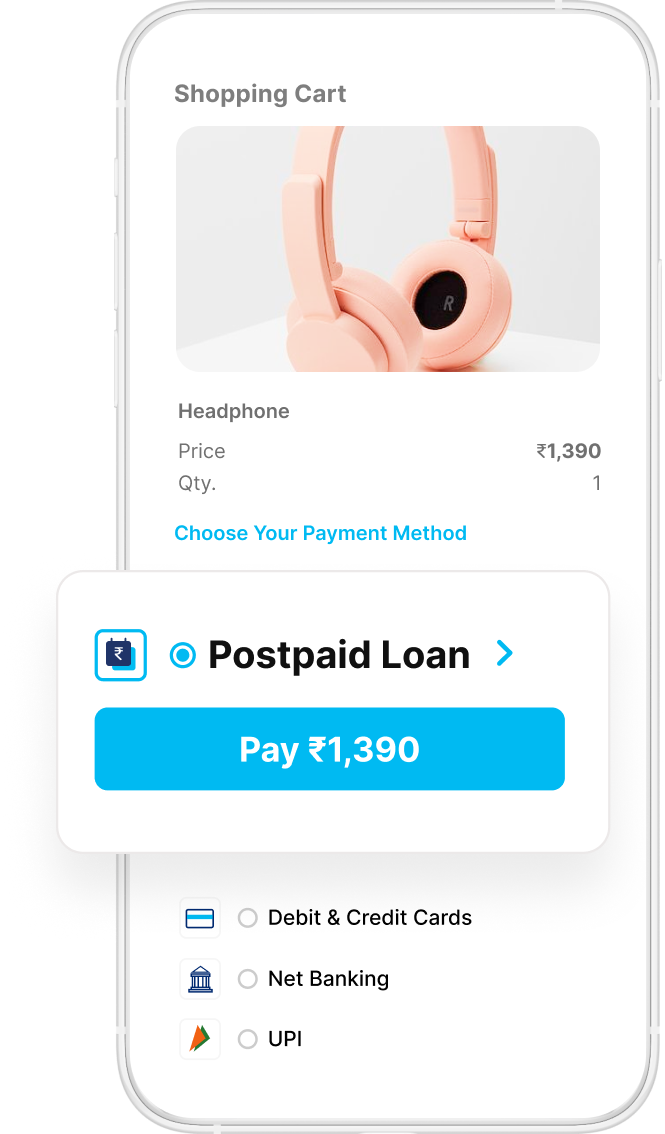

Paytm Now.

Pay Later.

Paytm Payments Bank does not provide any loan or credit card on the Paytm

App.

Know more.

Loan facility is provided by our NBFC partners.

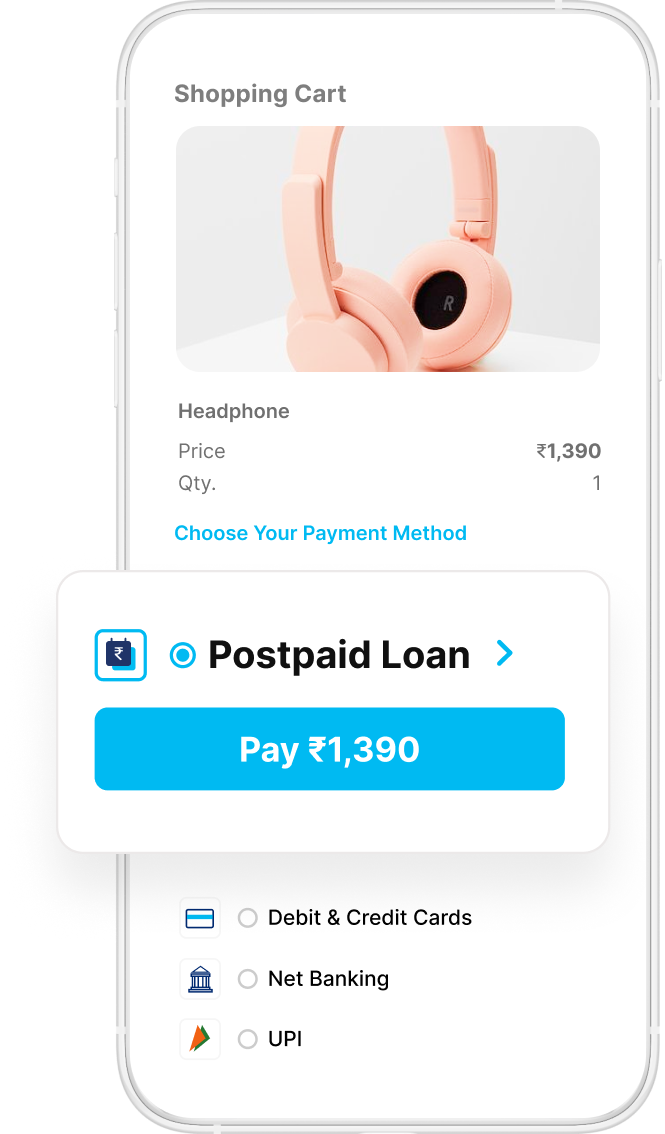

Paytm Now.

Pay Later.

Paytm Payments Bank does not provide any loan or credit card on the Paytm

App.

Know more.

Loan facility is provided by our NBFC partners.

Accepted

Everywhere.

Pay with Postpaid Loan at 1.5 Cr+

shops across India and all your

favourite Apps & Websites.

Interest-Free

30 Days

Improve Your

Credit Score.

Postpaid Loan helps you build

and improve your credit profile.

Timely

repayments

can make you

eligible for a credit card or get you

a better loan offer.

Superfast

Checkouts

Enjoy single click

checkouts without hassle.