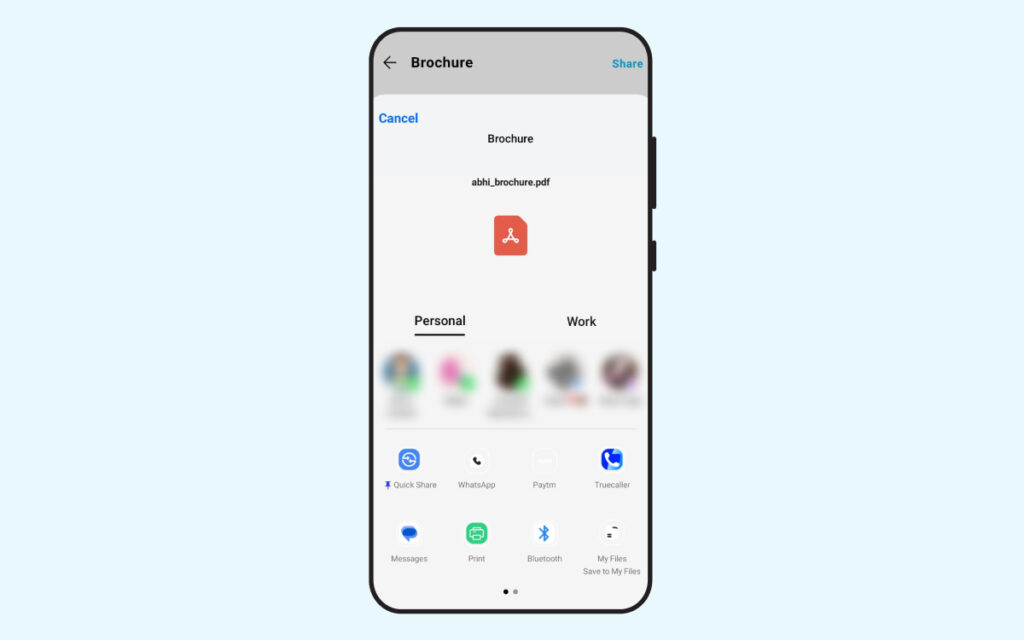

*Note: You can also download your policy brochure and have the option to share it with others if you purchased the policy on their behalf.

In conclusion, Paytm Health Insurance offers a convenient and digital solution for individuals and families in India to access comprehensive health coverage. Through partnerships with various insurance providers, Paytm aims to simplify the process of purchasing and managing health insurance policies.

Disclaimer: The purpose of this blog is to simplify complex processes for readers’ understanding. Please note that some information and screenshots provided may become outdated or change over time. However, we strive to keep our blogs updated and relevant to provide accurate and helpful information.