Meet your financial needs with ease

Easy to

Apply

Flexible repayment

options

Faster processing

& quick disbursal

Minimal

documentation

Doorstep

service

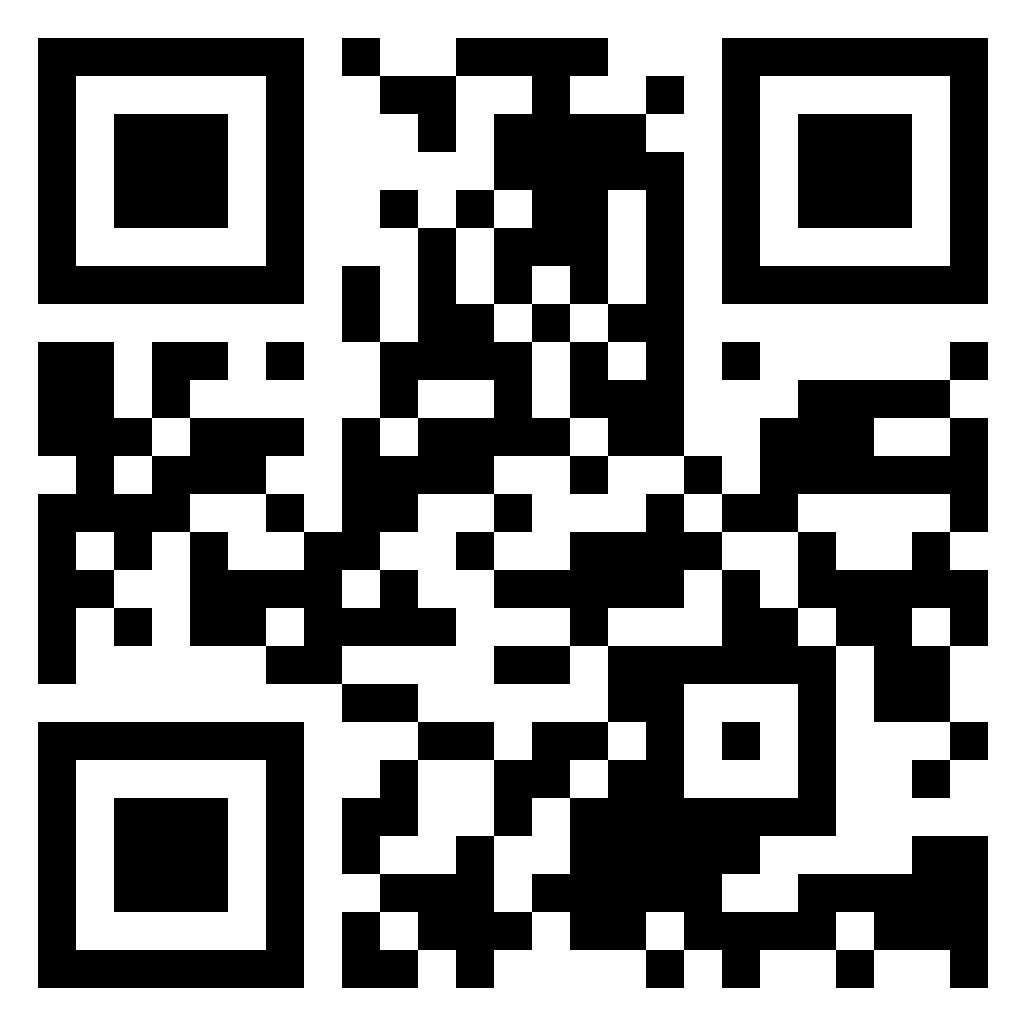

The quickest loan you’ll ever get

- Enter your PAN & gold details to get your offer

- Visit a designated Lender branch with your bank details & gold ornaments, & complete your KYC process

- Get money in your bank account instantly

Frequently Asked Questions

FAQs

What is Gold loan?

Gold loan is a type of secured loan where individuals can borrow money by

pledging their gold jewellery, coins (bank

issued coins), or ornaments as collateral. The loan amount is determined based on the appraised value

of the gold. Gold

loans are often preferred for their quick processing, minimal documentation, and relatively lower

interest rates

compared to unsecured loans.

What is the eligibility criteria for Gold Loan?

The minimum age requirement is 18 years, while the maximum age is 75 years.

However, your golden items must match the

purity of 18KT or above to qualify for the loan.

What are the documents required for Gold Loan?

The specific documents required for gold loan may vary among lenders, but

generally, the following documents are

commonly requested:

Identity Proof:

- Aadhar card

- Passport

- Voter ID

- Driving license

Address Proof:

- Aadhar card

- Passport

- Utility bills (electricity, water, gas) in the borrower's name

- Rental agreement

Photographs:

- Passport-sized photographs of the borrower

Proof of Ownership of Gold:

- Invoice or bill of purchase, if available

- Receipts related to the gold ornaments

What is the Interest rate on Gold Loan?

The interest rate depends on the lender and various other factors like

gold purity, gold form etc. However, interest

rates may vary between 11.99% to 29% per annum.

What are the factors affecting the Gold Loan Interest rate?

Various factors determine the applicable interest rate on gold loan, including

but not limited to:

- Loan amount

- Gold purity

- Gold value

What are the additional charges involved in Gold Loan?

Paytm does not charge you any fee for your Gold loan application. Processing

Fee of upto 1% on your loan value may be

charged at the time of disbursement.

What is the typical Gold Loan tenure?

The tenure of gold loan can range from 6 months to 36 months, depending on the

lender.

What Types of Gold Can I Offer as Collateral?

Gold items eligible for pledging must be of a purity level between 18 karats

and 22 karats. Whether it's gold jewellery,

coins or ornaments you can use them as collateral to secure the loan. The loan amount you qualify for

is determined by

the assessed value of the gold. It's important to note that the presence of gems or gemstones in your

gold jewellery

does not impact the loan amount, as the valuation is primarily based on the gold's intrinsic value.

How is the value of my gold assessed?

The value of your gold is assessed based on its purity and current market

rates. Lenders use professional appraisers or

technology for accurate valuation.

What is the loan-to-value (LTV) ratio for gold loans?

The LTV ratio represents the percentage of the gold's value that can be

borrowed. It depends on the lender to lender

ranging between 70-75%.

Can I get gold loan if I have a low credit score?

Yes, since gold loans are secured by collateral, a low credit score may not be

a significant barrier.

What happens if the gold's value fluctuates during the loan tenure?

The loan amount is determined at the time of approval. Any change in gold value

generally does not affect the

agreed-upon loan amount.

Contact our Lender Partner(s)

1800-102-1616 [email protected]